- Israel

- /

- Real Estate

- /

- TASE:ROTS

Exploring Undiscovered Gems In The Middle East This May 2025

Reviewed by Simply Wall St

As the Middle East markets navigate mixed outcomes from corporate earnings and geopolitical developments, investors are keeping a close watch on the impact of U.S.-China trade talks and steady monetary policies in the region. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and potential growth despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 13.40% | 30.21% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Value Rating: ★★★★★★

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi is involved in real estate development, leasing, and business administration activities in Turkey with a market capitalization of TRY20.74 billion.

Operations: Avrupakent generates revenue primarily from land sales (TRY4.09 billion), residential and office projects (TRY1.49 billion), and rental offices and shopping centers (TRY1.87 billion). The company's net profit margin is a key metric to consider when evaluating its financial performance.

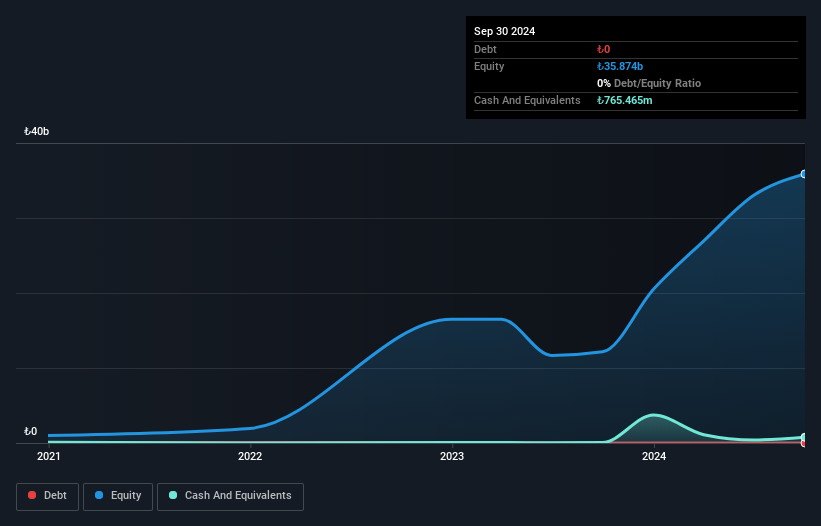

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi, a promising player in the real estate sector, has shown significant growth with earnings up by 56.8% over the past year, outpacing its industry peers. Despite being debt-free for five years, it reported a substantial one-off gain of TRY4.9 billion impacting recent financial results. The company's net income surged to TRY7.38 billion from TRY4.71 billion last year, reflecting robust operational performance amid challenging market conditions. With free cash flow turning positive at TRY538 million by mid-2024 and trading significantly below its estimated fair value, Avrupakent presents intriguing potential for investors seeking opportunities in emerging markets like Turkey's real estate scene.

Sinpas Gayrimenkul Yatirim Ortakligi (IBSE:SNGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sinpas Gayrimenkul Yatirim Ortakligi, originally established as Sinpas Insaat in 2006 and transformed into a Real Estate Investment Partnership in 2007, operates primarily in the real estate sector with a market capitalization of TRY13.88 billion.

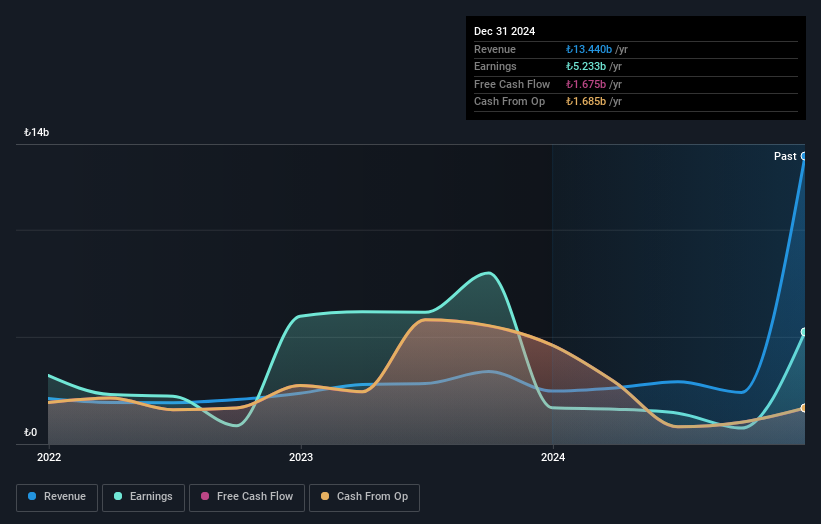

Operations: Sinpas Gayrimenkul Yatirim Ortakligi generates revenue primarily from residential real estate developments, amounting to TRY13.44 billion.

Sinpas Gayrimenkul Yatirim Ortakligi, a notable player in the Middle East real estate sector, has shown remarkable financial shifts. Over five years, its debt to equity ratio plummeted from 608.3% to 11.3%, reflecting improved financial stability with a satisfactory net debt to equity of 11.1%. Earnings surged by 210.1% last year, significantly outpacing the Residential REITs industry growth of 5.8%. However, profit margins dipped to 38.9% from the previous year's 68.3%, influenced by a substantial TRY5.3 billion one-off gain in its recent results ending December 2024, highlighting both potential and volatility in its earnings profile.

- Delve into the full analysis health report here for a deeper understanding of Sinpas Gayrimenkul Yatirim Ortakligi.

Learn about Sinpas Gayrimenkul Yatirim Ortakligi's historical performance.

Rotshtein Realestate (TASE:ROTS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rotshtein Realestate Ltd focuses on the development and construction of residential projects in Israel, with a market capitalization of ₪1.29 billion.

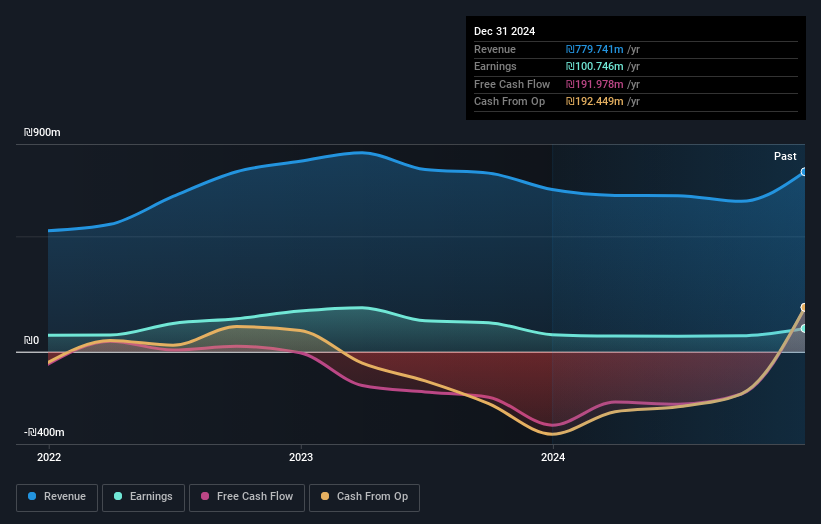

Operations: Rotshtein Realestate generates revenue primarily from the development and construction of residential projects, amounting to ₪789.57 million. The company's investment property segment contributes an additional ₪13.40 million in revenue.

Rotshtein Realestate, a smaller player in the Middle East real estate market, has shown impressive performance with earnings rising by 36% over the past year. This growth surpasses the industry average of 34.6%, highlighting its competitive edge. The company's net income jumped to ILS 100.75 million from ILS 73.91 million previously, while basic earnings per share increased to ILS 6.34 from ILS 4.8 last year. Despite trading at nearly half its estimated fair value, Rotshtein's debt remains high with a net debt to equity ratio of 170%. However, interest payments are comfortably covered by EBIT at a rate of 4.1x.

- Navigate through the intricacies of Rotshtein Realestate with our comprehensive health report here.

Explore historical data to track Rotshtein Realestate's performance over time in our Past section.

Next Steps

- Navigate through the entire inventory of 242 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rotshtein Realestate, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ROTS

Rotshtein Realestate

Develops and constructs residential projects in Israel.

Solid track record and good value.

Market Insights

Community Narratives