- Turkey

- /

- Industrial REITs

- /

- IBSE:RYGYO

Exploring Three Promising Middle East Stocks with Strong Potential

Reviewed by Simply Wall St

As most Gulf markets recently ended lower due to weak oil prices and ongoing global economic concerns, investors are paying close attention to corporate earnings reports that could influence market sentiment. In this environment, identifying promising stocks involves looking for companies with strong fundamentals and resilience in the face of fluctuating energy prices and broader market pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Payton Industries | NA | 5.14% | 14.54% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 54.38% | 44.16% | 40.25% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi (IBSE:KLKIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi is engaged in the construction chemicals industry, serving both domestic and international markets, with a market capitalization of TRY14.78 billion.

Operations: Kalekim generates revenue primarily from Ceramic Applications and Concrete Chemicals, contributing TRY4.54 billion and TRY1.96 billion respectively. The Paint-Plaster and Technical Construction Chemicals segments also contribute to the revenue with TRY449.51 million and TRY504.04 million respectively.

Kalekim Kimyevi Maddeler Sanayi Ve Ticaret Anonim Sirketi, a notable player in the chemicals industry, boasts a price-to-earnings ratio of 14.6x, undercutting the TR market's 21.2x, indicating good value. Over the past year, earnings surged by 26.6%, outpacing the industry's 3.2% growth rate and showcasing robust performance with net income reaching TRY 324 million for Q2 of 2025 compared to TRY 237 million last year. The debt-to-equity ratio improved from 19% to just 5% over five years, highlighting financial prudence and positioning it well for continued growth with forecasted earnings expansion at nearly 29% annually.

Ofis Yem Gida Sanayi ve Ticaret (IBSE:OFSYM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ofis Yem Gida Sanayi ve Ticaret A.S. operates in Turkey, focusing on the production and sale of livestock feeds, with a market capitalization of TRY10.75 billion.

Operations: The company generates revenue primarily from the production and sale of livestock feeds. Its financial performance is influenced by the cost of raw materials and production expenses. The net profit margin has shown variability, reflecting the impact of these costs on overall profitability.

With a net income jump to TRY 264.88 million in the first half of 2025 from TRY 90.82 million a year ago, Ofis Yem Gida Sanayi ve Ticaret showcases its robust financial health. The earnings surge of 1367% over the past year outpaces industry norms significantly, underscoring its high-quality earnings profile. Despite sales dipping to TRY 8,453.93 million for six months compared to last year's TRY 9,477.22 million, the company's price-to-earnings ratio at 20.3x remains attractive against the TR market's average of 21.5x, and its debt-to-equity ratio is satisfactorily low at 34.7%.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. operates as a real estate investment trust focusing on commercial properties, with a market capitalization of TRY41.24 billion.

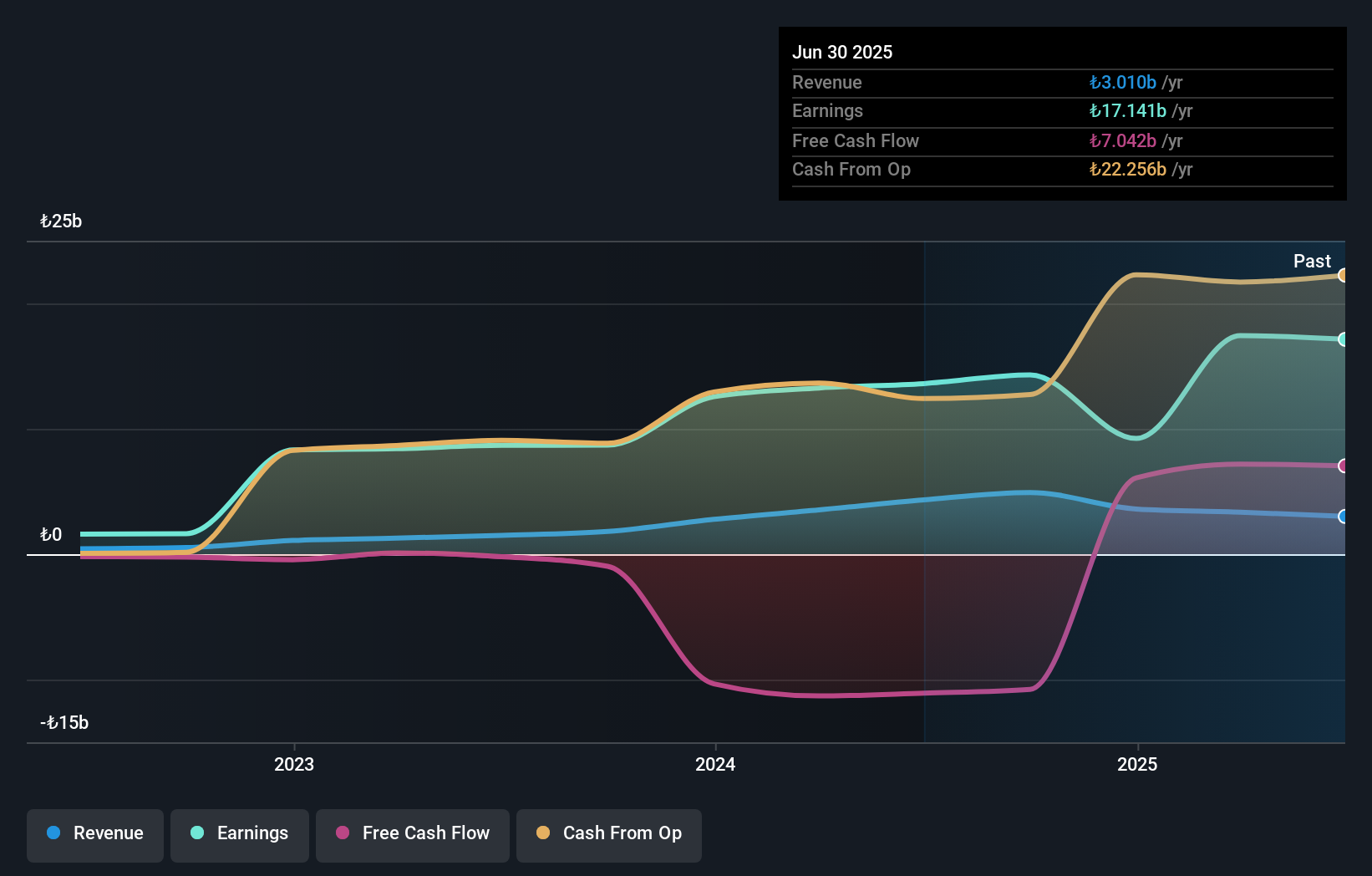

Operations: Reysas Gayrimenkul Yatirim Ortakligi generates revenue from its commercial real estate investments, with reported earnings of TRY3.01 billion. The company's financial performance is highlighted by a focus on optimizing its investment returns within the commercial property sector.

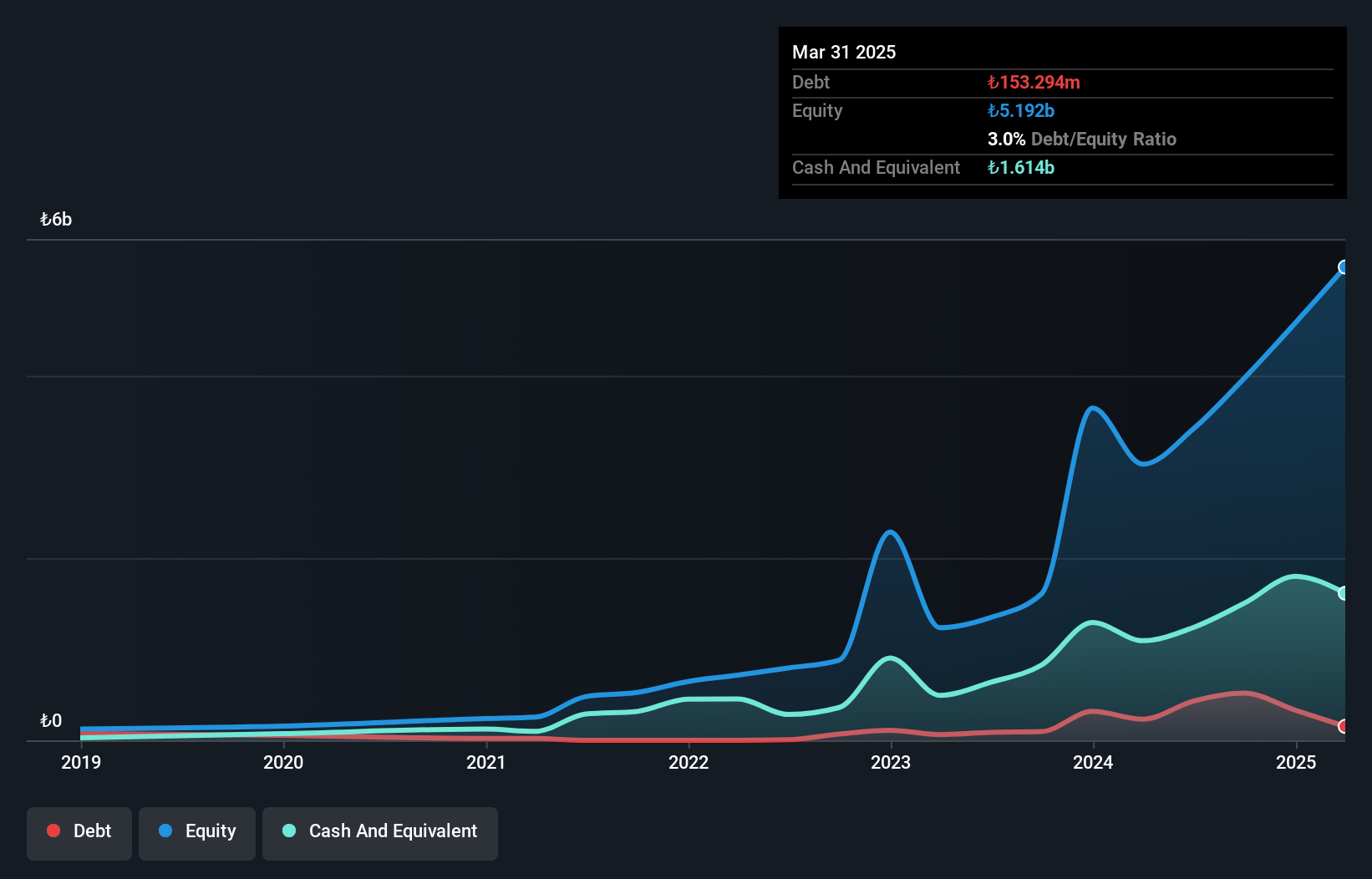

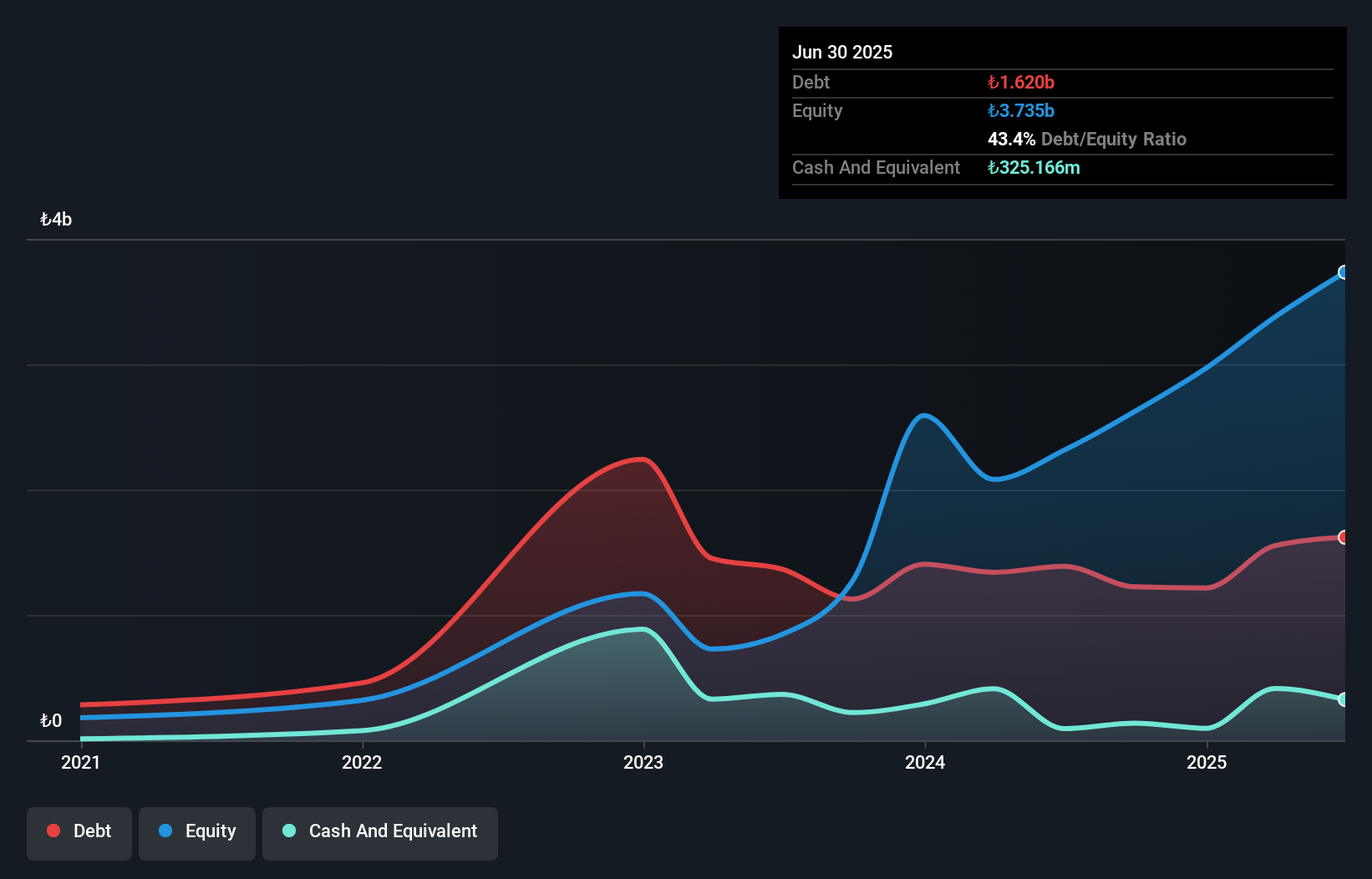

Reysas Gayrimenkul Yatirim Ortakligi, a promising player in the industrial REITs sector, has shown impressive financial health with its debt to equity ratio dropping significantly from 66.8% to 7.6% over five years. This improvement aligns with their robust earnings growth of 26%, outpacing the industry average of 5.6%. Despite a dip in quarterly sales and net income compared to last year, Reysas still reported high-quality earnings and trades at nearly half its estimated fair value. The company’s net debt to equity ratio stands at a satisfactory level of 6%, ensuring interest coverage is not an issue.

- Navigate through the intricacies of Reysas Gayrimenkul Yatirim Ortakligi with our comprehensive health report here.

Learn about Reysas Gayrimenkul Yatirim Ortakligi's historical performance.

Where To Now?

- Explore the 207 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:RYGYO

Reysas Gayrimenkul Yatirim Ortakligi

Reysas Gayrimenkul Yatirim Ortakligi A.S.

Solid track record and good value.

Market Insights

Community Narratives