As global markets continue to navigate geopolitical tensions and policy uncertainties, smaller-cap indexes have been outperforming their larger counterparts, suggesting a renewed investor interest in more nimble companies. With U.S. indexes nearing record highs and positive economic indicators like falling jobless claims and rising home sales, the environment seems conducive for exploring stocks with promising potential. In such a dynamic market landscape, identifying stocks that combine strong fundamentals with growth opportunities can be key to uncovering undiscovered gems worth considering.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market capitalization of TRY43.35 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi generates revenue primarily from its motor vehicles and motor vehicles liability insurance segments, contributing TRY12.77 billion and TRY7.31 billion respectively. The disease/health insurance segment also plays a significant role with revenues of TRY7.28 billion.

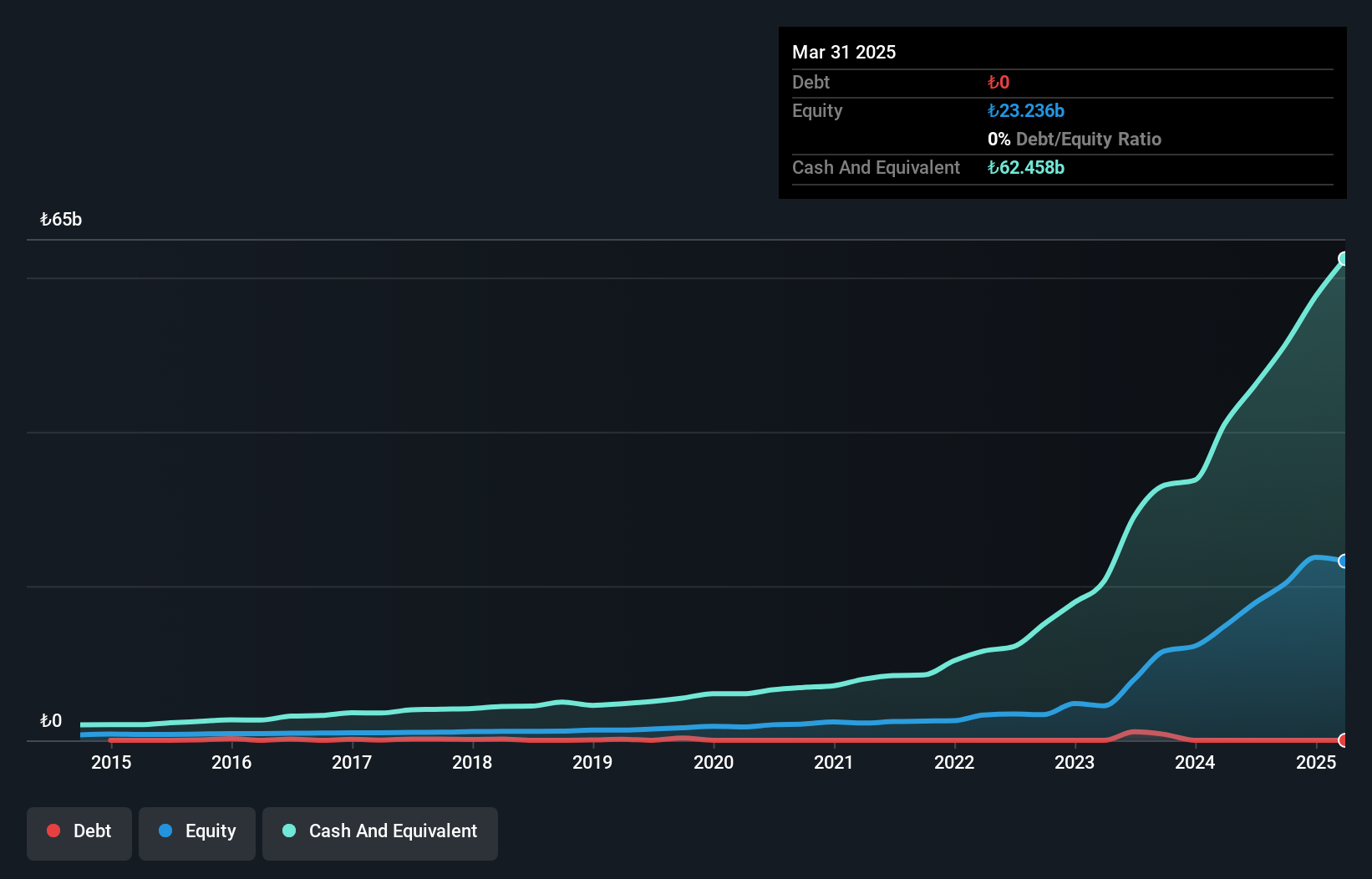

Anadolu Sigorta, a prominent player in the insurance sector, showcases strong financial health with a Price-To-Earnings ratio of 4.9x, significantly below the TR market average of 15.5x, indicating potential undervaluation. The company is debt-free now compared to five years ago when its debt-to-equity ratio stood at 18.9%. Over the past five years, earnings have grown impressively by 67.9% annually despite not outpacing industry growth last year. Recent figures reveal a net income for Q3 at TRY 2,596 million and nine-month earnings reaching TRY 8,279 million—highlighting robust performance amidst competitive pressures.

- Click to explore a detailed breakdown of our findings in Anadolu Anonim Türk Sigorta Sirketi's health report.

Learn about Anadolu Anonim Türk Sigorta Sirketi's historical performance.

Reysas Gayrimenkul Yatirim Ortakligi (IBSE:RYGYO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reysas Gayrimenkul Yatirim Ortakligi A.S. is a real estate investment trust focused on commercial properties, with a market capitalization of TRY29.30 billion.

Operations: RYGYO generates revenue primarily from its commercial real estate segment, reporting TRY3.53 billion in this area.

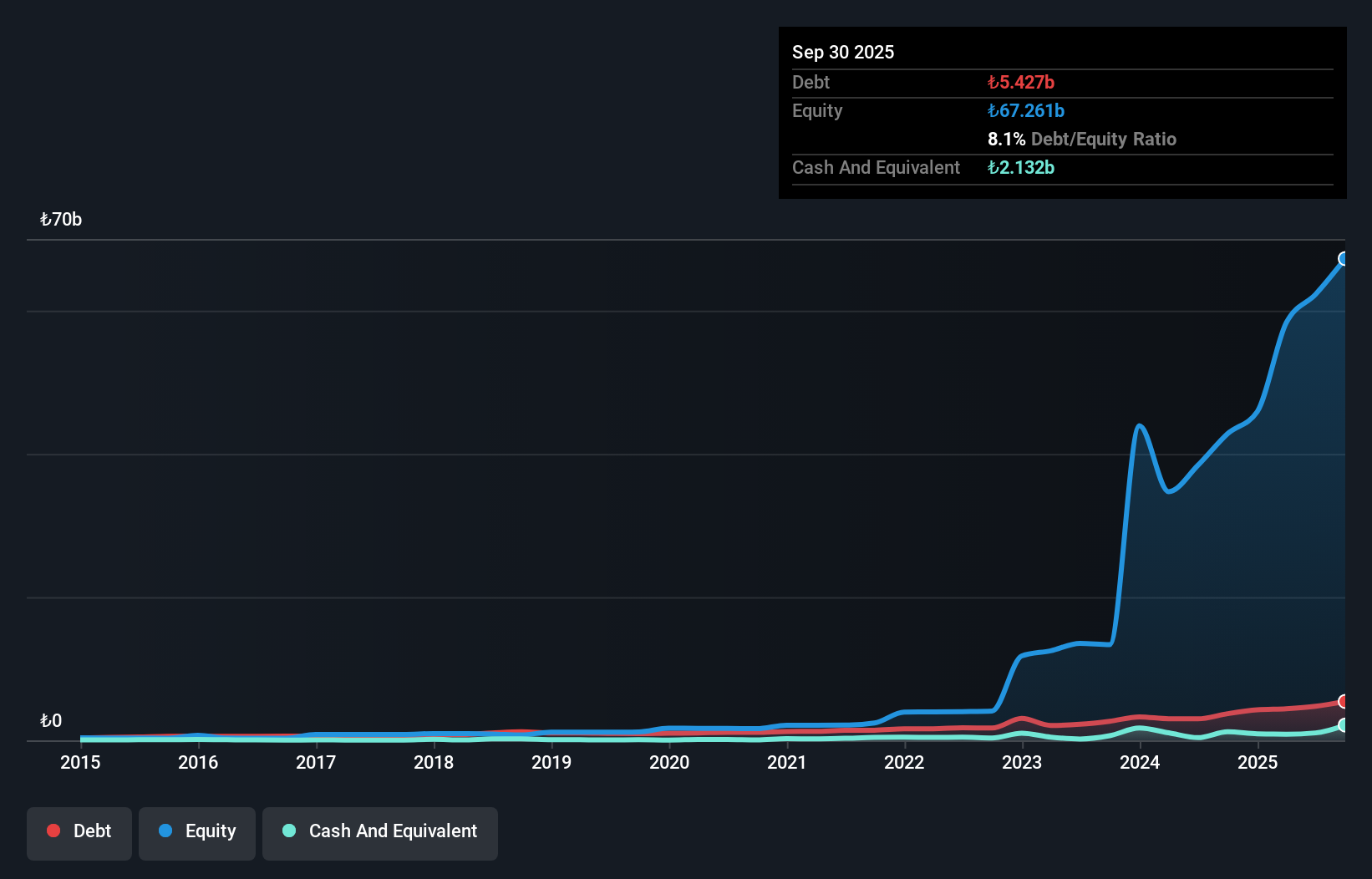

Reysas Gayrimenkul Yatirim Ortakligi, a notable player in the real estate investment sector, has demonstrated impressive financial growth recently. Its earnings soared by 115.7% over the past year, significantly outpacing industry averages. The company's debt to equity ratio improved dramatically from 79.8% to just 8.7% over five years, reflecting strong financial management. In recent quarters, net income reached TRY 802 million for Q3 compared to TRY 106 million a year ago, with sales climbing to TRY 1 billion from TRY 474 million last year. Trading at about half its estimated fair value suggests potential investment appeal despite share price volatility.

Migdal Insurance and Financial Holdings (TASE:MGDL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Migdal Insurance and Financial Holdings Ltd., with a market cap of ₪6.82 billion, operates in Israel offering insurance, pension, and financial services for both private and corporate clients through its subsidiaries.

Operations: Migdal generates revenue primarily from its life insurance and long-term savings segment, which includes life insurance contributing ₪26.70 billion. The general insurance sector also plays a significant role with automobile property insurance bringing in ₪904.37 million. Net profit margin trends are crucial for understanding profitability dynamics within these segments over time.

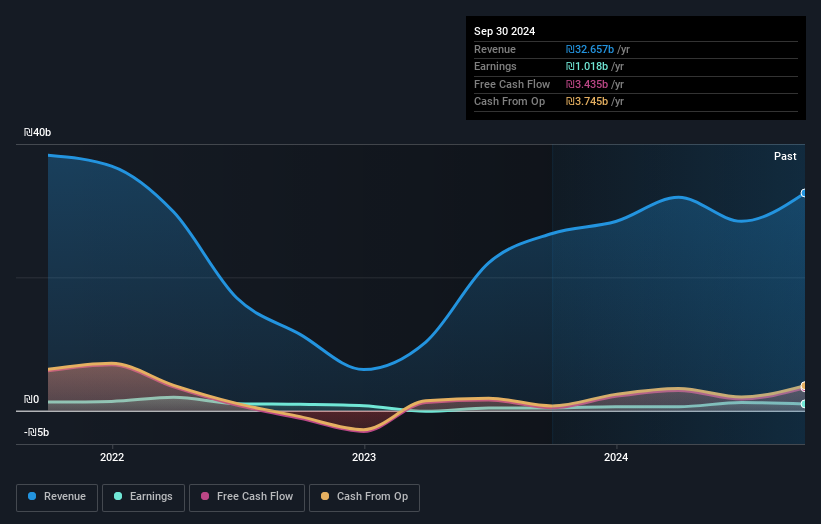

Migdal Insurance, a financial player with a market cap that suggests potential for growth, has been making notable strides. Trading at 63.5% below its estimated fair value, it presents an intriguing opportunity. The company's interest payments are well covered by EBIT at 7.4 times coverage, highlighting strong financial health. Over the past five years, earnings have grown annually by 26.9%, showcasing consistent performance despite not outpacing industry growth of 148.8%. Recent earnings reveal revenue of ILS 9.91 billion for Q3 2024 compared to ILS 5.67 billion last year; however, net income dipped to ILS 20 million from ILS 224 million previously due to likely increased expenses or strategic investments impacting short-term profits but potentially setting up long-term gains.

Summing It All Up

- Embark on your investment journey to our 4621 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ANSGR

Anadolu Anonim Türk Sigorta Sirketi

Offers non-life insurance products in Turkey.

Flawless balance sheet with acceptable track record.