- Turkey

- /

- Electric Utilities

- /

- IBSE:ARASE

Three Hidden Small Caps To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets show resilience with smaller-cap indexes outperforming large-caps, investors are increasingly seeking opportunities in less prominent sectors to diversify their portfolios. In this environment of broad-based gains and positive economic indicators, identifying small-cap stocks that offer potential for growth can be a strategic move, as these often-overlooked gems may provide unique value propositions aligned with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harvia Oyj specializes in the manufacturing and distribution of traditional, steam, and infrared saunas, with a market capitalization of €811.15 million.

Operations: Harvia generates revenue primarily from its Building Materials - HVAC Equipment segment, amounting to €163.66 million.

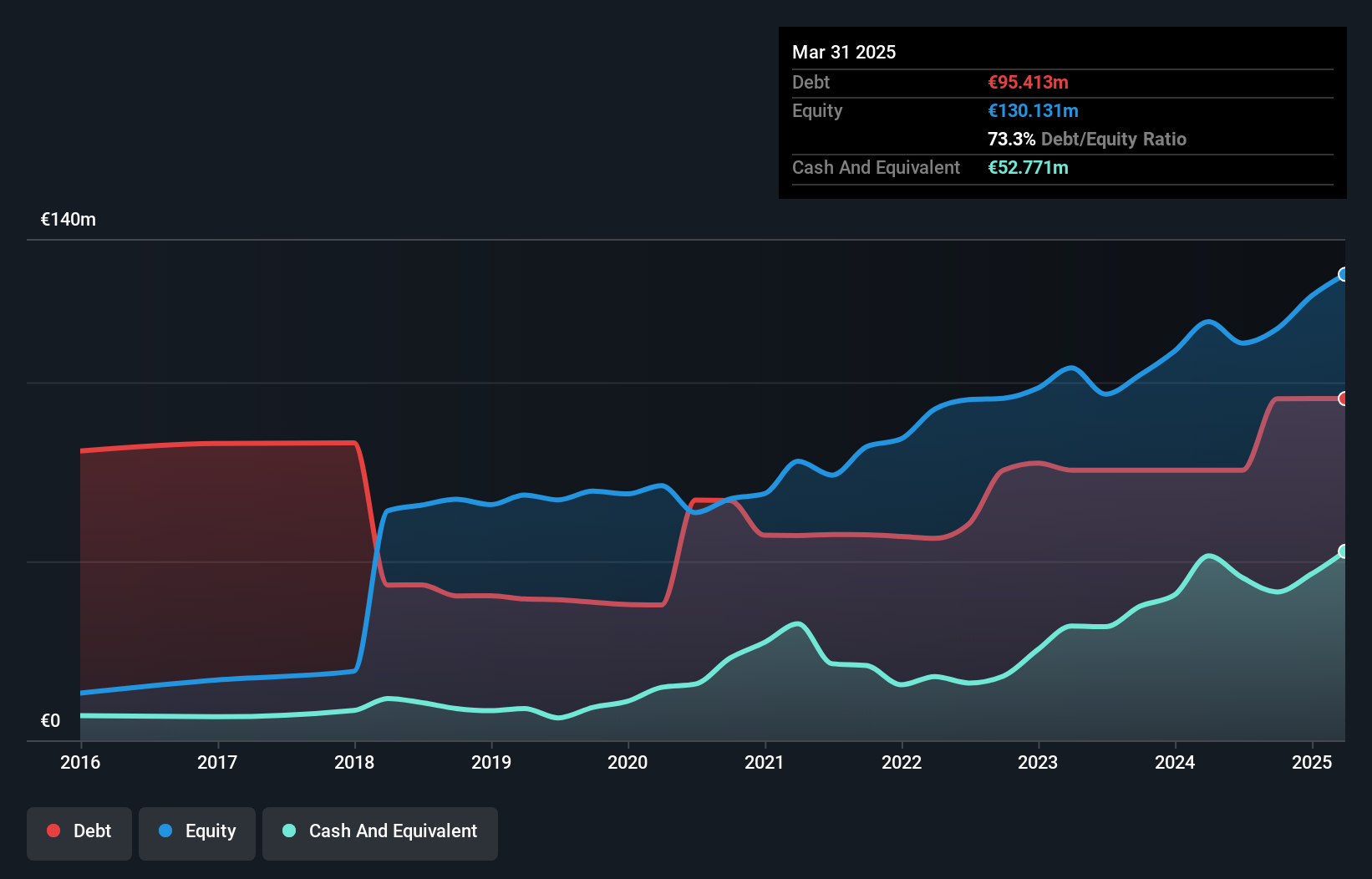

Harvia, a notable player in the sauna and spa sector, has demonstrated robust financial performance with sales reaching €38.72 million for Q3 2024, up from €33.98 million the previous year. The company's net income also rose to €5.46 million compared to last year's €4.47 million, reflecting high-quality earnings and an impressive EBIT coverage of interest payments at 14.6 times. Despite a rise in its debt-to-equity ratio from 55% to 83% over five years, Harvia's net debt remains manageable at 47%. However, recent insider selling may raise eyebrows among investors considering its promising forecasted earnings growth of 17% annually.

- Click to explore a detailed breakdown of our findings in Harvia Oyj's health report.

Evaluate Harvia Oyj's historical performance by accessing our past performance report.

Dogu Aras Enerji Yatirimlari (IBSE:ARASE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dogu Aras Enerji Yatirimlari AS, with a market cap of TRY12.67 billion, operates in Turkey focusing on the retail sale and distribution of electricity through its subsidiaries.

Operations: Dogu Aras Enerji Yatirimlari generates revenue primarily from retail electricity sales, accounting for TRY23.31 billion, and electricity distribution, contributing TRY9.39 billion. The company's financial performance is influenced by these core segments without detailing specific cost breakdowns or profit margins in the provided data.

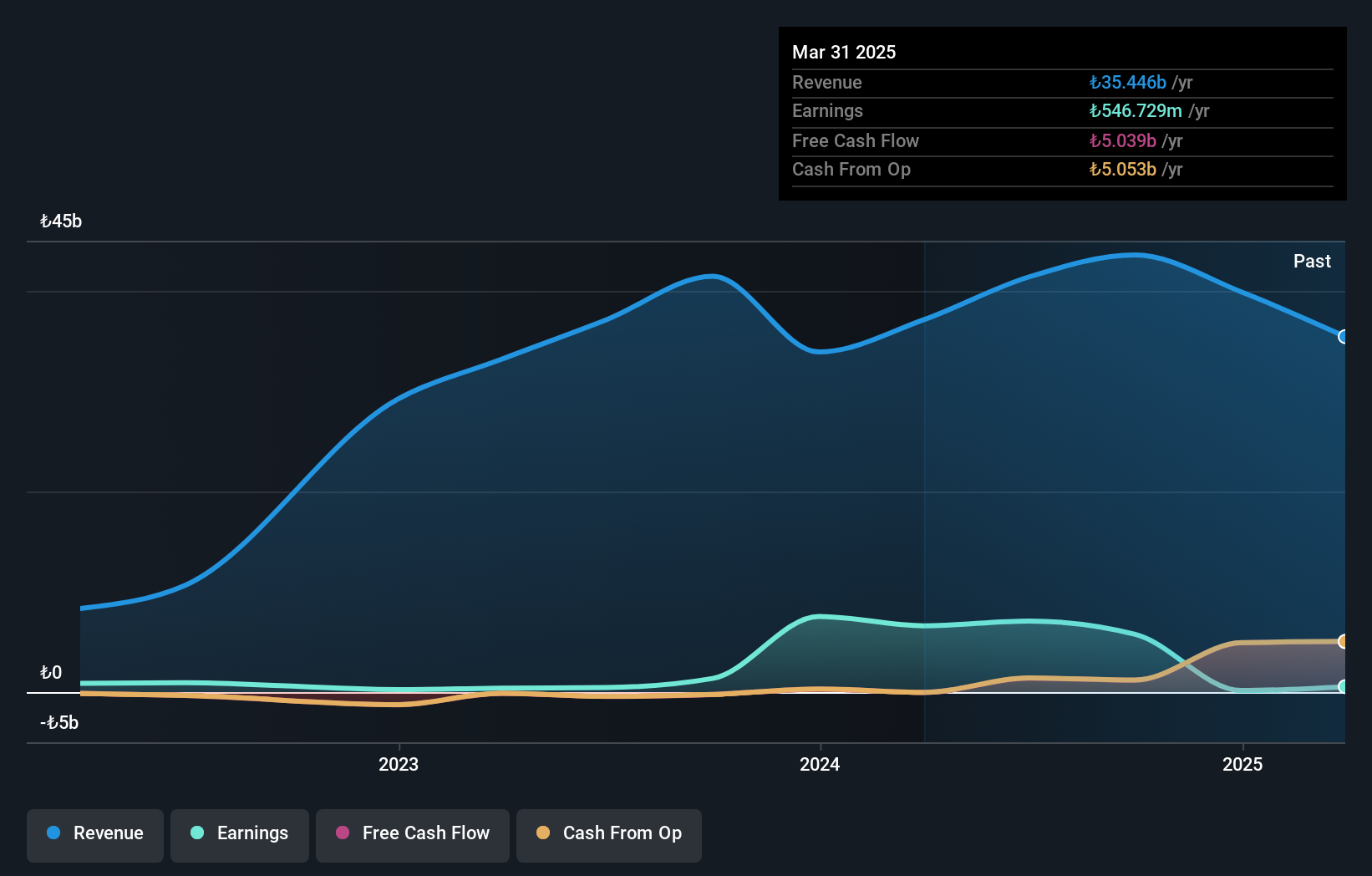

Dogu Aras Enerji Yatirimlari, a player in the energy sector, has seen its earnings soar by 157% over the past year, outpacing the industry's modest 3% growth. Despite this impressive profit surge, revenue dropped by 25.5%, highlighting potential challenges in sales performance. The company's net debt to equity ratio stands at a satisfactory 15%, indicating manageable leverage levels. However, recent financial results show mixed outcomes; while third-quarter sales increased to TRY 10.16 billion from TRY 7.98 billion last year, it recorded a net loss of TRY 340 million compared to previous profits of TRY 982 million.

Ege Profil Ticaret ve Sanayi Anonim Sirketi (IBSE:EGPRO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Profil Ticaret ve Sanayi Anonim Sirketi is engaged in the manufacturing and sale of plastic pipes, spare parts, and various profiles and plastic goods in Turkey, with a market capitalization of TRY12.41 billion.

Operations: Ege Profil generates revenue primarily from its Building Products segment, amounting to TRY7.40 billion.

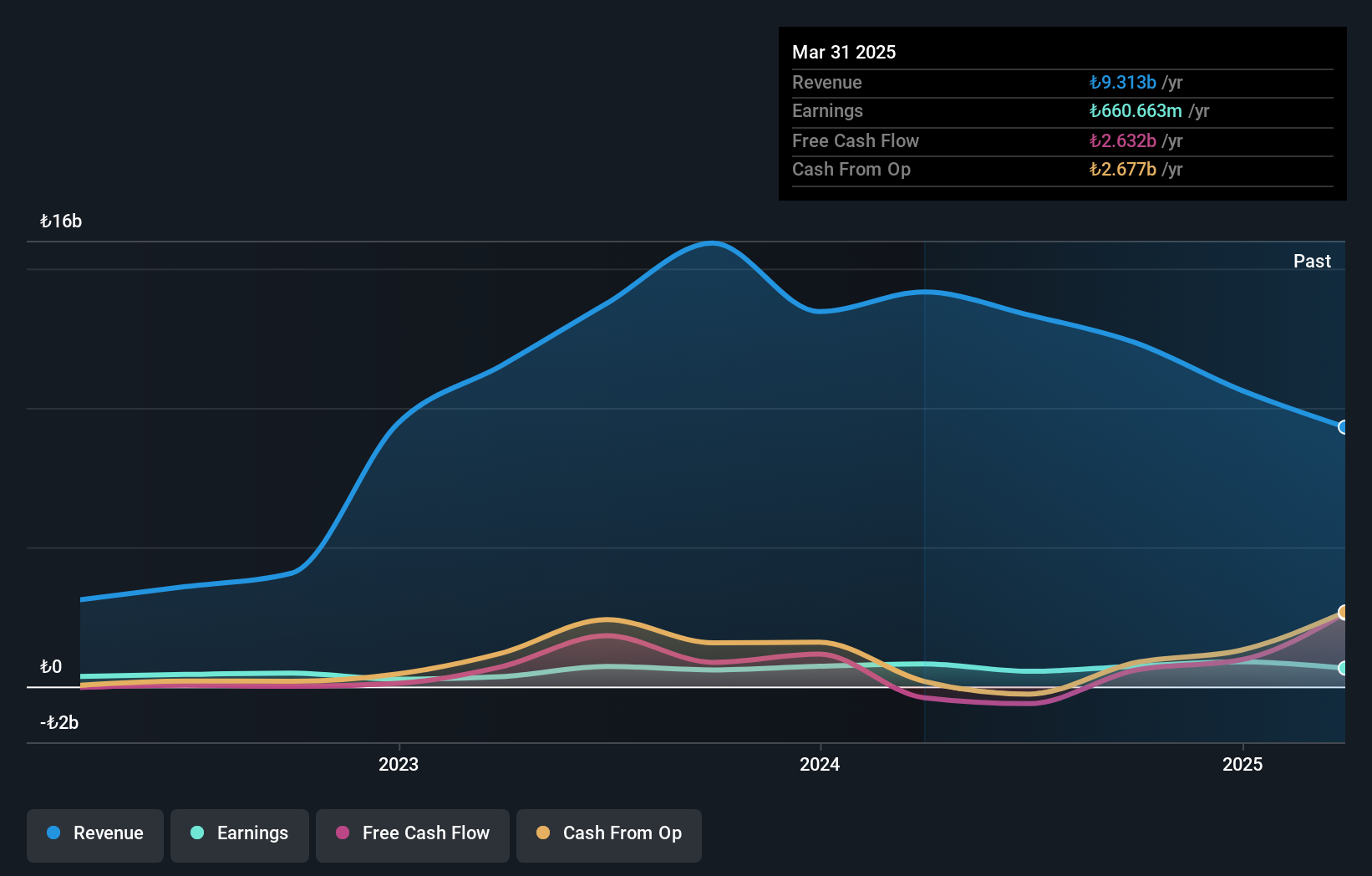

Ege Profil, a smaller player in the building industry, showcases robust financial health with a satisfactory net debt to equity ratio of 6.5% and strong interest coverage at 52.6 times EBIT. Despite experiencing negative earnings growth of 25.3% over the past year, its high-quality earnings and positive free cash flow offer some reassurance. The company reported TRY 2,327.7 million in third-quarter sales for 2024 compared to TRY 3,318.72 million last year but turned around from a net loss to a net income of TRY 184.09 million this quarter. Over five years, debt levels have impressively decreased from 68.5% to just 11.2%.

Taking Advantage

- Reveal the 4634 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ARASE

Dogu Aras Enerji Yatirimlari

Through its subsidiaries, engages in the retail sale and distribution of electricity in Turkey.

Excellent balance sheet and fair value.

Market Insights

Community Narratives