Undiscovered Gems With Strong Fundamentals To Watch This November 2024

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and small-cap stocks outperforming their larger counterparts, investors are increasingly optimistic amid strong labor market data and rising home sales. In this environment of broad-based gains, identifying stocks with robust fundamentals becomes essential for those looking to capitalize on potential opportunities in the evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions in Turkey and Romania, with a market capitalization of TRY10.91 billion.

Operations: Logo Yazilim generates revenue primarily from the software industry, amounting to TRY3.56 billion.

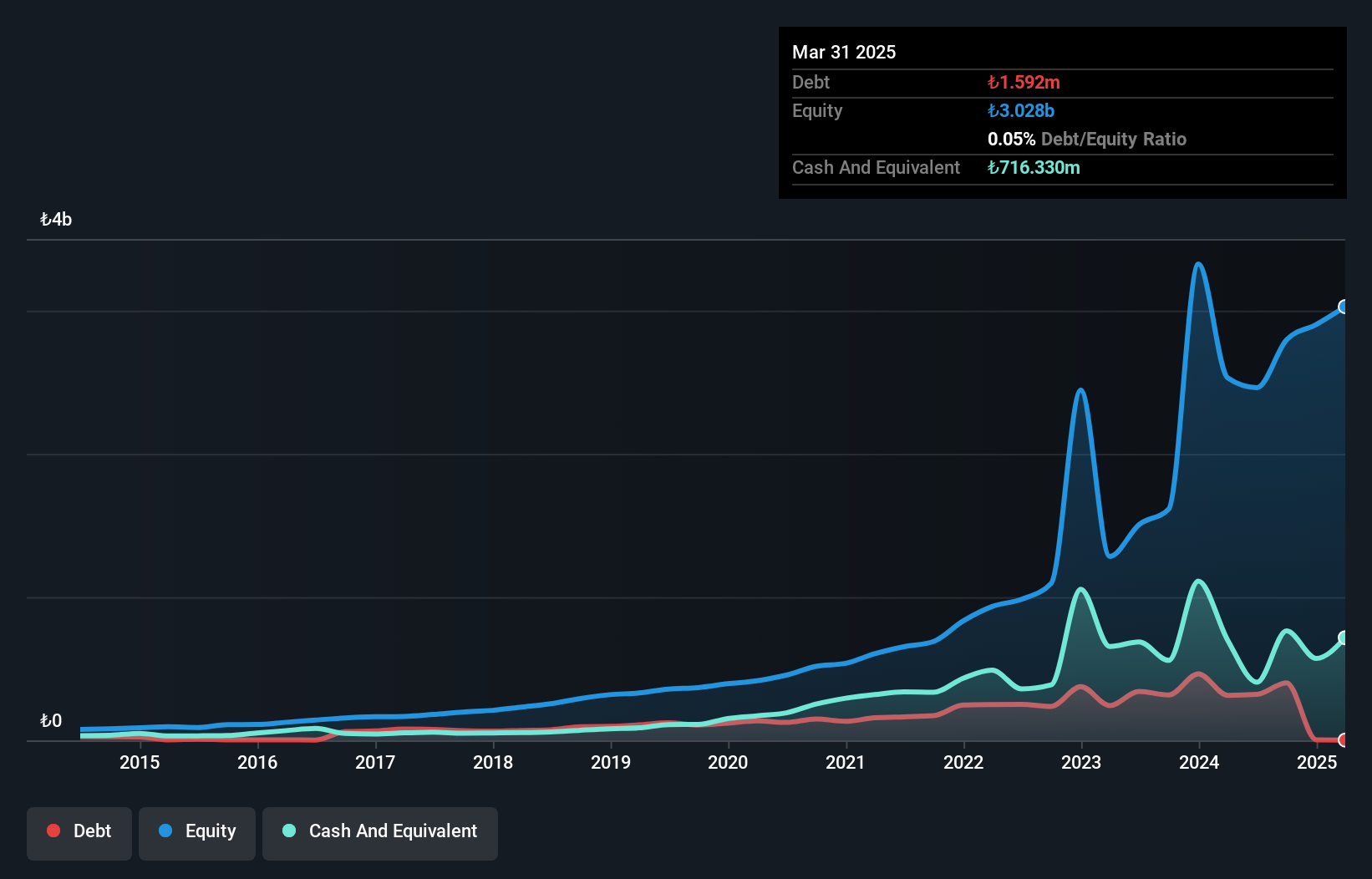

Logo Yazilim, a notable player in the software industry, has demonstrated robust financial performance recently. For the third quarter of 2024, sales reached TRY 1.17 billion compared to TRY 973.89 million last year, turning a net loss into a net income of TRY 111.31 million. Over five years, its debt-to-equity ratio improved significantly from 28.9% to 14.4%, indicating better financial health while maintaining more cash than total debt suggests prudent fiscal management despite interest coverage concerns at only 2.1 times EBIT. Looking ahead, earnings are forecasted to grow by an impressive rate of nearly 95% annually.

Hanil Holdings (KOSE:A003300)

Simply Wall St Value Rating: ★★★★★★

Overview: Hanil Holdings Co., Ltd., along with its subsidiaries, is engaged in the manufacture and sale of construction materials in South Korea, with a market capitalization of ₩442.12 billion.

Operations: Hanil Holdings generates revenue primarily from the manufacture and sale of construction materials in South Korea.

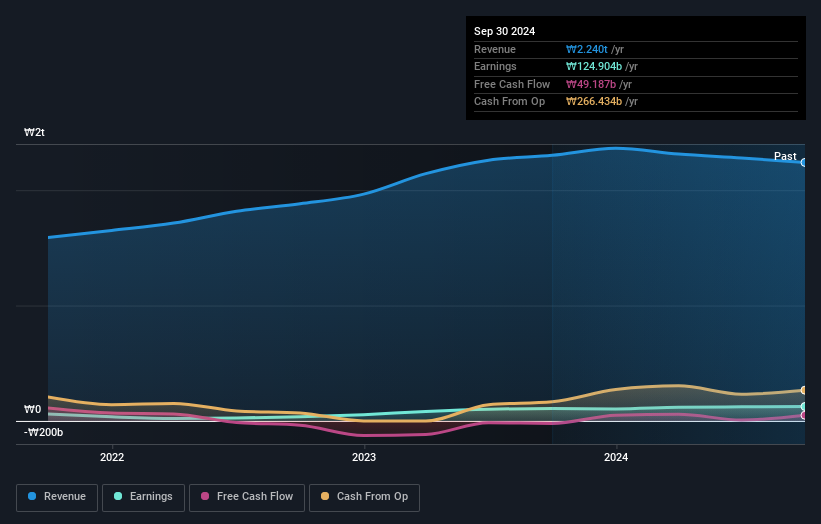

Hanil Holdings, a promising contender in the small cap space, recently reported a net income of KRW 30.54 billion for Q3 2024, up from KRW 27.69 billion the previous year. The company boasts a satisfactory net debt to equity ratio of 13.1%, reflecting strong financial health over time as it reduced from 48.9% to 35.2% in five years. Trading at nearly half its estimated fair value suggests potential undervaluation opportunities for investors seeking growth; earnings grew by an impressive 16.6% last year, outpacing the Basic Materials industry average of 9%.

- Get an in-depth perspective on Hanil Holdings' performance by reading our health report here.

Gain insights into Hanil Holdings' historical performance by reviewing our past performance report.

Onward Holdings (TSE:8016)

Simply Wall St Value Rating: ★★★★★★

Overview: Onward Holdings Co., Ltd. operates in the design, manufacture, and sale of men's, women's, and children's apparel across Japan, China, the United Kingdom, and the United States with a market capitalization of ¥71.40 billion.

Operations: Onward Holdings generates revenue primarily from its apparel business across multiple regions including Japan, China, the United Kingdom, and the United States. The company's financial performance is influenced by its net profit margin trends over time.

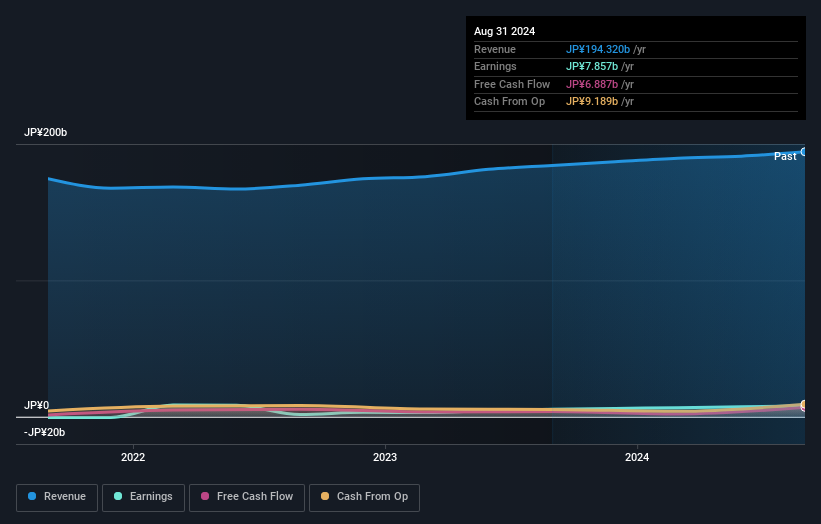

Onward Holdings, a nimble player in the market, has been making waves with its impressive earnings growth of 44.2% over the past year, outpacing the Luxury industry average of 16.7%. The company seems to be trading at a compelling value, priced 36.2% below its estimated fair value. Despite facing a significant one-off loss of ¥3.9 billion impacting recent financial results through August 2024, Onward's interest payments are well covered by EBIT at 23 times coverage. With a satisfactory net debt to equity ratio of 31.6%, it appears financially stable and poised for potential opportunities ahead.

- Delve into the full analysis health report here for a deeper understanding of Onward Holdings.

Explore historical data to track Onward Holdings' performance over time in our Past section.

Next Steps

- Reveal the 4634 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LOGO

Logo Yazilim Sanayi ve Ticaret

Develops and markets software solutions in Turkey and Romania.

High growth potential with proven track record.