- Turkey

- /

- Transportation

- /

- IBSE:ESCAR

Top Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience broad-based gains and U.S. indexes approach record highs, investors are navigating through a landscape marked by strong labor market reports and geopolitical uncertainties. In such an environment, dividend stocks can offer a blend of income stability and potential growth, making them an attractive consideration for portfolios seeking resilience amidst economic fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

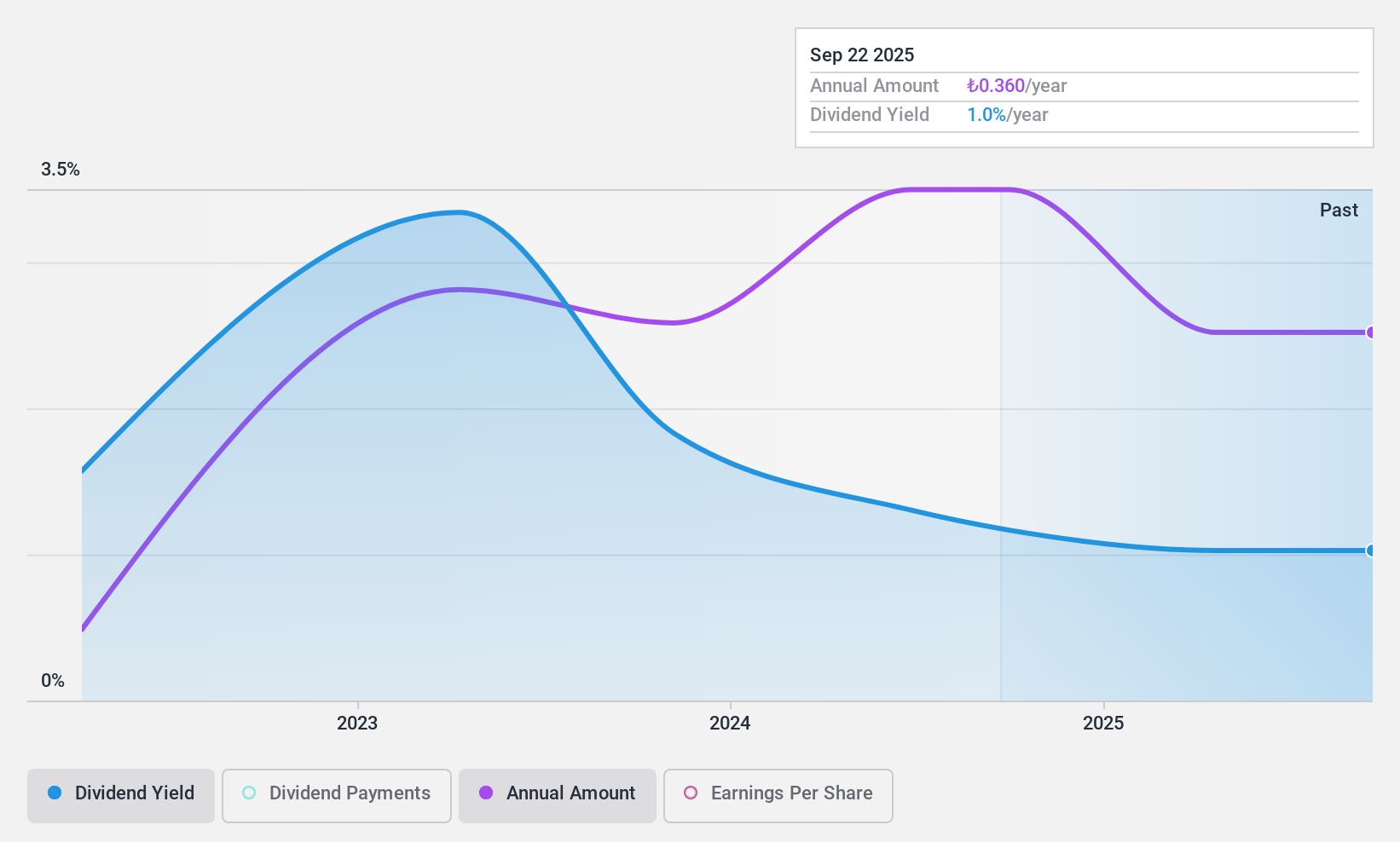

Escar Filo Kiralama Hizmetleri (IBSE:ESCAR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Escar Filo Kiralama Hizmetleri A.S. offers motor vehicle renting services in Turkey with a market cap of TRY22.30 billion.

Operations: Escar Filo Kiralama Hizmetleri A.S. generates revenue primarily through its Rental & Leasing segment, which accounts for TRY1.88 billion.

Dividend Yield: 5.2%

Escar Filo Kiralama Hizmetleri offers a dividend yield of 5.16%, placing it in the top quartile of dividend payers in Turkey. The dividends are well-covered by earnings with a low payout ratio of 11.1% and reasonable cash flow coverage at 73.7%. However, the company's dividend history is unstable, having been paid for only three years with volatility over that period. Recent financial results show declining sales and net income, impacting overall stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Escar Filo Kiralama Hizmetleri.

- According our valuation report, there's an indication that Escar Filo Kiralama Hizmetleri's share price might be on the cheaper side.

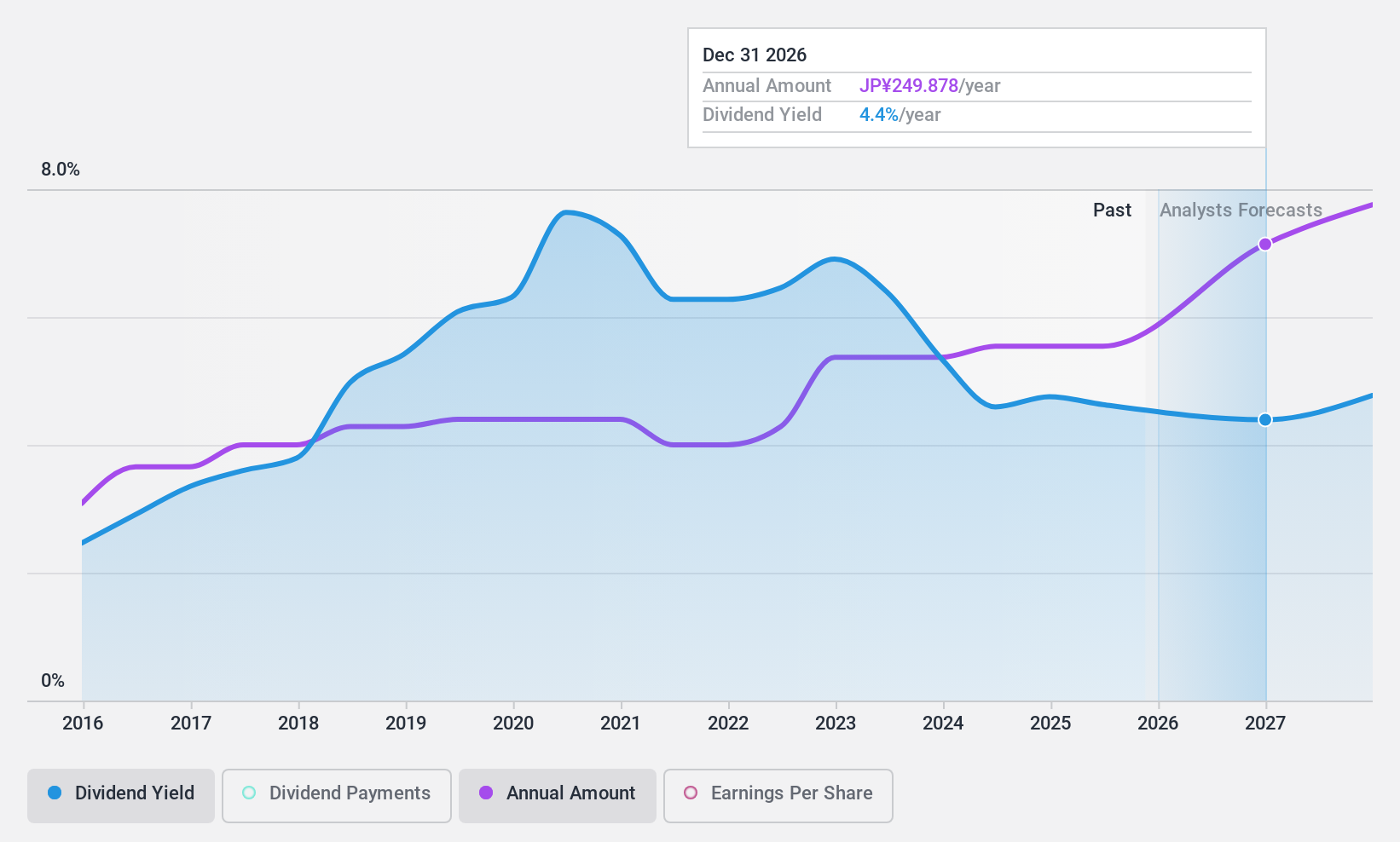

Japan Tobacco (TSE:2914)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Japan Tobacco Inc. is a tobacco company that manufactures and sells tobacco products, pharmaceuticals, and processed foods both in Japan and internationally, with a market cap of ¥7.56 trillion.

Operations: Japan Tobacco Inc.'s revenue is primarily derived from its tobacco segment, which accounts for ¥2.83 trillion, with additional contributions from processed foods at ¥155.88 billion and pharmaceuticals at ¥92.13 billion.

Dividend Yield: 4.6%

Japan Tobacco's dividend yield of 4.56% ranks it among the top 25% in Japan, though its dividend history has been volatile over the past decade. The dividends are covered by earnings with a payout ratio of 72.5%, but not by free cash flows, as indicated by a high cash payout ratio of 106.6%. Recent affirmations maintain the annual dividend forecast at ¥194 per share for 2024, despite modest earnings growth and strategic initiatives in quantum AI-driven drug discovery.

- Delve into the full analysis dividend report here for a deeper understanding of Japan Tobacco.

- In light of our recent valuation report, it seems possible that Japan Tobacco is trading behind its estimated value.

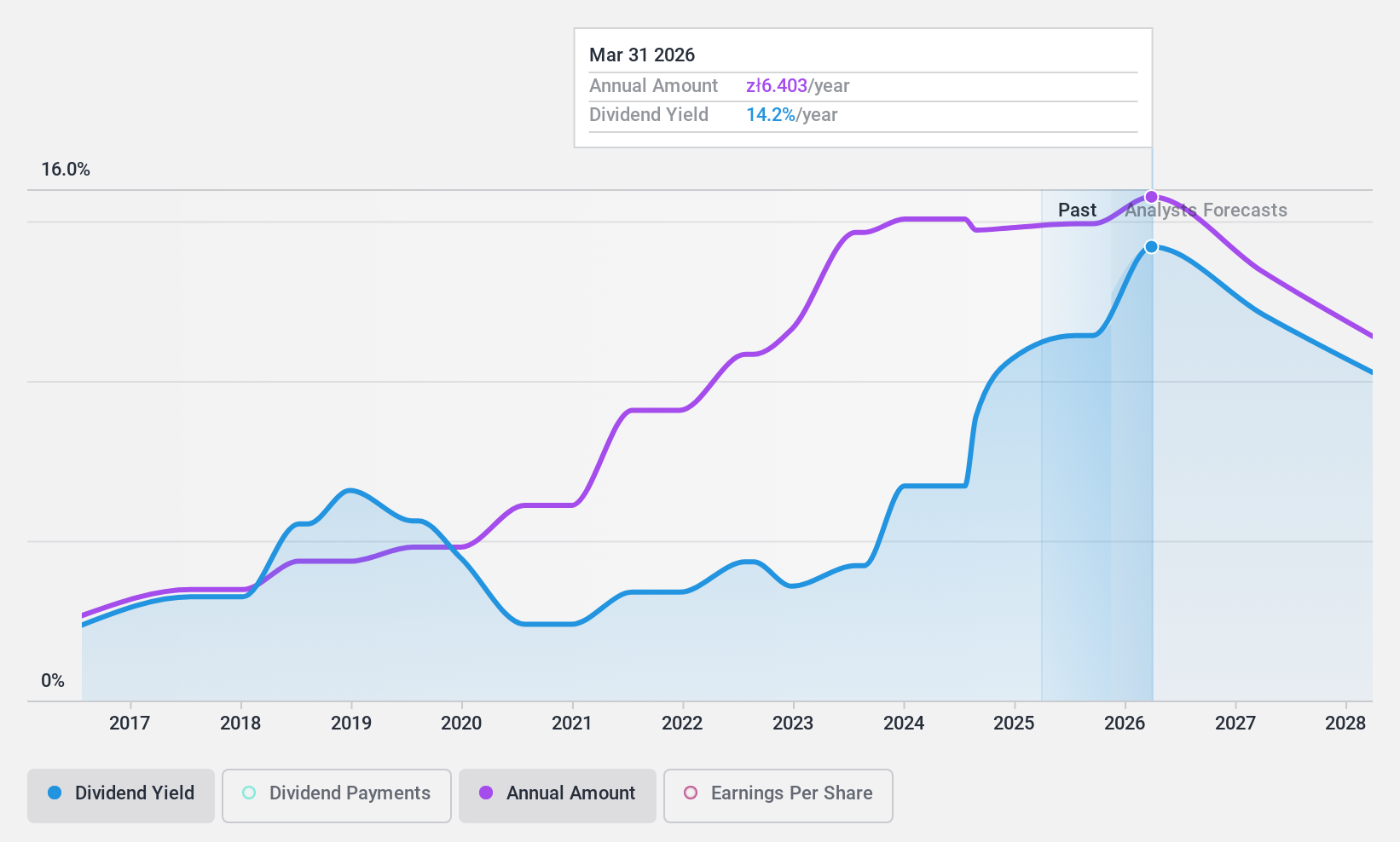

Text (WSE:TXT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Text S.A. develops and distributes online text communication software for businesses worldwide, with a market cap of PLN 1.56 billion.

Operations: Text S.A.'s revenue segments include the development and distribution of online text communication software for businesses globally.

Dividend Yield: 9.9%

Text S.A. offers a high dividend yield of 9.88%, placing it in the top 25% of Polish dividend payers, although its dividends are not well covered by free cash flows, with a cash payout ratio of 102%. Despite this, the company has maintained stable and growing dividends over the past decade. Recent earnings show growth in sales and net income for Q2 2024 compared to last year, but future earnings are expected to decline slightly.

- Click here to discover the nuances of Text with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Text shares in the market.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1963 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Escar Filo Kiralama Hizmetleri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ESCAR

Escar Filo Kiralama Hizmetleri

Provides motor vehicle rental services in Turkey.

Adequate balance sheet unattractive dividend payer.

Market Insights

Community Narratives