- Turkey

- /

- Retail REITs

- /

- IBSE:PAGYO

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from the ECB and SNB, alongside expectations for a Fed cut, investors are witnessing mixed performances across major indices. While the Nasdaq Composite reached new heights, other indexes faced declines amid evolving economic data and monetary policy shifts. In this environment, dividend stocks can offer stability and income potential, providing an attractive option for those seeking to balance growth with consistent returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.70% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.79% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.55% | ★★★★★★ |

Click here to see the full list of 1847 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

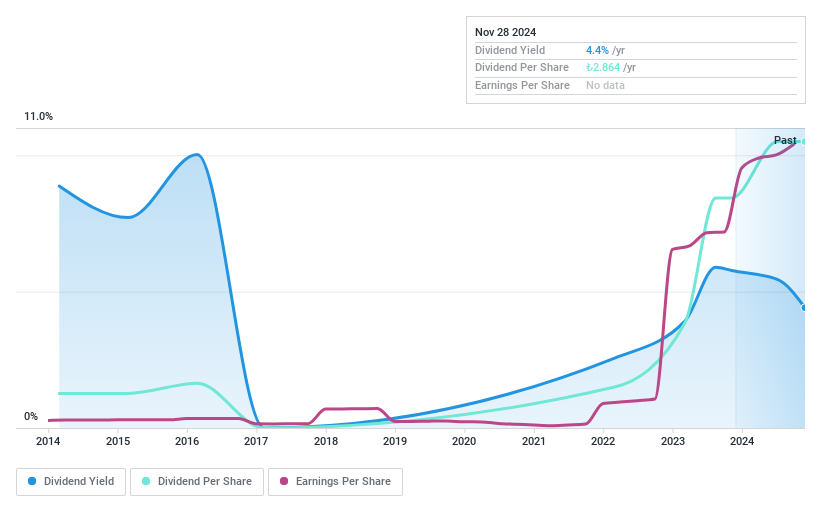

Panora Gayrimenkul Yatirim Ortakligi (IBSE:PAGYO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Panora Gayrimenkul Yatirim Ortakligi A.S. operates in the real estate investment sector, focusing on managing and developing properties, with a market capitalization of TRY6.16 billion.

Operations: Panora Gayrimenkul Yatirim Ortakligi A.S. generates revenue primarily from its commercial real estate investment trust (REIT) segment, amounting to TRY574.41 million.

Dividend Yield: 4%

Panora Gayrimenkul Yatirim Ortakligi has shown strong earnings growth, with a significant rise in net income for the third quarter of 2024 to TRY 154.8 million. Despite this growth, the company's dividend history is marked by volatility and unreliability over the past decade. However, dividends are well-covered by both earnings and cash flows, with low payout ratios of 27% and 26.5%, respectively. The dividend yield stands at an attractive 4.04%, positioning it among the top payers in Turkey's market.

- Click to explore a detailed breakdown of our findings in Panora Gayrimenkul Yatirim Ortakligi's dividend report.

- Our comprehensive valuation report raises the possibility that Panora Gayrimenkul Yatirim Ortakligi is priced lower than what may be justified by its financials.

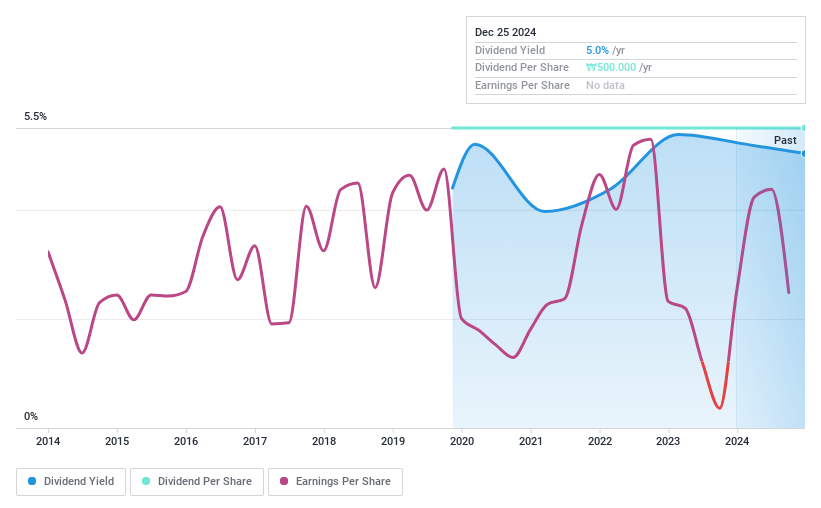

SillaLtd (KOSE:A004970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Silla Co., Ltd operates in the deep-sea fishery business in South Korea with a market cap of ₩157.38 billion.

Operations: Silla Co., Ltd's revenue is primarily derived from the Deep Sea Fishery Sector at ₩212.58 billion, followed by the Fishery Product Distribution Sector at ₩189.59 billion, Agricultural Products & Brokerage at ₩40.81 billion, and the Steel Business contributing ₩30.94 billion.

Dividend Yield: 5%

Silla Ltd.'s dividends are well-supported by earnings and cash flows, with payout ratios of 48.5% and 11.2%, respectively. Despite being profitable this year, the company has only paid dividends for five years without any increase, reflecting an unreliable dividend history. Trading significantly below its estimated fair value, Silla offers a dividend yield of 5.02%, placing it in the top quarter among Korean market payers but lacks long-term stability.

- Click here to discover the nuances of SillaLtd with our detailed analytical dividend report.

- According our valuation report, there's an indication that SillaLtd's share price might be on the cheaper side.

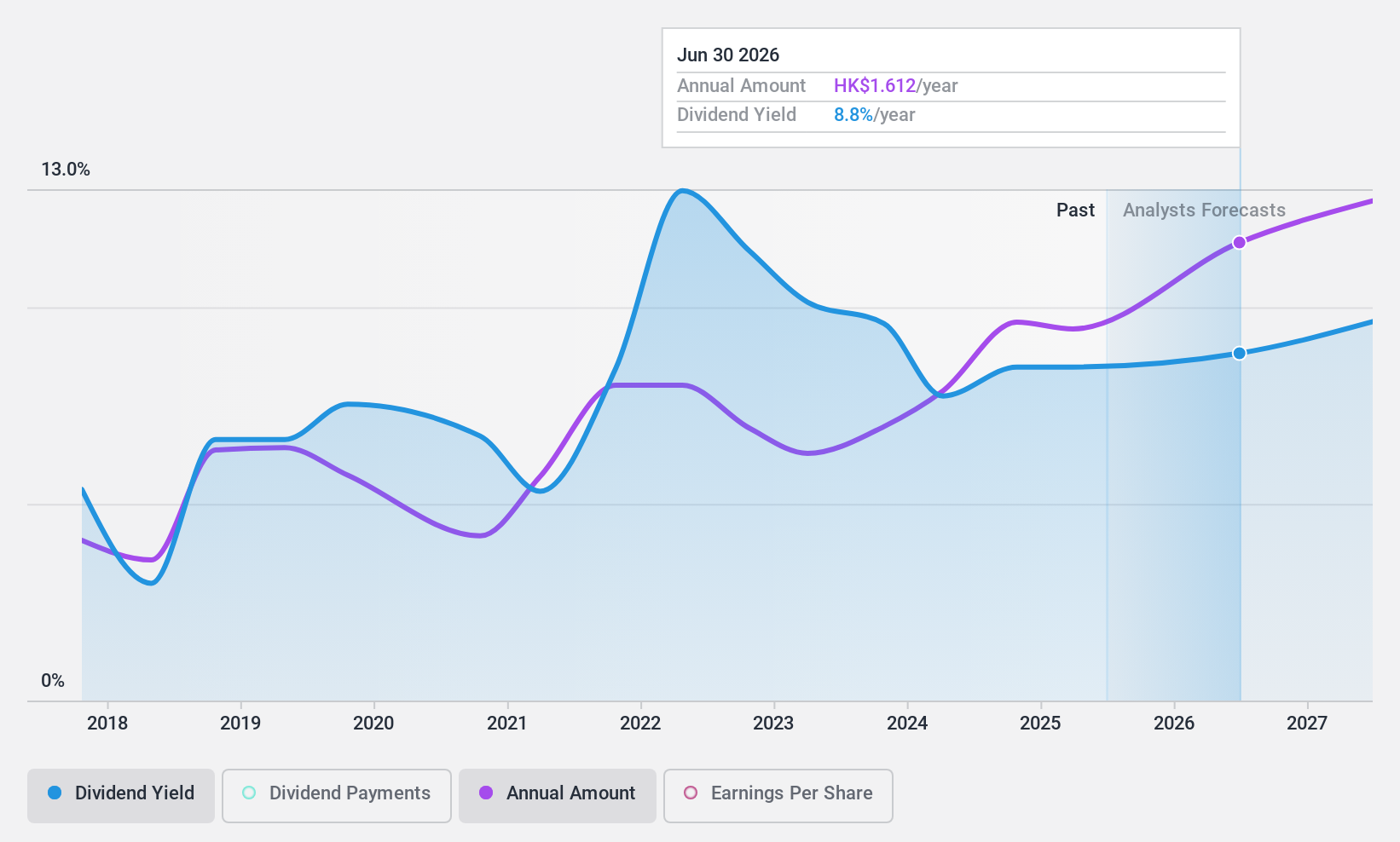

JNBY Design (SEHK:3306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JNBY Design Limited operates in the design, marketing, retail, and sale of fashion apparel, accessory products, and household goods both in China and internationally, with a market capitalization of approximately HK$8.19 billion.

Operations: JNBY Design Limited's revenue is primarily derived from its Mature Brand segment at CN¥2.94 billion, followed by Younger Brands at CN¥2.18 billion, and Emerging Brands at CN¥109.84 million.

Dividend Yield: 8.1%

JNBY Design's dividends are well-covered by earnings and cash flows, with payout ratios of 73.4% and 42.9%, respectively. Despite a top-tier dividend yield of 8.15% in Hong Kong, its seven-year history shows volatility and unreliability in payments. Recent approval for a final dividend of HK$0.86 per share highlights ongoing shareholder returns, though significant insider selling raises caution about future stability despite trading below estimated fair value.

- Unlock comprehensive insights into our analysis of JNBY Design stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JNBY Design shares in the market.

Taking Advantage

- Discover the full array of 1847 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:PAGYO

Panora Gayrimenkul Yatirim Ortakligi

Panora Gayrimenkul Yatirim Ortakligi A.S.

Established dividend payer and good value.

Market Insights

Community Narratives