Middle Eastern Penny Stocks With Market Caps Over US$60M To Watch

Reviewed by Simply Wall St

As the Middle Eastern markets navigate the complexities of global trade tensions, particularly between the U.S. and China, investors are keeping a close eye on regional indices that have shown mixed performances. In this context, penny stocks—though an older term—continue to represent smaller or less-established companies that might offer significant value to discerning investors. By focusing on those with solid financials and growth potential, these stocks can provide unique opportunities for those looking beyond traditional investment options.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.13 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.92 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.999 | ₪123.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.446 | ₪171.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.922 | ₪2.87B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.222 | ₪165.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.709 | AED425.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.40 | AED390.39M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED10.03B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Yayin Holding A.S. operates in Turkey through its subsidiaries, focusing on media, publishing, and advertising businesses with a market cap of TRY940.50 million.

Operations: The company generates revenue from several segments, including Journalism and Printing Works (TRY1.77 billion), News Agencies (TRY389.08 million), and TV Services and Other (TRY318.35 million).

Market Cap: TRY940.5M

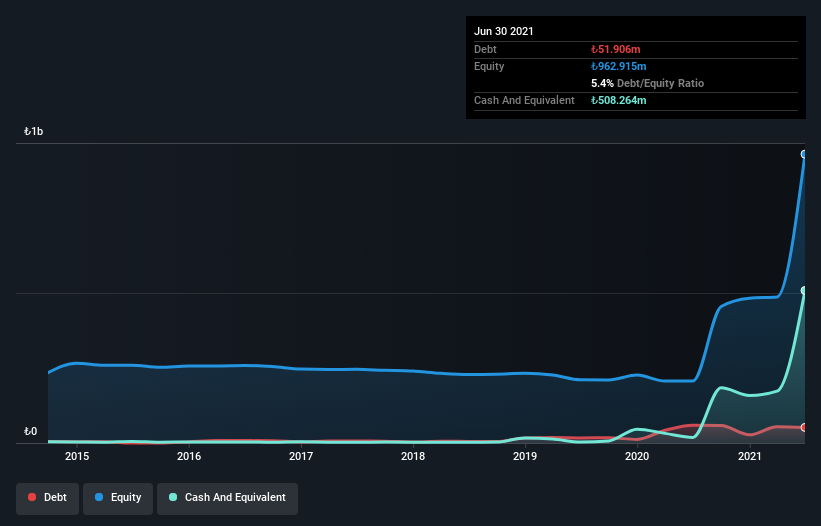

Ihlas Yayin Holding's financial landscape presents a mixed picture for investors considering penny stocks. The company's revenue of TRY2.48 billion reflects a slight decline from the previous year, while it remains unprofitable with a net loss of TRY227.23 million. Despite this, the company has more cash than debt and its short-term assets exceed short-term liabilities, indicating some financial resilience. However, its cash runway is less than one year if free cash flow continues to shrink at historical rates. The board's average tenure of 5.3 years suggests experienced governance amidst these challenges.

- Jump into the full analysis health report here for a deeper understanding of Ihlas Yayin Holding.

- Gain insights into Ihlas Yayin Holding's historical outcomes by reviewing our past performance report.

Metro Ticari ve Mali Yatirimlar Holding (IBSE:METRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metro Ticari ve Mali Yatirimlar Holding A.S. operates as a diversified holding company with various business interests, and it has a market capitalization of TRY1.33 billion.

Operations: The company generates revenue primarily from its Transportation - Railroads segment, amounting to TRY28.73 million.

Market Cap: TRY1.33B

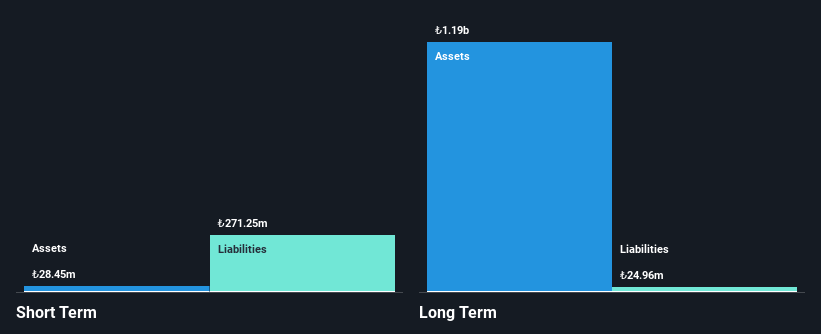

Metro Ticari ve Mali Yatirimlar Holding, with a market cap of TRY1.33 billion, operates without debt and has not diluted shareholders recently. Despite generating TRY28.73 million in revenue primarily from its railroads segment, the company remains unprofitable with a significant net loss of TRY1,085.84 million for the past year. Its short-term assets exceed liabilities but fall short against long-term obligations of TRY219.6 million. The firm boasts a cash runway exceeding three years if current free cash flow remains stable, supported by an experienced board averaging 4.8 years in tenure amidst financial challenges and volatility stability over the past year.

- Unlock comprehensive insights into our analysis of Metro Ticari ve Mali Yatirimlar Holding stock in this financial health report.

- Assess Metro Ticari ve Mali Yatirimlar Holding's previous results with our detailed historical performance reports.

Bonus BioGroup (TASE:BONS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bonus BioGroup Ltd. is a clinical-stage biotechnology company focused on developing tissue engineering and cell therapy products, with a market cap of ₪230.08 million.

Operations: Bonus BioGroup Ltd. currently has no reported revenue segments.

Market Cap: ₪230.08M

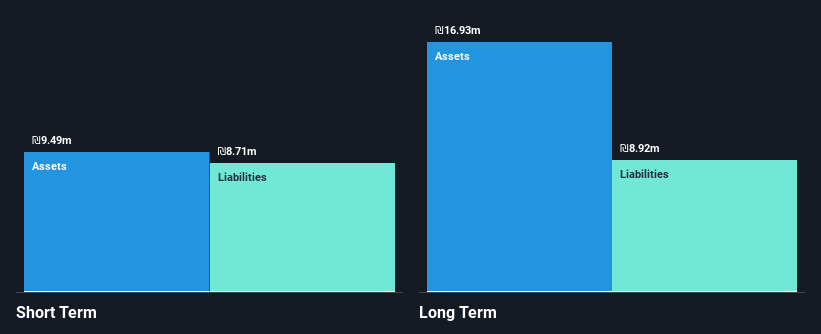

Bonus BioGroup Ltd., with a market cap of ₪230.08 million, is a pre-revenue clinical-stage biotechnology company focusing on tissue engineering and cell therapy products. The firm recently secured FDA clearance for a Phase III clinical study of MesenCure™, targeting respiratory distress in severely ill patients. Despite its potential, the company faces financial challenges, including short-term assets that do not cover liabilities and a cash runway limited to three months before recent capital raising efforts. While debt-free and led by an experienced management team, Bonus BioGroup's stock remains highly volatile with no significant revenue streams yet established.

- Click here and access our complete financial health analysis report to understand the dynamics of Bonus BioGroup.

- Gain insights into Bonus BioGroup's past trends and performance with our report on the company's historical track record.

Next Steps

- Gain an insight into the universe of 95 Middle Eastern Penny Stocks by clicking here.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ihlas Yayin Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHYAY

Ihlas Yayin Holding

Through its subsidiaries, engages in media, publishing, and advertising businesses in Turkey.

Adequate balance sheet low.

Market Insights

Community Narratives