- Saudi Arabia

- /

- Construction

- /

- SASE:2320

3 Middle Eastern Dividend Stocks Yielding Up To 7.2%

Reviewed by Simply Wall St

As most Gulf markets have recently settled higher, buoyed by optimism over a U.S.-China trade truce and steady oil supplies, investors in the Middle East are keenly observing dividend stocks as a potential source of income. In this environment, identifying robust dividend stocks can be particularly appealing for those seeking stability and consistent returns amidst fluctuating market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.41% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.24% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.61% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.71% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.64% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.86% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.13% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.44% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.05% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.65% | ★★★★★☆ |

Click here to see the full list of 77 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

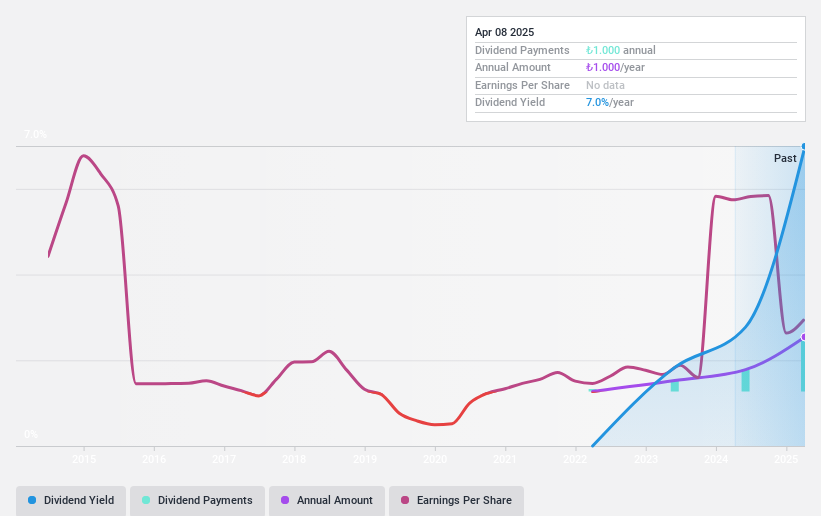

Afyon Çimento Sanayi Türk Anonim Sirketi (IBSE:AFYON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afyon Çimento Sanayi Türk Anonim Sirketi is a company that produces and sells cement in Turkey, with a market cap of TRY5.52 billion.

Operations: Afyon Çimento Sanayi Türk Anonim Sirketi generates revenue primarily from its cement segment, amounting to TRY3.17 billion.

Dividend Yield: 7.2%

Afyon Çimento Sanayi Türk Anonim Sirketi's recent dividend increase to TRY 1.00 per share reflects its commitment to returning value to shareholders, despite only two years of dividend history. The company's dividends are covered by both earnings and cash flows, with payout ratios of 76.5% and 85.8%, respectively, suggesting sustainability. Although sales declined in Q1 2025 compared to the previous year, net income significantly improved from TRY 8.98 million to TRY 88.17 million, supporting its strong dividend yield in Turkey's market.

- Delve into the full analysis dividend report here for a deeper understanding of Afyon Çimento Sanayi Türk Anonim Sirketi.

- Our valuation report unveils the possibility Afyon Çimento Sanayi Türk Anonim Sirketi's shares may be trading at a discount.

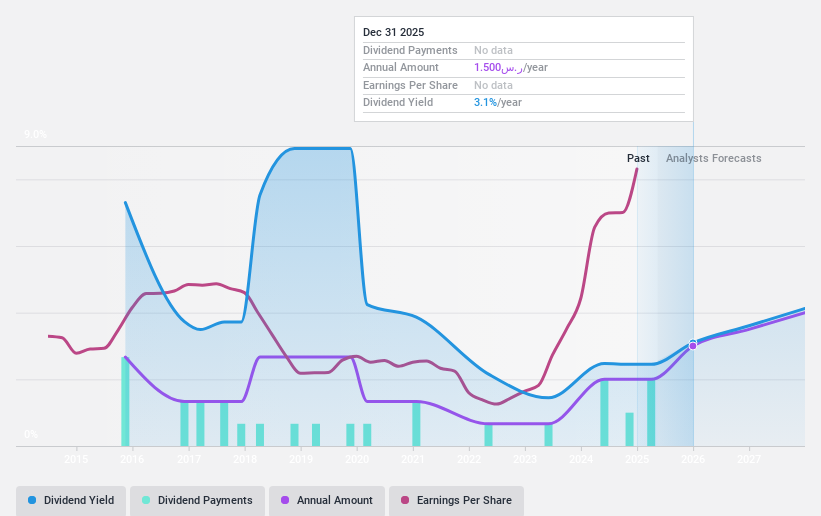

Al-Babtain Power and Telecommunications (SASE:2320)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al-Babtain Power and Telecommunications Company, along with its subsidiaries, manufactures lighting poles and power transmission towers in the United Arab Emirates, Saudi Arabia, and Egypt, with a market cap of SAR3.14 billion.

Operations: Al-Babtain Power and Telecommunications Company's revenue segments include the Towers and Metal Structures Sector at SAR1.13 billion, Solar Energy Sector at SAR637.87 million, Columns and Lighting at SAR617 million, and Design, Supplying and Installation Sector at SAR425.52 million.

Dividend Yield: 4.1%

Al-Babtain Power and Telecommunications, with a recent dividend of SAR 1 per share, demonstrates solid earnings and cash flow coverage with payout ratios of 36.1% and 27.2%, respectively. Despite an unstable dividend history, the company's net income surged to SAR 272.01 million in 2024 from SAR 141.49 million the previous year, supporting its dividend capacity. However, its dividends have been volatile over the past decade amid high debt levels and share price fluctuations.

- Dive into the specifics of Al-Babtain Power and Telecommunications here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Al-Babtain Power and Telecommunications is trading behind its estimated value.

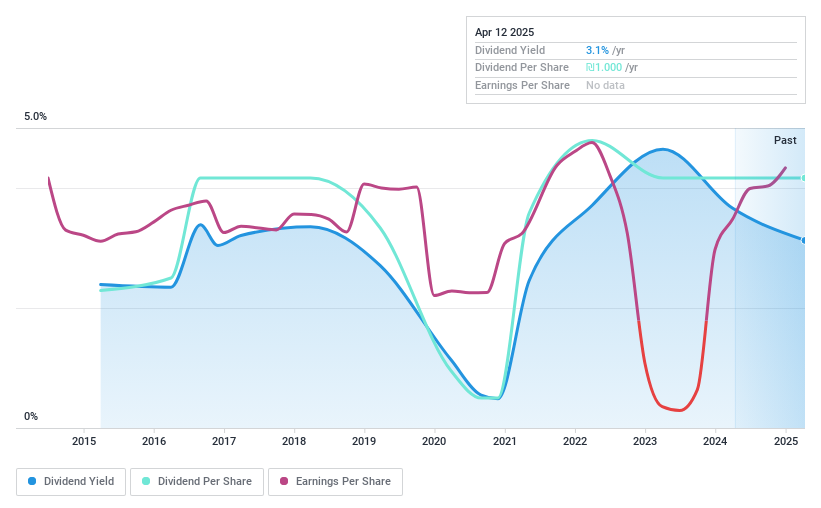

Amir Marketing and Investments in Agriculture (TASE:AMRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amir Marketing and Investments in Agriculture Ltd, with a market cap of ₪418.05 million, supplies and markets agricultural inputs in Israel.

Operations: Amir Marketing and Investments in Agriculture Ltd generates revenue from several segments, including Mixtures (₪305.39 million), Packaging (₪231.07 million), Real Estate (₪4.96 million), and Plant Protection and Nutrition (₪552.64 million).

Dividend Yield: 3.6%

Amir Marketing and Investments in Agriculture reported a significant rise in net income to ILS 44.69 million for 2024, supporting its dividend capacity despite an unstable payout history. The annual dividend of ILS 1.20 per share is well-covered by earnings with a payout ratio of 33.6% and cash flow coverage at 13.8%. While the dividend yield of 3.59% lags behind top-tier payers, recent profit growth enhances its potential appeal for investors seeking dividends in the Middle East market.

- Click to explore a detailed breakdown of our findings in Amir Marketing and Investments in Agriculture's dividend report.

- According our valuation report, there's an indication that Amir Marketing and Investments in Agriculture's share price might be on the cheaper side.

Taking Advantage

- Reveal the 77 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Al-Babtain Power and Telecommunications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2320

Al-Babtain Power and Telecommunications

Produces lighting poles, power transmission towers and accessories in the United Arab Emirates, Saudi Arabia, and Egyptian Arabic Republic.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives