- Saudi Arabia

- /

- Insurance

- /

- SASE:8313

Three Undiscovered Gems in Middle East Stocks with Promising Potential

Reviewed by Simply Wall St

As the Gulf markets navigate mixed outcomes amid tariff concerns and economic uncertainties, investors are closely watching for developments that may influence market direction, particularly with first-quarter earnings releases on the horizon. In this context, identifying stocks with strong fundamentals and resilience to external pressures becomes crucial for those looking to uncover potential opportunities in the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Amir Marketing and Investments in Agriculture | 34.26% | 5.82% | 3.78% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 25.31% | 6.39% | 13.45% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Formula Systems (1985) | 34.50% | 9.19% | 12.63% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 23.69% | 28.47% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

AgeSA Hayat ve Emeklilik Anonim Sirketi (IBSE:AGESA)

Simply Wall St Value Rating: ★★★★★☆

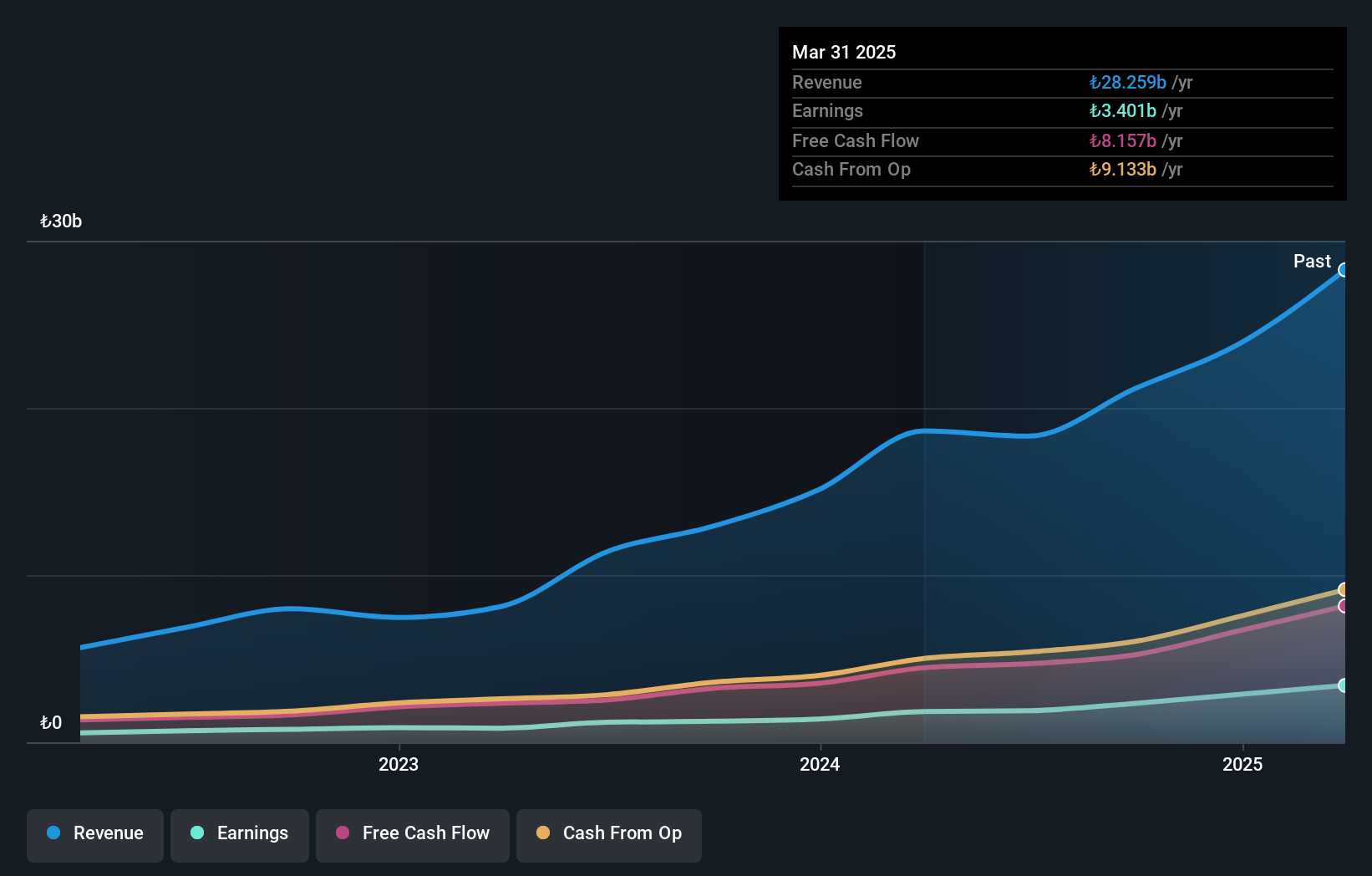

Overview: AgeSA Hayat ve Emeklilik Anonim Sirketi operates in the pension and life insurance sector mainly in Turkey, with a market capitalization of TRY25.18 billion.

Operations: AgeSA generates revenue primarily from its Life Insurance - Retirement and Life Insurance - Pension segments, contributing TRY6.45 billion and TRY5.95 billion, respectively. The company's net profit margin is a key metric for evaluating financial performance, though specific figures are not provided here.

AgeSA, a dynamic player in the insurance sector, showcases robust financial health with no debt and high-quality earnings. The company’s price-to-earnings ratio of 8.8x is notably below the TR market average of 17.4x, suggesting potential undervaluation. Over the past year, AgeSA's earnings surged by 106.6%, outpacing the industry growth rate of 93.7%. Recently added to the FTSE All-World Index, AgeSA reported a net income jump to TRY 2.87 billion from TRY 1.39 billion last year, with basic EPS rising from TRY 7.72 to TRY 15.95 per share—indicating strong performance momentum and promising prospects ahead.

MLP Saglik Hizmetleri (IBSE:MPARK)

Simply Wall St Value Rating: ★★★★★☆

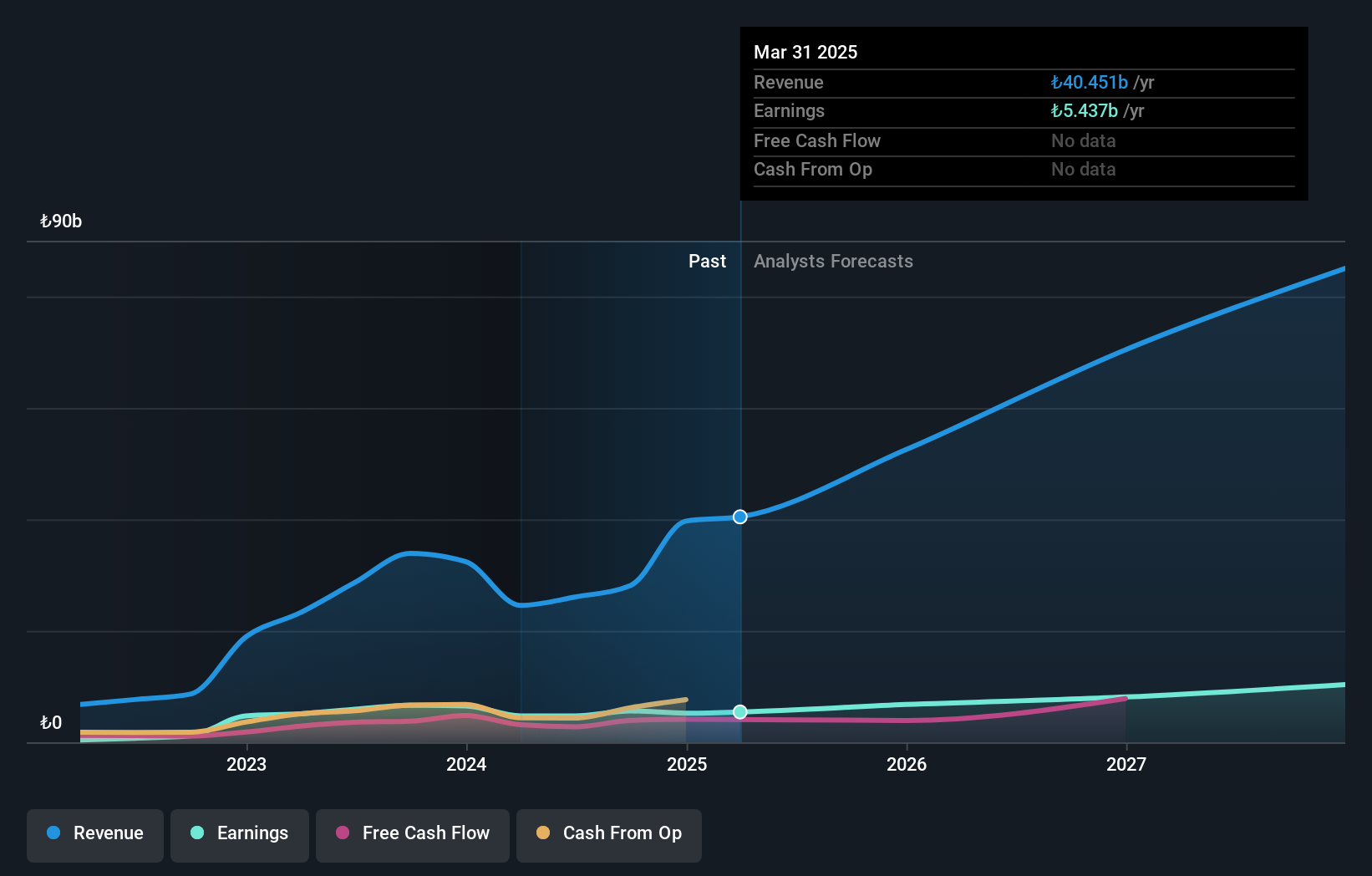

Overview: MLP Saglik Hizmetleri A.S. operates healthcare services in Turkey, Azerbaijan, and Hungary with a market capitalization of TRY62.08 billion.

Operations: MPARK generates revenue primarily from its healthcare facilities and services, amounting to TRY39.69 billion. The company has a market capitalization of TRY62.08 billion.

MPARK, a notable player in the healthcare sector, showcases a mixed financial landscape. Despite negative earnings growth of 20.3% last year, its net debt to equity ratio stands at a satisfactory 2.8%, reflecting prudent financial management over five years as it reduced from 643.8% to 14.4%. The company trades at an attractive value, being priced 20.8% below estimated fair value and maintains high-quality earnings with interest payments well-covered by EBIT at 17.6x coverage. Recent annual sales reached TRY39,689 million; however, net income fell to TRY5,210 million from TRY6,539 million the previous year due to lower profit margins now at 13.1%.

- Click here to discover the nuances of MLP Saglik Hizmetleri with our detailed analytical health report.

Gain insights into MLP Saglik Hizmetleri's past trends and performance with our Past report.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

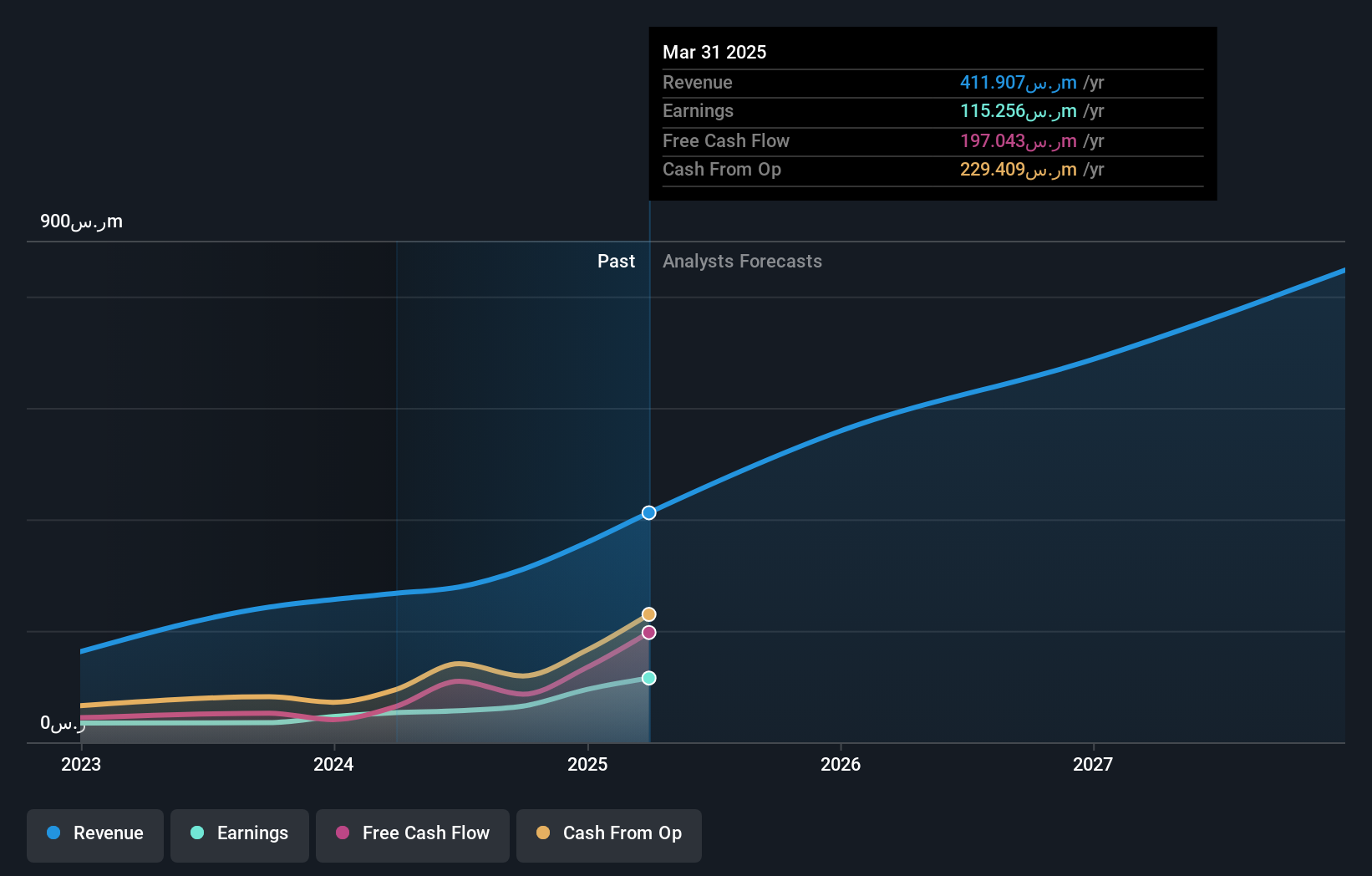

Overview: Rasan Information Technology Company is a financial technology firm that offers insurance and financial services in Saudi Arabia, with a market capitalization of SAR6.50 billion.

Operations: Rasan derives its revenue primarily from Tameeni - Motors, contributing SAR197.39 million, followed by Leasing at SAR107.61 million and Tameeni - Health at SAR48.30 million.

Rasan Information Technology, a smaller player in the Middle East tech scene, has demonstrated impressive financial resilience. Over the past year, earnings surged by 106.1%, outpacing the insurance industry's -29.6% performance. The company reported a net income of SAR 94.73 million for 2024, up from SAR 45.95 million in 2023, with sales climbing to SAR 358.33 million from SAR 256.23 million previously. Despite its highly volatile share price over recent months, Rasan remains debt-free and boasts high-quality earnings, indicating robust operational health and potential for future growth amidst its ongoing equity offerings of over thirteen million shares this March.

Next Steps

- Unlock our comprehensive list of 242 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8313

Rasan Information Technology

A financial technology company, provides insurance and financial services in the Kingdom of Saudi Arabia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives