3 Reliable Dividend Stocks To Consider With Up To 5.1% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of trade tariffs and mixed economic indicators, investors are increasingly seeking stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for those looking to weather market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.16% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1961 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Ulusoy Un Sanayi ve Ticaret (IBSE:ULUUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ulusoy Un Sanayi ve Ticaret A.S. is a Turkish company that specializes in the production and sale of wheat flour, with a market capitalization of TRY 4.49 billion.

Operations: Ulusoy Un Sanayi ve Ticaret A.S. generates revenue primarily from Flour Production and Agricultural Commodity Trade, amounting to TRY 33.39 billion, and Licensed Warehousing, contributing TRY 76.25 million.

Dividend Yield: 4.7%

Ulusoy Un Sanayi ve Ticaret's dividend yield of 4.66% places it in the top 25% of TR market payers, yet its dividends have been unreliable and non-growing over the past two years. Despite this, a low payout ratio of 40.4% and a cash payout ratio of 5.6% indicate strong coverage by earnings and cash flows, suggesting sustainability. However, large one-off items have impacted earnings quality recently, which may affect future payouts stability.

- Delve into the full analysis dividend report here for a deeper understanding of Ulusoy Un Sanayi ve Ticaret.

- Insights from our recent valuation report point to the potential undervaluation of Ulusoy Un Sanayi ve Ticaret shares in the market.

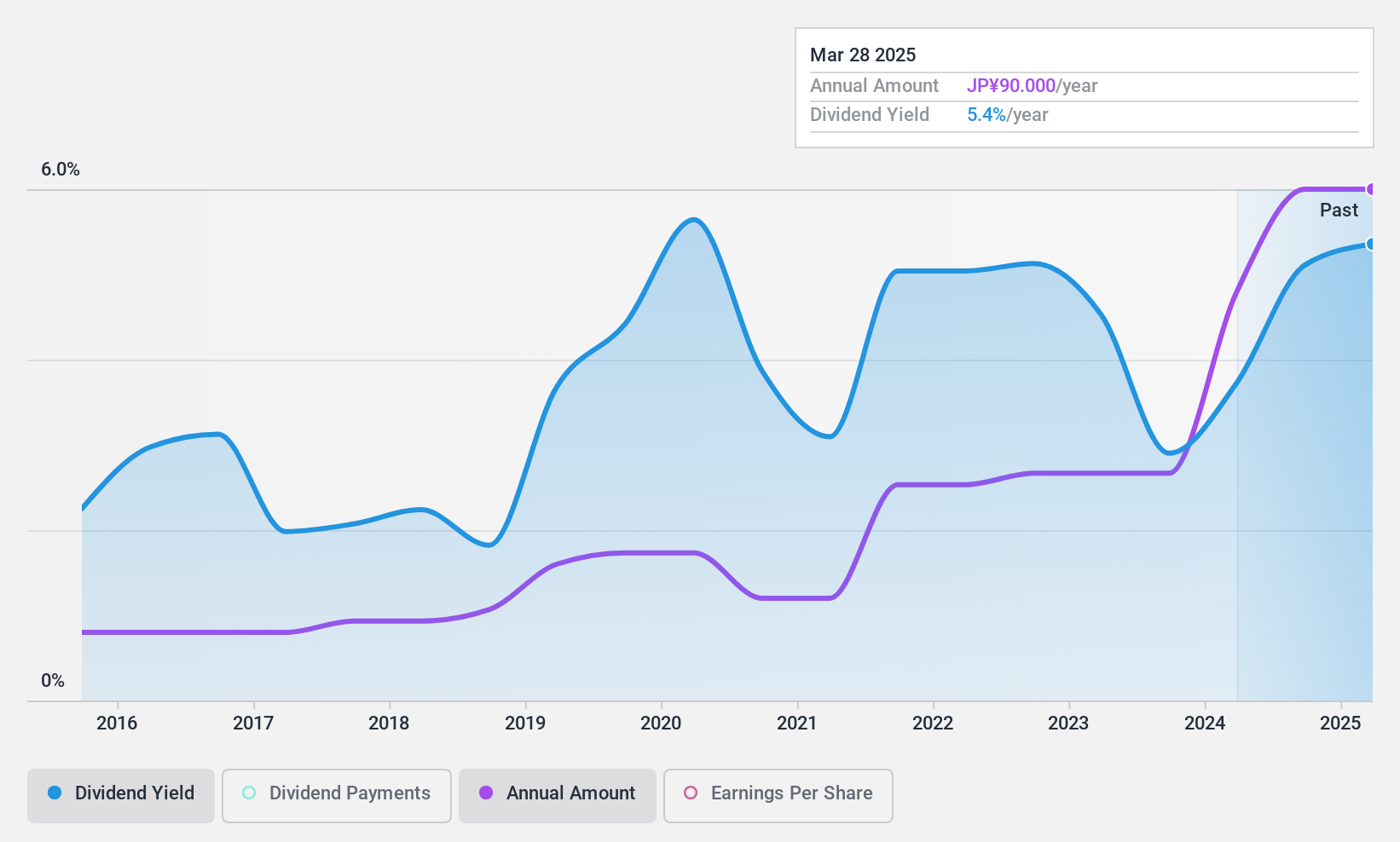

Shinagawa Refractories (TSE:5351)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shinagawa Refractories Co., Ltd. manufactures and sells refractory products both in Japan and internationally, with a market cap of ¥80.08 billion.

Operations: Shinagawa Refractories Co., Ltd. generates revenue from the manufacture and sale of refractory products across domestic and international markets.

Dividend Yield: 5.1%

Shinagawa Refractories offers a reliable dividend yield of 5.13%, ranking in the top 25% of Japan's market payers. Over the past decade, its dividends have been stable and growing with minimal volatility. The company's dividends are well-supported by earnings (payout ratio: 15.6%) and cash flows (cash payout ratio: 52.6%), indicating sustainability despite a high debt level. Additionally, it trades at a significant discount to its estimated fair value, enhancing its appeal for dividend investors.

- Unlock comprehensive insights into our analysis of Shinagawa Refractories stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Shinagawa Refractories is priced lower than what may be justified by its financials.

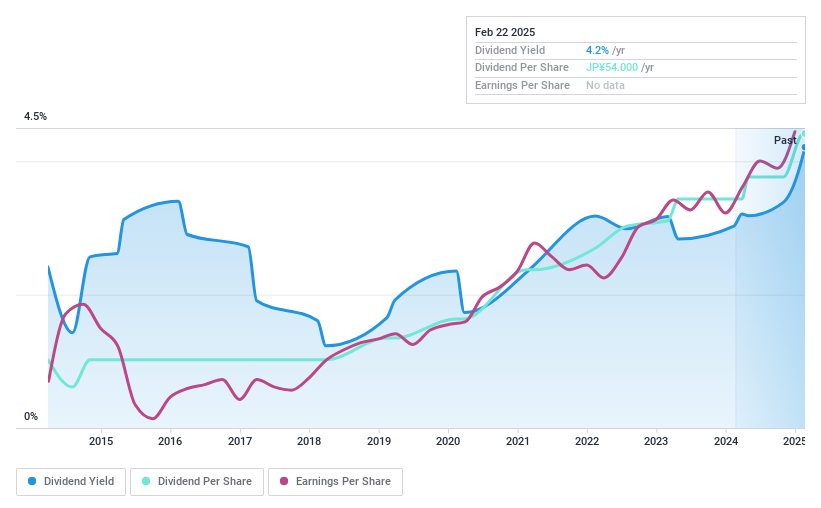

ISB (TSE:9702)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ISB Corporation provides embedded software development services for mobile, medical, and automotive applications in Japan and has a market cap of ¥15.51 billion.

Operations: ISB Corporation's revenue segments include embedded software development services for mobile, medical, and automotive applications in Japan.

Dividend Yield: 3.4%

ISB's dividend yield of 3.39% is below the top quartile of Japan's market payers, but its low payout ratio (26.9%) suggests strong earnings coverage. The cash payout ratio of 30.3% further supports dividend sustainability, despite an unstable track record over the past decade with volatility and unreliability in payments. However, ISB trades significantly below its estimated fair value, potentially offering a valuation opportunity for investors seeking growth alongside dividends.

- Navigate through the intricacies of ISB with our comprehensive dividend report here.

- Our valuation report unveils the possibility ISB's shares may be trading at a discount.

Taking Advantage

- Discover the full array of 1961 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ULUUN

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion