- Japan

- /

- Construction

- /

- TSE:1888

3 High-Quality Dividend Stocks Yielding Up To 4.3%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and a strong labor market driving positive sentiment, investors are increasingly seeking stable income sources amid economic uncertainties. In this environment, high-quality dividend stocks yielding up to 4.3% can offer a reliable income stream, making them an attractive option for those looking to balance growth potential with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.78% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ulusoy Un Sanayi ve Ticaret (IBSE:ULUUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ulusoy Un Sanayi ve Ticaret A.S. is a Turkish company that produces and sells wheat flour, with a market capitalization of TRY4.79 billion.

Operations: Ulusoy Un Sanayi ve Ticaret A.S. generates revenue primarily from Flour Production and Agricultural Commodity Trade, amounting to TRY33.39 billion, and Licensed Warehousing, contributing TRY76.25 million.

Dividend Yield: 4.4%

Ulusoy Un Sanayi ve Ticaret's dividends are well-covered by earnings and cash flows, with a payout ratio of 40.4% and a cash payout ratio of 5.6%. Despite being in the top 25% for dividend yield in Turkey, its payments have been unreliable over the past two years without growth. Recent financials show declining sales and continued net losses, which may affect future dividend stability despite current coverage metrics.

- Delve into the full analysis dividend report here for a deeper understanding of Ulusoy Un Sanayi ve Ticaret.

- Our valuation report unveils the possibility Ulusoy Un Sanayi ve Ticaret's shares may be trading at a discount.

Novartis (SWX:NOVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Novartis AG is involved in the research, development, manufacture, and marketing of healthcare products globally and has a market cap of CHF187.29 billion.

Operations: Novartis AG generates revenue primarily from its Innovative Medicines segment, which amounted to $49.94 billion.

Dividend Yield: 3.4%

Novartis's dividends are stable and well-covered by earnings (67.8% payout ratio) and cash flows (57.2% cash payout ratio), though its 3.43% yield is below the top tier in Switzerland. Recent strategic alliances, such as with Vyriad for CAR-T therapies, highlight growth potential which could support future dividend sustainability despite current challenges like large one-off items affecting earnings quality. The company trades at a significant discount to estimated fair value, suggesting potential long-term investment appeal.

- Unlock comprehensive insights into our analysis of Novartis stock in this dividend report.

- In light of our recent valuation report, it seems possible that Novartis is trading behind its estimated value.

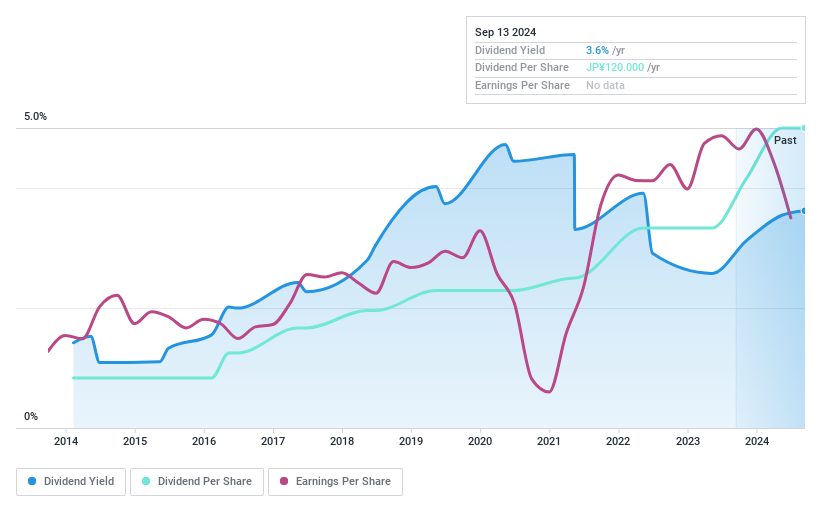

Wakachiku Construction (TSE:1888)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wakachiku Construction Co., Ltd. operates in the construction and real estate sectors with a market cap of ¥45.74 billion.

Operations: Wakachiku Construction Co., Ltd. generates revenue primarily from its Construction Business, amounting to ¥82.49 billion, and also derives income from its Real Estate segment, which contributes ¥446 million.

Dividend Yield: 3.3%

Wakachiku Construction's dividend is reliable, having grown steadily over the past decade with little volatility. It maintains a sustainable payout ratio of 49.9%, well-covered by both earnings and cash flows (16.9% cash payout ratio). Despite trading at a significant discount to its estimated fair value, its 3.33% yield is below Japan's top dividend payers' average of 3.78%. Recent profit margins have declined from last year, impacting overall financial performance.

- Click to explore a detailed breakdown of our findings in Wakachiku Construction's dividend report.

- The valuation report we've compiled suggests that Wakachiku Construction's current price could be inflated.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1957 more companies for you to explore.Click here to unveil our expertly curated list of 1960 Top Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wakachiku Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1888

Wakachiku Construction

Engages in construction and real estate businesses.

Flawless balance sheet established dividend payer.