- China

- /

- Electronic Equipment and Components

- /

- SHSE:688307

Uncovering Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, major U.S. stock indexes have been climbing toward record highs, with small-cap stocks facing some challenges as evidenced by the recent performance of the Russell 2000 Index. In this dynamic environment, identifying promising investment opportunities requires a keen eye for stocks that may not yet be on everyone's radar but possess strong fundamentals and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Sun | 32.74% | 8.77% | 65.36% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Türk Tuborg Bira ve Malt Sanayii (IBSE:TBORG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türk Tuborg Bira ve Malt Sanayii A.S. is engaged in the production, sale, and distribution of beer and malt both within Turkey and internationally, with a market capitalization of TRY41.18 billion.

Operations: Türk Tuborg generates revenue primarily from the sale of alcoholic beverages, amounting to TRY20.78 billion. The company's financial performance is highlighted by its net profit margin, which reflects its profitability after accounting for all expenses and taxes.

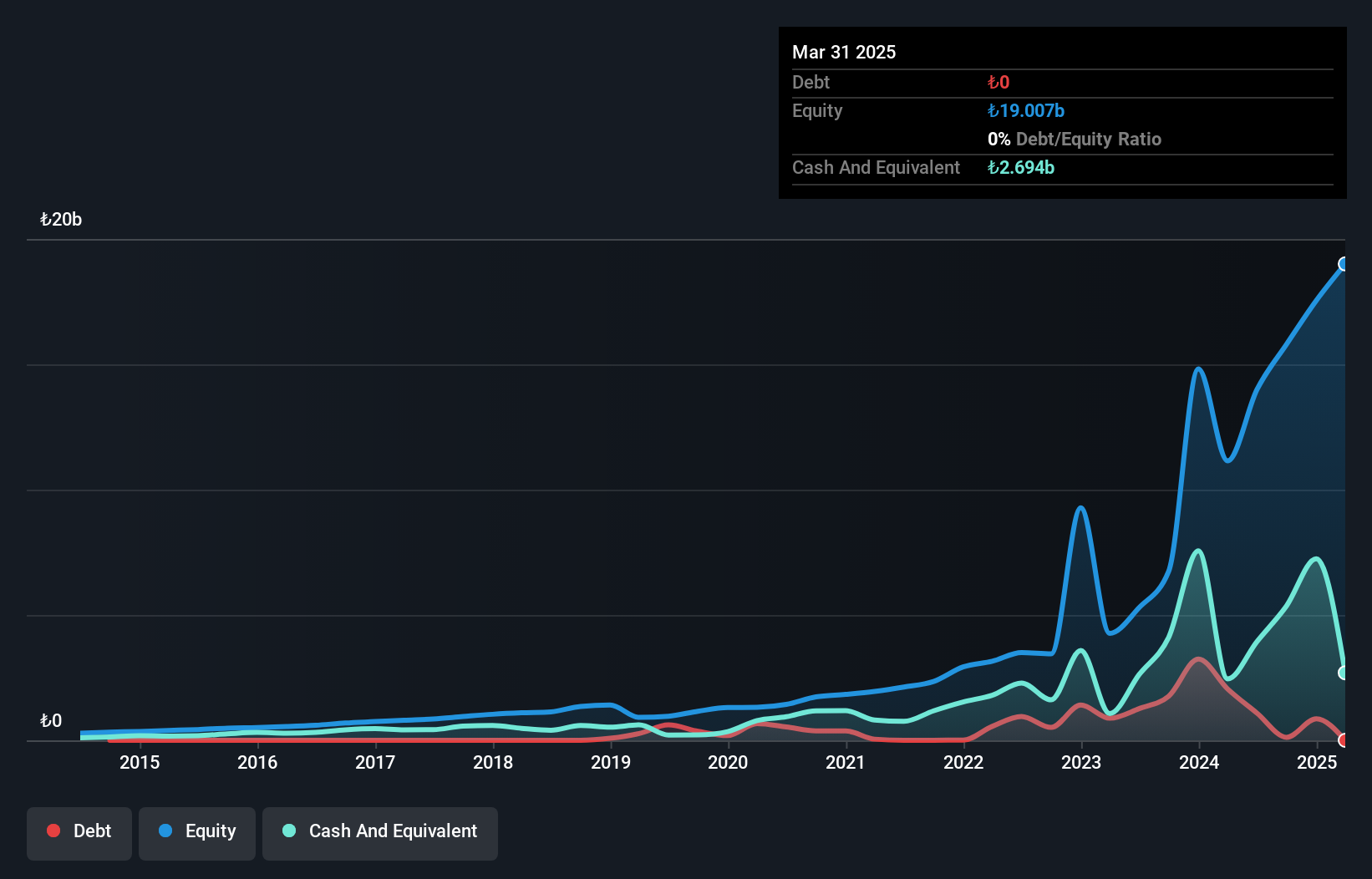

Türk Tuborg, a relatively small player in the beverage industry, has demonstrated impressive financial health and growth. Over the past year, its earnings surged by 90%, significantly outpacing the industry's 11% growth rate. The company's debt to equity ratio has impressively decreased from 31% to just under 1% over five years, highlighting effective debt management. With more cash on hand than total debt and positive free cash flow figures reaching A$2.35 billion recently, Türk Tuborg shows strong financial resilience. This robust performance is complemented by high-quality earnings and sufficient interest coverage, positioning it well within its sector.

Jiaxing ZMAX Optech (SHSE:688307)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiaxing ZMAX Optech Co., Ltd. focuses on the research, development, production, and sales of optical lenses and components both in China and internationally, with a market cap of CN¥2.68 billion.

Operations: ZMAX Optech generates revenue primarily from its Laser Systems and Components segment, which amounted to CN¥462.77 million. The company's net profit margin is an essential metric to consider when evaluating its financial performance.

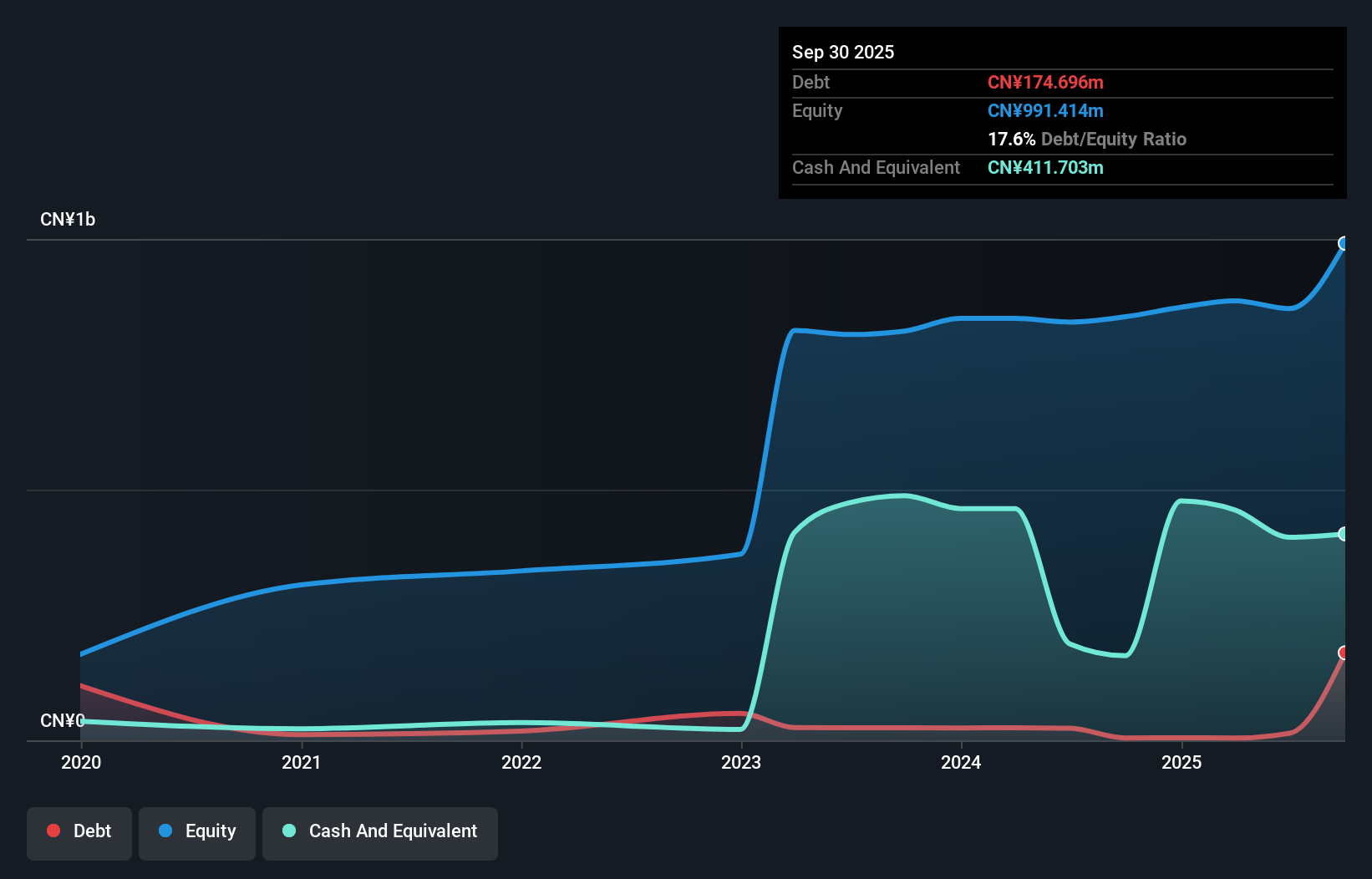

Jiaxing ZMAX Optech, a smaller player in the electronics sector, showcases impressive earnings growth of 105.7% over the past year, outpacing the industry average of 1.9%. The company's price-to-earnings ratio stands at 43.9x, which is favorable compared to the industry average of 50.2x, suggesting potential value for investors. With high-quality past earnings and more cash than total debt, financial stability seems strong; interest payments are well-covered by profits too. Revenue is projected to grow annually by 28.27%, highlighting promising future prospects despite insufficient data on debt reduction trends over five years.

Shenzhen Jufei Optoelectronics (SZSE:300303)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Jufei Optoelectronics Co., Ltd. specializes in the R&D, production, marketing, and sales of SMD LED devices across various global markets and has a market cap of CN¥10.15 billion.

Operations: The company's primary revenue stream is derived from the sale of SMD LED devices across multiple international markets. It focuses on optimizing its cost structure to enhance profitability, with attention to both production and operational efficiencies. The net profit margin reflects the company's ability to manage costs effectively in relation to its revenue generation capabilities.

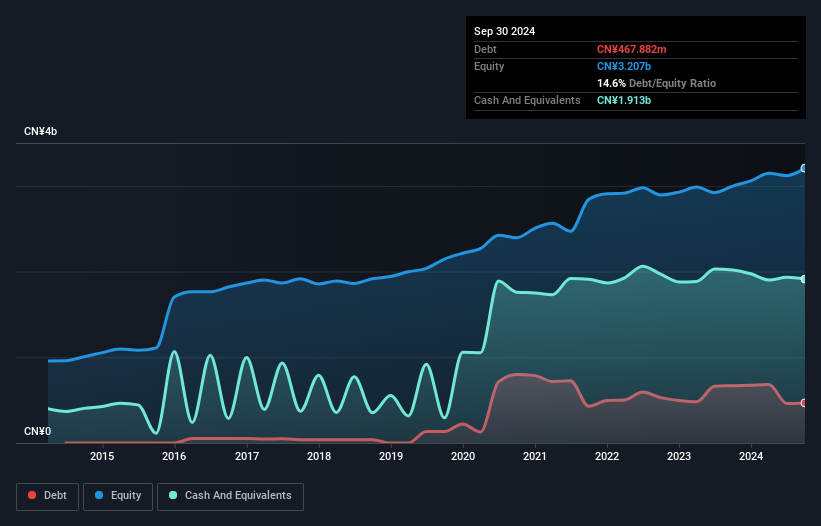

Shenzhen Jufei Optoelectronics, a nimble player in the semiconductor space, has shown impressive earnings growth of 29.6% over the past year, outpacing the industry average of 12.9%. Despite this recent surge, its earnings have seen an annual decline of 6.5% over five years. The company boasts a favorable debt position with more cash than total debt and maintains positive free cash flow. A notable CN¥56M one-off gain recently impacted its financials, suggesting some volatility in results. With a price-to-earnings ratio at 36.7x below industry norms, it offers potential value for discerning investors seeking growth opportunities within this sector.

- Dive into the specifics of Shenzhen Jufei Optoelectronics here with our thorough health report.

Understand Shenzhen Jufei Optoelectronics' track record by examining our Past report.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4739 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688307

Jiaxing ZMAX Optech

Engages in the research and development, production, and sales of optical lenses and technology development services in China and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives