Lydia Yesil Enerji Kaynaklari And Two Other Undiscovered Gems To Consider

Reviewed by Simply Wall St

As global markets experience a surge, driven by robust stimulus measures in China and optimism around artificial intelligence, U.S. stocks have reached record highs with technology stocks leading the charge. Amidst this backdrop of economic shifts and mixed signals in consumer confidence, small-cap companies present intriguing opportunities for investors seeking potential growth beyond the mainstream indices. In such a dynamic environment, identifying promising small-cap stocks requires an eye for innovation and resilience—traits that can often be found in lesser-known companies poised to benefit from emerging trends or market inefficiencies.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 17.77% | 8.22% | ★★★★★★ |

| Polyram Plastic Industries | 39.36% | 4.96% | 11.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 30.34% | 9.84% | -2.45% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 40.67% | 10.19% | 19.02% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★★

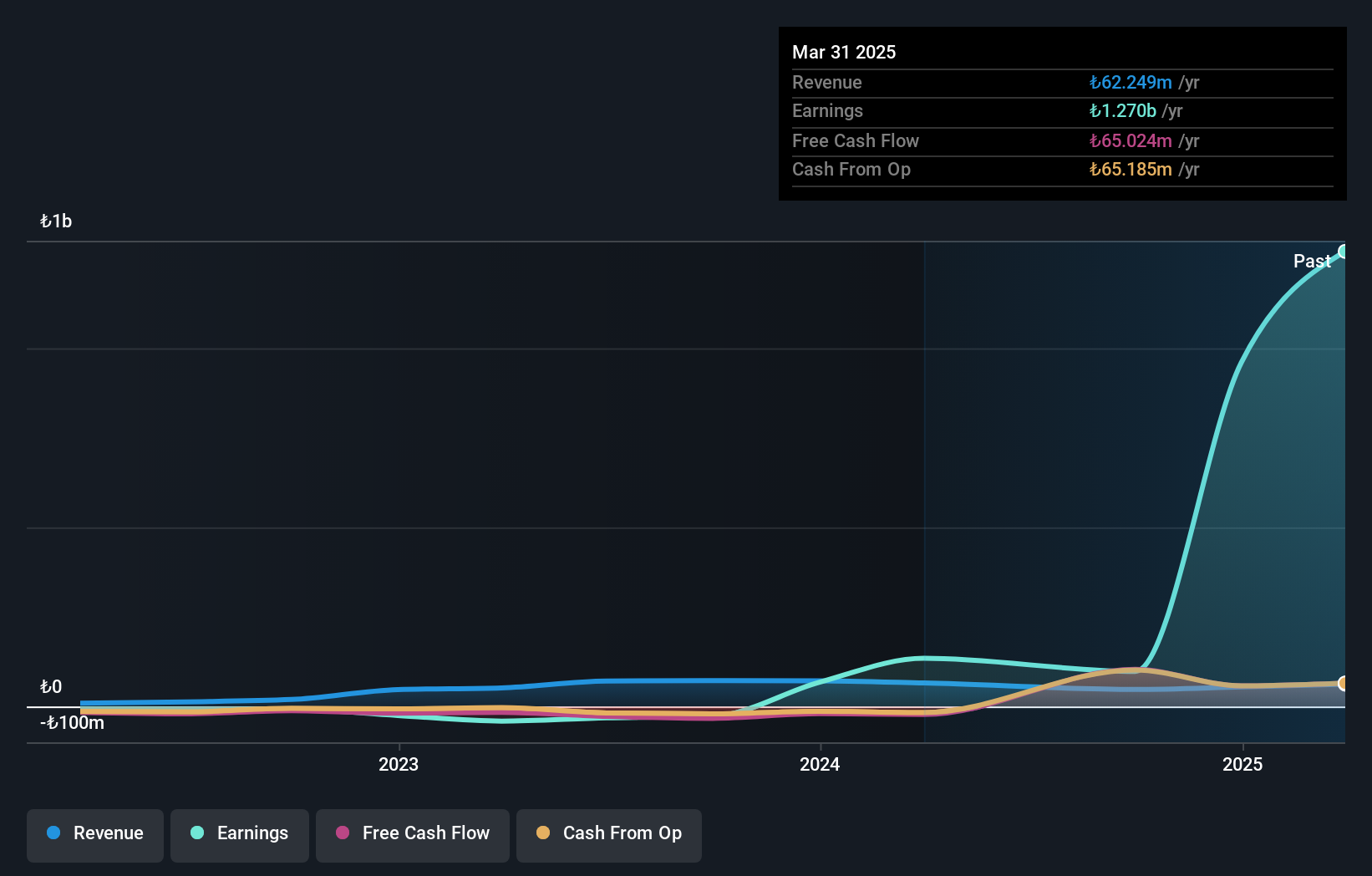

Overview: Lydia Yesil Enerji Kaynaklari A.S. operates in the food industry in Turkey with a market capitalization of TRY13.42 billion.

Operations: Lydia Yesil generates revenue primarily from its food industry operations in Turkey. The company's financial performance is highlighted by a net profit margin of 15%, reflecting its ability to convert sales into profit efficiently.

Lydia Yesil Enerji Kaynaklari, a nimble player in its field, has recently turned profitable with net income of TRY 36.18 million for the first half of 2024, compared to TRY 9.4 million last year. Despite revenue challenges—TRY 35 million not being substantial—the company is debt-free, a significant improvement from a debt-to-equity ratio of over 1400% five years ago. Its inclusion in the S&P Global BMI Index suggests growing recognition despite recent share price volatility.

- Delve into the full analysis health report here for a deeper understanding of Lydia Yesil Enerji Kaynaklari.

Understand Lydia Yesil Enerji Kaynaklari's track record by examining our Past report.

KRN Heat Exchanger and Refrigeration (NSEI:KRN)

Simply Wall St Value Rating: ★★★★☆☆

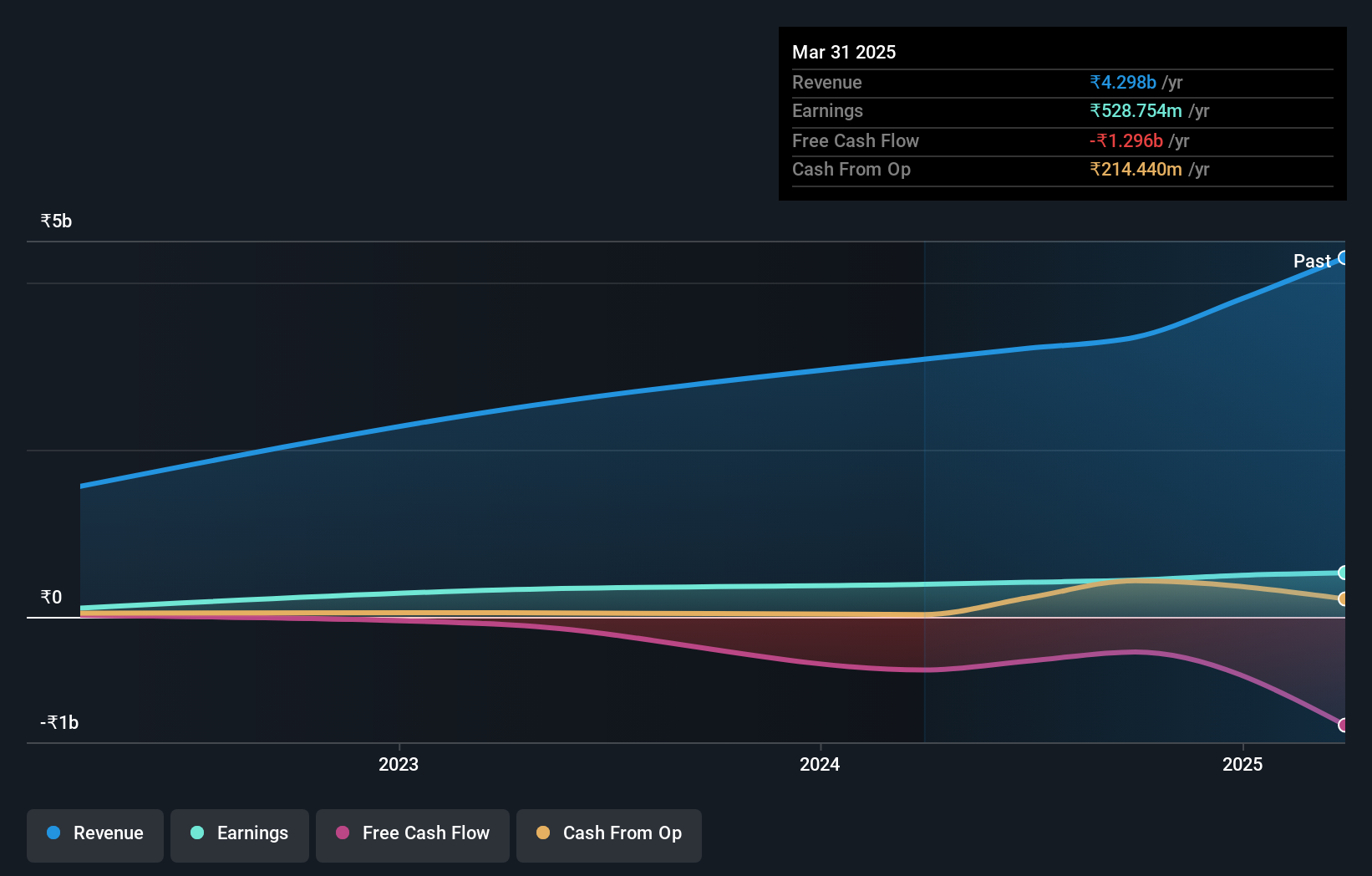

Overview: KRN Heat Exchanger and Refrigeration Limited specializes in the manufacturing and sale of aluminium and copper fin and tube-type heat exchangers for the HVACR industry, with a market capitalization of ₹29.76 billion.

Operations: KRN generates revenue primarily from the manufacture and sale of HVAC parts and accessories, totaling ₹3.08 billion.

KRN Heat Exchanger and Refrigeration, a niche player in the HVAC industry, recently completed an IPO raising INR 3.42 billion. The company reported impressive earnings growth of 20.9% over the past year, with net income rising to INR 390.69 million from INR 323.14 million previously and basic earnings per share increasing to INR 8.69 from INR 7.34 last year. With a satisfactory net debt to equity ratio of 37.5%, KRN seems poised for expansion through its new manufacturing facility aimed at broadening client offerings and enhancing product scope for partners like Daikin India and Schneider Electric.

Addiko Bank (WBAG:ADKO)

Simply Wall St Value Rating: ★★★★★☆

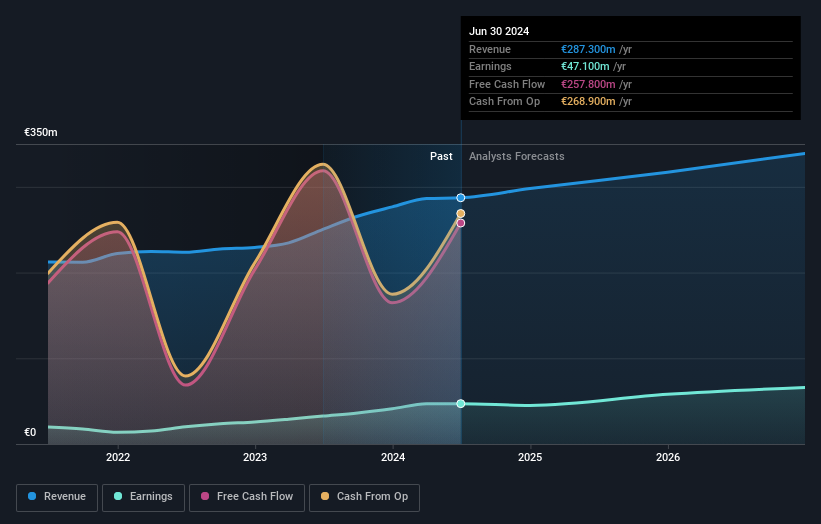

Overview: Addiko Bank AG operates as a provider of banking products and services across several European countries, including Croatia, Slovenia, Serbia, Bosnia and Herzegovina, Montenegro, Austria, and Germany, with a market capitalization of approximately €362.60 million.

Operations: Addiko Bank's revenue streams primarily include Consumer banking (€163.80 million), SME Business (€99 million), and Mortgage services (€28.10 million). The Corporate Center segment shows a negative contribution of -€33.90 million, impacting overall financial performance.

With total assets of €6.1 billion and equity at €806.4 million, Addiko Bank stands out for its robust financial health. The bank's deposits amount to €5.1 billion against loans of €3.5 billion, showcasing a solid deposit base with 96% low-risk funding sources. Despite a high level of bad loans at 3.6%, it maintains a sufficient allowance for these potential losses at 120%. Its P/E ratio of 7.7x suggests good value relative to the Austrian market's average of 12.5x, while earnings have grown annually by 19% over five years despite recent volatility in share price and one-off losses impacting results.

- Click here and access our complete health analysis report to understand the dynamics of Addiko Bank.

Where To Now?

- Delve into our full catalog of 4775 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KRN Heat Exchanger and Refrigeration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KRN

KRN Heat Exchanger and Refrigeration

Manufactures and sells aluminium and copper fin and tube-type heat exchangers for the heat, ventilation, air conditioning, and refrigeration industry.

Excellent balance sheet with acceptable track record.