Middle Eastern Market Gems: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi And 2 More Penny Stocks

Reviewed by Simply Wall St

The Middle Eastern stock markets have been buoyed by rising oil prices and speculation around potential U.S. interest rate cuts, creating a favorable backdrop for investors. In this context, penny stocks—though an old term—still represent opportunities in smaller or less-established companies that can offer significant value. By focusing on those with strong financials and growth potential, investors may find promising prospects among these lesser-known market players.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.35 | SAR1.34B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.807 | ₪201.25M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.01 | AED2.08B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.60 | AED745.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.95 | AED340.73M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.42 | AED14.67B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.801 | AED2.3B | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.83 | AED504.85M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.71 | ₪212.73M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market cap of TRY1.01 billion.

Operations: The company generates revenue of TRY1.38 billion from its food activities segment.

Market Cap: TRY1.01B

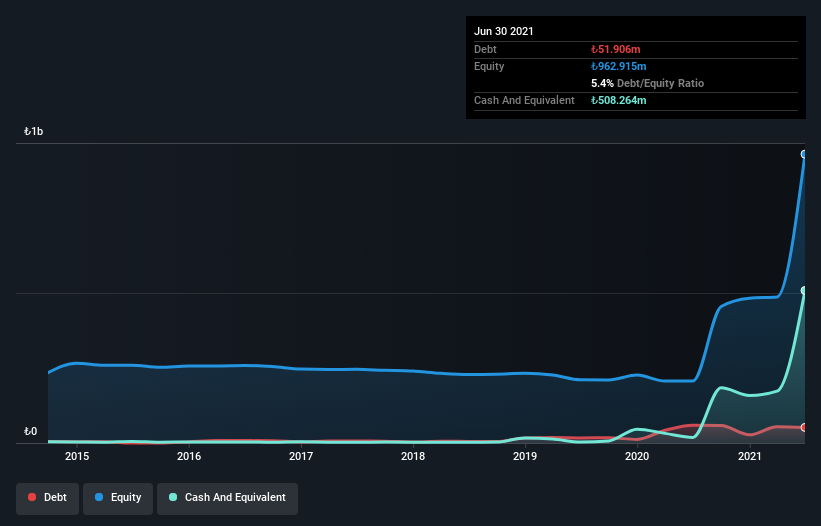

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, with a market cap of TRY1.01 billion and revenue from its food activities segment at TRY1.38 billion, recently reported a narrowed net loss for Q3 2025 at TRY23.11 million compared to the previous year's larger loss. Despite being unprofitable and experiencing increased losses over the past five years, A.V.O.D benefits from strong short-term asset coverage over liabilities and has reduced its debt-to-equity ratio significantly over time. The company maintains a stable cash runway exceeding three years due to positive free cash flow growth, though it remains highly volatile in share price movements.

- Click here to discover the nuances of A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi with our detailed analytical financial health report.

- Explore historical data to track A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's performance over time in our past results report.

Ihlas Yayin Holding (IBSE:IHYAY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ihlas Yayin Holding A.S. operates in Turkey through its subsidiaries, focusing on media, publishing, and advertising businesses with a market cap of TRY990 million.

Operations: The company generates revenue through its segments, including News Agencies (TRY380.41 million), TV Services and Other (TRY259.40 million), and Journalism and Printing Works (TRY1.89 billion).

Market Cap: TRY990M

Ihlas Yayin Holding, with a market cap of TRY990 million, operates in media and publishing sectors. Despite its unprofitability and increasing losses over the past five years at a rate of 50.2% annually, it reported Q3 2025 sales of TRY831.63 million, up from TRY759.21 million the previous year. The company has more cash than total debt and a reduced debt-to-equity ratio from 12.7% to 3.5% over five years, indicating improved financial management. Its short-term assets (TRY1.4 billion) cover short-term liabilities (TRY1.2 billion), supporting stability despite negative return on equity (-4.8%).

- Jump into the full analysis health report here for a deeper understanding of Ihlas Yayin Holding.

- Gain insights into Ihlas Yayin Holding's historical outcomes by reviewing our past performance report.

Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi (IBSE:ORCAY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi manufactures and sells various tea products both in Turkey and internationally, with a market cap of TRY316 million.

Operations: The company generates revenue from its food processing segment, amounting to TRY554.10 million.

Market Cap: TRY316M

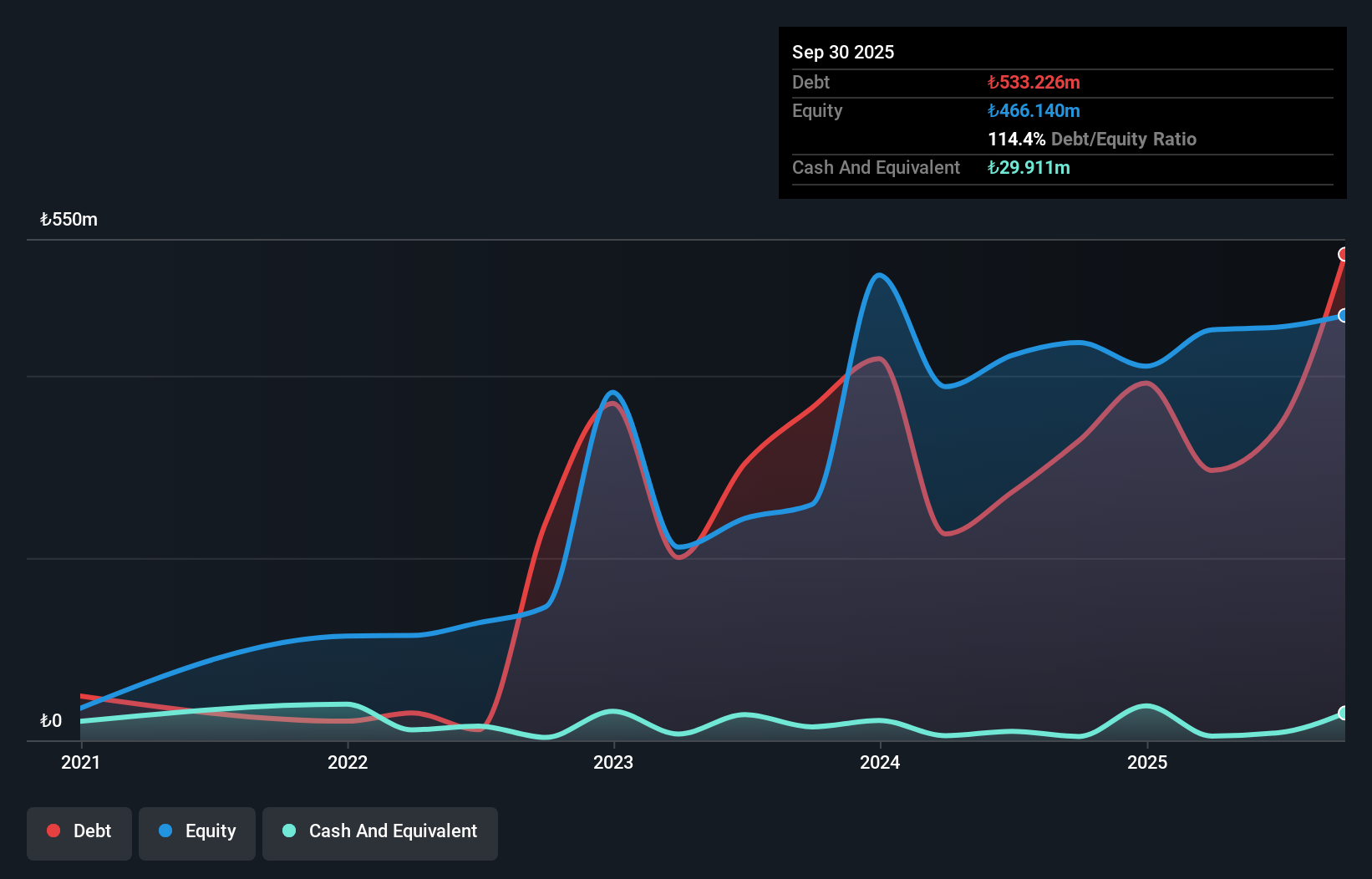

Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY316 million, remains unprofitable but shows improving cash flow and reduced losses. Recent earnings highlighted a significant increase in sales to TRY160.13 million for Q3 2025, compared to TRY33.88 million the previous year, though net losses persist at TRY21.3 million. The company maintains a high net debt-to-equity ratio of 108%, yet its short-term assets (TRY772.9M) comfortably exceed both short-term (TRY613.2M) and long-term liabilities (TRY61.8M), providing some financial stability amidst volatility in share price and earnings decline trends.

- Take a closer look at Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi's potential here in our financial health report.

- Understand Orçay Ortaköy Çay Sanayi ve Ticaret Anonim Sirketi's track record by examining our performance history report.

Taking Advantage

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 73 more companies for you to explore.Click here to unveil our expertly curated list of 76 Middle Eastern Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AVOD

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi

Provides dried vegetables and derivatives, and vegetable based convenience foods under the Farmer`s Choice brand name in Turkey.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026