3 Middle Eastern Penny Stocks With Market Caps Larger Than US$10M

Reviewed by Simply Wall St

As the Middle Eastern markets experience gains amid renewed US-China trade talks, investors are increasingly looking beyond the major indices for unique opportunities. Penny stocks, although a somewhat outdated term, still represent an intriguing investment area for those interested in smaller or newer companies that might offer unexpected growth. This article will explore three such penny stocks in the Middle East that combine balance sheet strength with potential for significant returns, offering a glimpse into hidden value within these markets.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR4.13 | SAR1.58B | ✅ 2 ⚠️ 1 View Analysis > |

| Keir International (SASE:9542) | SAR3.92 | SAR474M | ✅ 2 ⚠️ 3 View Analysis > |

| Dna Group (T.R.) (TASE:DNA) | ₪0.999 | ₪123.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.446 | ₪171.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Oil Refineries (TASE:ORL) | ₪0.922 | ₪2.87B | ✅ 1 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.222 | ₪165.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.709 | AED425.78M | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.40 | AED390.39M | ✅ 2 ⚠️ 4 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.1B | ✅ 3 ⚠️ 2 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.36 | AED10.03B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 95 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

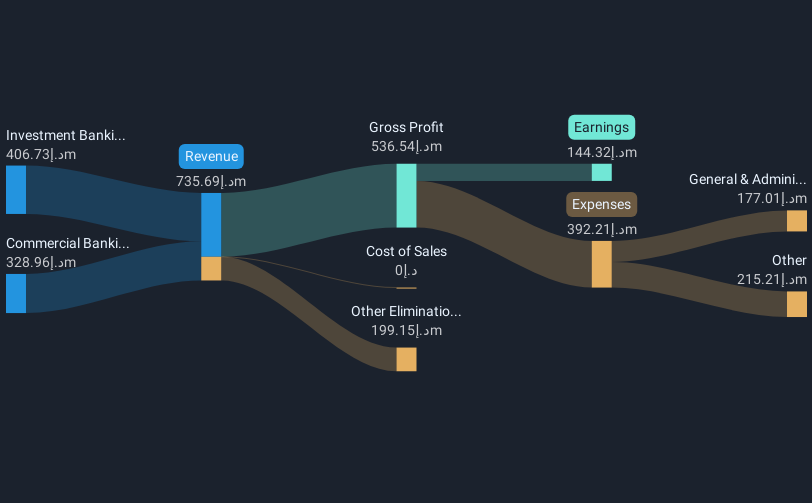

Overview: Bank Of Sharjah P.J.S.C. operates as a provider of commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED2.72 billion.

Operations: Bank Of Sharjah P.J.S.C. has not reported any specific revenue segments.

Market Cap: AED2.71B

Bank Of Sharjah P.J.S.C. has shown a significant turnaround, becoming profitable in the past year with net income reaching AED 116.35 million for Q1 2025, up from AED 80.67 million the previous year. Despite a low Return on Equity of 10.6%, its Price-To-Earnings ratio of 6.5x suggests it could be undervalued compared to the broader AE market at 12.7x. The bank maintains an appropriate Loans to Assets ratio of 58% and primarily relies on low-risk funding sources, with customer deposits making up a substantial part of its liabilities, enhancing financial stability amidst high bad loans at 7.6%.

- Take a closer look at Bank Of Sharjah P.J.S.C's potential here in our financial health report.

- Assess Bank Of Sharjah P.J.S.C's previous results with our detailed historical performance reports.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

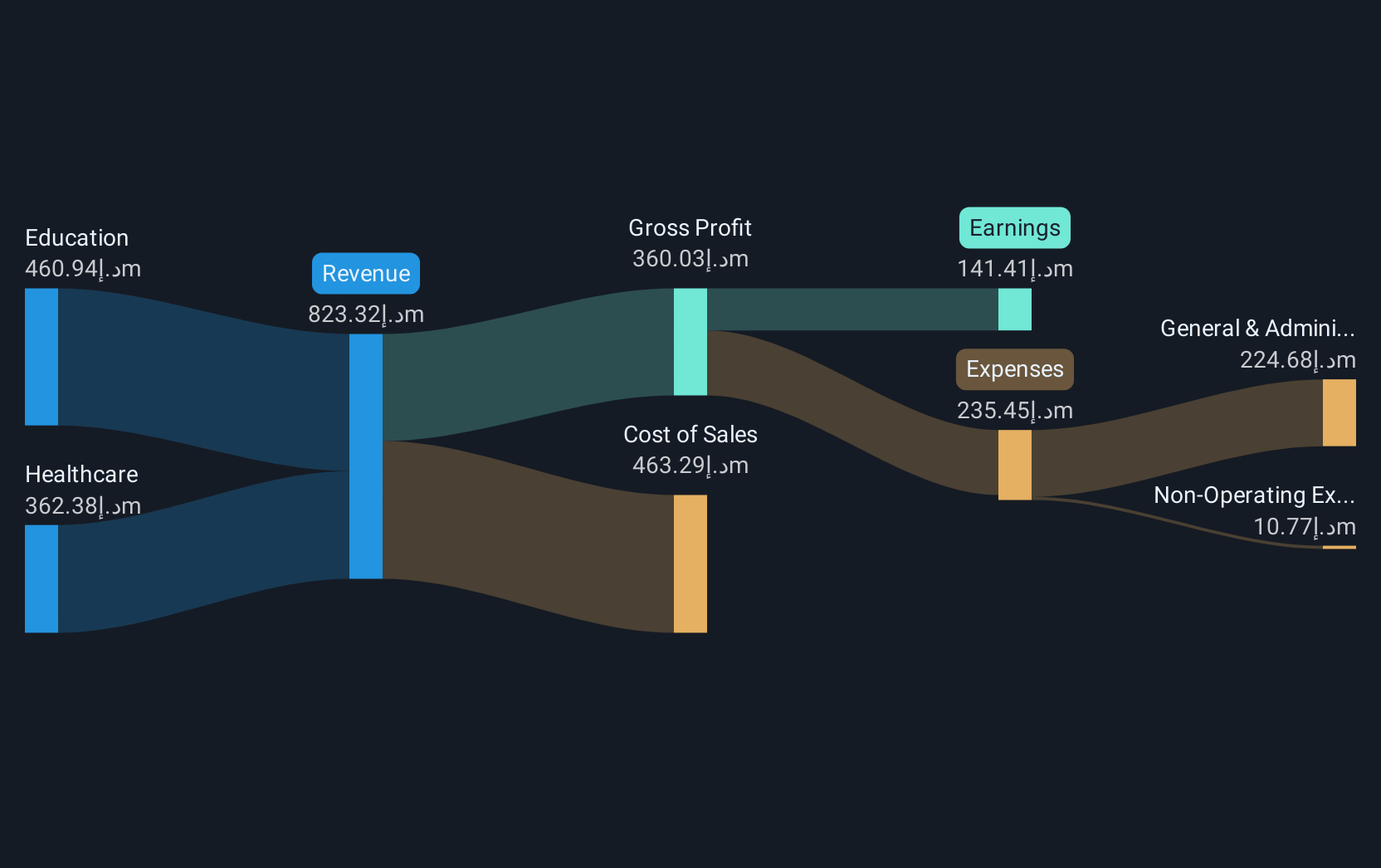

Overview: Amanat Holdings PJSC, with a market cap of AED2.67 billion, invests in companies within the education and healthcare sectors both in the United Arab Emirates and internationally.

Operations: The company's revenue is derived from two main segments: Education, contributing AED432.26 million, and Healthcare, accounting for AED363.84 million.

Market Cap: AED2.67B

Amanat Holdings PJSC has demonstrated robust financial performance, with its revenue rising to AED796.1 million in 2024, driven by strong contributions from both education and healthcare segments. The company reported a net income of AED115.84 million, a significant improvement from the previous year's loss. Despite an increased debt-to-equity ratio over five years, Amanat's debt is well-covered by operating cash flow and it holds more cash than total debt, indicating solid financial health. However, its dividend yield of 4.26% is not well covered by free cash flows, suggesting potential sustainability concerns for dividends moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of Amanat Holdings PJSC.

- Gain insights into Amanat Holdings PJSC's historical outcomes by reviewing our past performance report.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market cap of TRY745.20 million.

Operations: The company generated revenue of TRY1.41 billion from its food activities segment.

Market Cap: TRY745.2M

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, with a market cap of TRY745.20 million, reported revenue of TRY1.41 billion from its food activities segment but faced a net loss of TRY289.02 million for 2024, reversing from the previous year's profit. The company's short-term assets exceed both its short and long-term liabilities, indicating liquidity strength despite unprofitability and high volatility in share price. While debt levels have reduced over time, they remain high with a net debt to equity ratio of 48.5%. A.V.O.D's cash runway exceeds three years if current free cash flow trends continue.

- Dive into the specifics of A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's track record.

Where To Now?

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 92 more companies for you to explore.Click here to unveil our expertly curated list of 95 Middle Eastern Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 24 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AVOD

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi

Provides dried vegetables and derivatives, and vegetable based convenience foods under the Farmer`s Choice brand name in Turkey.

Excellent balance sheet and good value.

Market Insights

Community Narratives