- Turkey

- /

- Diversified Financial

- /

- IBSE:LRSHO

Middle Eastern Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

Middle Eastern markets have experienced a mix of gains and losses recently, with hopes of U.S. Federal Reserve rate cuts providing some optimism despite ongoing regional tensions. In the context of these fluctuating conditions, penny stocks—though often considered a niche investment—still offer intriguing opportunities for growth, particularly in smaller or newer companies that may be overlooked by mainstream investors. By focusing on those with strong financial health and solid fundamentals, investors can potentially uncover hidden value in this segment of the market.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.55 | SAR2.05B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.57 | SAR1.43B | ✅ 2 ⚠️ 1 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.60 | TRY1.26B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.06 | AED2.12B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.45 | AED398.48M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.87 | AED12.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Al Dhafra Insurance Company P.S.C (ADX:DHAFRA) | AED4.86 | AED486M | ✅ 1 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.854 | AED519.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.687 | ₪199.76M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Gulf Pharmaceutical Industries P.S.C (ADX:JULPHAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gulf Pharmaceutical Industries P.S.C., operating with its subsidiaries, produces and distributes a range of pharmaceutical, cosmetic, and medical products in the United Arab Emirates, other GCC countries, and globally, with a market cap of AED1.52 billion.

Operations: The company generates revenue through its manufacturing segment, which accounts for AED640.8 million.

Market Cap: AED1.52B

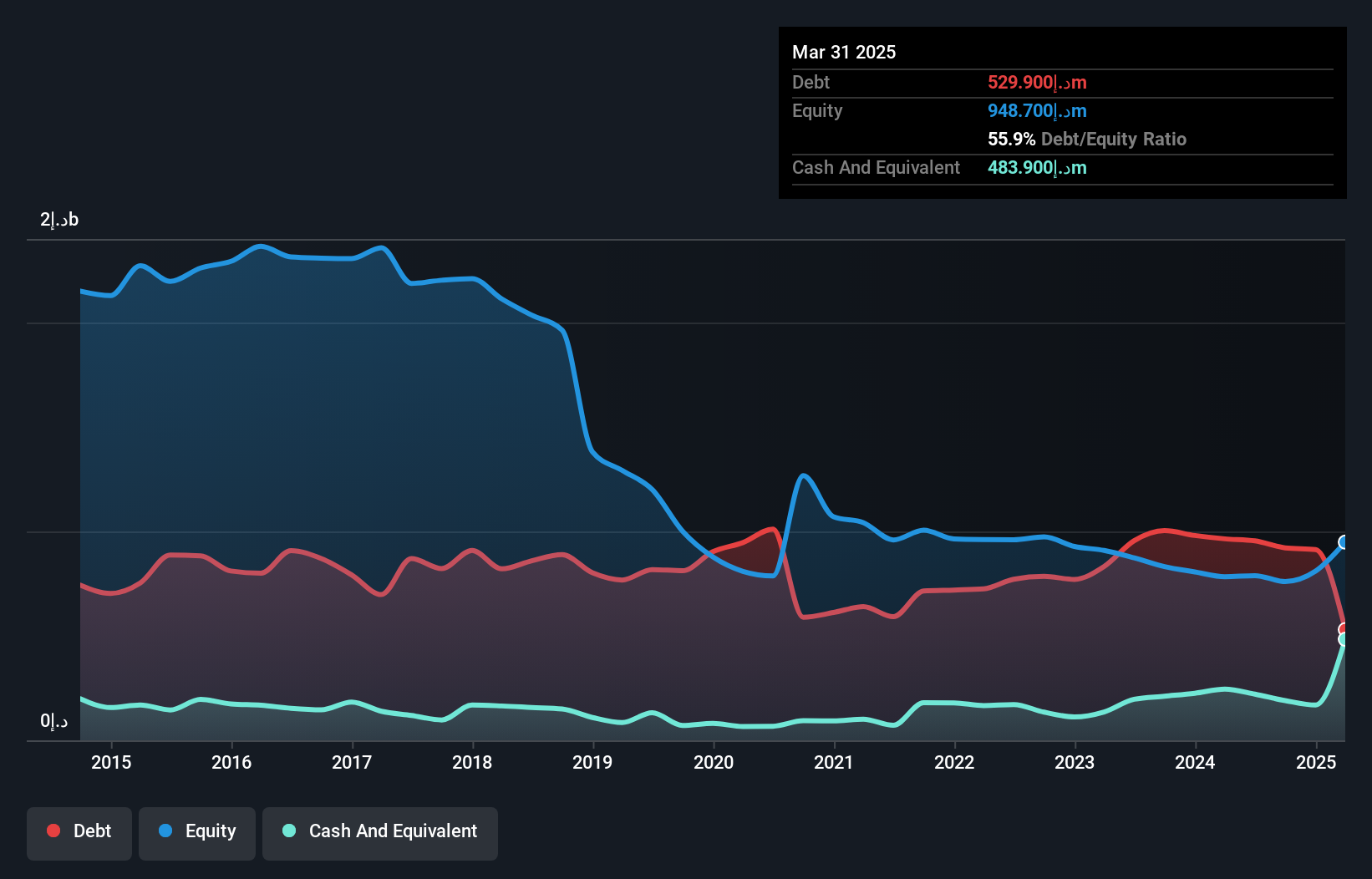

Gulf Pharmaceutical Industries P.S.C. has shown a positive turnaround with its recent earnings report, indicating sales of AED 348.1 million for Q2 2025 and a net income of AED 17 million, contrasting with a loss the previous year. The company's debt management is robust, as operating cash flow covers 52% of its debt while maintaining a satisfactory net debt to equity ratio of 2.1%. However, interest coverage remains below optimal levels at 2.1 times EBIT. With experienced management and board members, Gulf Pharmaceutical's financial health is further supported by assets exceeding both short and long-term liabilities significantly.

- Navigate through the intricacies of Gulf Pharmaceutical Industries P.S.C with our comprehensive balance sheet health report here.

- Evaluate Gulf Pharmaceutical Industries P.S.C's prospects by accessing our earnings growth report.

Loras Holding (IBSE:LRSHO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Loras Holding A.S. operates in Turkey across various sectors including food, construction, real estate investment, machinery, and energy, with a market capitalization of TRY3.83 billion.

Operations: Revenue Segments: No revenue segments have been reported for this company.

Market Cap: TRY3.83B

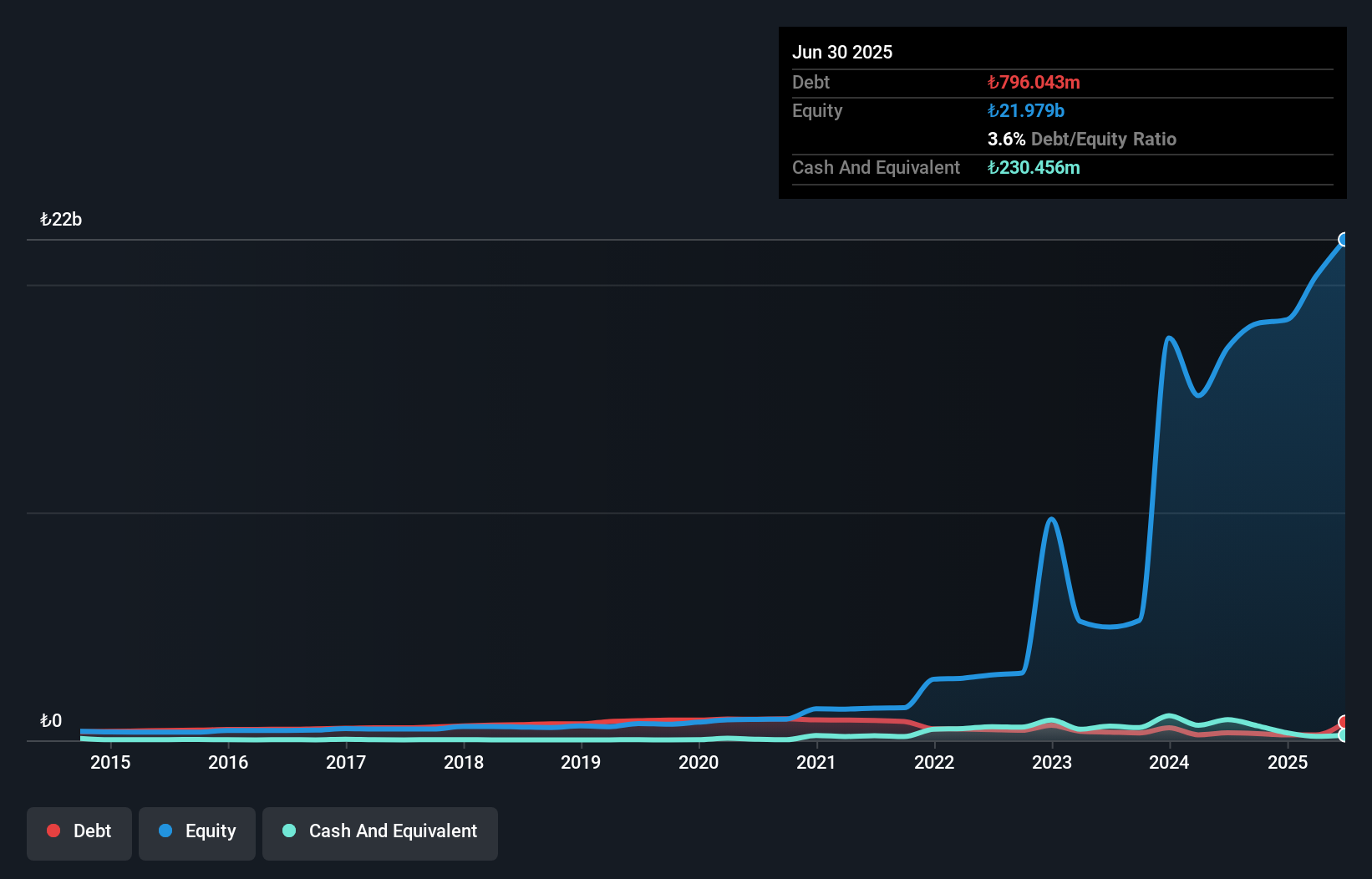

Loras Holding A.S. exhibits mixed financial health with strong asset coverage for both short and long-term liabilities, supported by TRY7.6 billion in short-term assets against TRY3.9 billion in long-term liabilities. Despite a satisfactory net debt to equity ratio of 2.6% and well-covered interest payments, the company faces challenges with declining earnings growth, evidenced by a significant drop in net income from TRY 817.56 million to TRY 67.61 million year-over-year for Q2 2025 due to large one-off losses impacting results. The board's experience is notable, though management tenure data is insufficient for assessment.

- Get an in-depth perspective on Loras Holding's performance by reading our balance sheet health report here.

- Gain insights into Loras Holding's historical outcomes by reviewing our past performance report.

Oil Refineries (TASE:ORL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oil Refineries Ltd., with a market cap of ₪2.75 billion, operates in the production and sale of fuel products, intermediate materials, and aromatic products both in Israel and internationally.

Operations: The company's revenue is primarily derived from its refining segment, which accounts for $5.81 billion, followed by the polymers segment at $766 million.

Market Cap: ₪2.75B

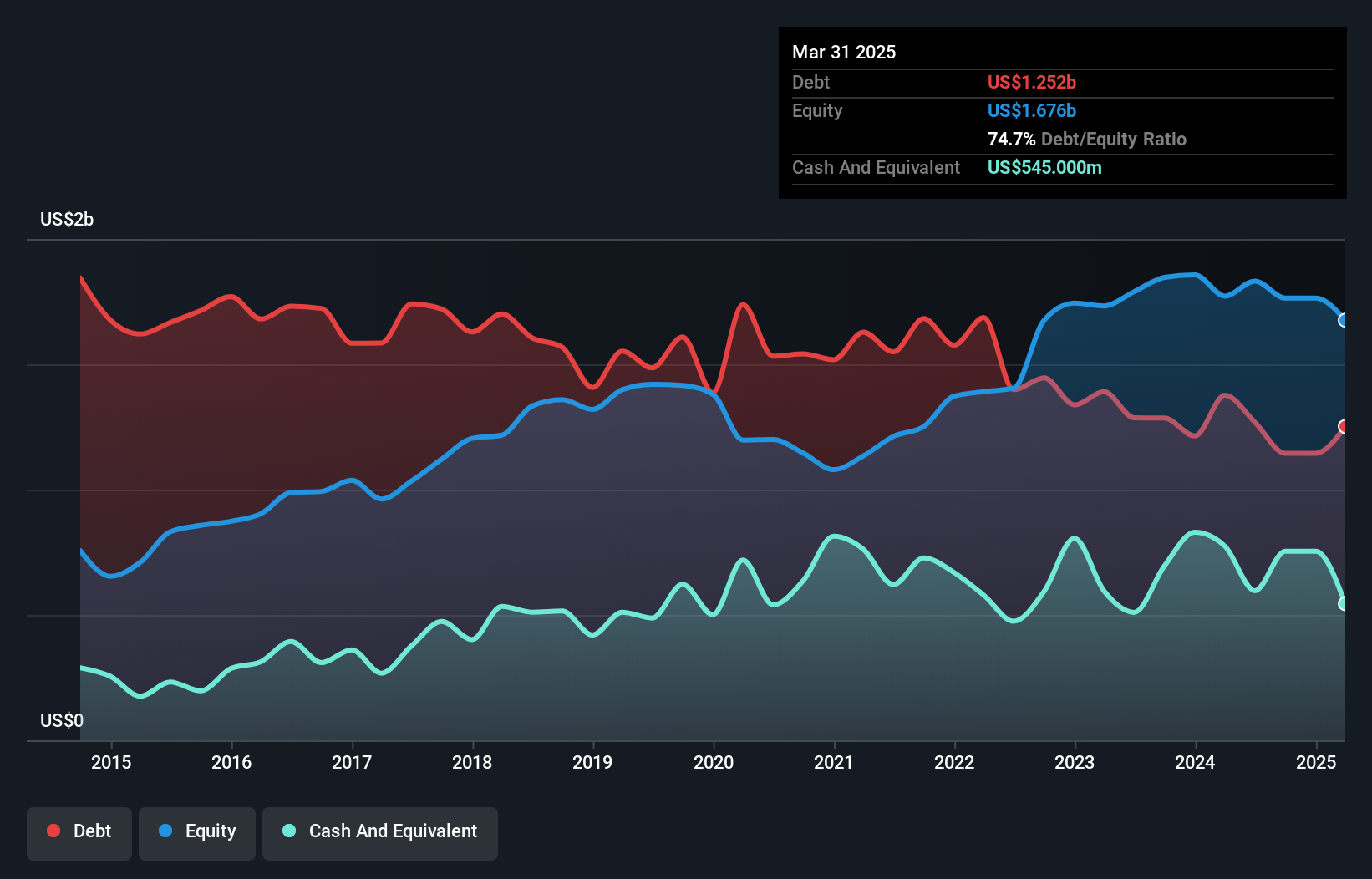

Oil Refineries Ltd. faces financial challenges, evidenced by a net loss of US$37 million in Q2 2025 compared to a net income of US$61 million the previous year, and sales declining from US$1.85 billion to US$1.47 billion. Despite reducing its debt-to-equity ratio over five years and having short-term assets exceeding both short- and long-term liabilities, the company remains unprofitable with negative return on equity and interest payments not covered by EBIT. The dividend is unsustainable given current earnings, though management's experience offers some stability amid volatile market conditions for penny stocks in the region.

- Dive into the specifics of Oil Refineries here with our thorough balance sheet health report.

- Evaluate Oil Refineries' historical performance by accessing our past performance report.

Where To Now?

- Access the full spectrum of 78 Middle Eastern Penny Stocks by clicking on this link.

- Ready For A Different Approach? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LRSHO

Loras Holding

Engages in the food, construction, real estate investment, machinery, and energy businesses in Turkey.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives