Middle East Undiscovered Gems And 2 More Small Caps With Strong Potential

Reviewed by Simply Wall St

As Gulf stock markets experience gains driven by prospects of a U.S. rate cut and improved investor sentiment, the Middle East is emerging as a fertile ground for small-cap opportunities. In this environment, identifying stocks with strong fundamentals and growth potential can be key to capitalizing on the region's economic dynamics and market shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Mobiltel Iletisim Hizmetleri Sanayi ve Ticaret | 21.21% | 19.59% | -34.35% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Gedik Yatirim Menkul Degerler (IBSE:GEDIK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gedik Yatirim Menkul Degerler A.S. is an investment banking company operating in Turkey and internationally, with a market cap of TRY14.16 billion.

Operations: Gedik Yatirim generates revenue primarily through its brokerage activities, amounting to TRY133.48 million. The company's net profit margin is notable at 26.5%, indicating efficient cost management relative to its revenue.

Gedik Yatirim Menkul Degerler, a financial entity in the Middle East, has shown robust earnings growth of 15.4% over the past year, outpacing the Capital Markets industry which saw a -5.6% change. The company boasts high-quality earnings and a favorable price-to-earnings ratio of 15.9x compared to the TR market's 21.6x, suggesting potential undervaluation. Its debt-to-equity ratio improved from 216.8% to 175.3% over five years, indicating better financial management while maintaining more cash than total debt enhances its stability further despite recent share price volatility within three months.

- Delve into the full analysis health report here for a deeper understanding of Gedik Yatirim Menkul Degerler.

Learn about Gedik Yatirim Menkul Degerler's historical performance.

Isik Plastik Sanayi ve Dis Ticaret Pazarlama Anonim Sirketi (IBSE:ISKPL)

Simply Wall St Value Rating: ★★★★☆☆

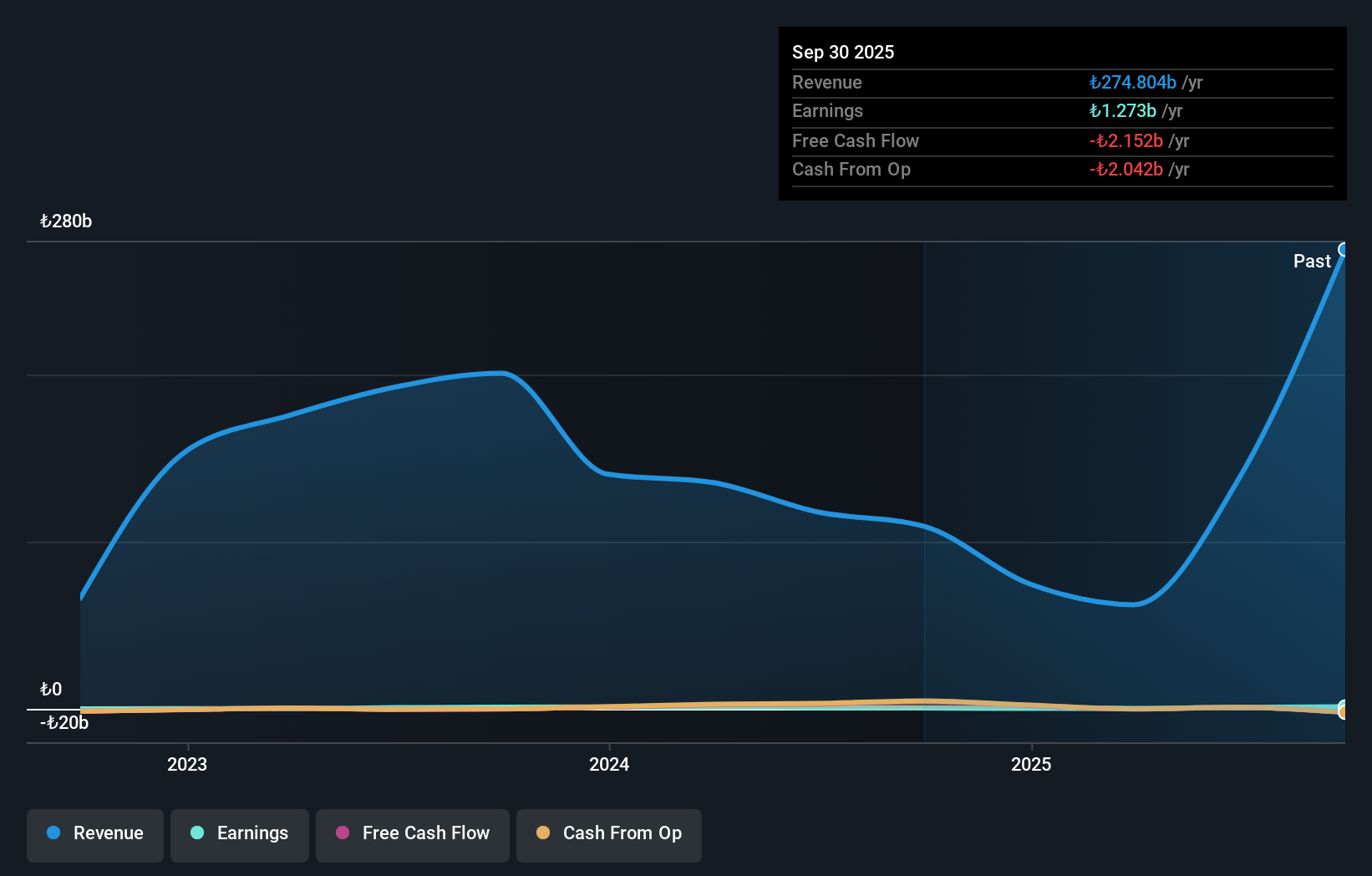

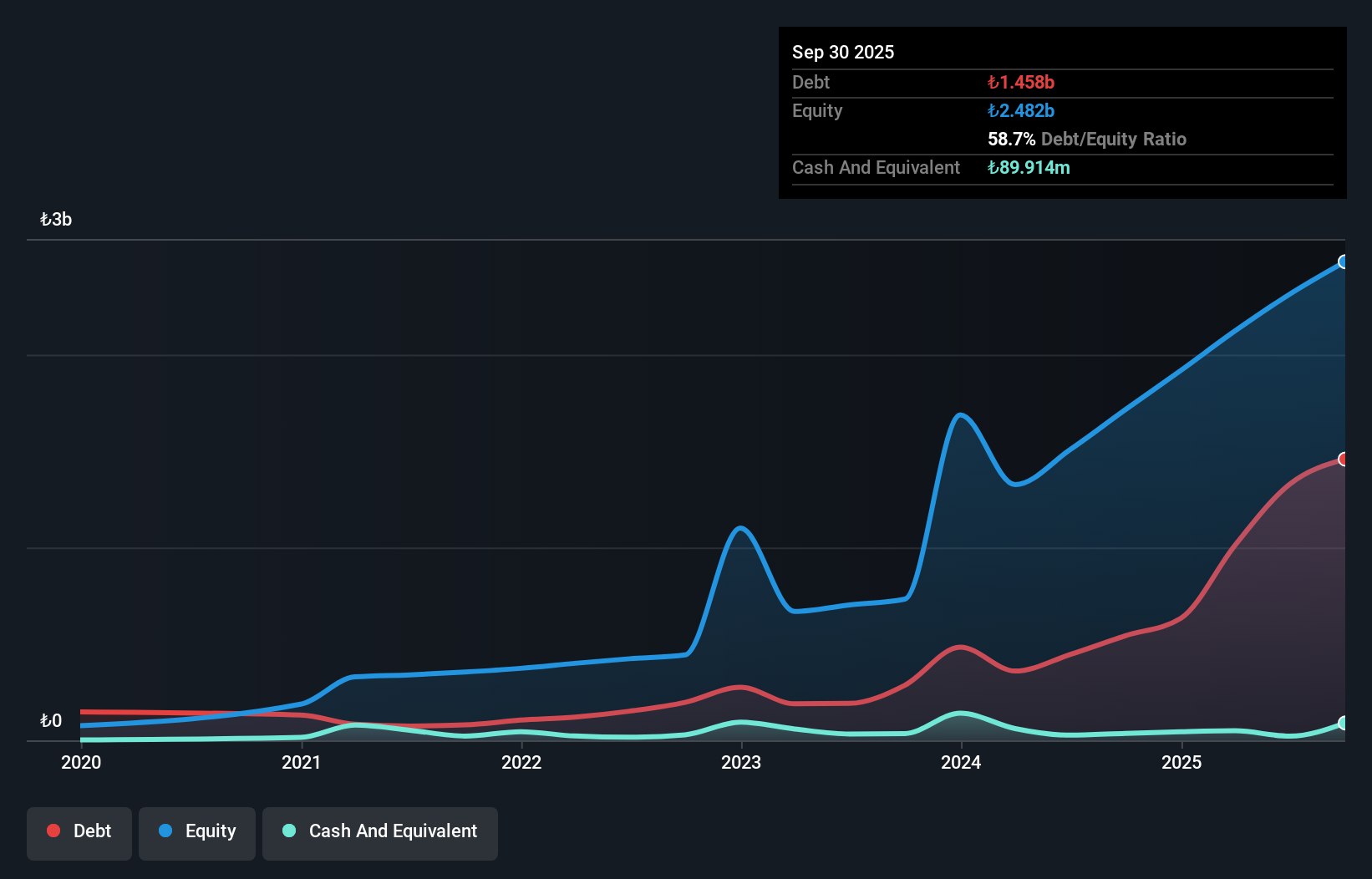

Overview: Isik Plastik Sanayi ve Dis Ticaret Pazarlama Anonim Sirketi is engaged in the manufacturing and sale of plastic products both domestically in Turkey and internationally, with a market capitalization of TRY13.34 billion.

Operations: ISKPL generates revenue primarily through its Plastics & Rubber segment, which reported TRY1.93 billion. The company's net profit margin shows notable trends over recent periods, reflecting its operational efficiency and cost management strategies.

Isik Plastik stands out with a notable earnings growth of 33.1% over the past year, surpassing the Chemicals industry's 3.2% increase, despite a challenging financial landscape. The company's net income for the first half of 2025 was TRY 151.89 million, slightly higher than last year's TRY 149.4 million, indicating resilience amidst declining sales figures from TRY 1,324.78 million to TRY 1,122.35 million in the same period. However, its interest coverage ratio is low at just 1.7x EBIT against debt obligations and a high net debt to equity ratio of 56.5%, reflecting potential financial strain despite reduced leverage from five years ago's peak at over double that level.

Ackerstein Group (TASE:ACKR)

Simply Wall St Value Rating: ★★★★★☆

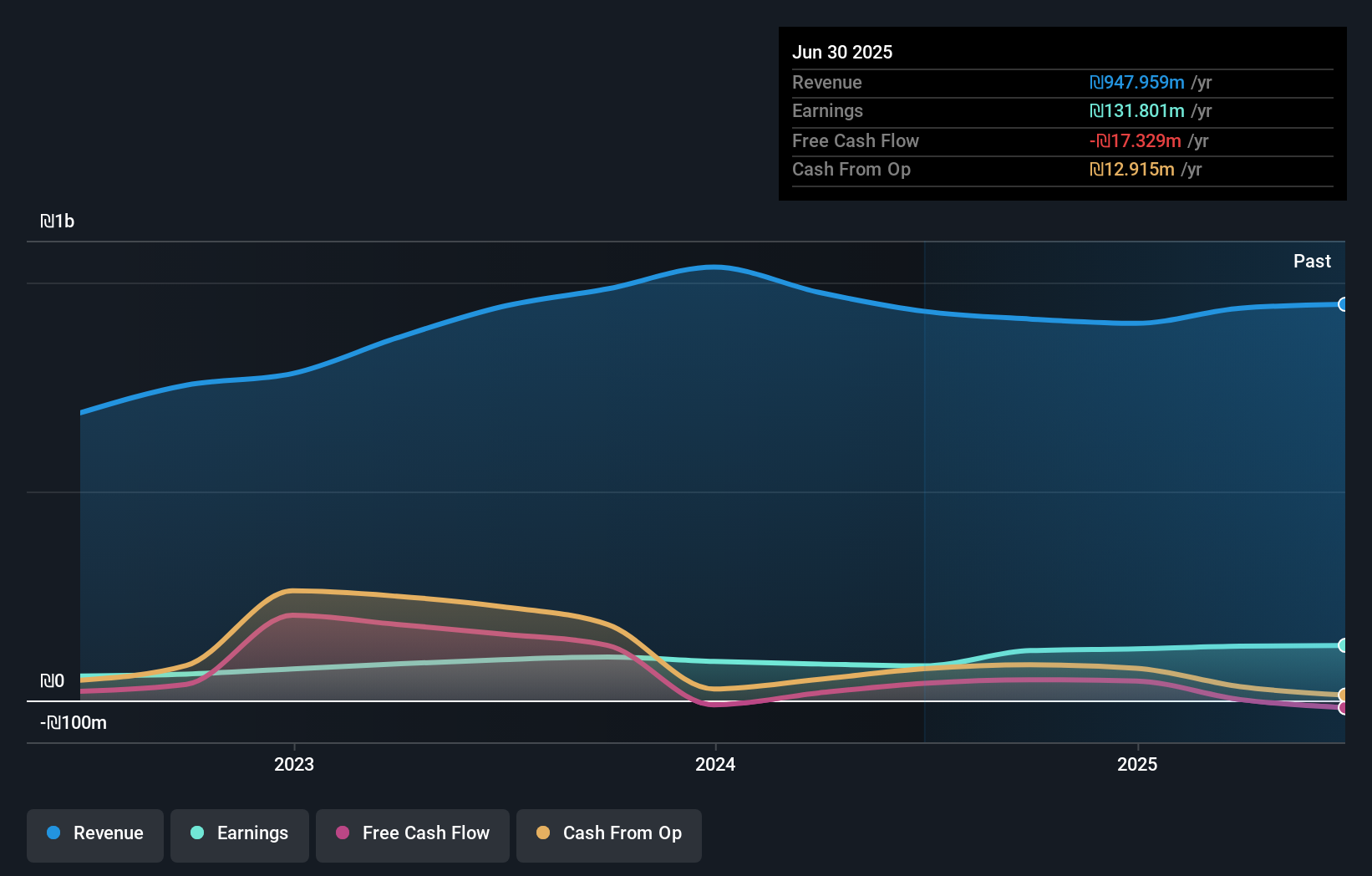

Overview: Ackerstein Group Ltd operates in production, infrastructure, construction, and development sectors across Israel and the United States, with a market capitalization of ₪2.83 billion.

Operations: Ackerstein Group generates revenue primarily from its Engineering Segment, contributing ₪550.28 million, followed by the Industry Sector at ₪313.53 million and the Real Estate Sector at ₪48.14 million. The company also earns from the Industry Sector Abroad, adding another ₪52.84 million to its revenue streams.

Ackerstein Group's recent performance highlights its potential as a noteworthy player in the Middle East market. Over the past year, earnings surged by 59.3%, significantly outpacing the Basic Materials industry's 6.2% growth rate, indicating robust operational momentum. The debt to equity ratio has impressively decreased from 40.5% to 13.6% over five years, reflecting effective debt management strategies and a satisfactory net debt to equity ratio of 9.7%. Despite a large one-off gain of ₪62.3M impacting recent results, Ackerstein remains profitable with interest payments well covered by EBIT at an impressive 31.8x coverage, suggesting strong financial health and stability for future endeavors.

- Dive into the specifics of Ackerstein Group here with our thorough health report.

Understand Ackerstein Group's track record by examining our Past report.

Taking Advantage

- Discover the full array of 207 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:ISKPL

Isik Plastik Sanayi ve Dis Ticaret Pazarlama Anonim Sirketi

Manufactures and sells plastic products in Turkey and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.