As global markets grapple with economic uncertainty and inflation fears, small-cap stocks have become a focal point for investors seeking potential opportunities amid broader market volatility. In this environment, identifying undiscovered gems requires a keen eye for companies that exhibit resilience and adaptability to navigate trade policy shifts and inflationary pressures.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.60% | 4.56% | 15.25% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Chudenko | NA | 4.57% | 0.97% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Ascentech K.K | NA | 134.28% | 78.96% | ★★★★★★ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| OUG Holdings | 97.54% | 2.27% | 32.89% | ★★★★☆☆ |

| Ogaki Kyoritsu Bank | 141.86% | 2.81% | 3.53% | ★★★★☆☆ |

| Yukiguni Maitake | 126.48% | -5.17% | -33.78% | ★★★★☆☆ |

| Kwang Dong Pharmaceutical | 44.94% | 6.47% | 3.58% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dogan Sirketler Grubu Holding (IBSE:DOHOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dogan Sirketler Grubu Holding A.S. operates in various sectors including electricity generation, industry and trade, automotive trade and marketing, finance and investment, internet and entertainment, and real estate investment in Turkey, with a market capitalization of TRY41.59 billion.

Operations: Dogan Sirketler Grubu Holding's primary revenue streams include financing and investment (TRY28.99 billion), automotive distribution (TRY26.33 billion), and industry and trade (TRY22.09 billion). The company also generates income from electricity production, internet & entertainment, mining, and real estate investments.

Dogan Sirketler Grubu Holding has shown remarkable earnings growth of 407.5% over the past year, outpacing the Specialty Retail industry’s 4.6%. Despite a challenging five-year period with earnings declining by 3.9% annually, recent performance highlights its potential as an undervalued opportunity, trading at 93.8% below estimated fair value. The company's net income for 2024 reached TRY 4,317 million from a previous loss of TRY 210 million in the prior year, reflecting strong operational improvements. However, its debt to equity ratio rose from 29.1% to 39.6%, indicating increased leverage over five years but still having more cash than total debt suggests financial flexibility remains intact.

GRAINTURK Holding (IBSE:GRTHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GRAINTURK Holding (IBSE:GRTHO) is engaged in agricultural commodity trading both domestically and internationally, with a market capitalization of TRY41.28 billion.

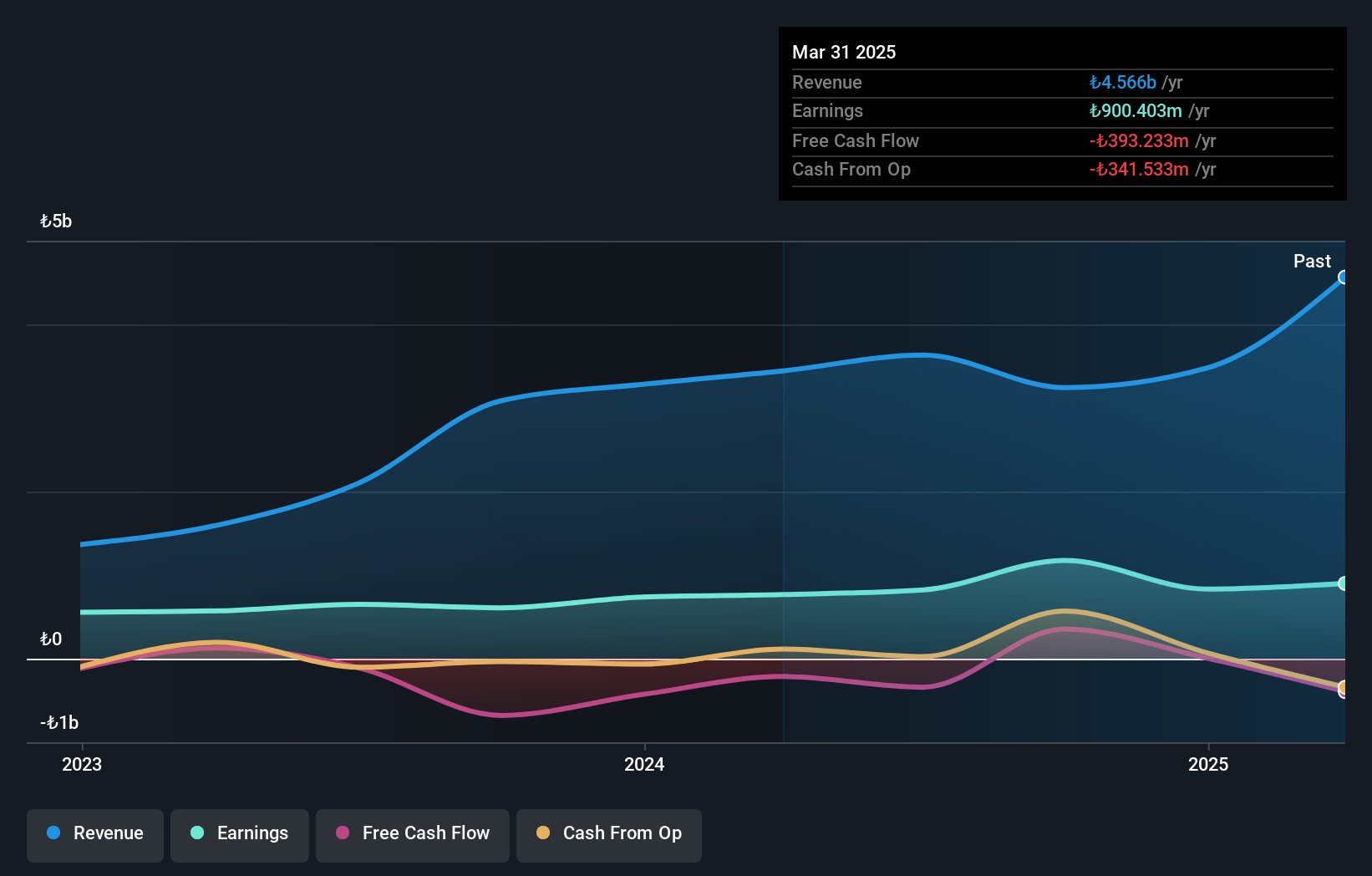

Operations: Grainturk generates revenue primarily through trade, contributing TRY4.19 billion, and warehousing, adding TRY70.63 million. The company faces elimination adjustments of TRY782.45 million in its financials.

GRAINTURK Holding, a smaller player in the market, has shown notable performance with earnings growth of 13.1% over the past year, outpacing the Consumer Retailing sector's -41%. The company reported sales of TRY 3.48 billion for 2024, up from TRY 3.28 billion in the previous year, while net income reached TRY 833.62 million compared to last year's TRY 736.95 million. Despite its highly volatile share price recently, GRAINTURK maintains high-quality earnings and a satisfactory net debt to equity ratio of just 6%, suggesting robust financial health amidst industry challenges.

- Click to explore a detailed breakdown of our findings in GRAINTURK Holding's health report.

Understand GRAINTURK Holding's track record by examining our Past report.

Reysas Tasimacilik ve Lojistik Ticaret (IBSE:RYSAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Reysas Tasimacilik ve Lojistik Ticaret A.S. operates in logistics and transportation services, hotel management, real estate rental activities, vehicle inspection services, and tobacco product storage with a market capitalization of TRY34.68 billion.

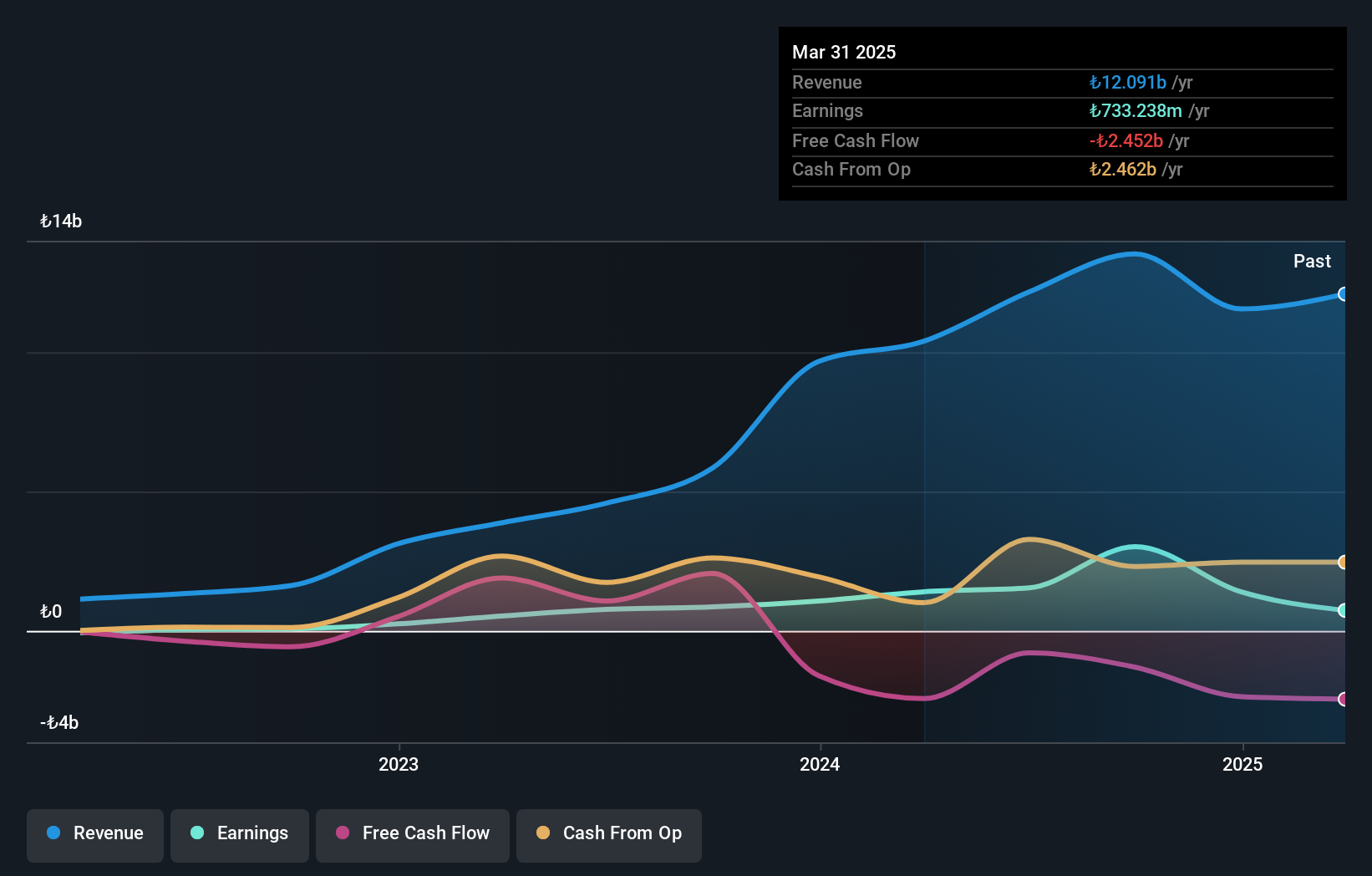

Operations: Reysas Tasimacilik ve Lojistik Ticaret generates significant revenue from transportation storage logistics services (TRY5.77 billion) and real estate rental activities (TRY4.43 billion). The company also earns from vehicle inspection services, hotel management, and tobacco product storage, contributing TRY1.19 billion, TRY245.84 million, and TRY1.09 billion respectively to its revenue streams.

Reysas Tasimacilik ve Lojistik Ticaret, a player in the logistics sector, has shown robust earnings growth of 30.3% over the past year, outpacing the industry's 11.3%. With sales reaching TRY 11.55 billion from TRY 9.67 billion and net income climbing to TRY 1.39 billion from TRY 1.07 billion, its financial performance is noteworthy. The company's debt profile is favorable with a net debt to equity ratio at a satisfactory level of 27%, and interest payments are well-covered by EBIT at four times coverage. Despite not being free cash flow positive, profitability remains strong without concerns about cash runway length due to high-quality non-cash earnings and reduced debt levels over five years from an overwhelming 1796% to just under 57%.

Next Steps

- Investigate our full lineup of 3228 Global Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:RYSAS

Reysas Tasimacilik ve Lojistik Ticaret

Reysas Tasimacilik ve Lojistik Ticaret A.S.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives