Amidst the backdrop of Gulf bourses experiencing significant declines due to recession fears sparked by US tariffs, investors are increasingly focusing on stable income sources like dividend stocks. In such volatile market conditions, a good dividend stock can offer a reliable yield and act as a buffer against market turbulence.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.84% | ★★★★★★ |

| Emaar Properties PJSC (DFM:EMAAR) | 8.44% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.21% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.69% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.62% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 6.10% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.12% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.97% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.56% | ★★★★★☆ |

| Nuh Çimento Sanayi (IBSE:NUHCM) | 3.50% | ★★★★★☆ |

Click here to see the full list of 67 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

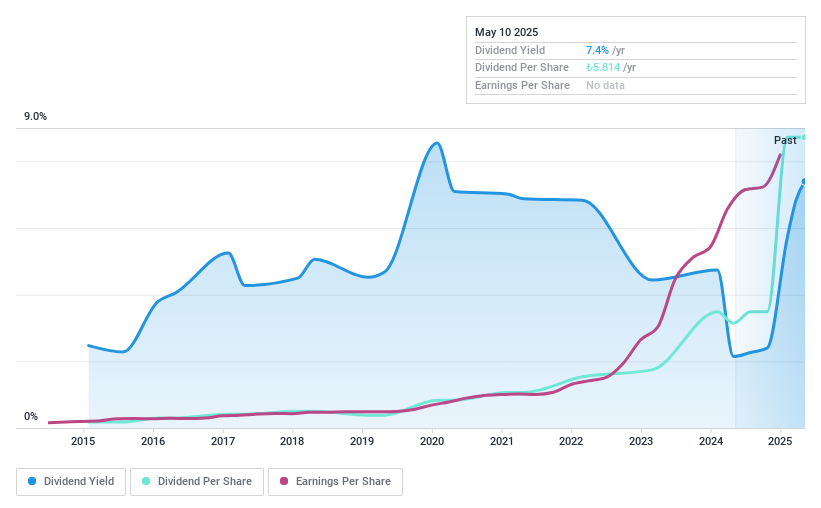

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anadolu Hayat Emeklilik Anonim Sirketi offers individual and group insurance and reinsurance services in life, retirement, and personal accident sectors in Turkey with a market cap of TRY37.78 billion.

Operations: Anadolu Hayat Emeklilik Anonim Sirketi generates revenue primarily from its Life segment at TRY16.10 billion and Retirement segment at TRY3.73 billion, with minimal contribution from Non-Life services.

Dividend Yield: 6.6%

Anadolu Hayat Emeklilik Anonim Sirketi offers a compelling dividend profile with a payout ratio of 58.1% and cash payout ratio of 49.8%, indicating dividends are well-covered by earnings and cash flows. Despite a volatile dividend history, recent increases highlight potential growth, supported by strong earnings performance (TRY 4.31 billion in 2024). The stock's price-to-earnings ratio (8.8x) suggests good value compared to the TR market average, while its dividend yield (6.62%) ranks in the top quartile regionally.

- Delve into the full analysis dividend report here for a deeper understanding of Anadolu Hayat Emeklilik Anonim Sirketi.

- The valuation report we've compiled suggests that Anadolu Hayat Emeklilik Anonim Sirketi's current price could be quite moderate.

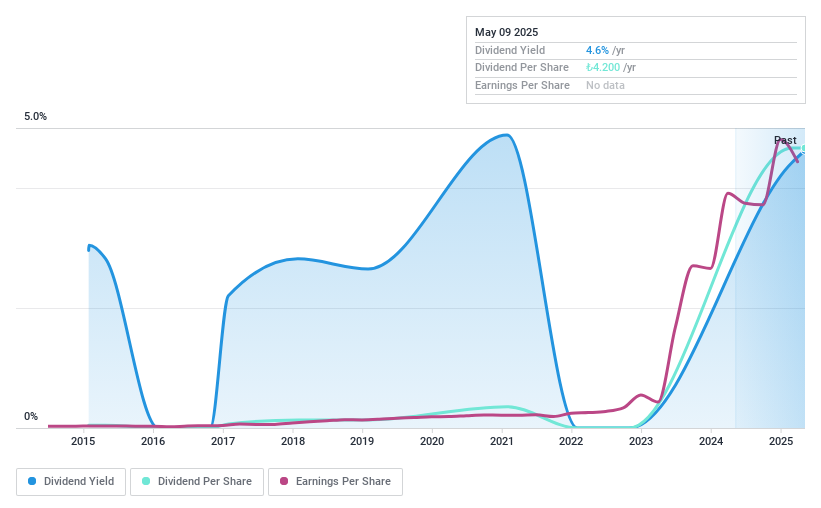

Anadolu Anonim Türk Sigorta Sirketi (IBSE:ANSGR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anadolu Anonim Türk Sigorta Sirketi provides non-life insurance products in Turkey and has a market cap of TRY47 billion.

Operations: Anadolu Anonim Türk Sigorta Sirketi's revenue is primarily derived from its non-life insurance segments, including Motor Vehicles (TRY13.67 billion), Disease/Health (TRY8.49 billion), Motor Vehicles Liability (TRY8.69 billion), and Fire and Natural Disasters (TRY4.78 billion).

Dividend Yield: 4.5%

Anadolu Anonim Türk Sigorta Sirketi maintains a strong dividend position with a low payout ratio of 18.2% and cash payout ratio of 33.9%, ensuring dividends are well-covered by earnings and cash flows. Despite past volatility, dividends have grown over the last decade, with the current yield (4.47%) in the top 25% regionally. Recent earnings show significant growth, enhancing its appeal as a dividend stock, though historical reliability remains a concern.

- Dive into the specifics of Anadolu Anonim Türk Sigorta Sirketi here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Anadolu Anonim Türk Sigorta Sirketi shares in the market.

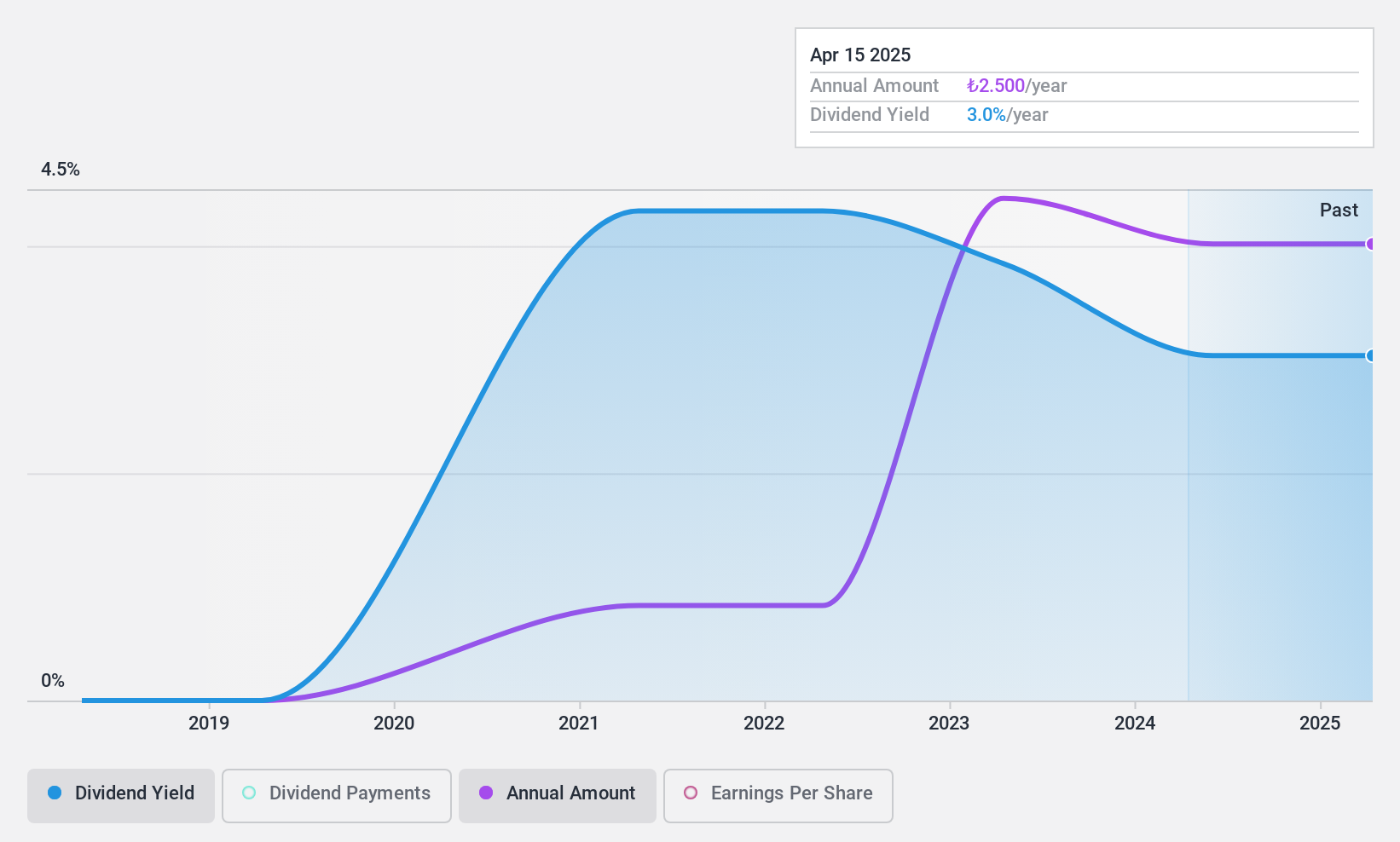

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri operates in the textile and ready-to-wear clothing industry with a market capitalization of TRY11.48 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri generates revenue primarily from its Apparel segment, which amounts to TRY14.86 billion.

Dividend Yield: 3.5%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri offers a compelling dividend profile with a payout ratio of 30.5% and cash payout ratio of 18.4%, indicating dividends are well-covered by earnings and cash flows. Despite only four years of dividend payments, recent increases to TRY 4 per share highlight growth potential. However, the company's net income has declined significantly from TRY 2.81 billion to TRY 806.49 million, affecting profit margins and overall financial stability.

- Get an in-depth perspective on Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's performance by reading our dividend report here.

- Our valuation report unveils the possibility Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's shares may be trading at a discount.

Summing It All Up

- Discover the full array of 67 Top Middle Eastern Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:VAKKO

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives