- Israel

- /

- Real Estate

- /

- TASE:ROTS

Unveiling Three Middle East Small Cap Gems with Strong Potential

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced downward pressure due to geopolitical tensions, with key indices such as Saudi Arabia's benchmark index and Dubai's main share index experiencing notable declines. In this challenging environment, identifying small-cap stocks with robust fundamentals and resilience can offer intriguing opportunities for investors seeking potential growth amidst market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

| Saudi Chemical Holding | 79.49% | 16.57% | 44.01% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

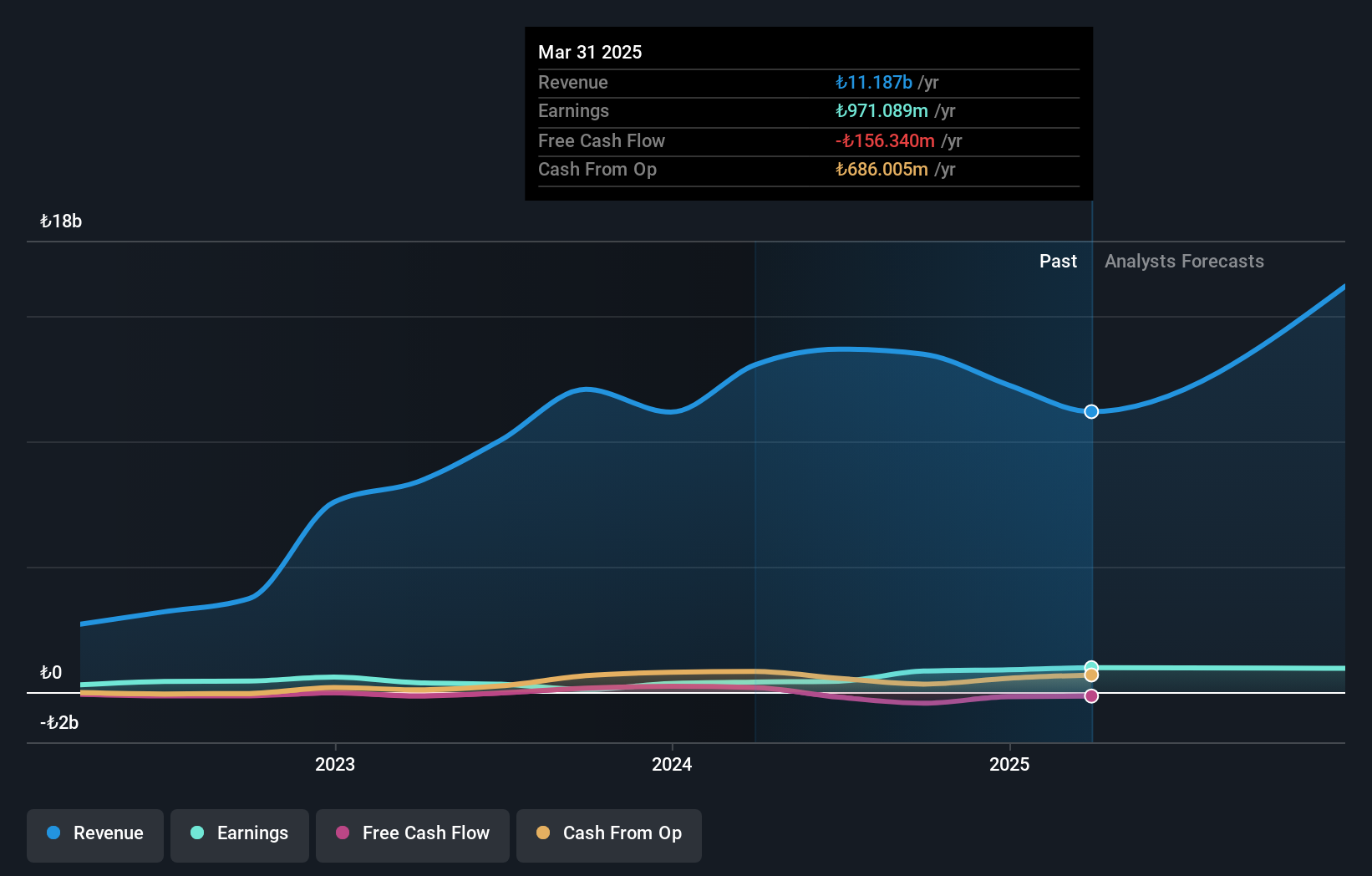

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Amanat Holdings PJSC is an investment company that focuses on the education and healthcare sectors both within the United Arab Emirates and internationally, with a market capitalization of AED2.66 billion.

Operations: Amanat generates revenue primarily from its investments in the education sector, contributing AED460.94 million, and the healthcare sector, adding AED362.38 million.

Amanat Holdings PJSC, a nimble player in the Middle East's financial landscape, has shown impressive earnings growth of 166.2% over the past year, outpacing its industry peers. Despite a rise in its debt to equity ratio from 2.3% to 11.3% over five years, Amanat's cash position remains robust compared to its total debt. The company reported AED 240.73 million in sales for Q1 2025, up from AED 213.5 million the previous year; however, net income dipped slightly to AED 37.67 million from AED 40.64 million last year, reflecting mixed results amidst strong revenue growth.

- Unlock comprehensive insights into our analysis of Amanat Holdings PJSC stock in this health report.

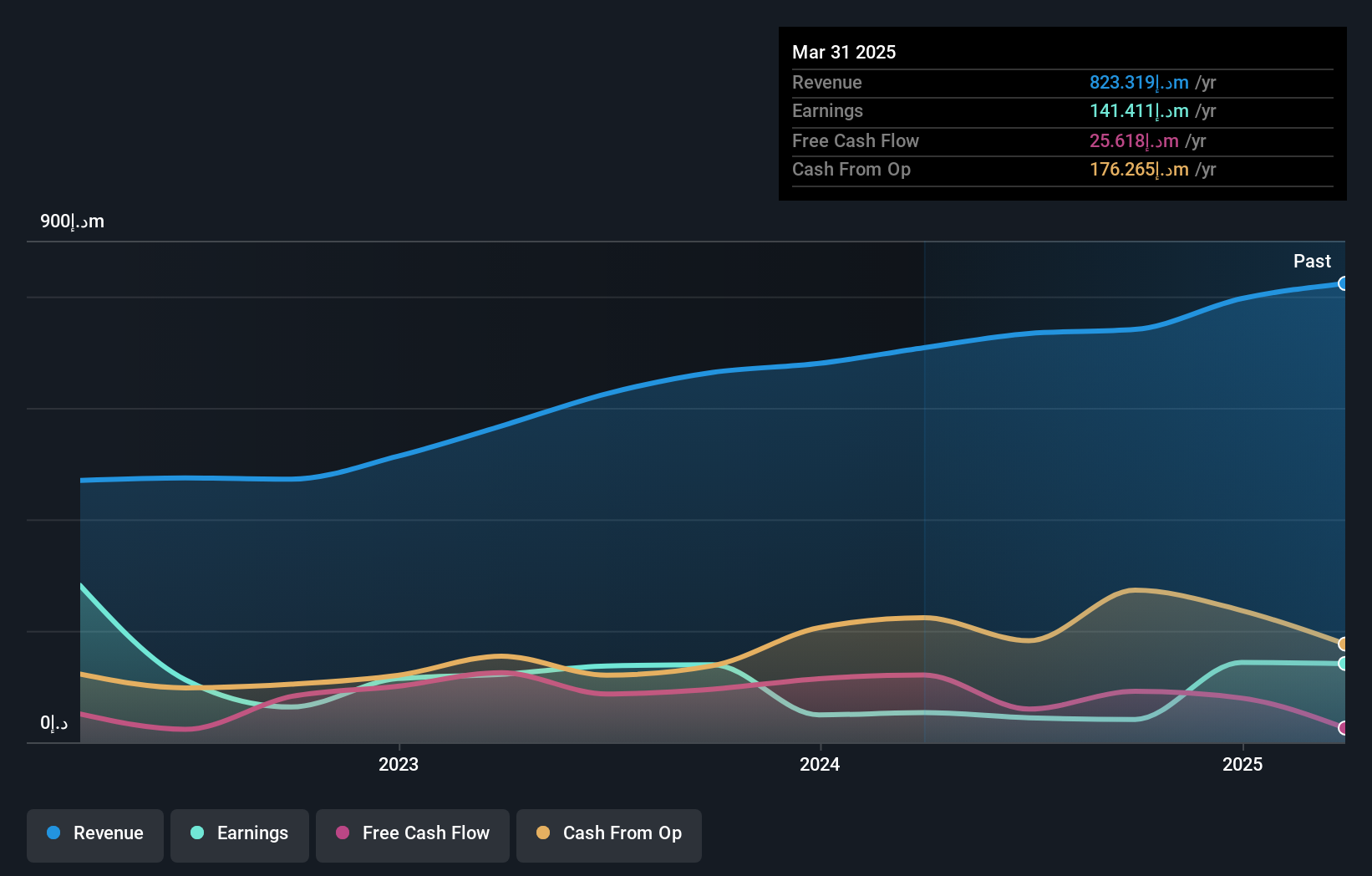

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★★★

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in designing, producing, and selling knit fabrics and ready-made womenswear garments both domestically and internationally, with a market capitalization of TRY16.09 billion.

Operations: Sun Tekstil generates revenue primarily from ready-made womenswear garments, contributing TRY8.26 billion, and fabric production, adding TRY3.01 billion. The company experiences eliminations amounting to TRY87.05 million in its financials.

Sun Tekstil Sanayi ve Ticaret, a nimble player in the Middle East, showcases intriguing financial dynamics. Over the past year, earnings surged by 142%, outpacing its luxury industry peers which saw a downturn of 42%. The company's net debt to equity ratio stands at a satisfactory 0.7%, having improved significantly from 115% over five years. Despite recent volatility in share price and challenges with free cash flow, Sun Tekstil remains profitable with non-cash earnings contributing positively. Recent quarterly results highlight an improvement from a net loss to TRY 14.81 million in profit, reflecting resilience amidst fluctuating sales figures.

- Take a closer look at Sun Tekstil Sanayi ve Ticaret's potential here in our health report.

Understand Sun Tekstil Sanayi ve Ticaret's track record by examining our Past report.

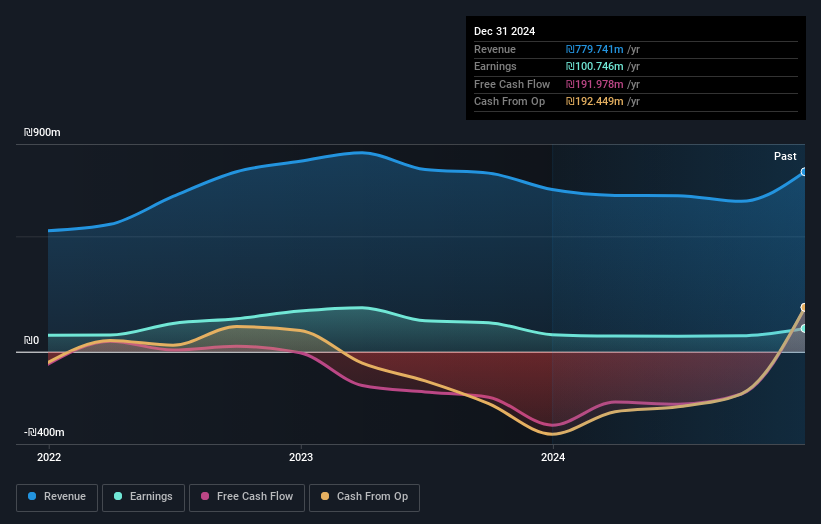

Rotshtein Realestate (TASE:ROTS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rotshtein Realestate Ltd focuses on the development and construction of residential projects in Israel, with a market capitalization of ₪1.32 billion.

Operations: The primary revenue stream for Rotshtein Realestate comes from the development and construction of residential projects, generating ₪837.41 million. The company's investment property segment contributes an additional ₪13.79 million to its revenue.

Rotshtein Realestate, a nimble player in the real estate sector, has been making waves with its impressive financial performance. Over the past year, earnings surged by 61.7%, outpacing the industry's 32.4%. Trading at a significant discount of 57.6% below its estimated fair value, it offers potential value for investors seeking opportunities in overlooked markets. The company's debt-to-equity ratio improved from 276.7% to 167.3% over five years, indicating better financial health despite high net debt levels at 155.5%. Recent results show revenue climbing to ILS 197.77 million and net income reaching ILS 23.36 million for Q1 2025 compared to last year’s figures, reflecting robust growth and profitability in its operations.

Key Takeaways

- Explore the 220 names from our Middle Eastern Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:ROTS

Rotshtein Realestate

Develops and constructs residential projects in Israel.

Solid track record and good value.

Market Insights

Community Narratives