Undiscovered Gems And Two Other Promising Small Caps On None

Reviewed by Simply Wall St

Amidst a backdrop of global market volatility, small-cap stocks have been navigating a complex environment marked by tariff uncertainties and mixed economic indicators. While major indices like the S&P 500 and Russell 2000 have faced declines, the resilience of certain sectors offers opportunities for discerning investors. In this context, identifying promising small-cap companies involves looking for those with strong fundamentals that can weather current challenges and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 11.98% | 17.61% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Olvi Oyj (HLSE:OLVAS)

Simply Wall St Value Rating: ★★★★★☆

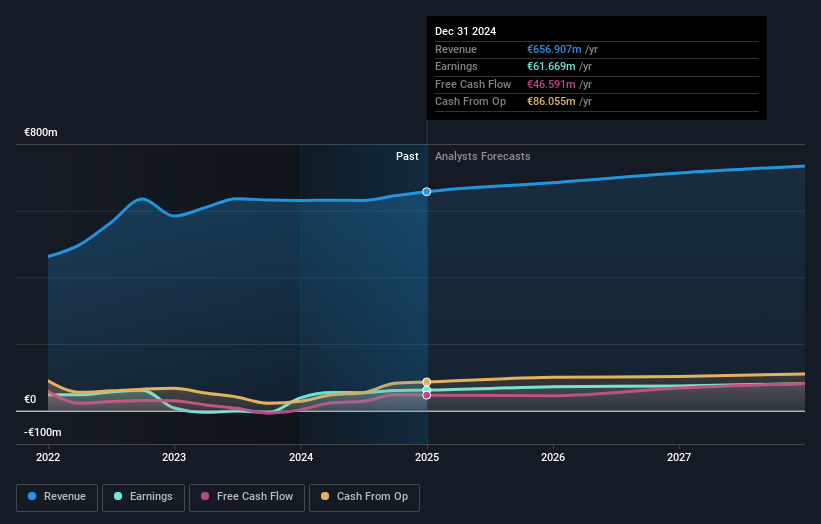

Overview: Olvi Oyj is a beverage company that manufactures and sells alcoholic and non-alcoholic beverages across Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus with a market cap of €659.31 million.

Operations: Olvi Oyj generates revenue primarily from alcoholic beverages, contributing €656.91 million.

Olvi Oyj, a smaller player in the beverage industry, has shown impressive financial performance recently. Their earnings surged by 61% last year, outpacing the industry's -2% growth rate. The company reported a net income of €61.67 million for 2024, up from €38.25 million in 2023, with basic earnings per share rising to €2.98 from €1.85. Olvi seems to be trading at a value significantly below its fair estimate and maintains strong interest coverage with more cash than total debt despite an increase in its debt-to-equity ratio over five years to 3%.

- Dive into the specifics of Olvi Oyj here with our thorough health report.

Evaluate Olvi Oyj's historical performance by accessing our past performance report.

Sun Tekstil Sanayi ve Ticaret (IBSE:SUNTK)

Simply Wall St Value Rating: ★★★★☆☆

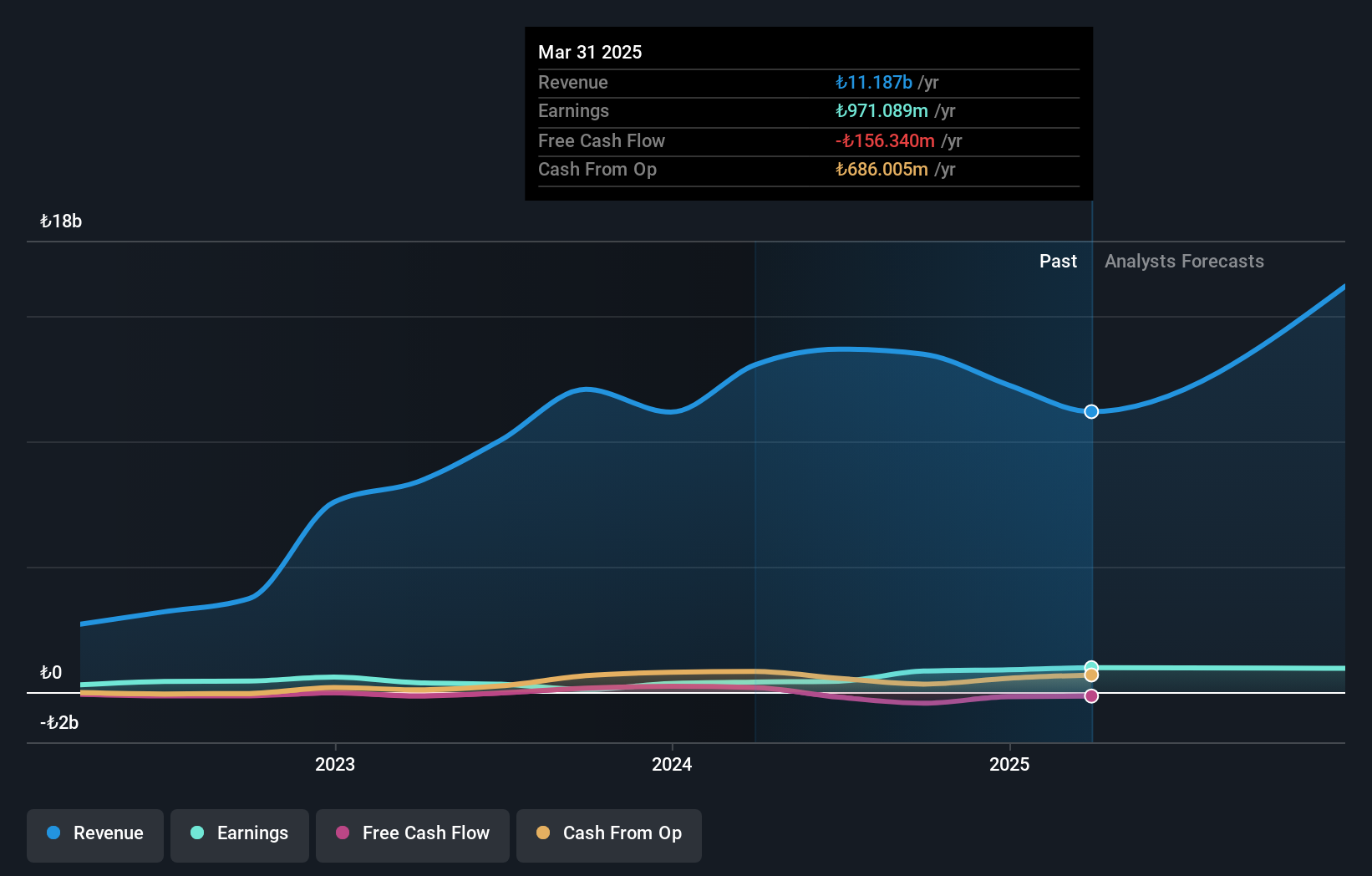

Overview: Sun Tekstil Sanayi ve Ticaret A.S. is engaged in the design, production, and sale of knit fabrics and ready-made womenswear garments both in Turkey and internationally, with a market capitalization of TRY18.43 billion.

Operations: Sun Tekstil Sanayi ve Ticaret generates revenue primarily from ready-made womenswear garments, contributing TRY7.26 billion, and fabric production, adding TRY2.09 billion. The company has a market capitalization of TRY18.43 billion.

Sun Tekstil has shown impressive earnings growth of 601% over the past year, significantly outpacing the Luxury industry's -22%. Despite this, its share price has been highly volatile in recent months. The company benefits from a satisfactory net debt to equity ratio of 0.1%, indicating prudent financial management. Sun Tekstil's high level of non-cash earnings suggests quality in reported profits, while interest coverage is not a concern as it earns more than it pays on debts. Looking ahead, earnings are forecasted to grow at 27% annually, offering potential for future expansion within its sector.

- Delve into the full analysis health report here for a deeper understanding of Sun Tekstil Sanayi ve Ticaret.

Learn about Sun Tekstil Sanayi ve Ticaret's historical performance.

Mitani Sekisan (TSE:5273)

Simply Wall St Value Rating: ★★★★★★

Overview: Mitani Sekisan Co., Ltd. is engaged in the production and sale of concrete products in Japan, with a market capitalization of approximately ¥92.89 billion.

Operations: The company's primary revenue stream is from the Concrete Secondary Product Related segment, generating ¥68.70 billion. The Information Related segment contributes an additional ¥7.74 billion to the overall revenue.

Mitani Sekisan, a relatively small player in the market, is trading at 70.8% below its estimated fair value, indicating potential undervaluation. Over the past five years, earnings have grown by 14.7% annually, showcasing robust performance despite not outpacing the Basic Materials industry last year with a growth of 5.2%. The company has reduced its debt to equity ratio from 0.5% to 0.3%, reflecting improved financial health and more cash than total debt on hand. Recently, Mitani Sekisan repurchased shares worth ¥2,532 million as part of a buyback program aimed at enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in Mitani Sekisan's health report.

Explore historical data to track Mitani Sekisan's performance over time in our Past section.

Summing It All Up

- Discover the full array of 4708 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:OLVAS

Olvi Oyj

A beverage company, manufactures and sells alcoholic and non-alcoholic beverages in Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives