Top Growth Companies With Insider Ownership In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are closely watching the Federal Reserve's steady rate policy and the European Central Bank's recent rate cuts. In this environment of uncertainty, companies with strong growth potential and significant insider ownership often stand out as they may indicate confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 86% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Let's uncover some gems from our specialized screener.

Mavi Giyim Sanayi ve Ticaret (IBSE:MAVI)

Simply Wall St Growth Rating: ★★★★★☆

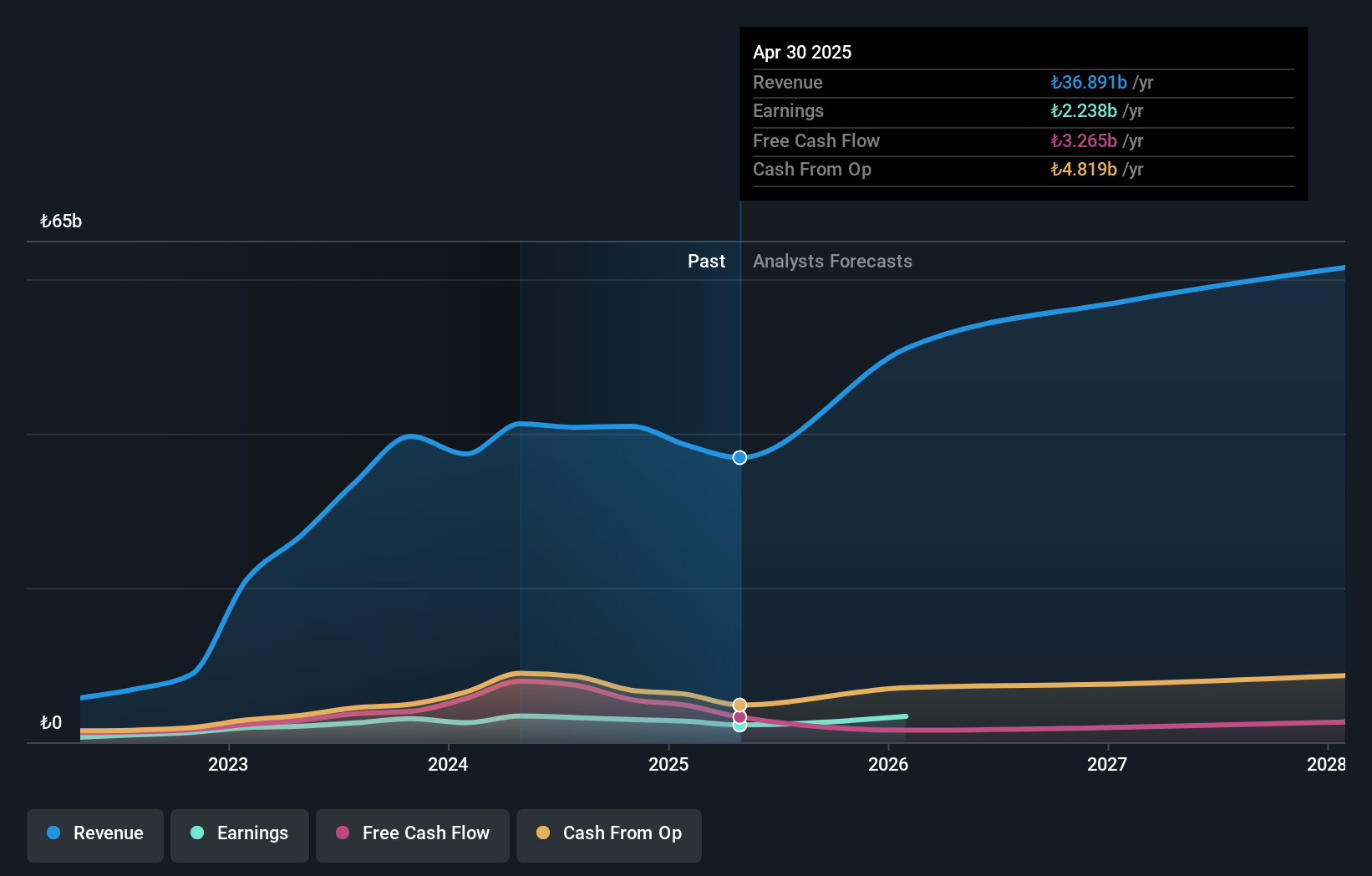

Overview: Mavi Giyim Sanayi ve Ticaret A.S. operates in the wholesale and retail sale of ready-to-wear denim apparel for men, women, and children, with a market cap of TRY28.23 billion.

Operations: The company's revenue is primarily derived from its apparel segment, amounting to TRY27.44 billion.

Insider Ownership: 27.2%

Earnings Growth Forecast: 28.6% p.a.

Mavi Giyim Sanayi ve Ticaret is experiencing robust revenue growth, with forecasts indicating a 33% annual increase, outpacing the Turkish market's average. Despite a recent dip in quarterly net income to TRY 737.69 million from TRY 1,001.29 million last year, earnings are expected to grow significantly at 28.64% annually over the next three years. The company's price-to-earnings ratio of 14.8x suggests it is trading at good value compared to the broader market and peers.

- Take a closer look at Mavi Giyim Sanayi ve Ticaret's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Mavi Giyim Sanayi ve Ticaret shares in the market.

Gentoo Media (OB:G2MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gentoo Media Inc. is an iGaming technology company that offers solutions, products, and services to iGaming operators in the Nordic region, other parts of Europe, and internationally, with a market cap of NOK3.06 billion.

Operations: The company's revenue segments include solutions, products, and services provided to iGaming operators across the Nordic region, other European countries, and globally.

Insider Ownership: 30.9%

Earnings Growth Forecast: 61.6% p.a.

Gentoo Media is poised for significant earnings growth, with forecasts suggesting a 61.6% annual increase, surpassing the Norwegian market's average. Insider activity has been positive, with substantial insider buying in recent months. However, challenges include a net loss of €57.79 million for Q3 2024 and lower profit margins compared to last year. The company plans to delist from Euronext Oslo Børs to focus on Nasdaq Stockholm, potentially enhancing share liquidity and value.

- Click here and access our complete growth analysis report to understand the dynamics of Gentoo Media.

- The valuation report we've compiled suggests that Gentoo Media's current price could be quite moderate.

Smoore International Holdings (SEHK:6969)

Simply Wall St Growth Rating: ★★★★☆☆

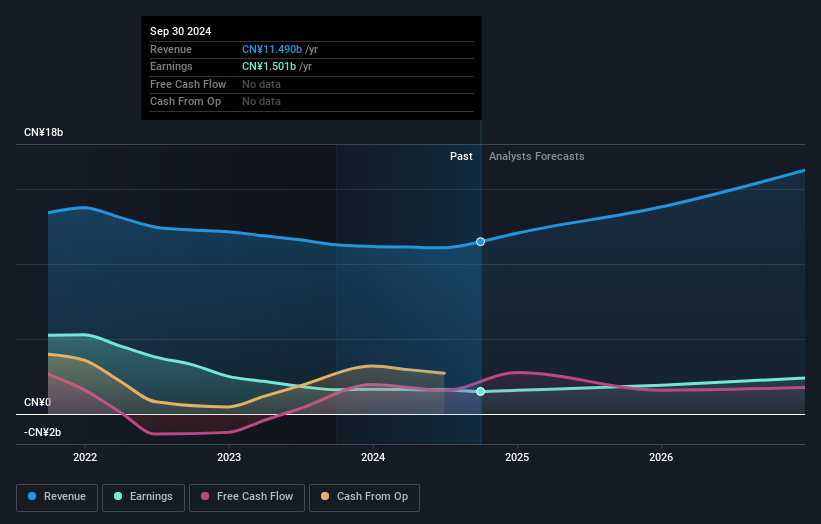

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market cap of HK$77.62 billion.

Operations: Smoore International Holdings Limited generates its revenue from the provision of vaping technology solutions.

Insider Ownership: 39.1%

Earnings Growth Forecast: 22.6% p.a.

Smoore International Holdings is set for robust growth, with earnings projected to increase by 22.63% annually, outpacing the Hong Kong market's average. Revenue is also expected to grow at 13.5% per year, though slower than the benchmark for high growth. Despite these strong forecasts, the company's Return on Equity is anticipated to remain low at 9%. Recent insider trading activity shows no significant buying or selling over the past three months.

- Click here to discover the nuances of Smoore International Holdings with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Smoore International Holdings is priced higher than what may be justified by its financials.

Seize The Opportunity

- Discover the full array of 1477 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:MAVI

Mavi Giyim Sanayi ve Ticaret

Engages in the wholesale and retail sale of ready-to-wear denim apparel for men, women, and children.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives