- Germany

- /

- Auto Components

- /

- XTRA:SFQ

Three Prominent Dividend Stocks To Enhance Your Investment Strategy

Reviewed by Simply Wall St

In the wake of recent global market developments, U.S. stocks have rallied to record highs, driven by optimism surrounding growth and tax reforms following a significant political shift. As investors navigate these dynamic conditions, dividend stocks stand out as a compelling option for those seeking stability and income in their investment portfolios amidst potential economic changes.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Aksa Akrilik Kimya Sanayii (IBSE:AKSA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aksa Akrilik Kimya Sanayii A.S., along with its subsidiaries, is engaged in the manufacturing and sale of textiles, chemicals, and other industrial products both in Turkey and internationally, with a market cap of TRY33.14 billion.

Operations: Aksa Akrilik Kimya Sanayii A.S. generates its revenue through the production and distribution of textiles, chemicals, and industrial products across domestic and international markets.

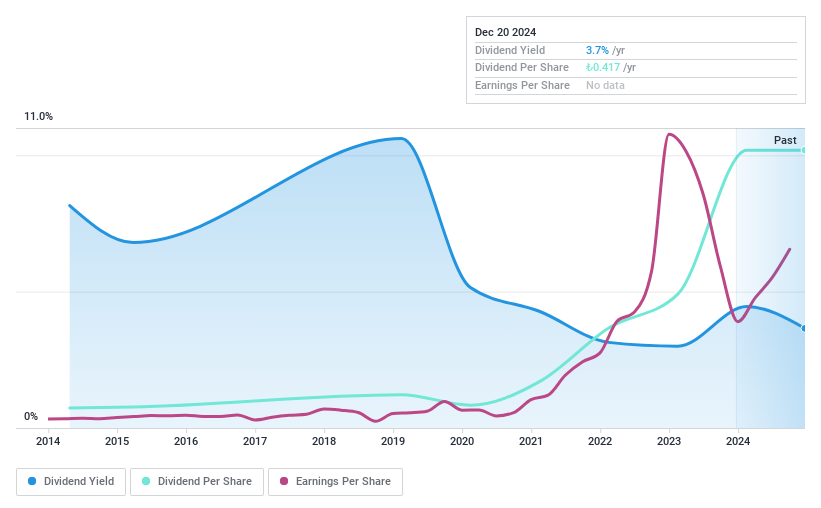

Dividend Yield: 4.7%

Aksa Akrilik Kimya Sanayii's dividend appeal is mixed. The company offers a high dividend yield of 4.73%, placing it in the top 25% of Turkish market payers, yet its dividends have been volatile and unreliable over the past decade. Despite a reasonable payout ratio of 70.9%, dividends are not backed by free cash flow, raising sustainability concerns. Recent earnings improvements, with net income reaching TRY 1.10 billion for nine months ending September 2024, offer some optimism for future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Aksa Akrilik Kimya Sanayii.

- Our valuation report unveils the possibility Aksa Akrilik Kimya Sanayii's shares may be trading at a premium.

Yamaichi ElectronicsLtd (TSE:6941)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yamaichi Electronics Co., Ltd. manufactures and sells test, connector, and optical-related products both in Japan and internationally, with a market cap of ¥52.58 billion.

Operations: The company's revenue is derived from three main segments: Test Solutions Business at ¥25.02 billion, Connector Solutions Business at ¥19.18 billion, and Optical Related Business at ¥1.20 billion.

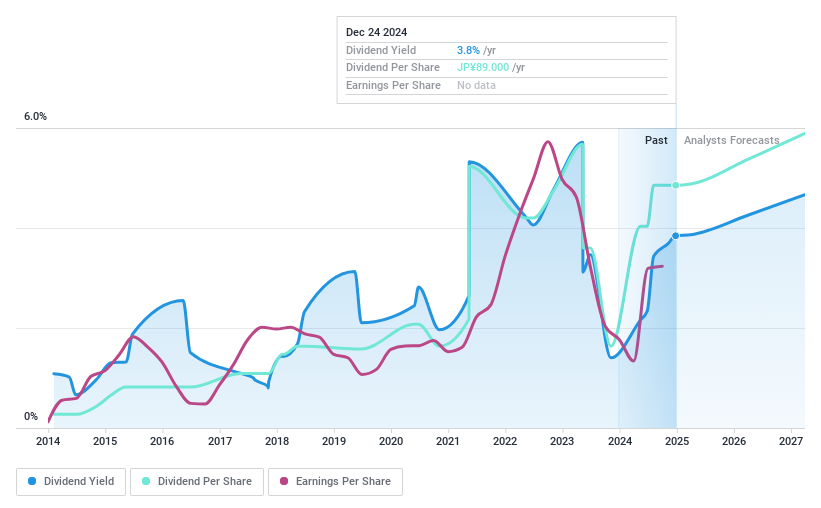

Dividend Yield: 3.4%

Yamaichi Electronics Ltd. shows a solid foundation for dividends, with a low payout ratio of 5.4% and cash payout ratio of 40.1%, ensuring coverage by earnings and cash flows. However, its dividend yield of 3.43% is below the top tier in Japan, and past payments have been volatile and unreliable despite growth over the last decade. The company recently completed a share buyback program worth ¥999.98 million, potentially enhancing shareholder value amidst forecasted earnings growth.

- Click here to discover the nuances of Yamaichi ElectronicsLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Yamaichi ElectronicsLtd is priced lower than what may be justified by its financials.

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €657.31 million.

Operations: SAF-Holland SE's revenue is segmented into €863.53 million from the Americas, €276.09 million from Asia/Pacific (APAC)/China/India, and €942.98 million from Europe, The Middle East, and Africa (EMEA).

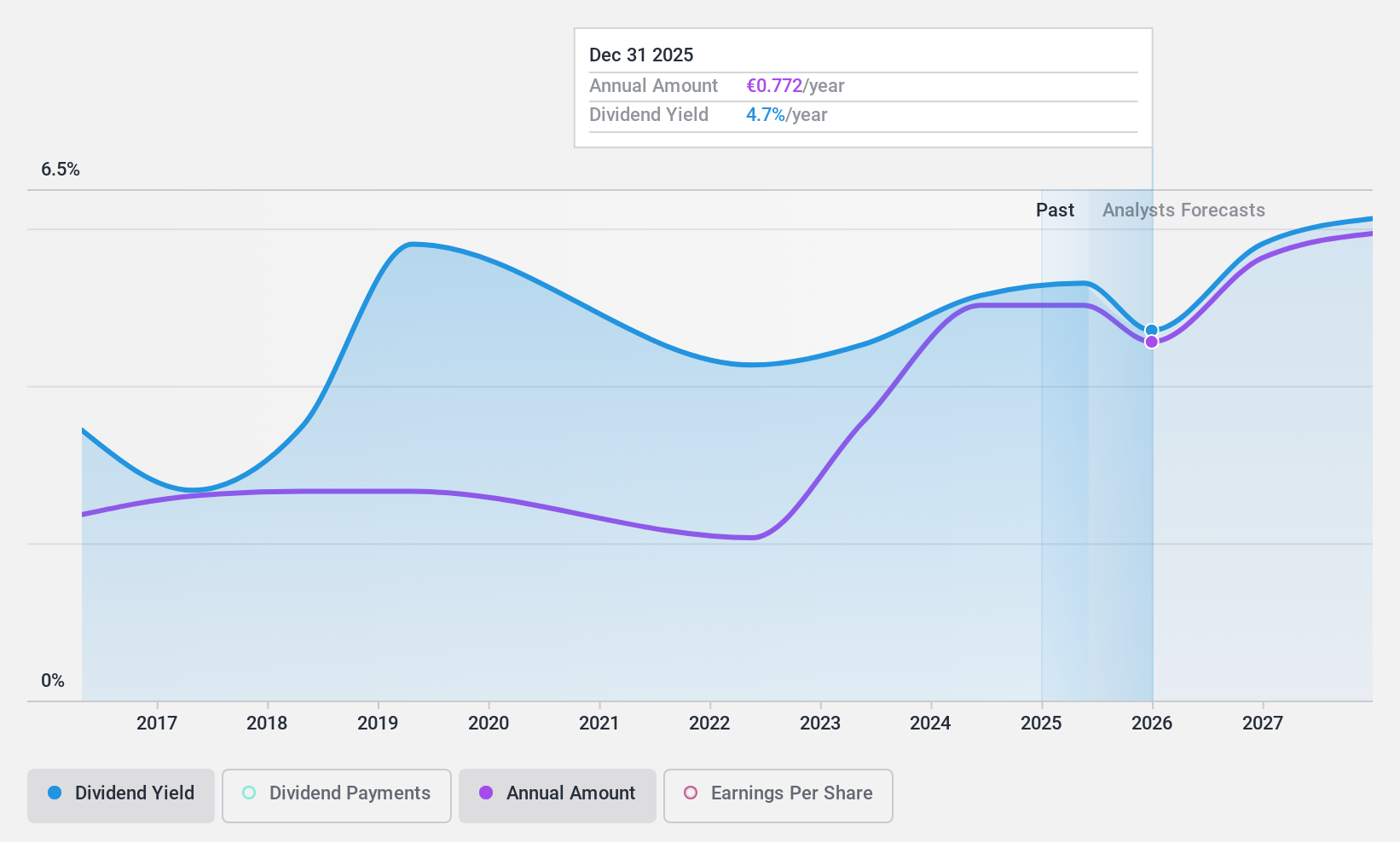

Dividend Yield: 5.7%

SAF-Holland's dividend yield ranks in the top 25% of German payers, supported by a cash payout ratio of 25% and earnings payout ratio of 41.5%, indicating strong coverage. Despite past volatility and unreliability, dividends have increased over the last decade. The stock trades at a significant discount to its estimated fair value, with analyst consensus predicting price appreciation. However, high debt levels could pose risks to financial stability and future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of SAF-Holland.

- Upon reviewing our latest valuation report, SAF-Holland's share price might be too pessimistic.

Next Steps

- Embark on your investment journey to our 1936 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SFQ

SAF-Holland

Manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

Undervalued established dividend payer.