Middle Eastern Penny Stocks To Watch With Market Caps Below US$80M

Reviewed by Simply Wall St

Most Gulf markets have recently faced downward pressure due to weak oil prices, which remain a significant influence on the region's financial landscape. Despite these challenges, penny stocks continue to offer intriguing opportunities for investors willing to explore smaller or newer companies. While often considered a niche area of investment, penny stocks can present growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.62 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.838 | ₪344.93M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.08 | AED2.16B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.40 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED344.19M | ✅ 2 ⚠️ 5 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.21 | AED13.73B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.813 | AED3.53B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.832 | AED506.68M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.832 | ₪222.31M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 79 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ihlas Gazetecilik A.S. is engaged in the publishing, selling, distributing, and marketing of newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.36 billion.

Operations: The company's revenue is primarily derived from its publishing segment, specifically newspapers, which generated TRY1.80 billion.

Market Cap: TRY1.36B

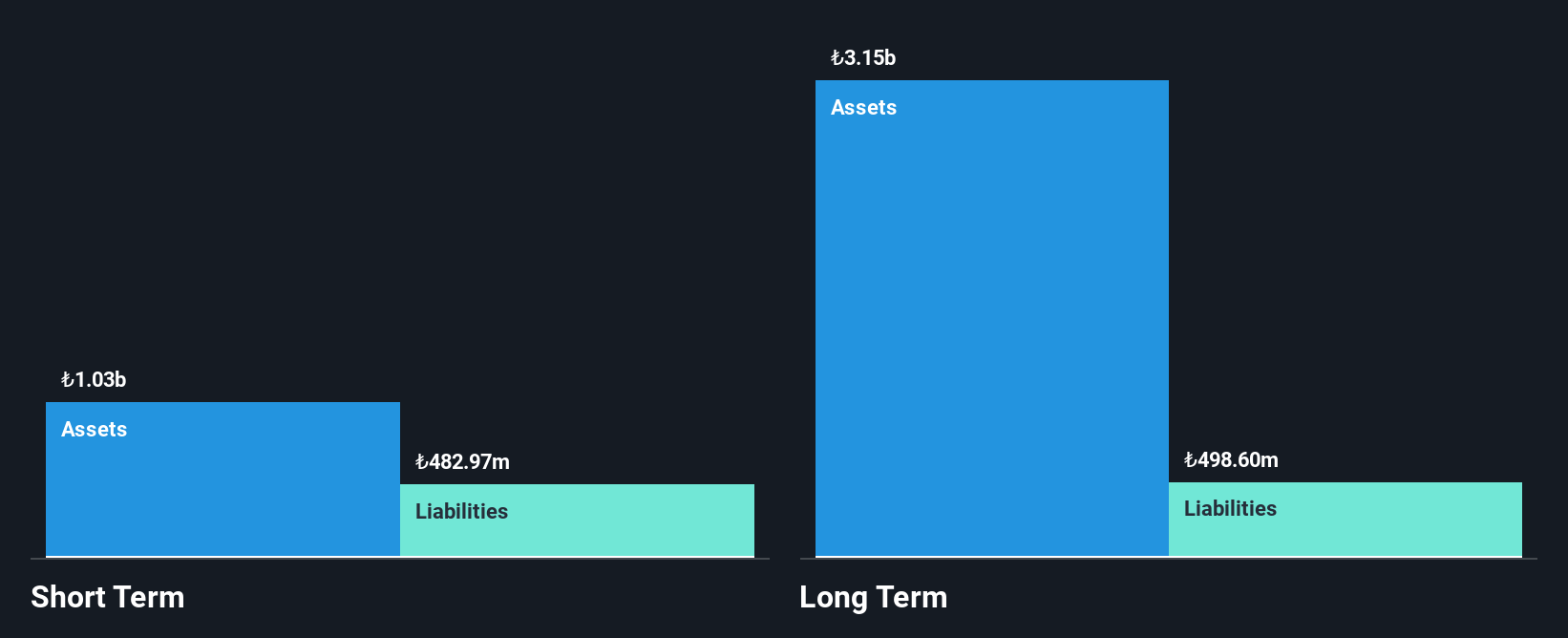

Ihlas Gazetecilik has recently turned profitable, although its Return on Equity remains low at 5.7%. The company is debt-free, with short-term assets of TRY1.1 billion exceeding both short and long-term liabilities. Despite a large one-off loss impacting recent financial results, the company reported improved sales in the second quarter of 2025 to TRY529.91 million from the previous year. However, it still posted a net loss of TRY65.79 million for that period. With a Price-to-Earnings ratio of 7.2x below the Turkish market average, it may appear undervalued but carries volatility risks typical for penny stocks.

- Click to explore a detailed breakdown of our findings in Ihlas Gazetecilik's financial health report.

- Gain insights into Ihlas Gazetecilik's past trends and performance with our report on the company's historical track record.

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. operates in the manufacturing sector, specializing in vehicle-mounted equipment, with a market cap of TRY3.03 billion.

Operations: The company generates revenue of TRY1.32 billion from its vehicle equipment manufacturing segment.

Market Cap: TRY3.03B

Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret A.S. has recently achieved profitability, reporting a net income of TRY62.19 million for the second quarter of 2025, a significant improvement from the previous year's loss. Despite its volatile share price and low Return on Equity at 10.3%, the company maintains strong financial health with short-term assets significantly exceeding liabilities and a satisfactory debt-to-equity ratio of 13.3%. While interest coverage is slightly below ideal levels, operating cash flow comfortably covers its debt obligations, suggesting potential stability amidst typical penny stock risks in the region.

- Dive into the specifics of Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret's track record.

Tedea Technological Development and Automation (TASE:TEDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tedea Technological Development and Automation Ltd. operates through its subsidiaries to manufacture, import, market, and sell building materials in Israel, with a market cap of ₪24.75 million.

Operations: The company generates revenue of ₪3.96 million from its Electronic Components & Parts segment.

Market Cap: ₪24.75M

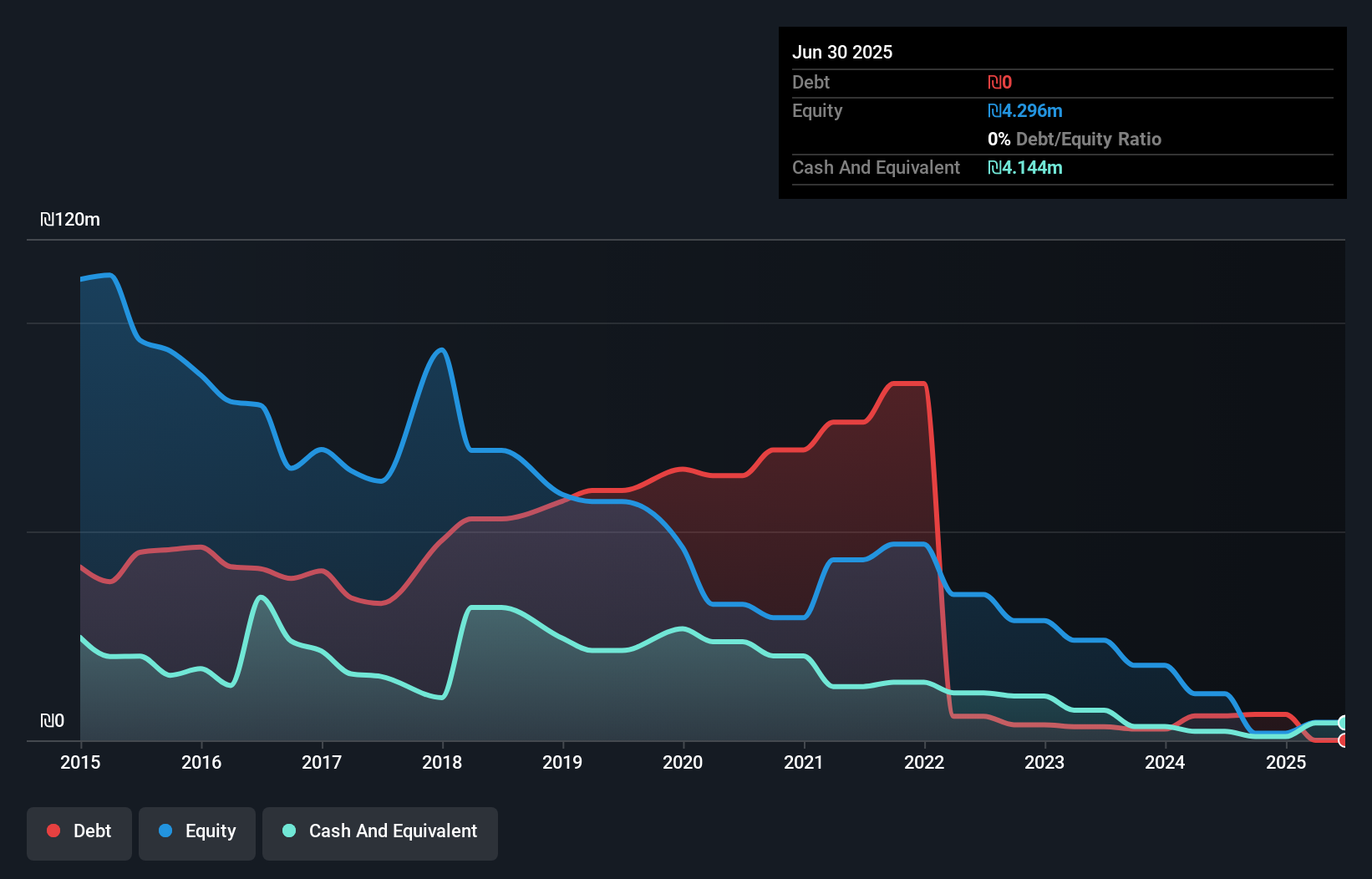

Tedea Technological Development and Automation Ltd. has shown a turnaround with a net income of ₪2.66 million for the half year ending June 2025, contrasting with the previous year's loss. Despite this improvement, it remains unprofitable over a five-year period and does not generate significant revenue from its operations (₪4M). The company is debt-free, which is an advantage in managing financial stability. However, its short-term assets of ₪4.6 million fall short of covering liabilities totaling ₪5.2 million, posing liquidity challenges typical among penny stocks in emerging markets like the Middle East.

- Unlock comprehensive insights into our analysis of Tedea Technological Development and Automation stock in this financial health report.

- Understand Tedea Technological Development and Automation's track record by examining our performance history report.

Taking Advantage

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 76 more companies for you to explore.Click here to unveil our expertly curated list of 79 Middle Eastern Penny Stocks.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHGZT

Ihlas Gazetecilik

Ihlas Gazetecilik A.S. publishes, sells, distributes, and markets newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives