- Japan

- /

- Transportation

- /

- TSE:9028

Unearthing None's Hidden Treasures Three Promising Small Caps with Strong Potential

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks driven by expectations of growth-friendly policies following a "red sweep" election, small-cap stocks have garnered attention, with the Russell 2000 Index leading gains despite not yet reaching record highs. Amid these dynamic market conditions, identifying promising small-cap companies can be particularly rewarding as they often offer unique opportunities for growth and innovation that may not be immediately apparent in larger indices.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Bera Holding (IBSE:BERA)

Simply Wall St Value Rating: ★★★★★★

Overview: Bera Holding A.S. is a diversified company engaged in sectors such as paper and cardboard, machinery, oil, construction and building materials, marble, textiles, tourism, and food on a global scale with a market capitalization of TRY9.70 billion.

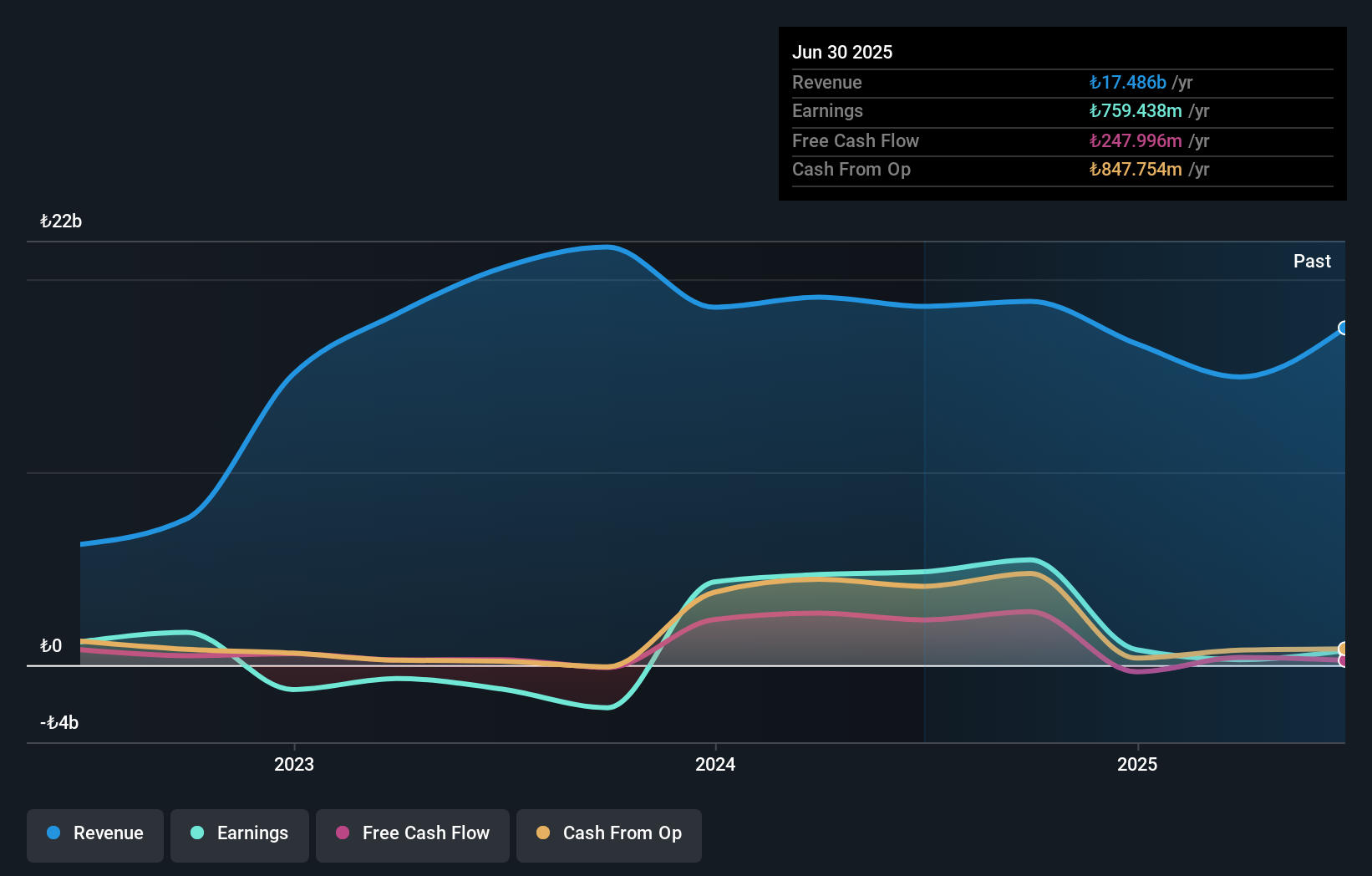

Operations: Bera Holding generates significant revenue from its Paper-Carton-Packaging and Construction and Building Materials segments, contributing TRY3.59 billion and TRY3.14 billion, respectively. The Food segment also adds to the revenue with TRY1.97 billion, while other sectors like Machinery and Bearing contribute TRY1.32 billion and TRY798 million, respectively. Despite a diverse portfolio, the Marble and Mine segment reported a negative figure of -TRY9.57 million in revenue.

Bera Holding, a smaller player in the industry, has recently turned profitable, showcasing a significant improvement with net income reaching TRY 247.61 million in Q3 2024 compared to a loss of TRY 374.6 million the previous year. The company is trading at an attractive valuation, reportedly 75.3% below its estimated fair value. Over the past five years, Bera's debt-to-equity ratio impressively decreased from 48% to just 6.5%, highlighting effective debt management. Additionally, it boasts high-quality earnings and free cash flow positivity while maintaining more cash than total debt—a solid footing for future growth potential.

Token (TSE:1766)

Simply Wall St Value Rating: ★★★★★★

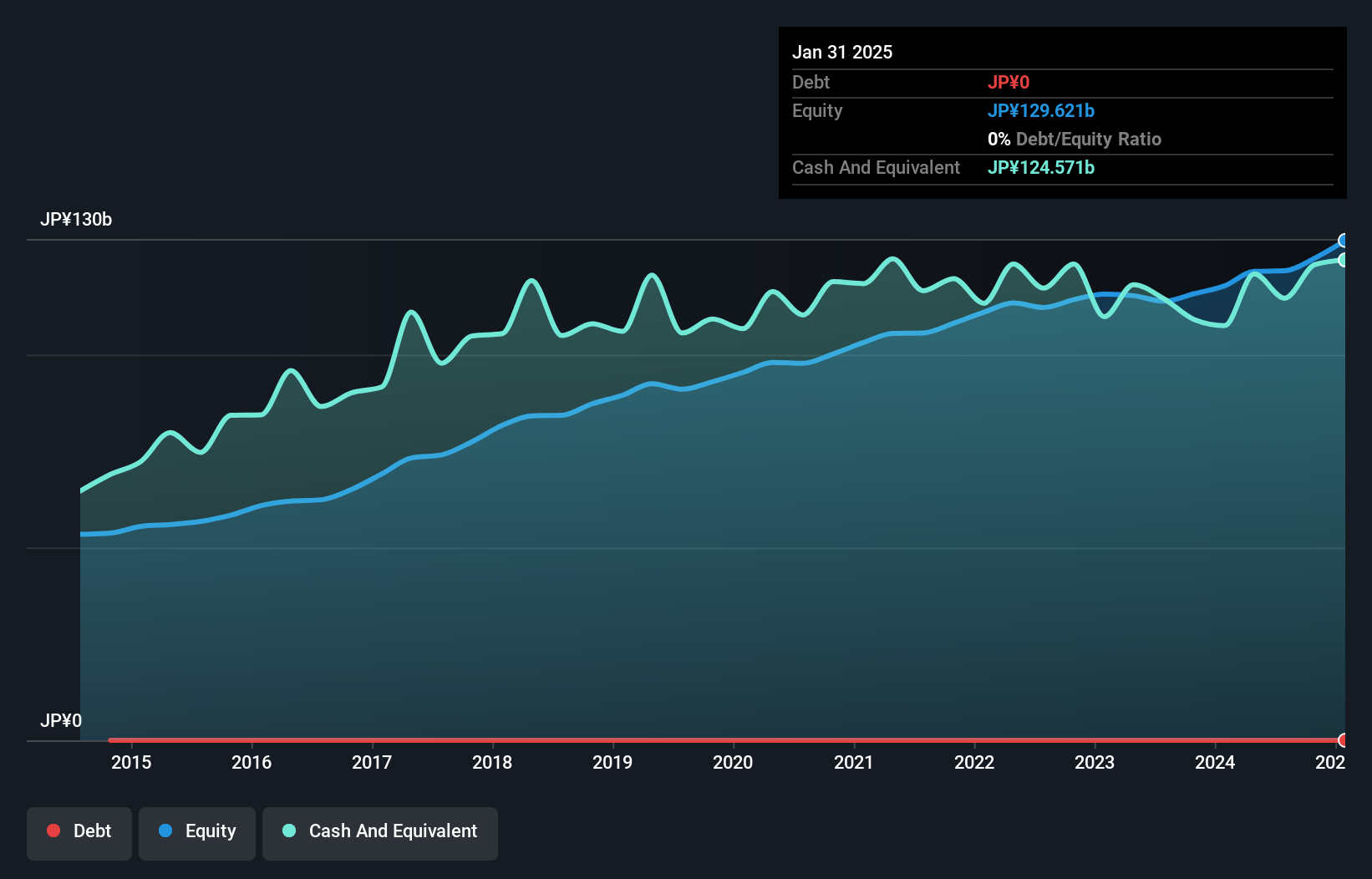

Overview: Token Corporation operates as a construction company in Japan with a market cap of ¥144.12 billion.

Operations: The company generates revenue primarily from its construction services in Japan. With a market cap of ¥144.12 billion, it focuses on optimizing its cost structure to enhance profitability.

Token, a promising entity in its sector, is trading at 48% below our fair value estimate, indicating potential undervaluation. The company has consistently delivered high-quality earnings and enjoys a debt-free status for the past five years. Recent guidance reveals expectations of JPY 360.48 billion in net sales and JPY 14.17 billion operating profit for the fiscal year ending April 2025. With an impressive earnings growth of 112.5% over the last year, Token is outpacing its industry peers significantly. Additionally, it plans to increase dividends to ¥270 per share from ¥250 previously, enhancing shareholder returns.

- Navigate through the intricacies of Token with our comprehensive health report here.

Gain insights into Token's historical performance by reviewing our past performance report.

ZERO (TSE:9028)

Simply Wall St Value Rating: ★★★★★☆

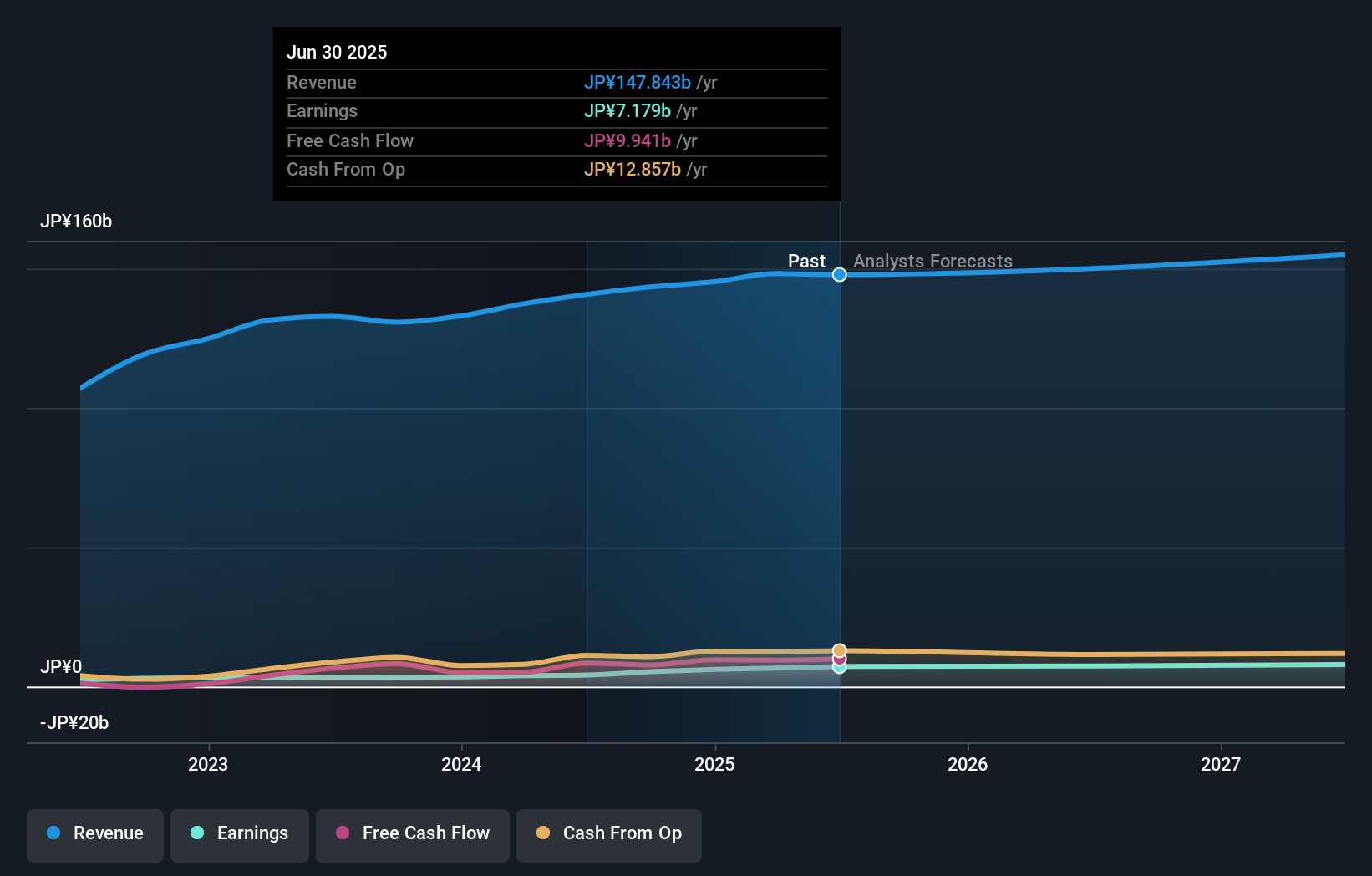

Overview: ZERO Co., Ltd., along with its subsidiaries, offers vehicle transportation and maintenance services in Japan, with a market capitalization of ¥44.04 billion.

Operations: ZERO Co., Ltd. generates revenue primarily through vehicle transportation and maintenance services in Japan. The company has a market capitalization of ¥44.04 billion, reflecting its position in the industry.

ZERO, a company with high-quality earnings, has been making waves in the market. Its recent 59.7% earnings growth outpaced the Transportation industry average of 15.8%, highlighting its robust performance. Trading at a significant discount of 68.2% below estimated fair value, it presents an intriguing valuation opportunity. The company's debt to equity ratio has risen from 6.5% to 17.5% over five years, yet it maintains more cash than total debt, suggesting financial resilience despite volatility in share price recently observed over three months. With EBIT covering interest payments by an impressive 833 times, ZERO seems well-positioned financially for future endeavors.

- Click to explore a detailed breakdown of our findings in ZERO's health report.

Review our historical performance report to gain insights into ZERO's's past performance.

Where To Now?

- Gain an insight into the universe of 4676 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZERO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9028

Solid track record with excellent balance sheet and pays a dividend.