- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4050

Discover 3 Elite Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets rebound from recent sell-offs, growth stocks have notably outpaced value shares, driven by strong performances in the technology sector. Amid this backdrop of economic recovery and investor optimism, identifying growth companies with significant insider ownership can provide a unique edge for investors. In the current market environment, where sentiment is influenced by both economic data and corporate outlooks, high insider ownership often signals confidence from those who know the company best. This article will explore three elite growth companies that not only demonstrate robust potential but also have substantial insider stakes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Yggdrazil Group (SET:YGG) | 12% | 85.5% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Haci Ömer Sabanci Holding (IBSE:SAHOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Haci Ömer Sabanci Holding A.S. operates primarily in the finance, manufacturing, and trading sectors worldwide, with a market cap of TRY196.60 billion.

Operations: The company's revenue segments include Energy (TRY171.88 billion), Banking (TRY438.35 billion), Digital (TRY52.22 billion), and Financial Services (TRY41.51 billion).

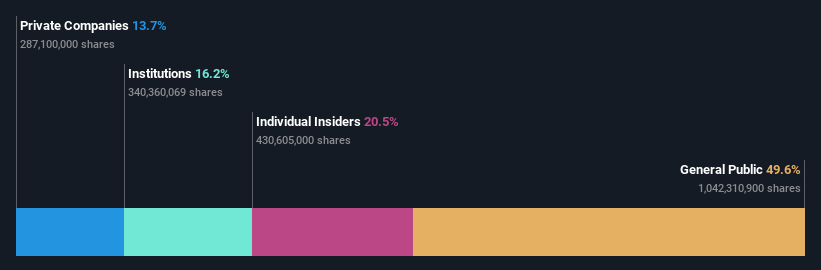

Insider Ownership: 20.5%

Haci Ömer Sabanci Holding A.S. is forecast to become profitable within the next three years, with earnings expected to grow at 146.22% annually, surpassing market averages. Despite recent financial setbacks, including a net loss of TRY 1.81 billion in Q2 2024 and significant shareholder dilution over the past year, analysts predict a stock price increase of 32.3%. Revenue growth is projected at an impressive 78.1% per year, well above market rates.

- Delve into the full analysis future growth report here for a deeper understanding of Haci Ömer Sabanci Holding.

- Upon reviewing our latest valuation report, Haci Ömer Sabanci Holding's share price might be too optimistic.

Saudi Automotive Services (SASE:4050)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Saudi Automotive Services Company operates a network of vehicle service stations in Saudi Arabia with a market cap of SAR5.85 billion.

Operations: Revenue segments include Saudi Club at SAR29.15 million, Fleet Transport at SAR55.84 million, and Retail and Operating (including Oil Company Petroleum Services) at SAR9.60 billion.

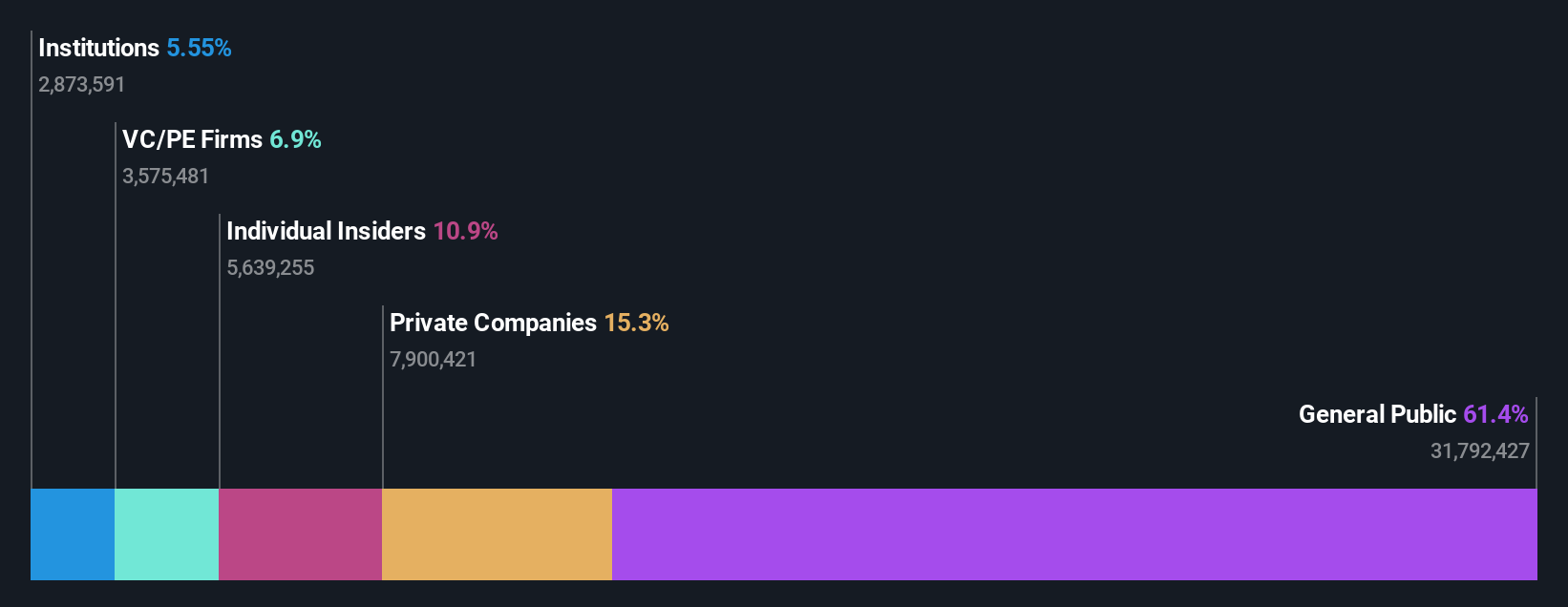

Insider Ownership: 10.6%

Saudi Automotive Services Company demonstrates potential as a growth company with high insider ownership. Despite recent executive changes, the company's earnings grew by 72.2% over the past year and are forecast to grow at 29.8% annually, outpacing the Saudi market's average. However, revenue growth is projected at 8.3% per year, which is slower than desired for high-growth companies. Interest payments are not well covered by earnings, indicating some financial challenges ahead despite significant profit growth expectations.

- Click here to discover the nuances of Saudi Automotive Services with our detailed analytical future growth report.

- The analysis detailed in our Saudi Automotive Services valuation report hints at an inflated share price compared to its estimated value.

Msscorps (TWSE:6830)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Msscorps Co., Ltd. specializes in the test and analysis of electronic materials across Asia, the United States, and internationally, with a market cap of NT$8.63 billion.

Operations: Revenue from the testing and analysis service segment amounts to NT$1.91 billion.

Insider Ownership: 12%

Msscorps shows potential with high insider ownership and earnings forecasted to grow 34.8% annually, outpacing the TW market's 18.4%. However, recent financials reveal a decline in net income and profit margins compared to last year. Revenue is expected to grow at 15.2% per year, slower than ideal for high-growth companies. Additionally, the company's dividend of 2.44% is not well covered by earnings or free cash flows, indicating some financial constraints despite growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Msscorps.

- In light of our recent valuation report, it seems possible that Msscorps is trading beyond its estimated value.

Summing It All Up

- Unlock our comprehensive list of 1498 Fast Growing Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4050

Saudi Automotive Services

Owns and operates a network of vehicle service stations in Saudi Arabia.

Proven track record average dividend payer.