- Singapore

- /

- Real Estate

- /

- SGX:W05

Broncus Holding And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of mixed economic signals, with major U.S. indexes hitting record highs while others decline, investors are increasingly seeking diverse opportunities for growth. Penny stocks, though often considered a relic from past trading days, remain relevant as they highlight smaller or newer companies that can offer significant value at lower price points. By focusing on those with strong financials and potential for growth, investors may discover hidden gems in this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.135 | £808.16M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.98 | £159.32M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,718 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Broncus Holding (SEHK:2216)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Broncus Holding Corporation is a medical device company specializing in interventional pulmonology products, operating in Mainland China, the European Union, the United States, and internationally, with a market cap of HK$316.32 million.

Operations: The company's revenue is derived from its medical products segment, totaling $8.73 million.

Market Cap: HK$316.32M

Broncus Holding Corporation, with a market cap of HK$316.32 million, operates in the medical device sector across multiple regions. Despite its unprofitability and negative return on equity (-12.02%), the company shows financial resilience with short-term assets ($163.2M) exceeding both short-term and long-term liabilities, and more cash than total debt. Revenue is expected to grow 25.64% annually, although earnings remain negative due to ongoing losses despite a 21.7% annual reduction over five years. The board's average tenure of 2.3 years indicates recent changes in leadership which may impact future strategic direction.

- Jump into the full analysis health report here for a deeper understanding of Broncus Holding.

- Gain insights into Broncus Holding's outlook and expected performance with our report on the company's earnings estimates.

Thachang Green Energy (SET:TGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thachang Green Energy Public Company Limited operates in the renewable energy sector in Thailand with a market cap of THB5.24 billion.

Operations: The company generates revenue primarily from its Biomass Power Plant segment at THB922.36 million and its Waste Power Plant segment at THB41.72 million.

Market Cap: THB5.24B

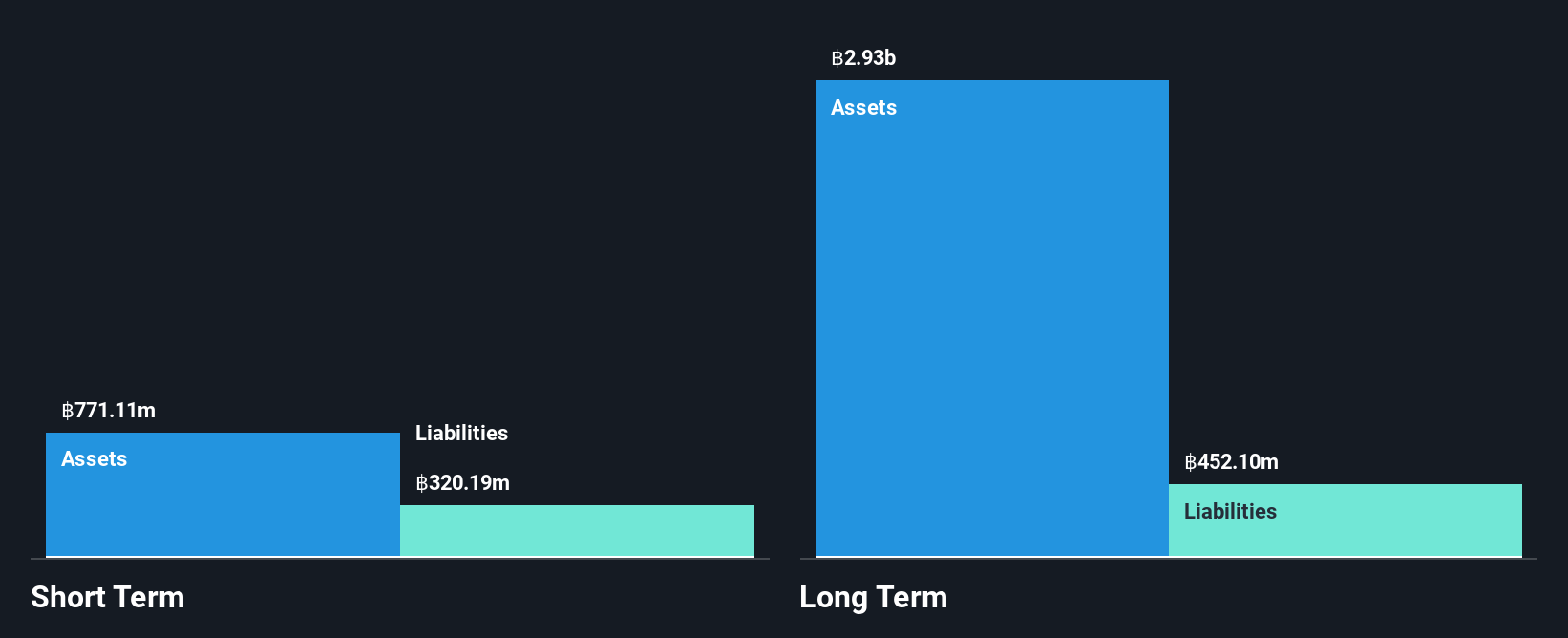

Thachang Green Energy, with a market cap of THB5.24 billion, has shown stable weekly volatility and improved its debt to equity ratio significantly over five years. The company's revenue from its Biomass and Waste Power Plant segments totaled THB964.08 million for the nine months ending September 2024, with a net income of THB199.15 million. Despite recent negative earnings growth (-2.8%), Thachang maintains high-quality earnings and satisfactory debt coverage by operating cash flow (49.1%). Short-term assets comfortably cover both short-term (THB307.8M) and long-term liabilities (THB548.8M), indicating sound financial management amidst ongoing strategic changes.

- Get an in-depth perspective on Thachang Green Energy's performance by reading our balance sheet health report here.

- Learn about Thachang Green Energy's historical performance here.

Wing Tai Holdings (SGX:W05)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wing Tai Holdings Limited is an investment holding company involved in property investment and development across Singapore, Malaysia, Australia, Japan, and China with a market capitalization of SGD953.66 million.

Operations: The company's revenue is primarily derived from development properties (SGD75.09 million), investment properties (SGD42.82 million), and retail operations (SGD40.79 million).

Market Cap: SGD953.66M

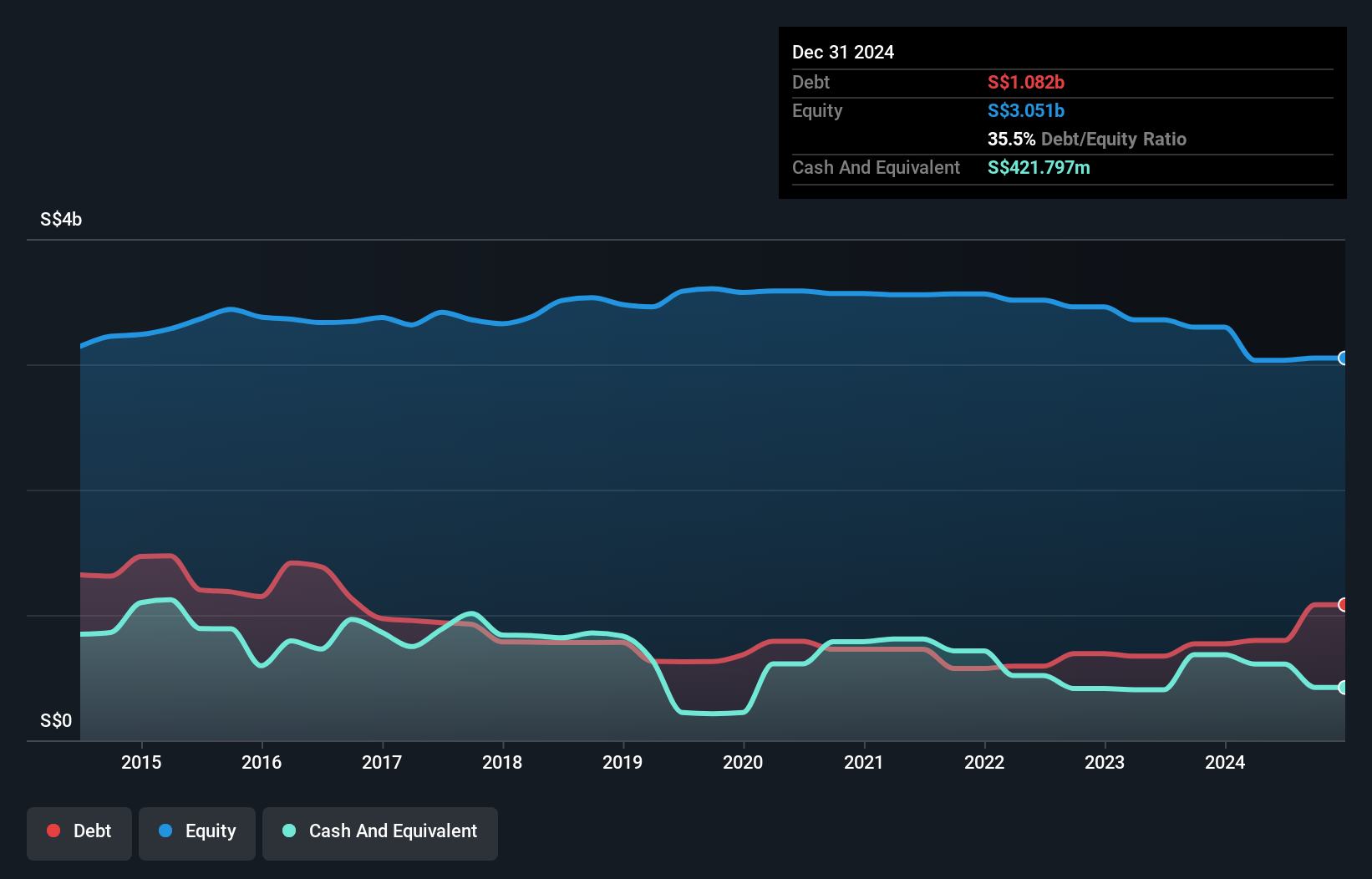

Wing Tai Holdings, with a market cap of SGD953.66 million, is currently unprofitable, facing challenges in covering interest payments on its debt with EBIT at 0.3x coverage. Despite this, the company maintains strong financial management as short-term assets (SGD1.3 billion) exceed both short-term (SGD147.8 million) and long-term liabilities (SGD809.2 million). The board and management team are seasoned, averaging tenures of 6.9 years and 30.3 years respectively, indicating stability in leadership amidst financial hurdles such as increasing debt to equity ratio from 17.5% to 26.3% over five years and declining earnings by 19.3% annually over the same period.

- Click to explore a detailed breakdown of our findings in Wing Tai Holdings' financial health report.

- Gain insights into Wing Tai Holdings' historical outcomes by reviewing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 5,718 companies within our Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wing Tai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:W05

Wing Tai Holdings

An investment holding company, engages in the property investment and development business in Singapore, Malaysia, Australia, Japan, Hong Kong, and China.

Mediocre balance sheet with minimal risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026