- Taiwan

- /

- Entertainment

- /

- TPEX:5478

3 Dividend Stocks Yielding Up To 7.3% For Your Portfolio

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding tariffs and mixed economic signals have led to fluctuations in major indices, with U.S. stocks experiencing a slight decline amid tariff concerns and earnings reports. Despite these challenges, dividend stocks remain an attractive option for investors seeking stability and income in their portfolios, especially when yields are as high as 7.3%.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

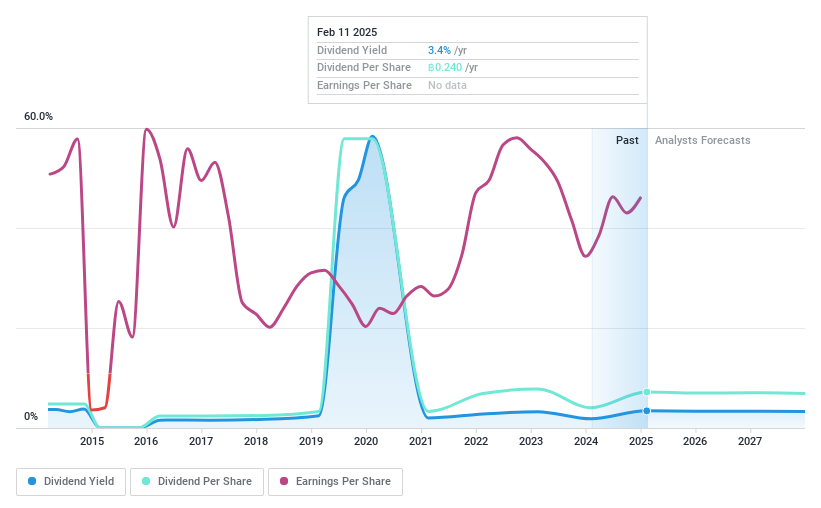

SVI (SET:SVI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SVI Public Company Limited, along with its subsidiaries, offers electronic manufacturing services in Asia and Europe, with a market cap of THB15.18 billion.

Operations: SVI Public Company Limited generates its revenue from several segments, including Communication Network (THB8.24 billion), Industrial Control System (THB6.06 billion), Automotive & Transportation (THB2.24 billion), and Professional Audio and Video (THB2.17 billion).

Dividend Yield: 3.4%

SVI's dividend payments have been volatile over the past decade, with a recent proposal to pay THB 0.24 per share for fiscal year 2024, covering 37.48% of net profit. Despite earnings growth of 49.9% last year and a low payout ratio (37.3%), dividends remain unstable historically. The company trades at good value with a P/E ratio of 10.9x, below the TH market average, but its dividend yield is low compared to top-tier payers in Thailand.

- Click here and access our complete dividend analysis report to understand the dynamics of SVI.

- According our valuation report, there's an indication that SVI's share price might be on the cheaper side.

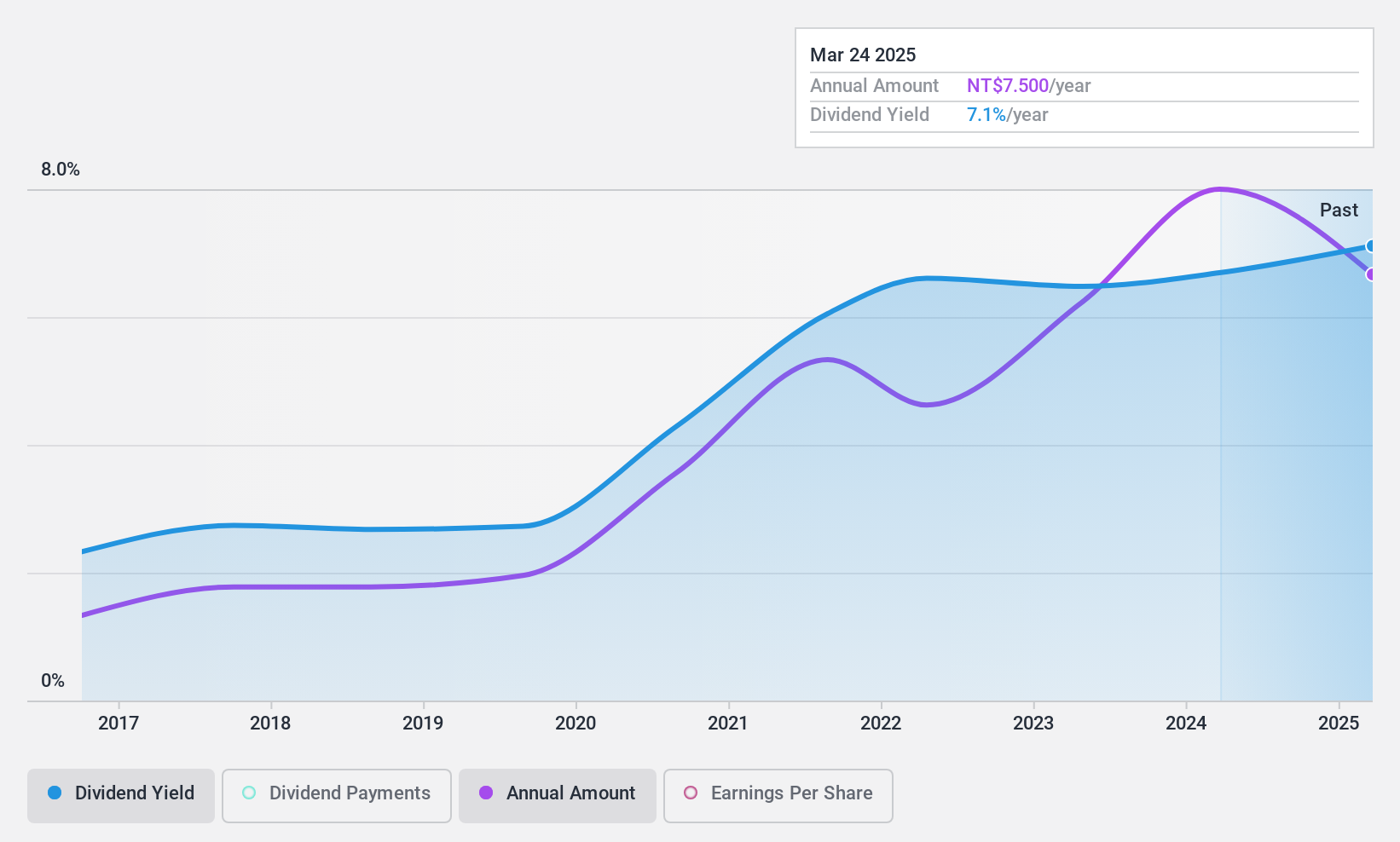

Soft-World International (TPEX:5478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China, with a market cap of NT$18.14 billion.

Operations: Soft-World International Corporation's revenue segments include NT$0.96 billion from Yifan, NT$0.43 billion from Chinese Gamer Int., NT$0.47 billion from Xinganxian and Zhifandi, NT$1.44 billion from Neweb Technologies Co., Ltd., and NT$3.37 billion from Soft-World and Soft-World (Hong Kong).

Dividend Yield: 7.3%

Soft-World International's recent earnings show strong growth, with third-quarter sales and net income rising to TWD 1.82 billion and TWD 275.53 million, respectively. Despite this, the dividend yield of 7.32% is not well-covered by earnings due to a high payout ratio of 112.5%, although cash flow coverage is adequate at a 78.6% cash payout ratio. The dividend has been volatile over the past decade but has shown growth over this period, making it an attractive yet risky option for dividend investors seeking high yields in Taiwan's market.

- Navigate through the intricacies of Soft-World International with our comprehensive dividend report here.

- Our expertly prepared valuation report Soft-World International implies its share price may be lower than expected.

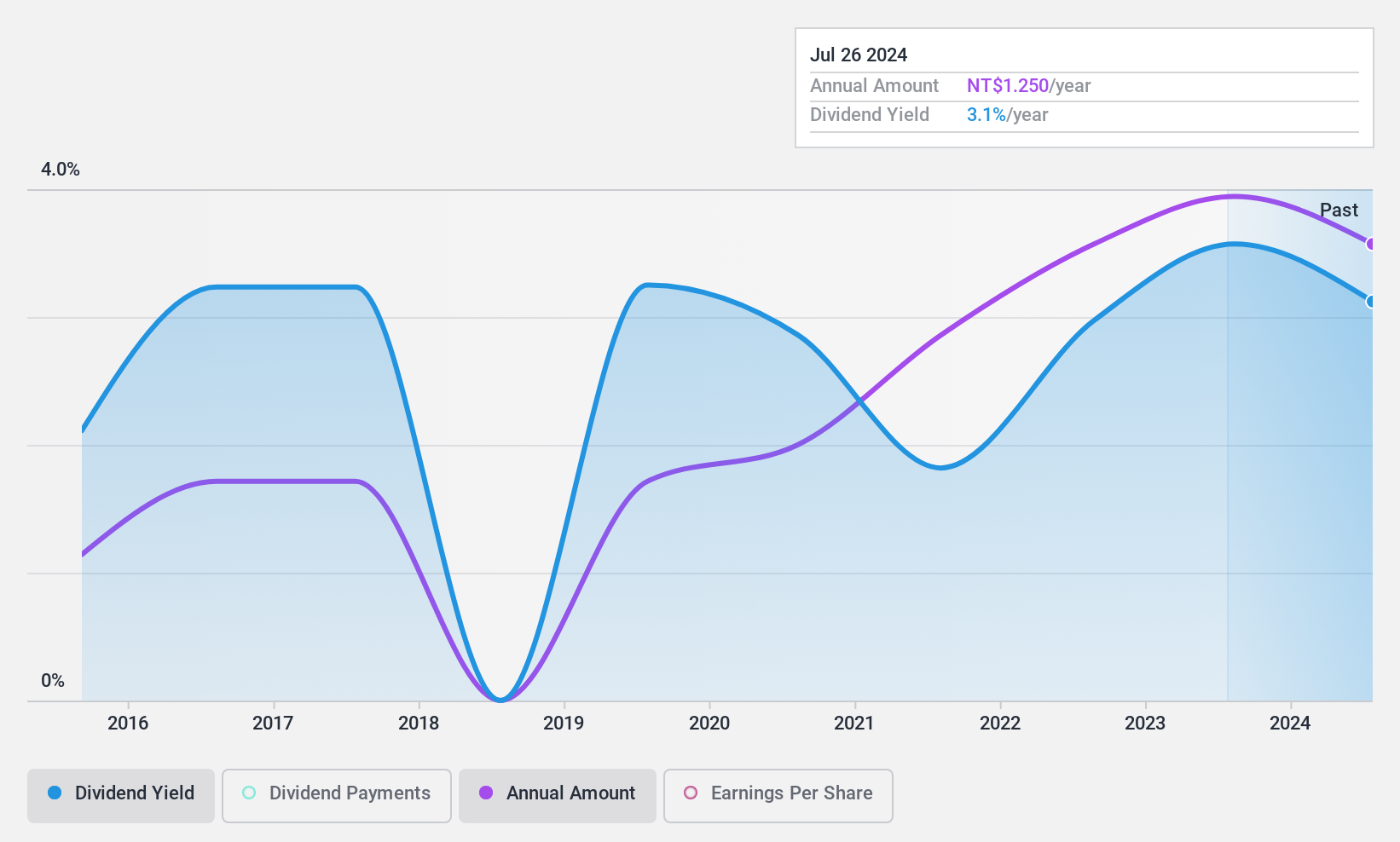

Taiwan Hopax Chemicals Manufacturing (TPEX:6509)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Hopax Chemicals Manufacturing Co., Ltd. operates in the chemical industry, focusing on the production of specialty chemicals and paper products, with a market cap of NT$7.66 billion.

Operations: Taiwan Hopax Chemicals Manufacturing Co., Ltd. generates revenue from Office Stationery (NT$2.32 billion), Special Chemicals (NT$1.83 billion), and Precision Chemicals (NT$2.30 billion).

Dividend Yield: 3.3%

Taiwan Hopax Chemicals Manufacturing exhibits a mixed dividend profile. The company's dividend payments, covered by earnings with a payout ratio of 42.8% and cash flows at 57.6%, indicate sustainability despite past volatility and unreliability in payouts. Profits have grown annually by 16.6% over five years, yet the dividend yield of 3.26% lags behind top-tier Taiwanese payers at 4.42%. Its price-to-earnings ratio of 15x suggests potential value compared to the TW market average of 21.1x.

- Delve into the full analysis dividend report here for a deeper understanding of Taiwan Hopax Chemicals Manufacturing.

- Our expertly prepared valuation report Taiwan Hopax Chemicals Manufacturing implies its share price may be too high.

Next Steps

- Dive into all 1960 of the Top Dividend Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Soft-World International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5478

Soft-World International

Develops, operates, and distributes games in Taiwan and China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives