In the face of recent global market fluctuations, including U.S. stocks ending lower due to tariff uncertainties and a cooling labor market, investors are closely watching economic indicators that could impact small-cap companies. Despite these challenges, high growth tech stocks continue to attract attention as they often demonstrate resilience and innovation potential in dynamic environments, making them intriguing prospects for those looking to navigate current market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Q Technology (Group) (SEHK:1478)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Q Technology (Group) Company Limited is an investment holding company involved in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules across Mainland China, Hong Kong, India, and internationally with a market capitalization of HK$9.49 billion.

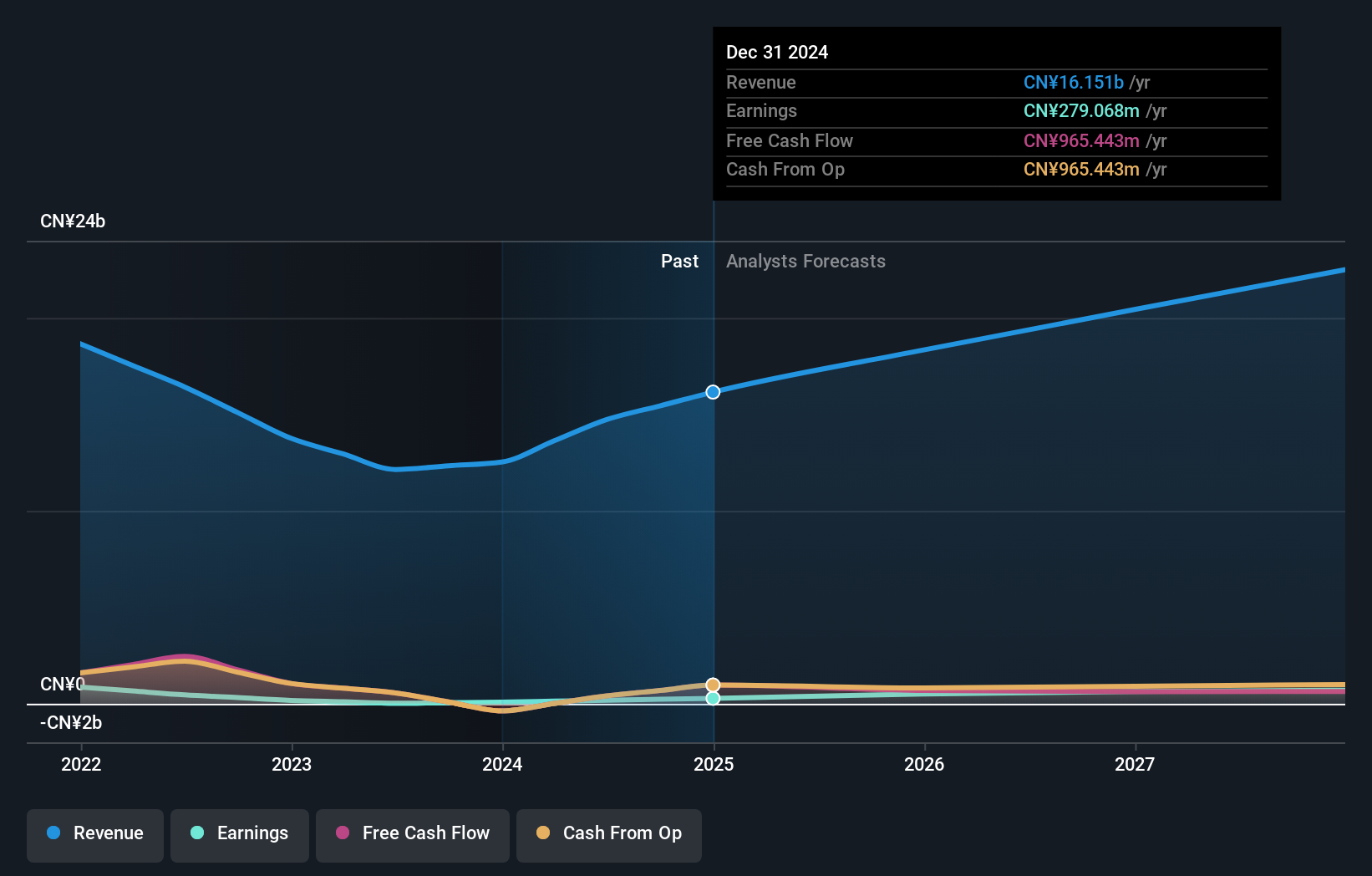

Operations: Q Technology (Group) generates revenue primarily from the sale of camera modules, amounting to CN¥13.79 billion, and fingerprint recognition modules, contributing CN¥781.23 million. The company operates in Mainland China, Hong Kong, India, and internationally.

Q Technology (Group) is poised for substantial growth, driven by its strategic focus on high-resolution camera modules and advanced fingerprint recognition technologies. In 2024, the company predicted a profit surge between 200% to 280% year-over-year, fueled by increased market shares in AI-enhanced consumer products and an improved product mix towards higher-end models. This shift not only boosts sales volumes—evidenced by the sale of over 391 million camera modules—but also enhances gross profit margins through better capacity utilization and cost efficiencies. With a robust annual earnings growth rate of 40.4%, Q Technology outpaces both its industry and the broader Hong Kong market's growth rates, indicating strong future prospects in a competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Q Technology (Group)'s health report.

Understand Q Technology (Group)'s track record by examining our Past report.

Hana Microelectronics (SET:HANA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hana Microelectronics Public Company Limited, along with its subsidiaries, is involved in the manufacture and trading of electronic components, with a market capitalization of approximately THB18.42 billion.

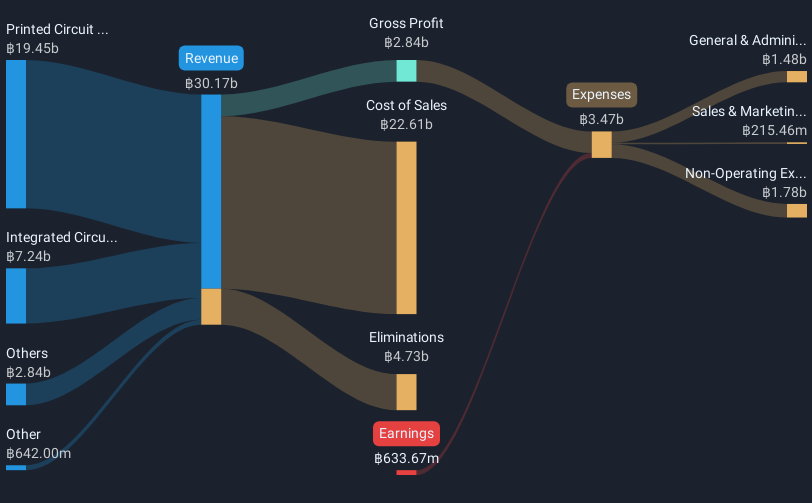

Operations: Hana Microelectronics focuses on manufacturing and trading electronic components, with key revenue streams from Integrated Circuits (IC) generating THB7.51 billion and Printed Circuit Board Assembly (PCBA) contributing THB19.72 billion.

Despite facing a challenging year with a 55% earnings decline, Hana Microelectronics is setting the stage for recovery with an expected annual earnings growth of 21.6%. This forecast outstrips the Thai market's average, highlighting its potential resilience and adaptability in the tech sector. The company's commitment to innovation is evident from its R&D spending trends, which remain robust relative to revenue, ensuring it stays at the forefront of technological advancements. Recent strategic shifts include appointing a new Chief Accountant and reshuffling its Audit Committee to strengthen governance—a move that could enhance investor confidence as it navigates recovery phases.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. offers a range of internet services globally and has a market capitalization of ¥293.47 billion.

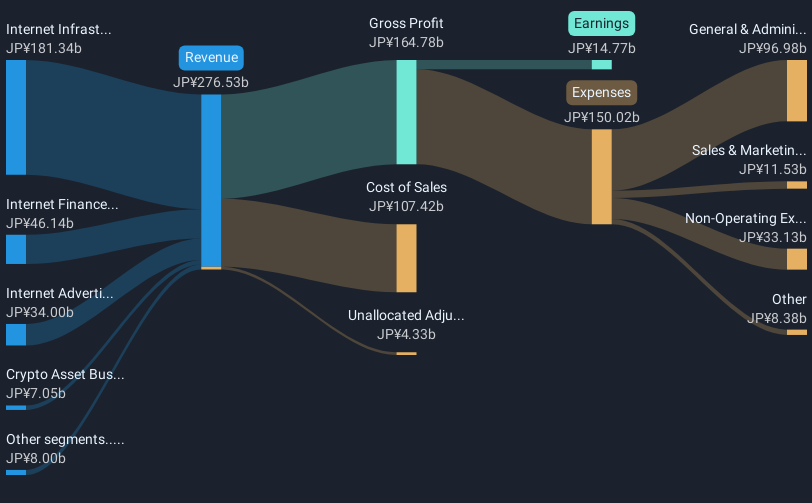

Operations: The company generates significant revenue from its Internet Infrastructure segment, contributing ¥181.34 billion, followed by the Internet Finance Business at ¥46.14 billion and the Internet Advertising and Media Business at ¥34 billion. The Crypto Asset Business also plays a role in their revenue model with ¥7.05 billion.

GMO Internet Group has demonstrated a robust performance with a 64.3% earnings growth over the past year, surpassing the IT industry's average of 11.4%. This growth is supported by significant R&D investments, aligning with its strategic focus on innovation and technological advancement. The company's recent share repurchase of 1,519,400 shares for ¥3.64 billion underscores its commitment to shareholder value. Looking ahead, GMO is poised for continued success with forecasted annual earnings growth of 16.5%, well above Japan's market average of 7.7%. Additionally, its revenue is expected to grow at 7.5% annually, outpacing the market projection of 4.2%, indicating a strong upward trajectory in both profitability and market share expansion.

- Get an in-depth perspective on GMO internet group's performance by reading our health report here.

Evaluate GMO internet group's historical performance by accessing our past performance report.

Next Steps

- Get an in-depth perspective on all 1212 High Growth Tech and AI Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9449

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)