As April 2025 unfolds, Asian markets are navigating a landscape marked by easing trade tensions and cautious optimism, with China signaling potential stimulus measures to bolster its economy amid U.S. tariff impacts. Against this backdrop, small-cap stocks in the region present intriguing opportunities for investors seeking growth and diversification, as they often benefit from localized economic resilience and innovative business models that can thrive even amidst broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Intelligent Wave | NA | 7.78% | 15.50% | ★★★★★★ |

| YAPP Automotive Systems | 0.57% | -2.12% | 0.68% | ★★★★★★ |

| Sesoda | 62.26% | 10.62% | 16.47% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Shenzhen Farben Information TechnologyLtd | 7.69% | 21.56% | 3.60% | ★★★★★★ |

| Zhejiang JW Precision MachineryLtd | 12.36% | 4.29% | -22.66% | ★★★★★★ |

| Gallant Precision Machining | 47.82% | -1.17% | 4.66% | ★★★★★☆ |

| Zhe Jiang Dayang Biotech Group | 29.02% | 8.38% | -9.33% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Hollyland (China) Electronics Technology | 3.40% | 15.35% | 13.21% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Yunfeng Financial Group (SEHK:376)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yunfeng Financial Group Limited is an investment holding company that provides insurance products in Hong Kong and Macau, with a market capitalization of approximately HK$5.72 billion.

Operations: The company generates revenue primarily from its insurance business, contributing HK$3.59 billion, and other financial services amounting to HK$108.55 million.

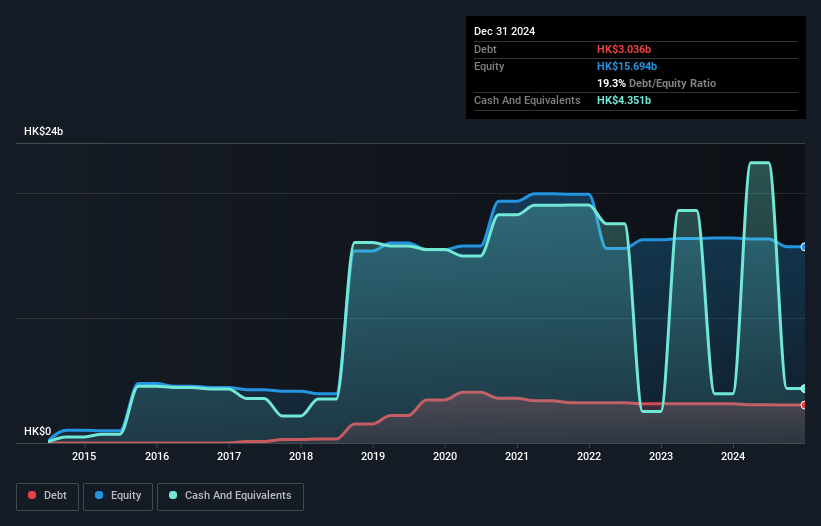

Yunfeng Financial Group, a smaller player in the financial sector, has shown resilience with net income rising to HK$470.79 million from HK$397.16 million last year, and basic earnings per share increasing to HK$0.12 from HK$0.10. Despite a volatile share price recently, the company has managed to reduce its debt-to-equity ratio over five years from 22.3% to 19.3%, indicating improved financial stability. While its earnings growth of 18.5% didn't match industry averages, Yunfeng's high-quality past earnings and sufficient interest coverage suggest a solid foundation for future endeavors amidst market challenges.

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, is engaged in the global manufacturing of electronic products and has a market capitalization of THB61.13 billion.

Operations: Cal-Comp Electronics (Thailand) generates revenue primarily from computer peripherals and telecommunication products, with THB159.33 billion and THB22.97 billion respectively. Service income contributes an additional THB1.72 billion to the total revenue stream.

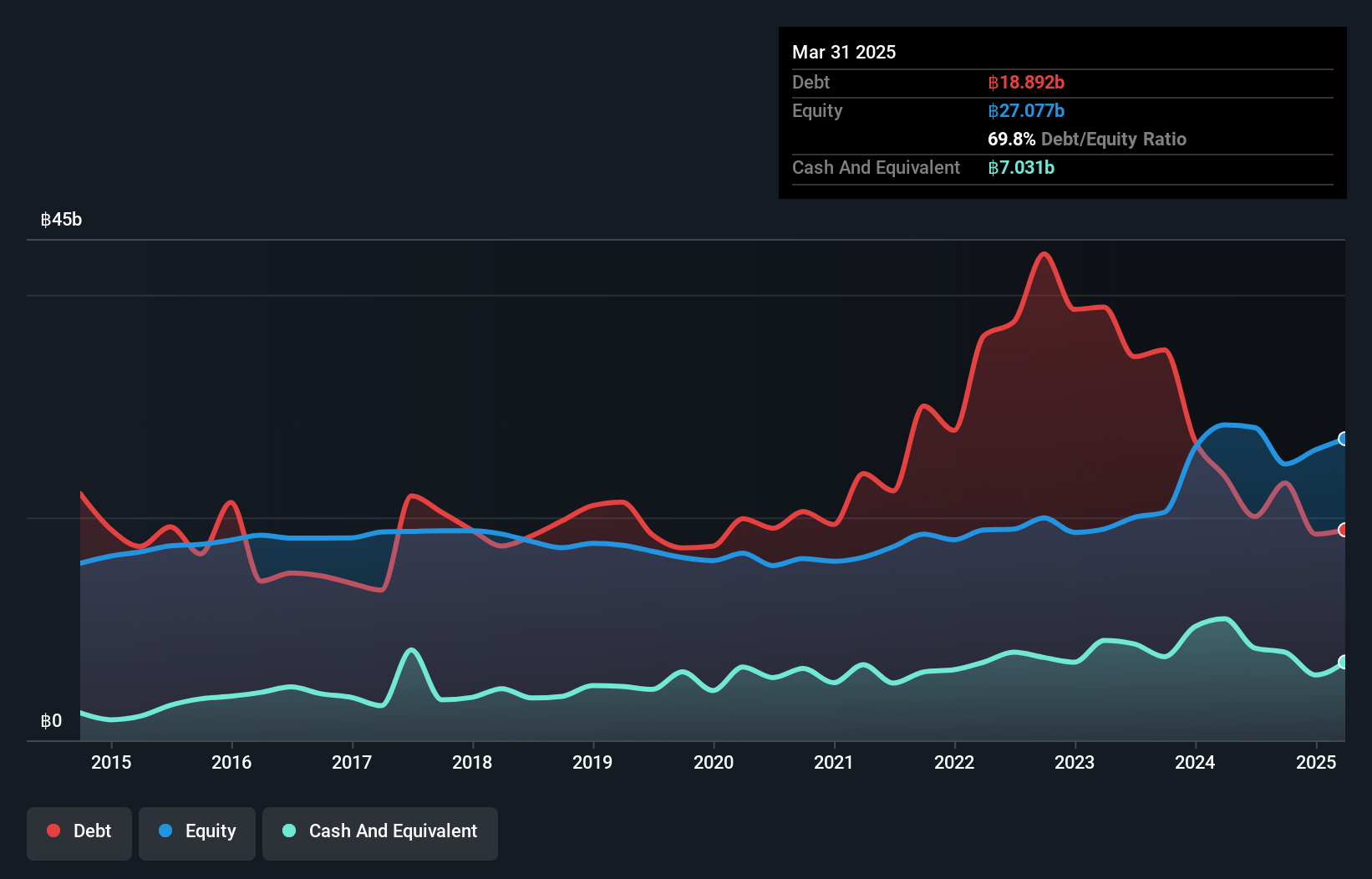

Cal-Comp Electronics (Thailand) has shown impressive earnings growth of 133% over the past year, outpacing the electronic industry's 12.6% rise. Despite a high net debt to equity ratio of 48%, its interest payments are well covered by EBIT at 6.6 times, indicating manageable financial obligations. The company's shares are trading at an attractive discount of 18% below estimated fair value, suggesting potential upside for investors. Recent sales figures reveal robust monthly increases, such as a March spike to US$332 million from US$300 million last year, although year-to-date sales have dipped slightly by around 16%.

PixArt Imaging (TPEX:3227)

Simply Wall St Value Rating: ★★★★★☆

Overview: PixArt Imaging Inc. is a company that, along with its subsidiaries, engages in the research, design, production, and sale of CMOS image sensors and related ICs across Taiwan, Hong Kong, China, Japan, and internationally with a market capitalization of approximately NT$33.13 billion.

Operations: PixArt Imaging generates revenue primarily from the design and production of CMOS image sensors and related ICs, amounting to NT$8.36 billion. The company operates with a market capitalization of approximately NT$33.13 billion.

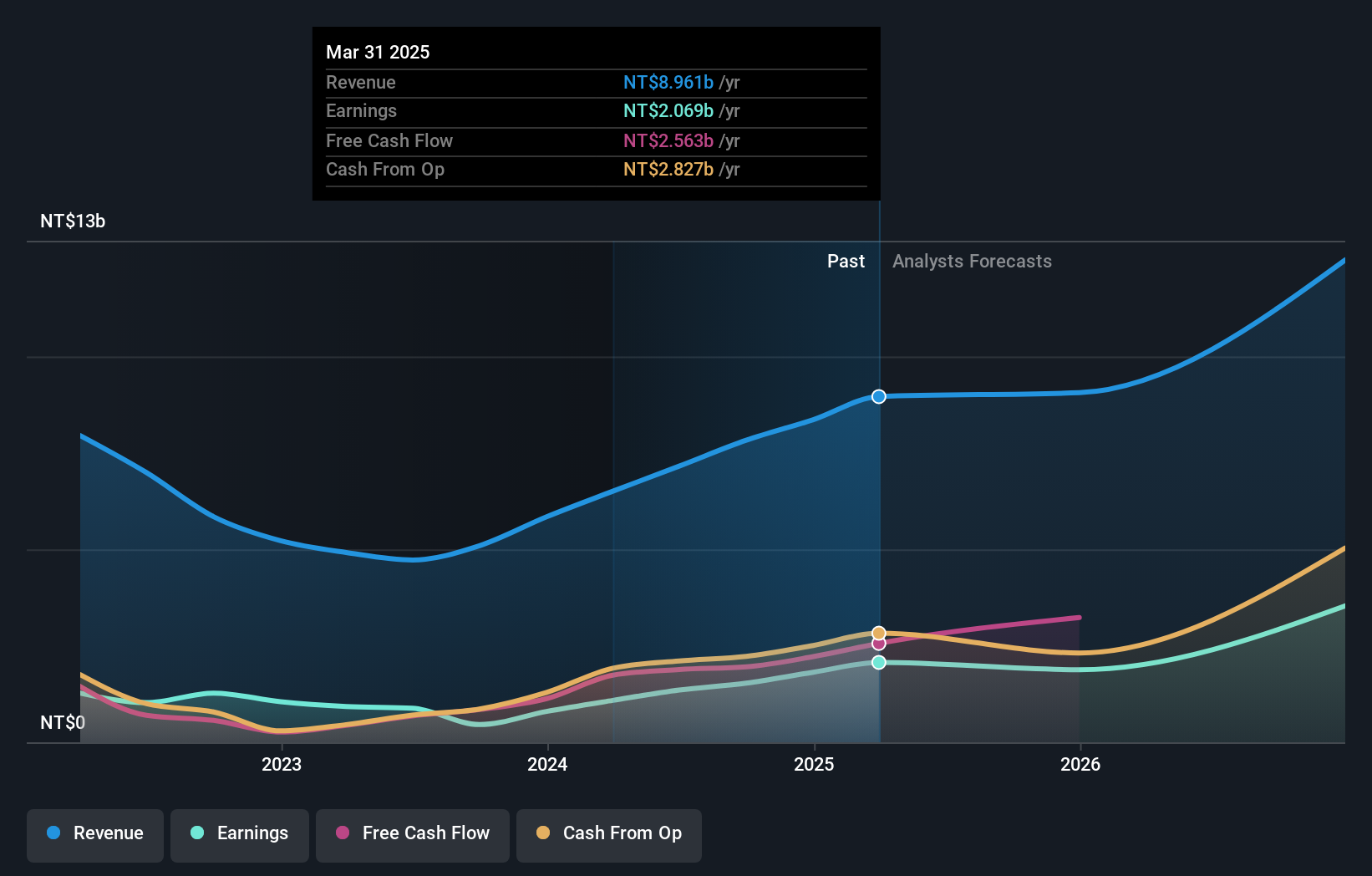

PixArt Imaging, a standout in the semiconductor sector, has seen its earnings soar by 127.1% over the past year, outpacing industry growth of 25%. The company is trading at a significant discount of 56.3% below its estimated fair value and maintains high-quality earnings with more cash than debt. Recent financials show net income jumped to TWD 1.82 billion from TWD 799 million the previous year, while basic EPS rose to TWD 12.52 from TWD 5.57. A cash dividend of TWD 10 per share was also announced for shareholders, totaling approximately TWD 1.49 billion in payouts.

Turning Ideas Into Actions

- Access the full spectrum of 2661 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yunfeng Financial Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:376

Yunfeng Financial Group

An investment holding company, engages in the provision of insurance products in Hong Kong and Macau.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives