- Japan

- /

- Auto Components

- /

- TSE:7240

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are considering how potential policy changes might impact growth and inflation. Amidst this backdrop of economic optimism and uncertainty, dividend stocks remain an attractive option for those seeking steady income streams in a fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.02% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Innotech (TSE:9880) | 5.04% | ★★★★★★ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

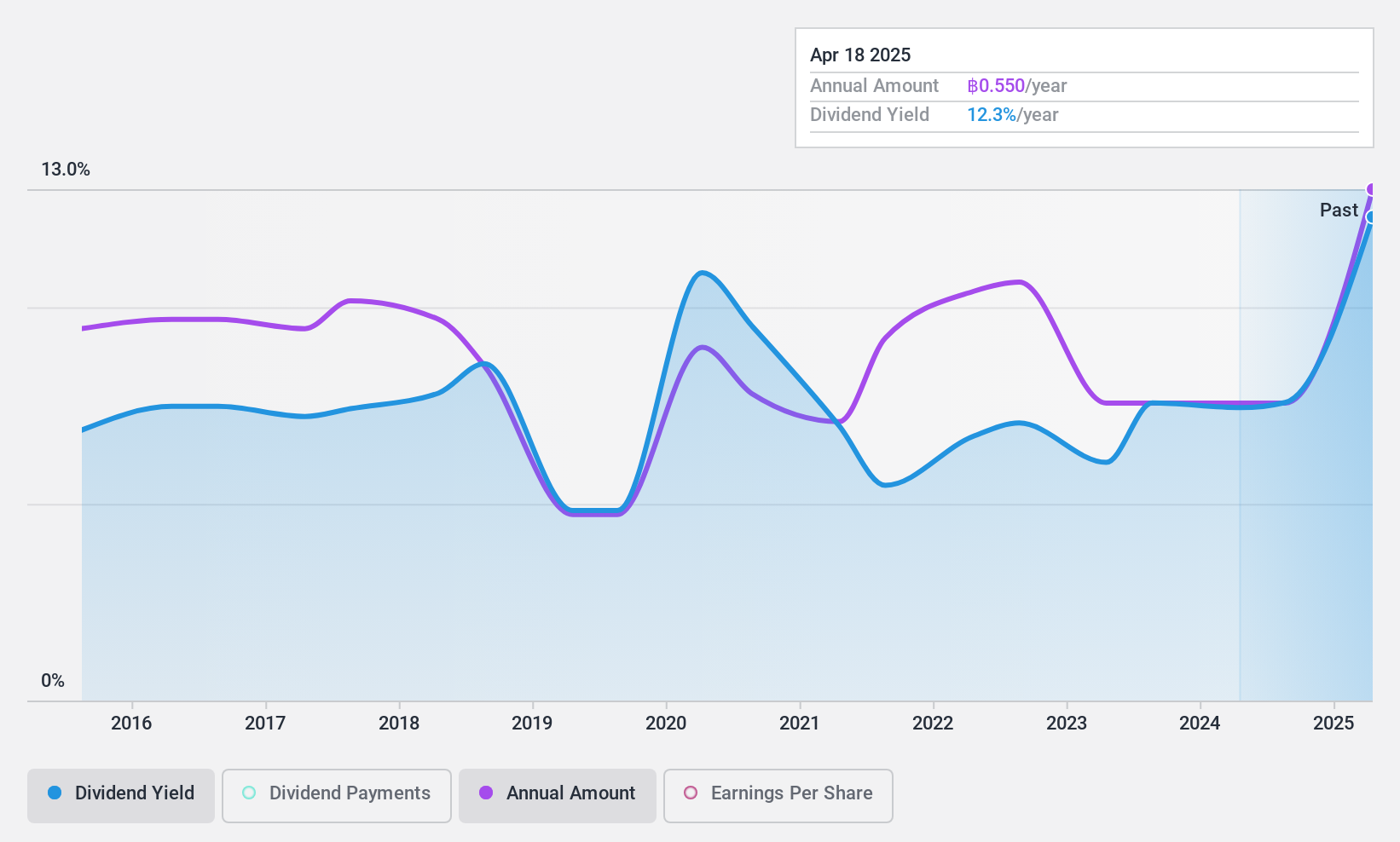

Advanced Information Technology (SET:AIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Information Technology Public Company Limited, with a market cap of THB6.79 billion, operates in Thailand by designing, selling, installing, servicing, repairing, maintaining, and providing training for information and communication technology network systems.

Operations: Advanced Information Technology Public Company Limited generates its revenue primarily from sales and service, amounting to THB7.07 billion.

Dividend Yield: 7.2%

Advanced Information Technology's dividend yield of 7.24% places it among the top 25% in the Thai market, supported by a reasonable cash payout ratio of 57.5%. Despite this, its dividend history is marked by volatility and unreliability over the past decade, with payments declining. The payout ratio of 85.8% indicates coverage by earnings but suggests limited room for growth or stability improvements. AIT's P/E ratio of 12.2x offers relative value compared to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Advanced Information Technology.

- Upon reviewing our latest valuation report, Advanced Information Technology's share price might be too optimistic.

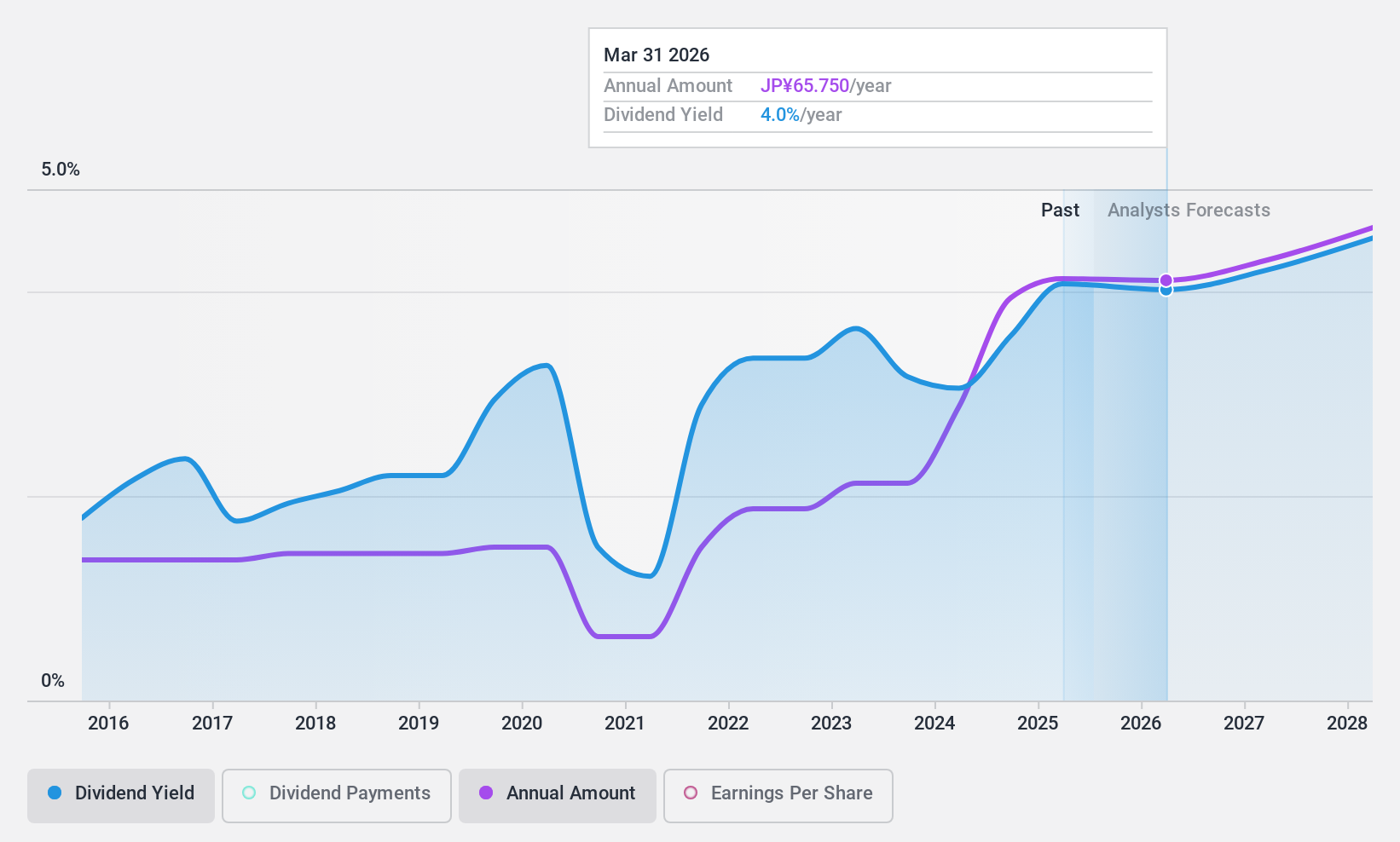

NHK Spring (TSE:5991)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NHK Spring Co., Ltd. operates in Japan, offering products for the automobile, data communications, and industry and lifestyle sectors, with a market cap of ¥407.52 billion.

Operations: NHK Spring Co., Ltd.'s revenue segments include Automotive Seating at ¥324.42 billion, Disk Drive Suspension (DDS) at ¥74.46 billion, Automotive Suspension Springs at ¥176.61 billion, and Industrial Machinery and Equipment along with other operations contributing ¥123.86 billion.

Dividend Yield: 3.3%

NHK Spring's dividend is well supported by a low payout ratio of 20% and a cash payout ratio of 41.3%, indicating strong coverage by earnings and cash flows. However, its dividend yield of 3.32% falls short compared to the top tier in Japan, and its dividend history has been unstable with past volatility. Despite trading at 40.5% below estimated fair value, the company’s dividends have grown over the last decade but remain unreliable due to inconsistent payments.

- Dive into the specifics of NHK Spring here with our thorough dividend report.

- Our valuation report here indicates NHK Spring may be undervalued.

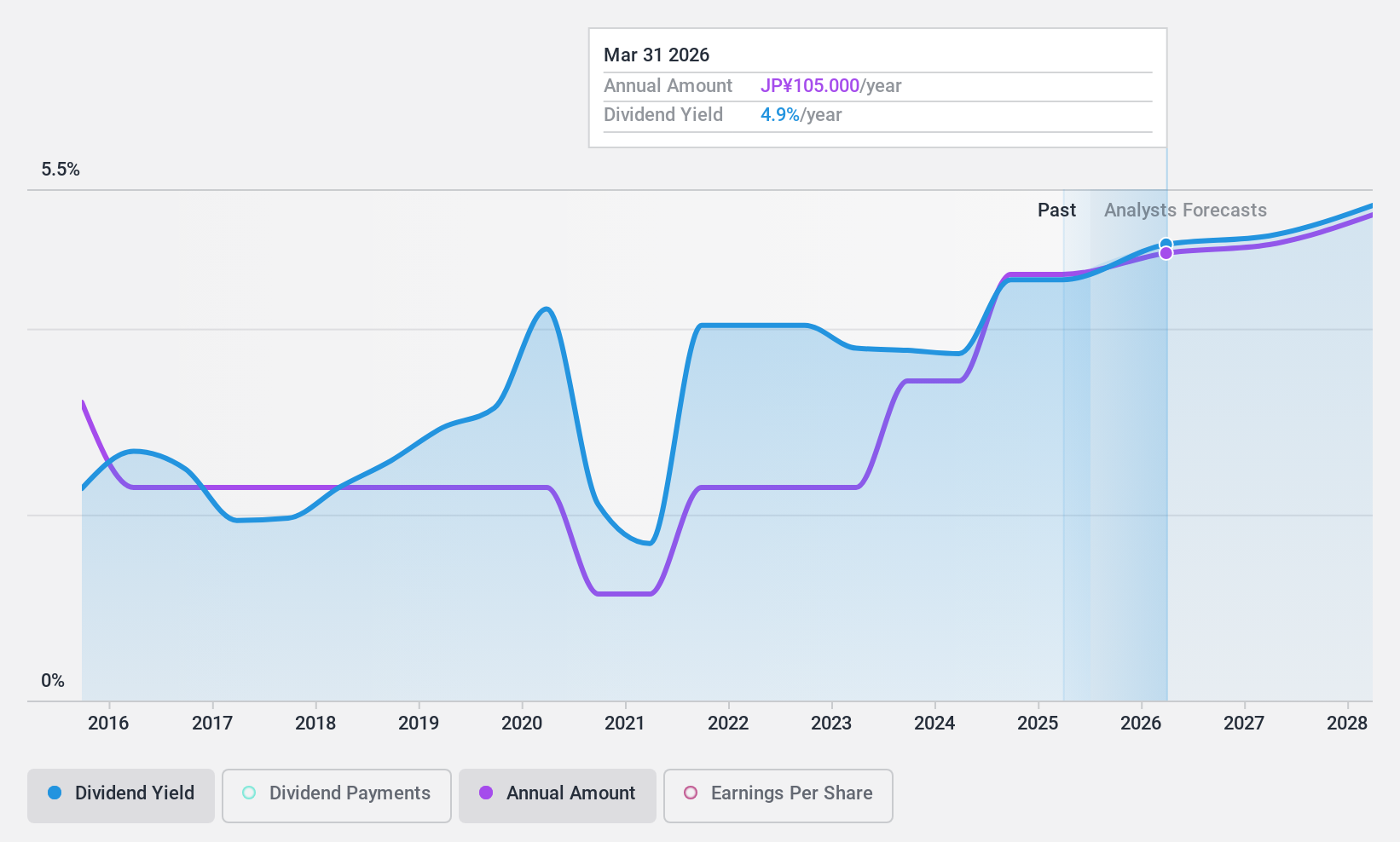

NOK (TSE:7240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOK Corporation is engaged in the manufacturing, importing, and selling of seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic items both in Japan and internationally; it has a market cap of approximately ¥374.24 billion.

Operations: NOK Corporation's revenue segments include seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic items.

Dividend Yield: 4.4%

NOK's dividend yield is competitive, ranking in the top 25% of Japanese dividend payers. However, its dividend history has been volatile and unreliable over the past decade. Despite this instability, dividends have grown during this period and are well covered by a low payout ratio of 25%. The company trades at a significant discount to estimated fair value. Recent share buybacks may positively impact shareholder returns but do not directly address dividend sustainability concerns.

- Get an in-depth perspective on NOK's performance by reading our dividend report here.

- The valuation report we've compiled suggests that NOK's current price could be quite moderate.

Key Takeaways

- Click here to access our complete index of 1930 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7240

NOK

Manufactures, imports, and sells seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic and various other products in Japan and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives