- United Arab Emirates

- /

- Banks

- /

- ADX:BOS

Bank Of Sharjah P.J.S.C And 2 Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have recently faced volatility, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic data, such as a cooling labor market and fluctuating manufacturing activity. Despite this backdrop, investors often seek opportunities in lesser-known areas of the market that can offer growth potential at attractive price points. Penny stocks, although an outdated term, continue to represent a niche for investing in smaller or newer companies that may offer significant upside when backed by strong financial health and fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.83 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$723.66M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £322.74M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.24M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Financial Health Rating: ★★★★☆☆

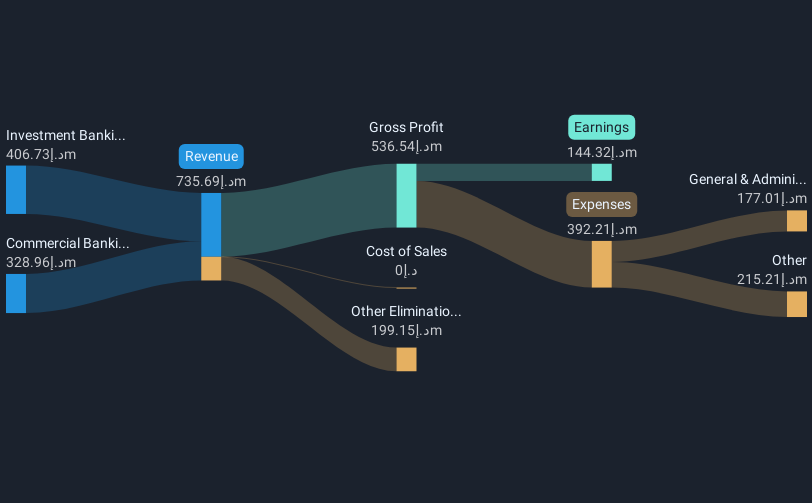

Overview: Bank Of Sharjah P.J.S.C. operates in the United Arab Emirates, offering commercial and investment banking products and services, with a market capitalization of AED2.73 billion.

Operations: The company generates revenue from two primary segments: Commercial Banking, contributing AED328.96 million, and Investment Banking, with AED406.73 million.

Market Cap: AED2.73B

Bank Of Sharjah P.J.S.C. has demonstrated significant earnings growth, with a very large increase of 2546.7% over the past year, surpassing both its historical average and industry benchmarks. Despite a one-off loss of AED73.4 million impacting recent results, the bank maintains an appropriate Loans to Assets ratio at 57% and primarily relies on low-risk funding sources like customer deposits (80%). However, challenges include a high level of bad loans at 8.3% and low Return on Equity at 3.8%. The management team is relatively new with an average tenure of just 0.6 years, contrasting with an experienced board averaging 5.3 years in tenure.

- Click here to discover the nuances of Bank Of Sharjah P.J.S.C with our detailed analytical financial health report.

- Understand Bank Of Sharjah P.J.S.C's track record by examining our performance history report.

Advanced Information Technology (SET:AIT)

Simply Wall St Financial Health Rating: ★★★★★★

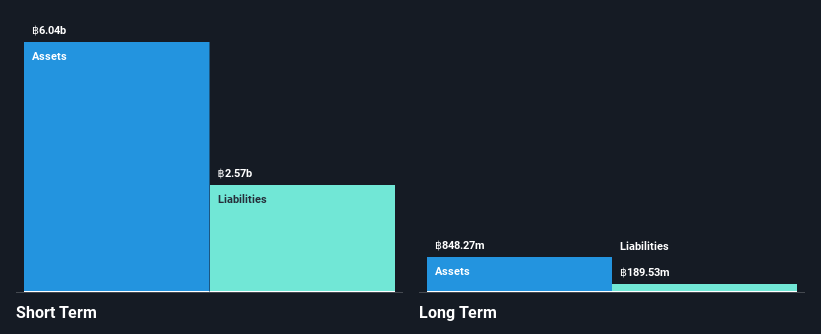

Overview: Advanced Information Technology Public Company Limited, with a market cap of ฿6.70 billion, operates in Thailand by designing, selling, installing, servicing, repairing, maintaining and providing training for information and communication technology network systems.

Operations: The company's revenue primarily derives from sales and service, amounting to ฿7.29 billion.

Market Cap: THB6.7B

Advanced Information Technology Public Company Limited shows promising financial stability with zero debt, improved profit margins at 8%, and consistent earnings growth of 29% over the past year, outpacing industry averages. The management and board are experienced, with average tenures of 8.1 and 9.2 years respectively. The company trades slightly below its estimated fair value while maintaining high-quality earnings without shareholder dilution in the past year. Despite a low Return on Equity at 14.2%, AIT's robust short-term assets (฿6 billion) comfortably cover both short- and long-term liabilities, indicating strong liquidity management.

- Unlock comprehensive insights into our analysis of Advanced Information Technology stock in this financial health report.

- Examine Advanced Information Technology's past performance report to understand how it has performed in prior years.

Peninsula Group (TASE:PEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

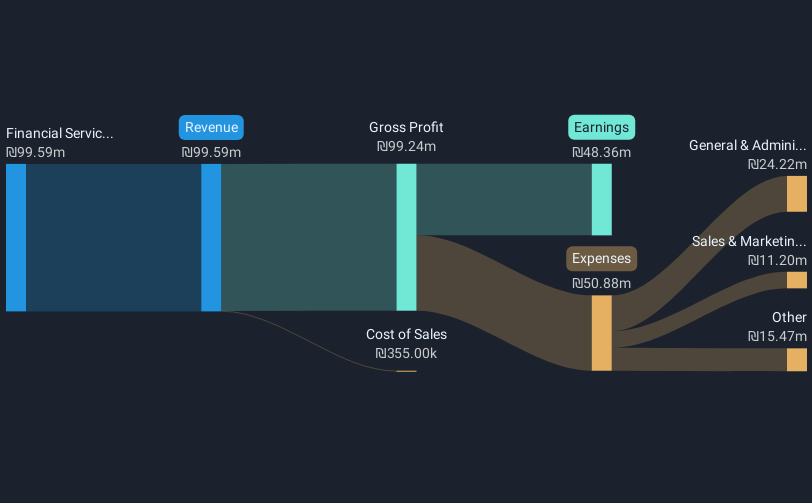

Overview: Peninsula Group Ltd offers credit solutions in Israel and has a market cap of ₪474.18 million.

Operations: The company generates revenue from its Financial Services - Commercial segment, amounting to ₪99.59 million.

Market Cap: ₪474.18M

Peninsula Group Ltd, with a market cap of ₪474.18 million, presents a mixed financial picture. The company's high net debt to equity ratio of 125.2% suggests significant leverage, though its short-term assets of ₪1.5 billion comfortably cover both short- and long-term liabilities. Despite recent negative earnings growth (-14.6%) compared to the industry average, Peninsula maintains high-quality earnings and offers an attractive dividend yield of 7.53%. The board's experience is contrasted by an inexperienced management team with an average tenure of 1.8 years, potentially impacting strategic execution moving forward.

- Dive into the specifics of Peninsula Group here with our thorough balance sheet health report.

- Gain insights into Peninsula Group's past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 5,706 of the Penny Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Of Sharjah P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BOS

Bank Of Sharjah P.J.S.C

Provides commercial and investment banking products and services in the United Arab Emirates.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives