As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, investors are increasingly seeking stability through dividend stocks. In light of recent market dynamics, such as moderate gains in major U.S. indices and rising treasury yields, identifying stocks with robust dividend yields can offer a reliable income stream amidst uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.71% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

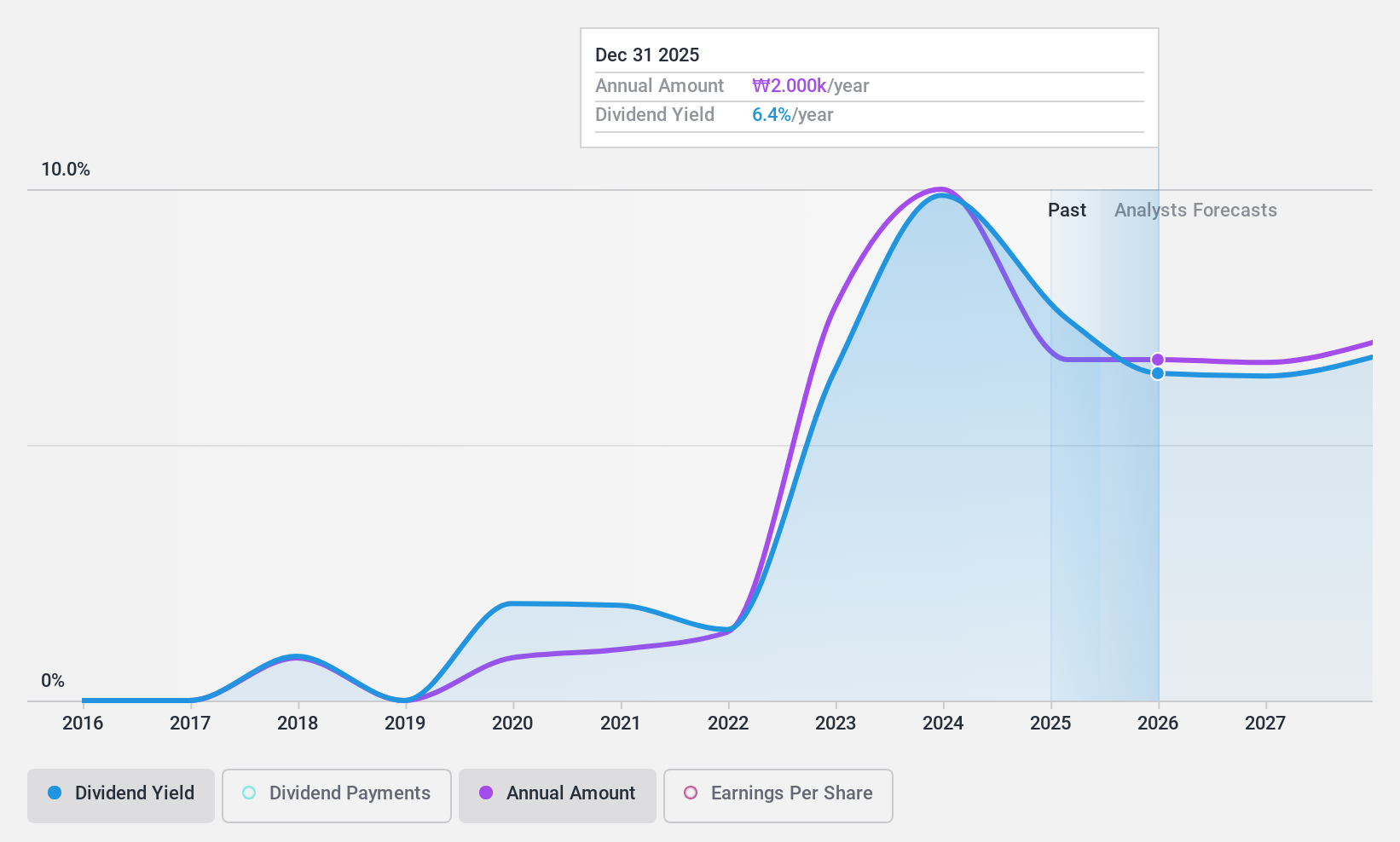

LX International (KOSE:A001120)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX International Corp. operates in the trading business both in Korea and internationally, with a market cap of approximately ₩967.54 billion.

Operations: LX International Corp.'s revenue is primarily derived from its Logistics Division at ₩7.50 billion, followed closely by Trading/New Business at ₩7.50 billion, and the Resource Sector contributing ₩1.12 billion.

Dividend Yield: 4.3%

LX International's dividend payments are well-covered by both earnings, with a payout ratio of 25.6%, and cash flows, with a cash payout ratio of 11.7%. Despite an attractive dividend yield in the top 25% of the Korean market, its eight-year track record has been unreliable and volatile. Recent strong financial performance, including Q3 sales of ₩4.56 trillion and net income growth to ₩85 billion, supports potential for future dividend stability.

- Dive into the specifics of LX International here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that LX International is priced lower than what may be justified by its financials.

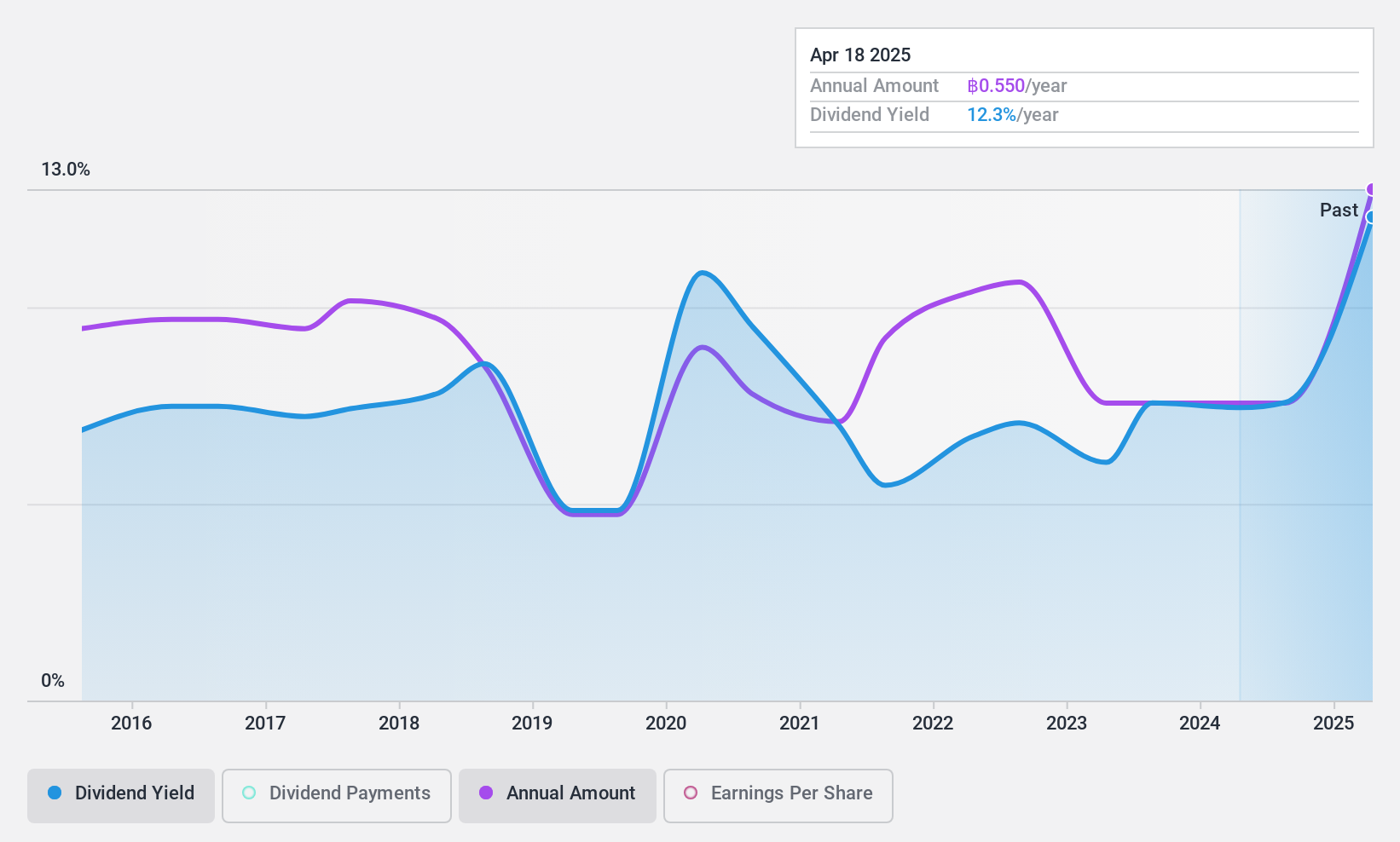

Advanced Information Technology (SET:AIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Information Technology Public Company Limited, with a market cap of ฿63.30 billion, operates in Thailand by designing, selling, installing, servicing, repairing, maintaining, and providing training for information and communication technology network systems.

Operations: Advanced Information Technology's revenue from sales and service amounts to ฿7.29 billion.

Dividend Yield: 7.7%

Advanced Information Technology's dividend yield ranks in the top 25% of the Thai market, supported by a cash payout ratio of 42.6%, indicating strong coverage by cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. Despite recent earnings growth of 29% and improved Q3 net income to THB 151.55 million, shareholder dilution last year raises concerns about future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Advanced Information Technology's dividend report.

- According our valuation report, there's an indication that Advanced Information Technology's share price might be on the expensive side.

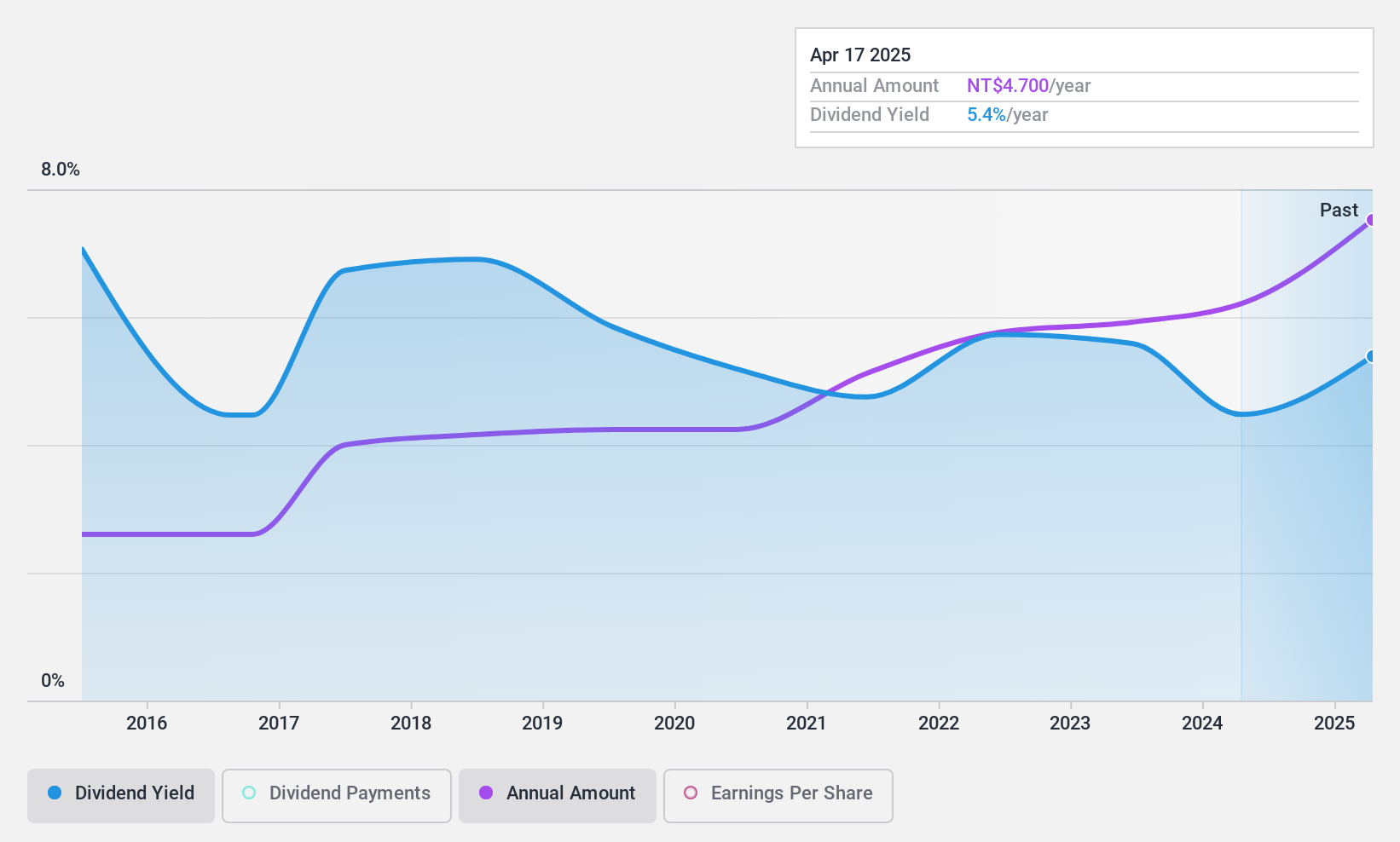

Taiwan Sakura (TWSE:9911)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Taiwan Sakura Corporation is involved in the manufacture and sale of kitchen appliances in Taiwan, with a market cap of NT$18.40 billion.

Operations: Taiwan Sakura Corporation's revenue is primarily derived from its Gas Appliance Division at NT$5.76 billion and Kitchenware Division at NT$2.83 billion.

Dividend Yield: 4.6%

Taiwan Sakura's dividend yield is among the top 25% in the Taiwan market, though its cash payout ratio of 99.6% suggests dividends are not well covered by free cash flow. Despite this, dividends have been stable and growing over the past decade with a reasonable payout ratio of 63.4%. Recent earnings growth of 35.1% supports dividend coverage by earnings, but sustainability concerns remain due to insufficient free cash flow coverage.

- Get an in-depth perspective on Taiwan Sakura's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Taiwan Sakura's current price could be inflated.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1970 more companies for you to explore.Click here to unveil our expertly curated list of 1973 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AIT

Advanced Information Technology

Engages in sale, design, installation, project management, repair and maintenance, training, and turnkey for network infrastructure and information and communication technology systems in Thailand.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion