- China

- /

- Electrical

- /

- SHSE:601126

3 Reliable Dividend Stocks Offering Up To 8.1% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are increasingly focused on strategies that can offer stability and income. In such an environment, dividend stocks stand out as attractive options for their potential to provide consistent returns through regular payouts, making them a reliable choice amid economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Dusit Thani Freehold and Leasehold Real Estate Investment Trust (SET:DREIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dusit Thani Freehold and Leasehold Real Estate Investment Trust is a real estate investment trust with a market cap of THB3.66 billion, focusing on investing in freehold and leasehold properties.

Operations: Dusit Thani Freehold and Leasehold Real Estate Investment Trust generates revenue primarily from leasing, amounting to THB540.05 million.

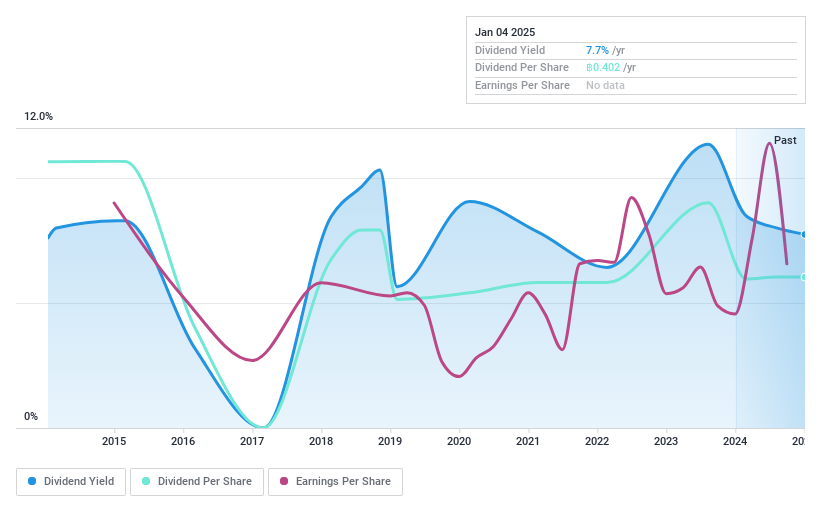

Dividend Yield: 7.8%

Dusit Thani Freehold and Leasehold Real Estate Investment Trust offers a dividend yield of 7.82%, placing it in the top 25% of Thai dividend payers. Despite its attractive yield, the dividends have been unreliable and volatile over the past decade, with notable annual declines exceeding 20%. The payout is sustainable with both earnings and cash flows covering dividends at approximately 56%. However, large one-off items have impacted financial results, affecting earnings quality.

- Dive into the specifics of Dusit Thani Freehold and Leasehold Real Estate Investment Trust here with our thorough dividend report.

- Our valuation report here indicates Dusit Thani Freehold and Leasehold Real Estate Investment Trust may be undervalued.

SCB X (SET:SCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SCB X Public Company Limited serves as a holding company for The Siam Commercial Bank Public Company Limited, offering a range of financial products and services, with a market cap of THB427.62 billion.

Operations: SCB X Public Company Limited derives its revenue from various financial products and services offered through The Siam Commercial Bank Public Company Limited.

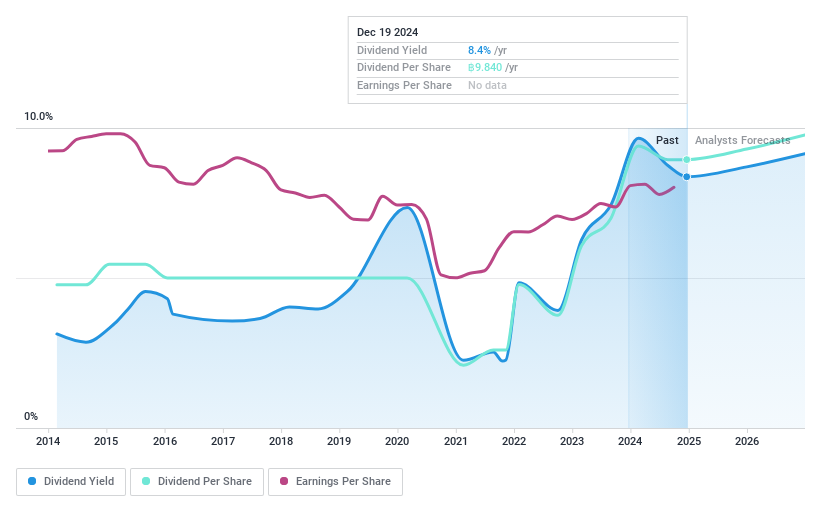

Dividend Yield: 8.2%

SCB X's dividend yield of 8.19% ranks it in the top 25% of Thai payers, but its dividends have been volatile over the past decade. Despite this instability, current and forecasted payout ratios of 80% and 78.7%, respectively, suggest dividends are covered by earnings. The company recently approved a THB 10.44 per share dividend for 2024 results, totaling approximately THB 35 billion, with payment scheduled for May 2, 2025.

- Click here to discover the nuances of SCB X with our detailed analytical dividend report.

- The analysis detailed in our SCB X valuation report hints at an inflated share price compared to its estimated value.

Beijing Sifang AutomationLtd (SHSE:601126)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Sifang Automation Co., Ltd. provides power transmission, transformation protection, and automation systems both in China and internationally, with a market cap of CN¥13.03 billion.

Operations: Beijing Sifang Automation Co., Ltd.'s revenue primarily stems from its offerings in power generation, enterprise power solutions, and systems for power distribution and consumption.

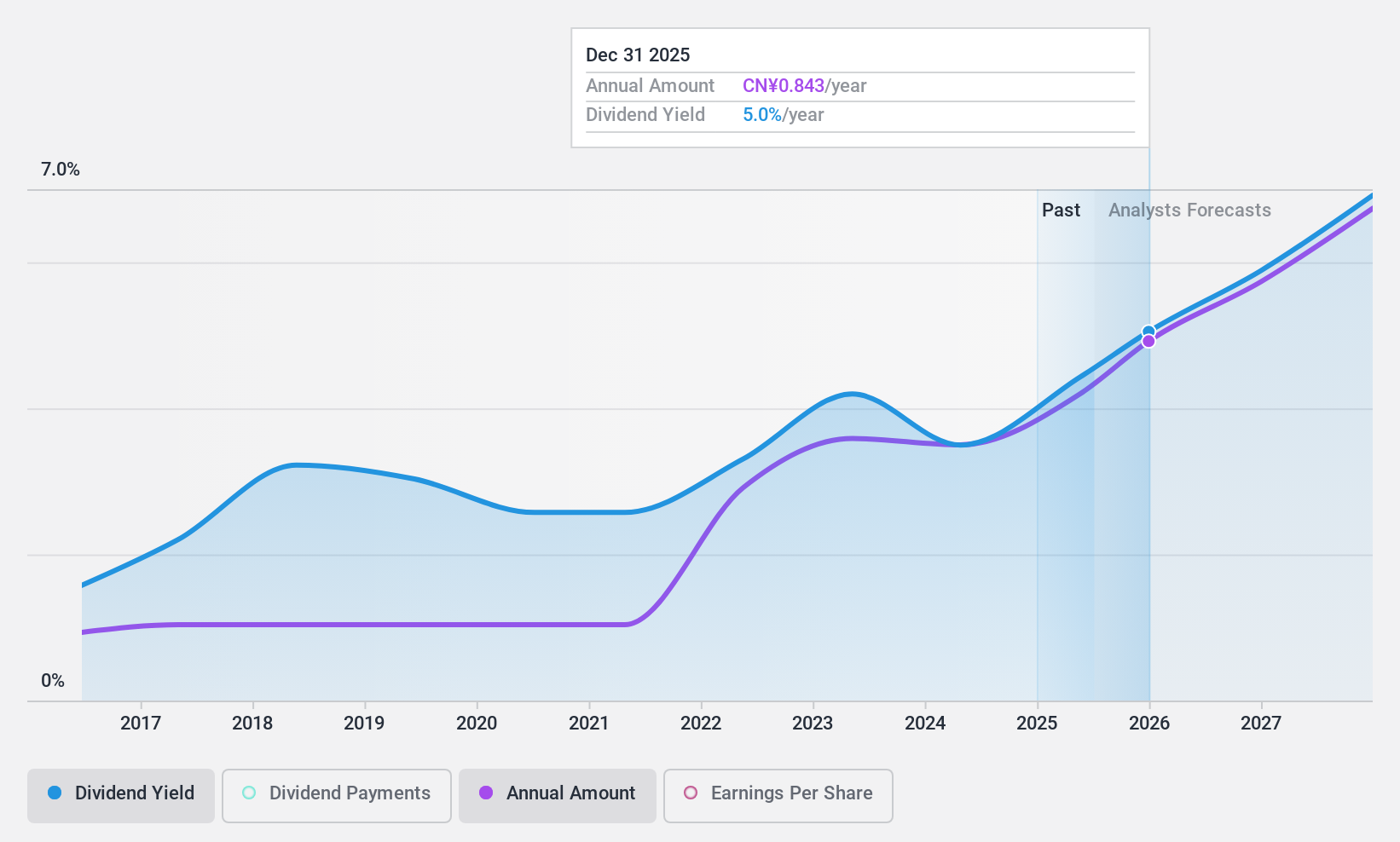

Dividend Yield: 3.7%

Beijing Sifang Automation Ltd. offers a dividend yield of 3.71%, placing it among the top 25% of CN market payers, with dividends covered by earnings (70% payout ratio) and cash flows (39.6% cash payout ratio). However, its dividend history is unstable due to past volatility exceeding 20%. The stock trades at an attractive value, being 18.5% below estimated fair value and favorably compared to peers, despite its unreliable dividend track record over the last decade.

- Click here and access our complete dividend analysis report to understand the dynamics of Beijing Sifang AutomationLtd.

- Our valuation report unveils the possibility Beijing Sifang AutomationLtd's shares may be trading at a discount.

Where To Now?

- Discover the full array of 1990 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Sifang AutomationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601126

Beijing Sifang AutomationLtd

Supplies power transmission, transformation protection, automation systems, power generation, enterprise power, and power distribution and consumption systems in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives