- China

- /

- Capital Markets

- /

- SZSE:002961

Discovering Hidden Potential With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, major indexes such as the S&P 500 have reached record highs, driven by optimism around potential trade deals and AI-related investments. Despite large-cap stocks generally outperforming their smaller-cap counterparts, there remains significant opportunity in the small-cap sector for those seeking undiscovered gems that may benefit from favorable market conditions and emerging trends. Identifying a good stock often involves looking for companies with strong fundamentals and growth potential that are well-positioned to capitalize on current economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Woori Technology Investment | NA | 25.42% | -1.59% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

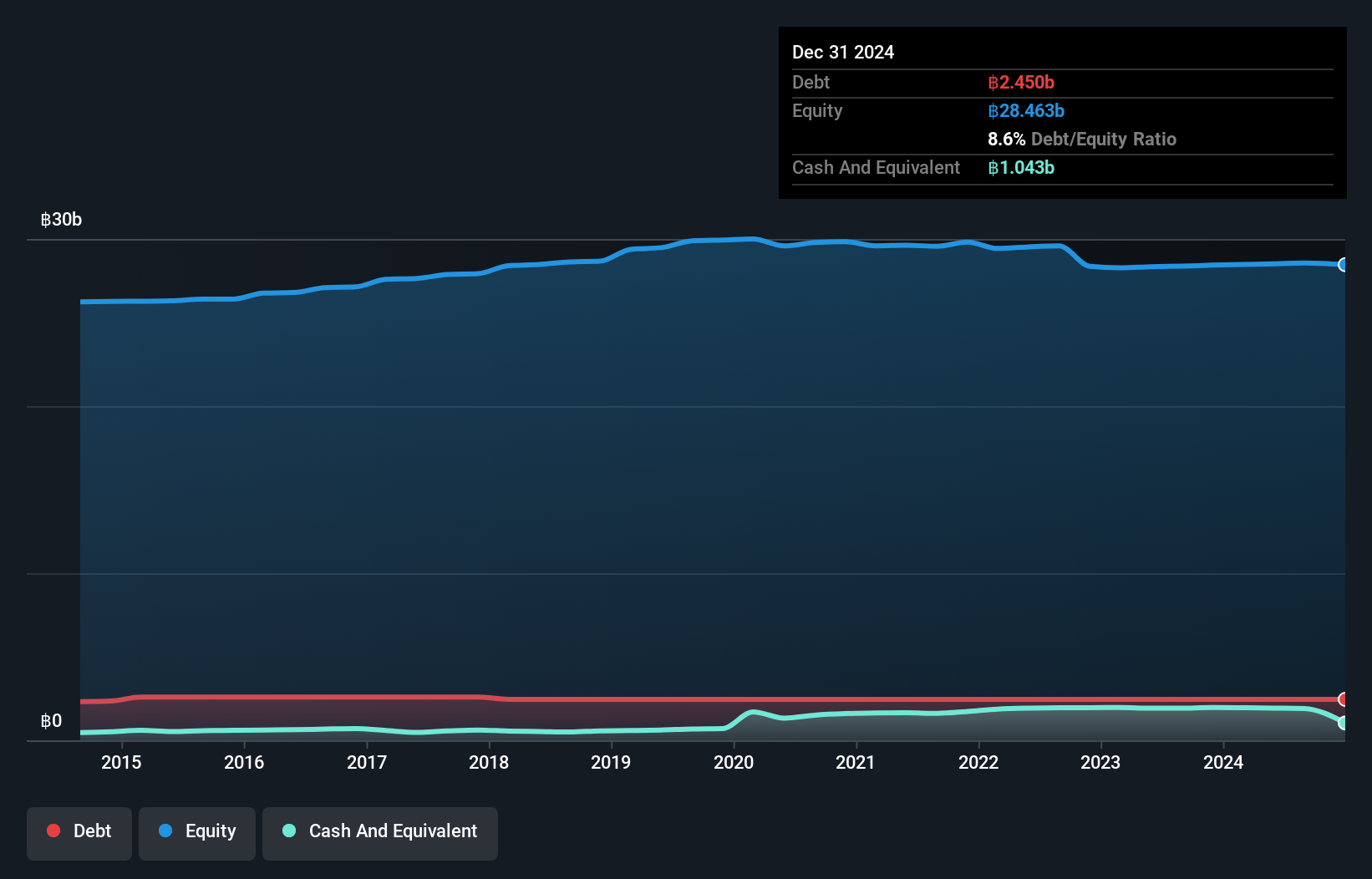

Axtra Future City Freehold And Leasehold Real Estate Investment Trust (SET:AXTRART)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Axtra Future City Freehold And Leasehold Real Estate Investment Trust focuses on investing in freehold and leasehold properties, specifically 17 shopping malls anchored by a Tesco Lotus hypermarket, with a market capitalization of THB26.65 billion.

Operations: Axtra Future City generates revenue primarily from its investments in property, amounting to THB2.95 billion. The net profit margin reflects the efficiency of its operations and profitability from these investments.

Axtra Future City REIT, a nimble player in the real estate sector, stands out with its impressive earnings growth of 190.9% over the past year, significantly surpassing the Retail REITs industry average of 22.4%. Its net debt to equity ratio is a comfortable 1.9%, reflecting prudent financial management. Trading at about 30% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. The company's interest payments are well covered by EBIT at 21.5 times, indicating robust financial health and high-quality earnings that enhance its appeal in a competitive market landscape.

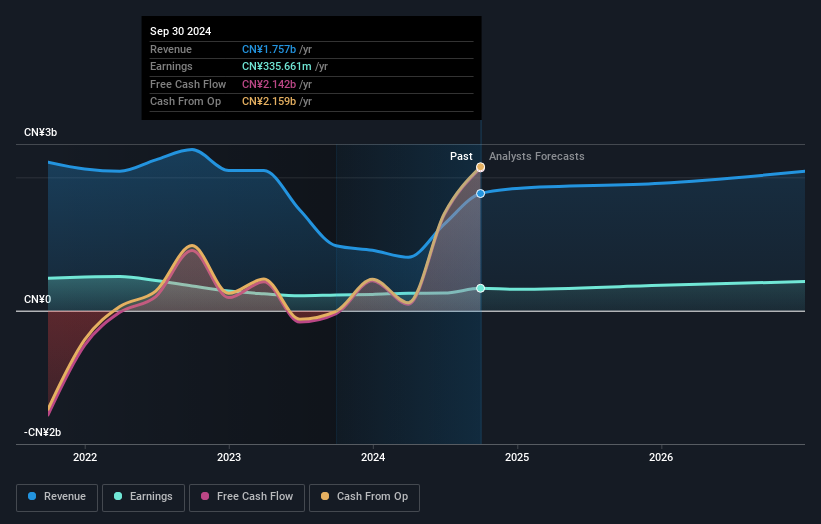

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market capitalization of CN¥6.32 billion.

Operations: The company generates revenue primarily from its futures trading operations. It has a market capitalization of CN¥6.32 billion.

Ruida Futures, a smaller player in the market, is making waves with its impressive earnings growth of 42.4% over the past year, outpacing the Capital Markets industry's -7.7%. Trading at a price-to-earnings ratio of 18.8x, it offers good value compared to peers and the broader CN market's 34.7x average. With high-quality earnings and positive free cash flow, Ruida seems well-positioned financially despite an increased debt-to-equity ratio from 24% to 28.4% over five years. The company announced a CNY1.30 dividend per ten shares recently, adding appeal for income-focused investors as they eye future growth prospects projected at 13.56% annually.

- Get an in-depth perspective on Ruida FuturesLtd's performance by reading our health report here.

Evaluate Ruida FuturesLtd's historical performance by accessing our past performance report.

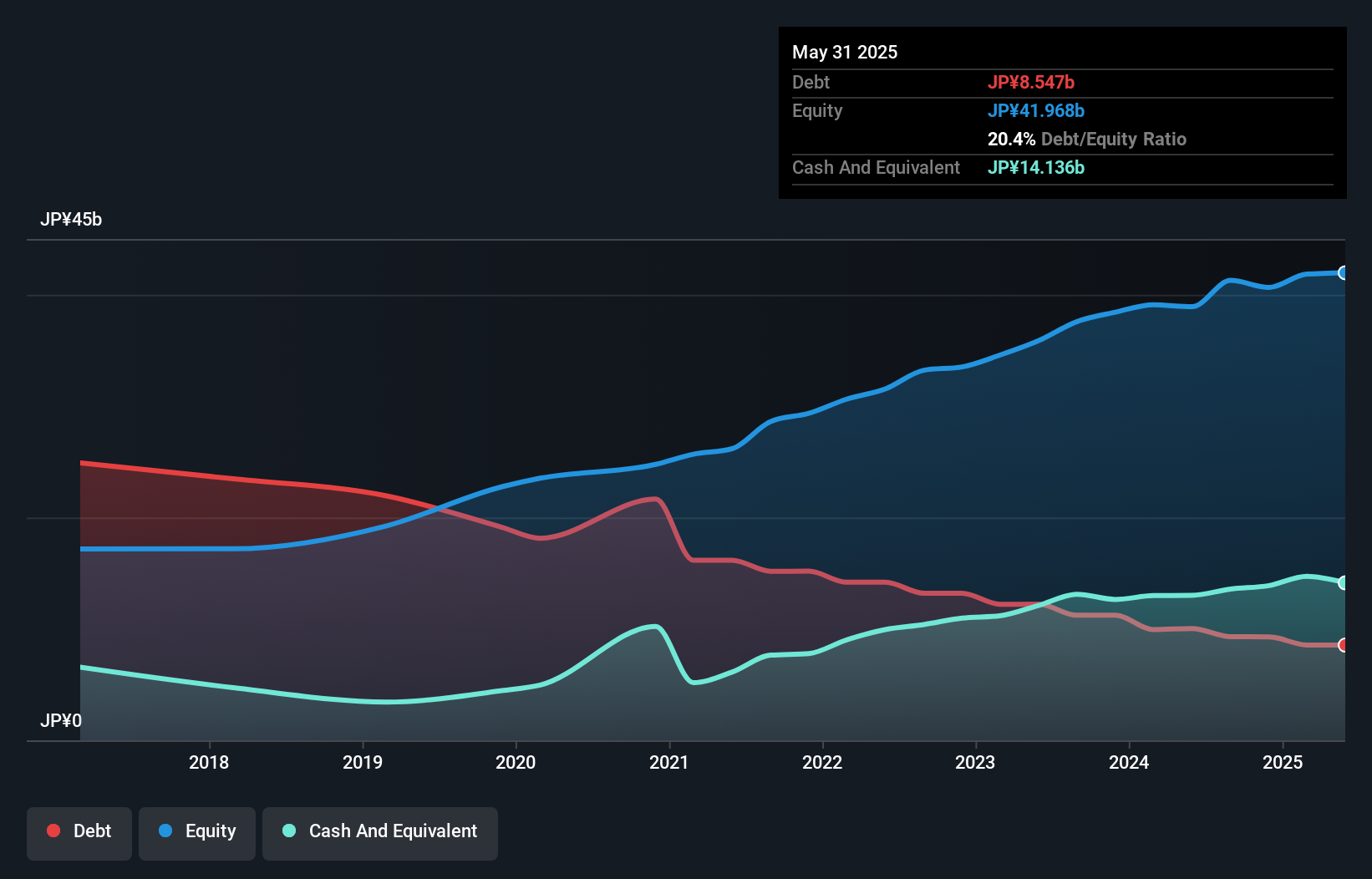

WingArc1st (TSE:4432)

Simply Wall St Value Rating: ★★★★★★

Overview: WingArc1st Inc. develops and sells software and services in Japan, with a market cap of ¥118.78 billion.

Operations: WingArc1st generates revenue primarily from its software and services offerings in Japan. The company's financial performance includes a notable net profit margin, which is an important indicator of its profitability.

WingArc1st, a promising player in the software sector, has shown robust earnings growth of 12.4% over the past year, outpacing the industry average of 12.1%. Trading at a valuation 19% below its estimated fair value suggests it offers good relative value compared to peers. The company’s debt-to-equity ratio significantly improved from 84% to 22.9% over five years, indicating prudent financial management. Recent guidance forecasts revenue of ¥28.5 billion and an operating profit of ¥8.1 billion for fiscal year-end February 2025, alongside a special dividend announcement of ¥20 per share, signaling confidence in future performance prospects.

- Navigate through the intricacies of WingArc1st with our comprehensive health report here.

Gain insights into WingArc1st's past trends and performance with our Past report.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4668 more companies for you to explore.Click here to unveil our expertly curated list of 4671 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002961

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives