Roctec Global And 2 Additional Penny Stocks With Promising Fundamentals

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Dow Jones Industrial Average and S&P 500 Index achieving new intraday peaks, investors are exploring diverse opportunities across various sectors. Penny stocks, a term that may seem outdated yet remains relevant, represent smaller or newer companies offering potential growth at lower price points. When these stocks are supported by strong fundamentals and robust balance sheets, they can present compelling opportunities for investors seeking hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.345 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,690 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Roctec Global (SET:ROCTEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Roctec Global Public Company Limited, with a market cap of THB7.87 billion, operates in the advertising services sector across Thailand, Hong Kong, and Vietnam.

Operations: The company's revenue is primarily derived from system installation services, generating THB2.46 billion, and advertising, contributing THB437 million.

Market Cap: THB7.87B

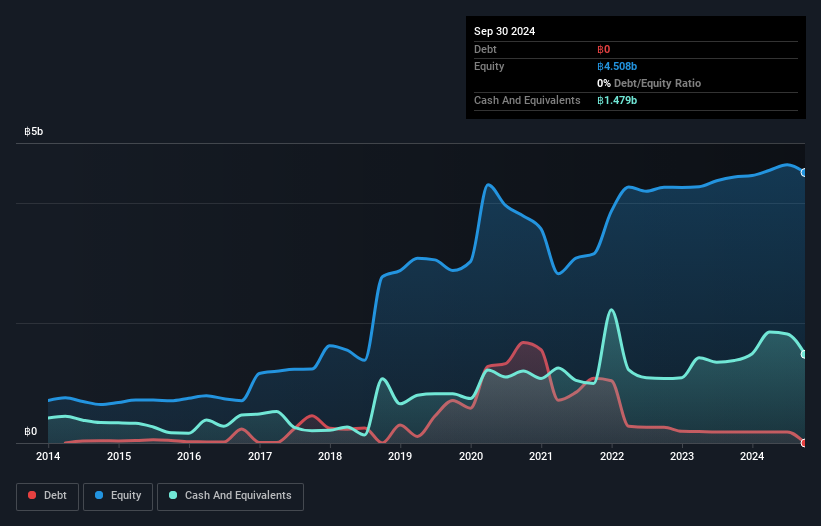

Roctec Global, operating in the advertising services sector across Thailand, Hong Kong, and Vietnam, has shown solid financial performance with recent revenue of THB1.58 billion for the first half of 2024. The company is debt-free and boasts a seasoned management team with an average tenure of 6.9 years. Despite experiencing high share price volatility recently, Roctec's earnings have grown significantly by 77% over the past year, outpacing both its five-year average growth rate and industry peers. Additionally, its net profit margin improved to 10%, supported by strong asset coverage for both short- and long-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of Roctec Global.

- Examine Roctec Global's past performance report to understand how it has performed in prior years.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, with a market cap of THB31.98 billion, operates in Thailand's property development sector through its subsidiaries.

Operations: The company generates revenue primarily from Real Estate at THB35.79 billion, supplemented by Building Management, Project Management and Real Estate Brokerage at THB2.13 billion, and the Hotel Business contributing THB553 million.

Market Cap: THB31.98B

Sansiri Public Company Limited, engaged in Thailand's property development sector, reported a slight increase in revenue to THB28.88 billion for the first nine months of 2024. Despite this growth, net income declined compared to the previous year. The company faces challenges with high debt levels, as its net debt to equity ratio remains elevated at 159.3%. While earnings quality is strong and interest payments are well covered by EBIT, shareholders have faced dilution over the past year with shares outstanding increasing by 4.9%. Sansiri trades below fair value estimates but struggles with unstable dividend payouts and lower profit margins than last year.

- Click here and access our complete financial health analysis report to understand the dynamics of Sansiri.

- Evaluate Sansiri's prospects by accessing our earnings growth report.

Shandong Polymer Biochemicals (SZSE:002476)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Polymer Biochemicals Co., Ltd. produces and sells special chemicals for oil and gas exploitation both in China and internationally, with a market cap of CN¥2.96 billion.

Operations: There are no specific revenue segments reported for Shandong Polymer Biochemicals Co., Ltd.

Market Cap: CN¥2.96B

Shandong Polymer Biochemicals Co., Ltd. has shown significant improvement, reporting a net income of CN¥23.37 million for the first nine months of 2024, transitioning from a loss in the previous year. The company's short-term assets significantly exceed both its short-term and long-term liabilities, indicating strong liquidity. However, earnings are influenced by a large one-off gain of CN¥27.2 million, suggesting potential volatility in future profits. Despite becoming profitable recently and reducing its debt-to-equity ratio to 2.6%, challenges remain with negative operating cash flow and low return on equity at 3.2%. A recent acquisition deal could impact shareholder dynamics moving forward.

- Get an in-depth perspective on Shandong Polymer Biochemicals' performance by reading our balance sheet health report here.

- Evaluate Shandong Polymer Biochemicals' historical performance by accessing our past performance report.

Taking Advantage

- Access the full spectrum of 5,690 Penny Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002476

Shandong Polymer Biochemicals

Produces and sells special chemicals for oil and gas exploitation in China and internationally.

Excellent balance sheet with questionable track record.