- China

- /

- Electrical

- /

- SHSE:688128

Undiscovered Gems on None Exchange for December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic policy shifts, small-cap stocks have joined their larger peers in reaching record highs, as evidenced by the Russell 2000 Index's recent performance. With domestic policies and consumer strength providing a backdrop of stability amidst manufacturing slumps, investors are increasingly on the lookout for undiscovered gems that offer potential growth opportunities in this dynamic environment. In such conditions, identifying promising small-cap stocks often involves looking for companies with strong fundamentals that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Longyan Kaolin Clay (SHSE:605086)

Simply Wall St Value Rating: ★★★★★★

Overview: Longyan Kaolin Clay Co., Ltd. focuses on the production and supply of kaolin for ceramic raw materials in China, with a market capitalization of CN¥5.21 billion.

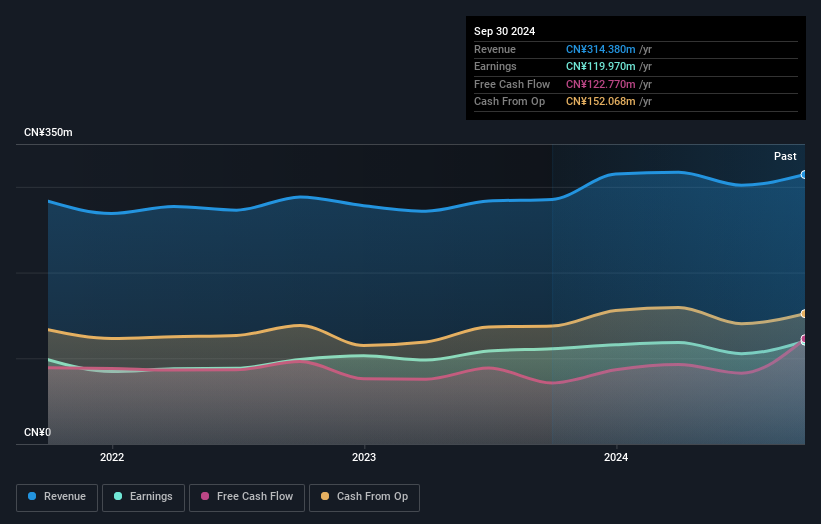

Operations: Longyan Kaolin Clay generates revenue primarily from its specialty chemicals segment, which amounted to CN¥314.38 million. The company's financial performance can be further analyzed by examining its gross profit margin or net profit margin trends over the specified periods for a comprehensive understanding of profitability.

Longyan Kaolin Clay, a smaller player in the industry, showcases a robust financial position with zero debt compared to a 9.9% debt-to-equity ratio five years ago. The company reported net income of CNY 96 million for the first nine months of 2024, up from CNY 92 million the previous year, reflecting its high-quality earnings and profitability. Recent transactions include Zijin Mining's agreement to acquire a 20% stake at CNY 14.93 per share and another acquisition by Longyan Hongtong Investment for CNY 17.26 per share, indicating investor confidence despite stable sales figures around CNY 232 million annually.

- Dive into the specifics of Longyan Kaolin Clay here with our thorough health report.

Evaluate Longyan Kaolin Clay's historical performance by accessing our past performance report.

China National Electric Apparatus Research Institute (SHSE:688128)

Simply Wall St Value Rating: ★★★★★★

Overview: China National Electric Apparatus Research Institute Co., Ltd. focuses on the research and development of electric apparatus, with a market cap of CN¥8.87 billion.

Operations: The company generates revenue primarily through its research and development activities in the electric apparatus sector.

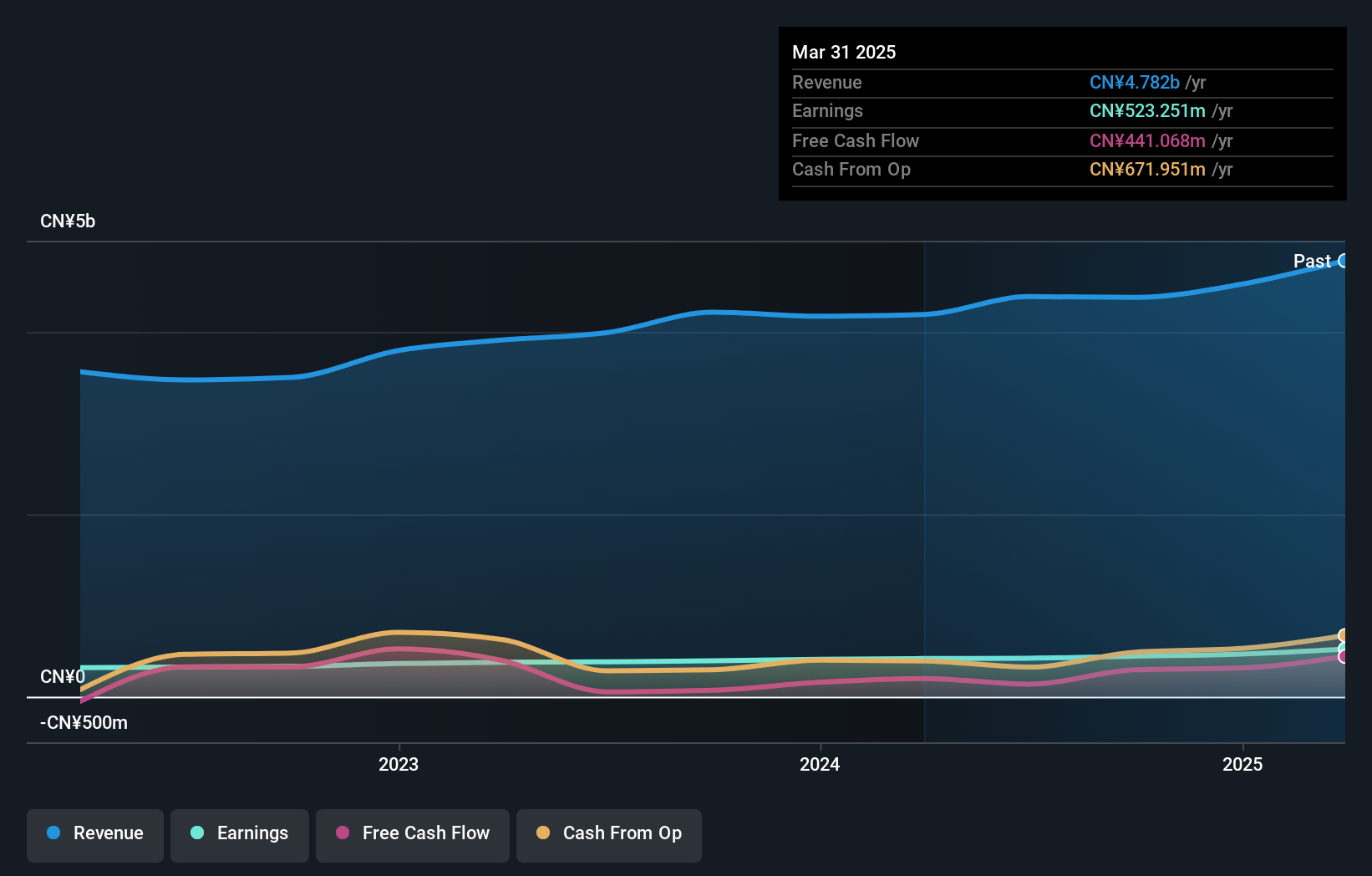

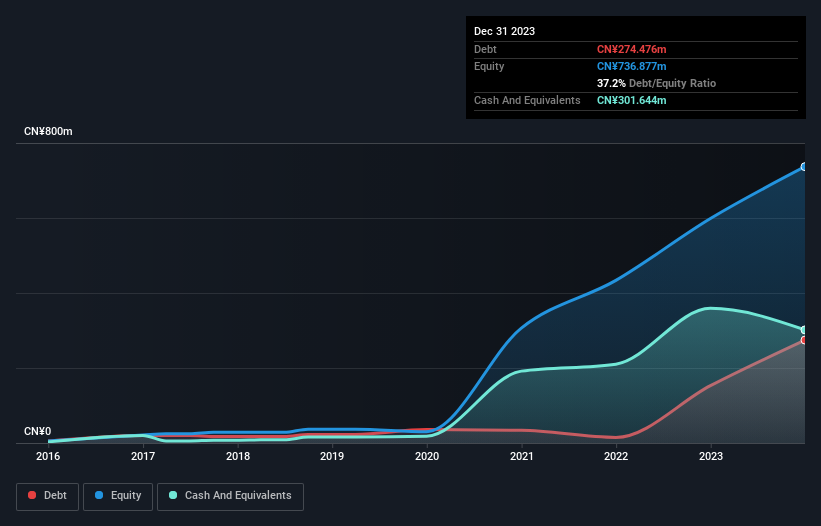

China National Electric Apparatus Research Institute, a smaller player in its industry, has shown promising financials with earnings growing by 12.8% over the past year, outpacing the Electrical industry’s growth of 1.1%. The company boasts a favorable price-to-earnings ratio of 20x compared to the broader CN market's 36.9x, indicating good value relative to peers. Recent results highlight sales reaching CNY 3.15 billion and net income at CNY 321 million for nine months ending September 2024, both up from last year’s figures. With more cash than debt and positive free cash flow, it seems well-positioned for future growth prospects.

Baotou INST Magnetic New Materials (SZSE:301622)

Simply Wall St Value Rating: ★★★★★★

Overview: Baotou INST Magnetic New Materials Co., Ltd. is engaged in the production and development of magnetic materials, with a market cap of CN¥2.59 billion.

Operations: The company generates revenue primarily from the production and sale of magnetic materials. It has a market capitalization of CN¥2.59 billion, reflecting its valuation in the financial markets.

Baotou INST Magnetic New Materials recently completed an IPO, raising CNY 648.06 million, which could bolster its financial position. The company reported robust sales of CNY 848.88 million for the first nine months of 2024, up from CNY 662.61 million the previous year, with net income reaching CNY 137.52 million compared to last year's CNY 106.07 million. Despite having a price-to-earnings ratio of 15x—well below the CN market average—the firm faces challenges with negative free cash flow and highly illiquid shares; however, it maintains more cash than total debt and covers interest payments comfortably.

Key Takeaways

- Gain an insight into the universe of 4645 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688128

China National Electric Apparatus Research Institute

China National Electric Apparatus Research Institute Co., Ltd.

Flawless balance sheet with solid track record.