- China

- /

- Household Products

- /

- SHSE:605378

Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets continue to reach record highs, with small-cap indices like the Russell 2000 hitting new peaks, investors are increasingly looking towards lesser-known opportunities that might offer untapped potential. In this dynamic environment, identifying stocks that exhibit strong fundamentals and resilience amidst geopolitical and economic shifts is crucial for those seeking to uncover promising investments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dah Sing Financial Holdings (SEHK:440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dah Sing Financial Holdings Limited is an investment holding company offering banking, insurance, financial, and related services across Hong Kong, Macau, and the People’s Republic of China with a market cap of approximately HK$7.94 billion.

Operations: Dah Sing Financial Holdings generates revenue primarily from personal banking (HK$2.68 billion), treasury and global markets (HK$1.34 billion), and corporate banking (HK$853.60 million). The insurance business contributes HK$246.25 million, while mainland China and Macau banking adds HK$176.27 million to the revenue stream.

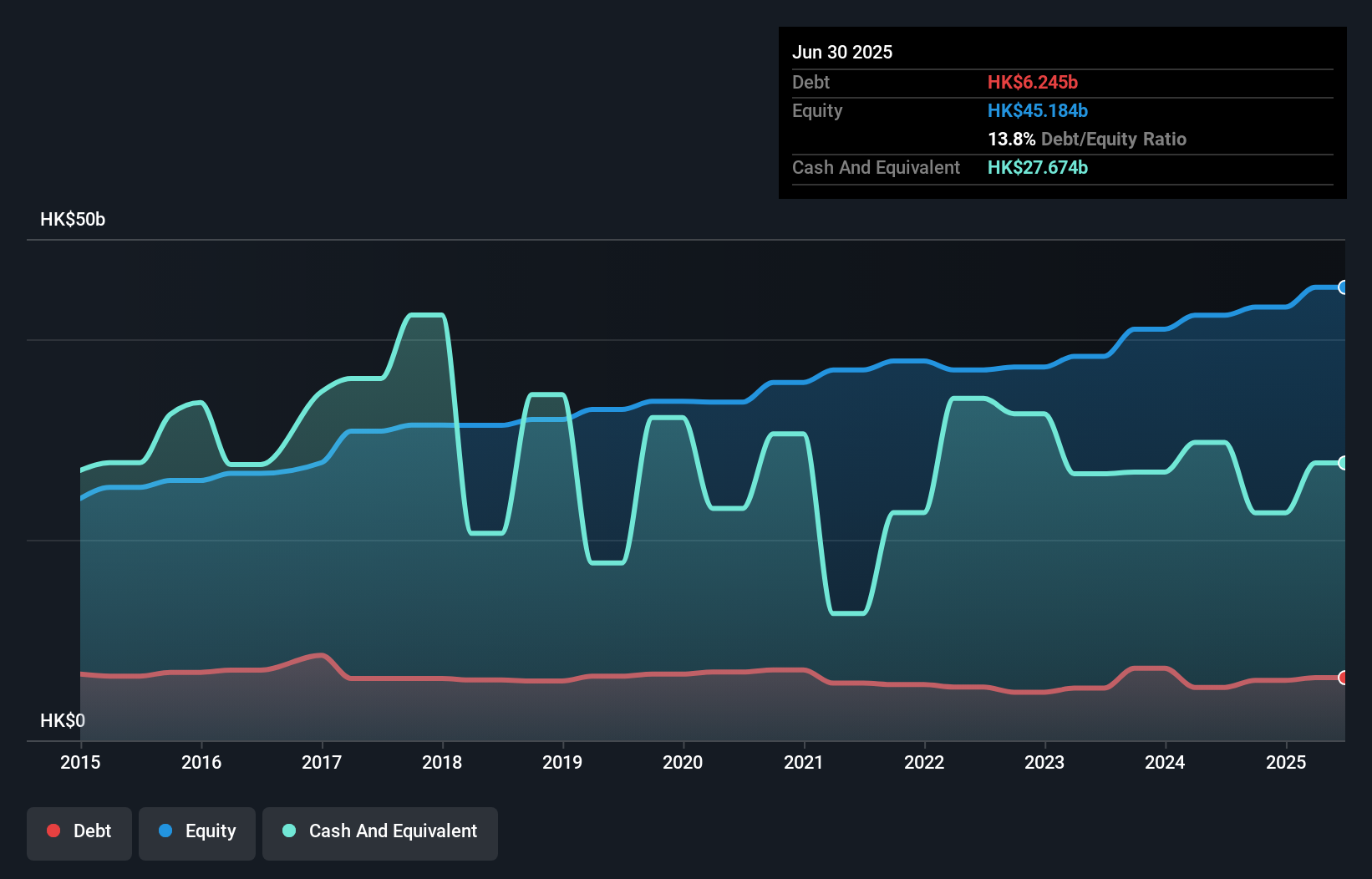

Dah Sing Financial Holdings, a relatively small player in the banking sector, shows promise with total assets of HK$272.4 billion and equity at HK$42.4 billion. The institution's non-performing loans are kept in check at 1.9%, while its allowance for bad loans stands at a low 43%. With 93% of liabilities sourced from low-risk funding like customer deposits, the bank appears stable. Despite not being free cash flow positive recently, its earnings have grown by an impressive 36.7% over the past year, outpacing industry growth of just 1.6%. Trading below estimated fair value by 34%, it offers potential upside for investors eyeing value opportunities in financial stocks.

Zhejiang Mustang BatteryLtd (SHSE:605378)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Mustang Battery Co., Ltd focuses on the research, development, production, and sale of dry batteries in China with a market capitalization of CN¥3.31 billion.

Operations: Mustang Battery generates its revenue primarily from the sale of dry batteries. The company's financial performance is highlighted by a net profit margin that has shown variation across reporting periods.

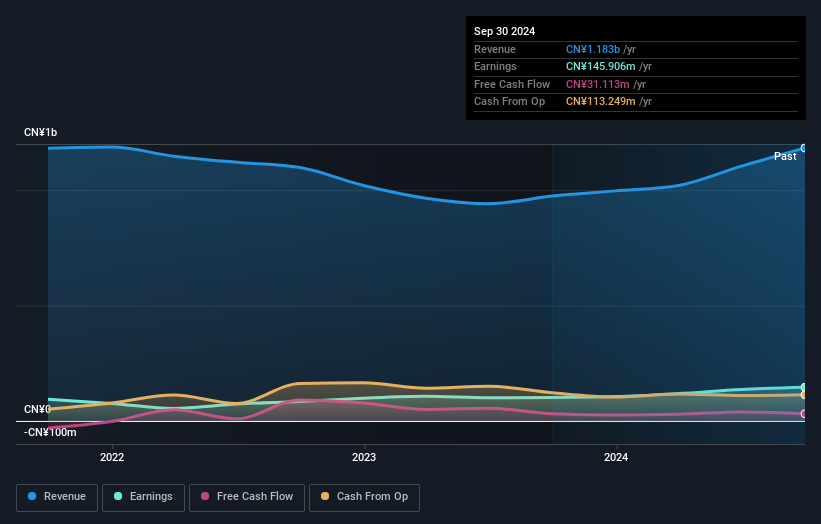

Zhejiang Mustang Battery, operating with no debt for the past five years, seems to be a standout in its sector. The company reported sales of CNY 950.47 million for the first nine months of 2024, up from CNY 764.69 million a year earlier, and net income rose to CNY 116.88 million from CNY 76.51 million. Its price-to-earnings ratio at 24.9x is attractive compared to the broader CN market's average of 36.9x, suggesting potential undervaluation. With earnings growth outpacing the industry by a significant margin and positive free cash flow, it appears well-positioned within its niche market segment.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Mustang BatteryLtd.

Understand Zhejiang Mustang BatteryLtd's track record by examining our Past report.

Ningbo Kangqiang Electronics (SZSE:002119)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Kangqiang Electronics Co., Ltd, along with its subsidiaries, is engaged in the manufacturing and sale of semiconductor packaging materials in China, with a market capitalization of CN¥5.78 billion.

Operations: The company generates revenue primarily from the sale of semiconductor packaging materials. It focuses on cost management to optimize profitability, with a notable emphasis on its net profit margin, which has shown significant variation across reporting periods.

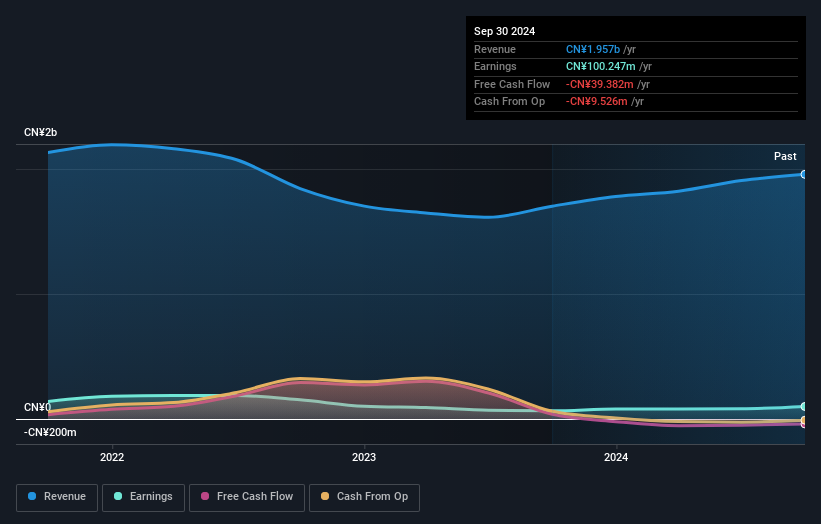

Ningbo Kangqiang Electronics, a smaller player in the semiconductor space, recently reported notable financial performance. Its earnings grew by 53.9% over the past year, outpacing the industry average of 12.1%. The company also reduced its debt to equity ratio from 64.6% to 50.1% over five years, indicating improved financial health. Despite a price-to-earnings ratio of 58.1x being below the industry average of 63.6x, earnings have declined by an annual rate of 1.7% over five years, which could be concerning for long-term growth prospects but highlights potential value opportunities within its sector context.

Where To Now?

- Get an in-depth perspective on all 4640 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Mustang BatteryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605378

Zhejiang Mustang BatteryLtd

Zhejiang MustangBattery Co.,Ltd engages in the research and development, production, and sale of dry batteries in China.

Flawless balance sheet with proven track record.