- China

- /

- Electronic Equipment and Components

- /

- SZSE:300811

3 Growth Companies With High Insider Ownership And Up To 28% Revenue Growth

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment around domestic policies and geopolitical developments, investors are increasingly focusing on growth opportunities. In this environment, companies with high insider ownership can be particularly attractive as they often signal strong confidence from those who know the business best, especially when coupled with impressive revenue growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Medley (TSE:4480) | 34% | 31.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

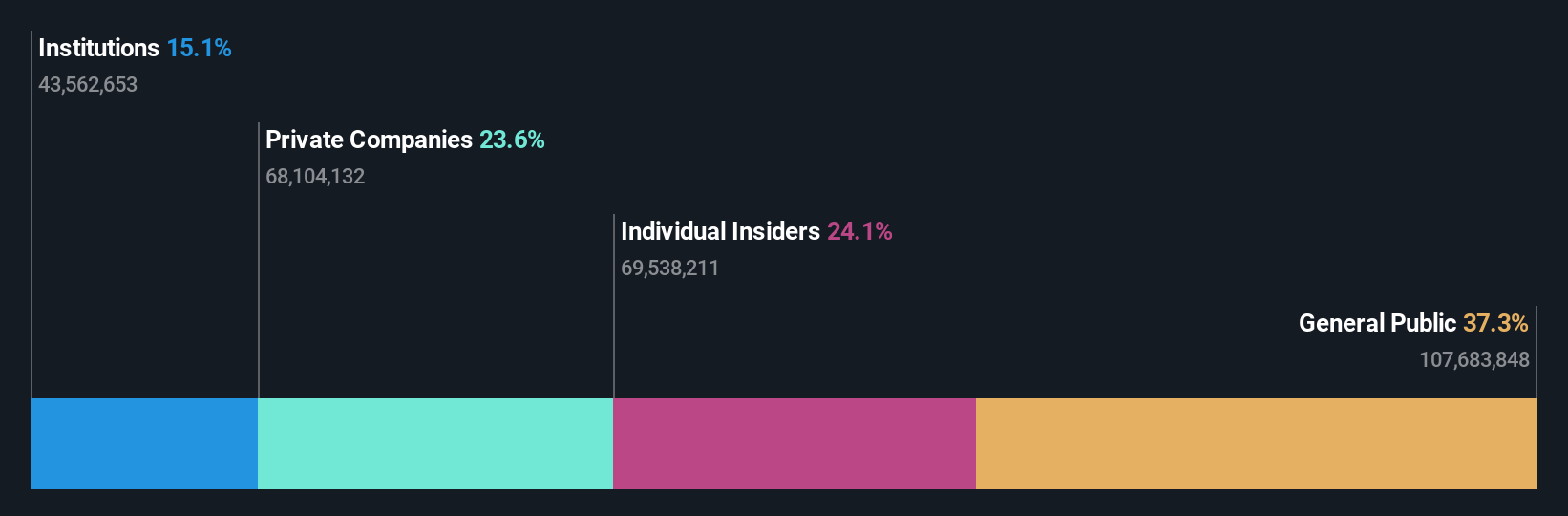

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry, with a market capitalization of approximately CN¥14.63 billion.

Operations: ArcSoft Corporation Limited generates revenue through its algorithm and software solutions in the computer vision sector globally.

Insider Ownership: 34.5%

Revenue Growth Forecast: 28.5% p.a.

ArcSoft has demonstrated robust revenue growth, reporting CNY 573.68 million for the first nine months of 2024, up from CNY 502.81 million a year ago. Earnings increased by 11.7% over the past year, with forecasts suggesting significant annual profit growth of 40.7%, outpacing the Chinese market average. Despite high volatility in its share price and an unstable dividend history, ArcSoft's revenue is expected to grow at a strong rate of 28.5% annually.

- Unlock comprehensive insights into our analysis of ArcSoft stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of ArcSoft shares in the market.

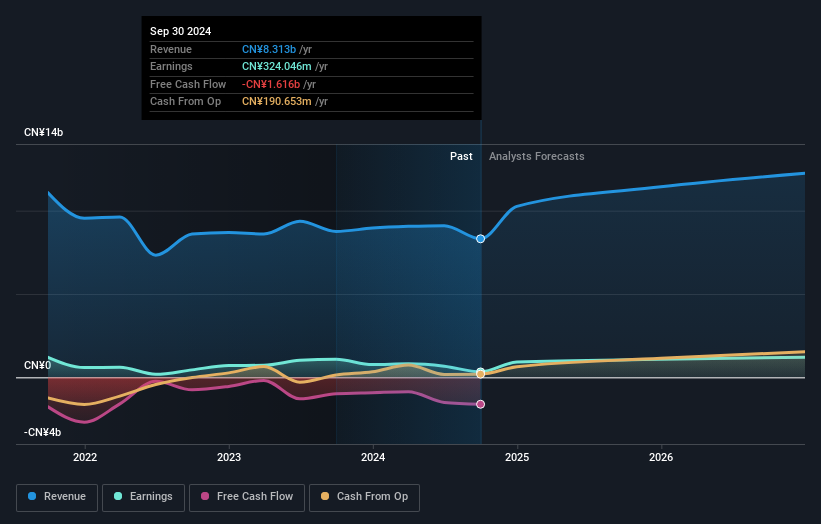

Beijing Originwater Technology (SZSE:300070)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Originwater Technology Co., Ltd. operates in the water treatment business both in China and internationally, with a market cap of CN¥21.35 billion.

Operations: Revenue segments for the company include water treatment services and related operations both domestically and internationally.

Insider Ownership: 14.1%

Revenue Growth Forecast: 14.3% p.a.

Beijing Originwater Technology is experiencing challenges, with a reported net loss of CNY 42.94 million for the first nine months of 2024, contrasting last year's profit. Despite this, its earnings are forecast to grow significantly at 35.36% annually, surpassing the Chinese market average. However, revenue growth is expected to be moderate at 14.3%, and profit margins have declined from last year’s figures. The company's debt coverage remains a concern due to insufficient operating cash flow.

- Get an in-depth perspective on Beijing Originwater Technology's performance by reading our analyst estimates report here.

- The analysis detailed in our Beijing Originwater Technology valuation report hints at an inflated share price compared to its estimated value.

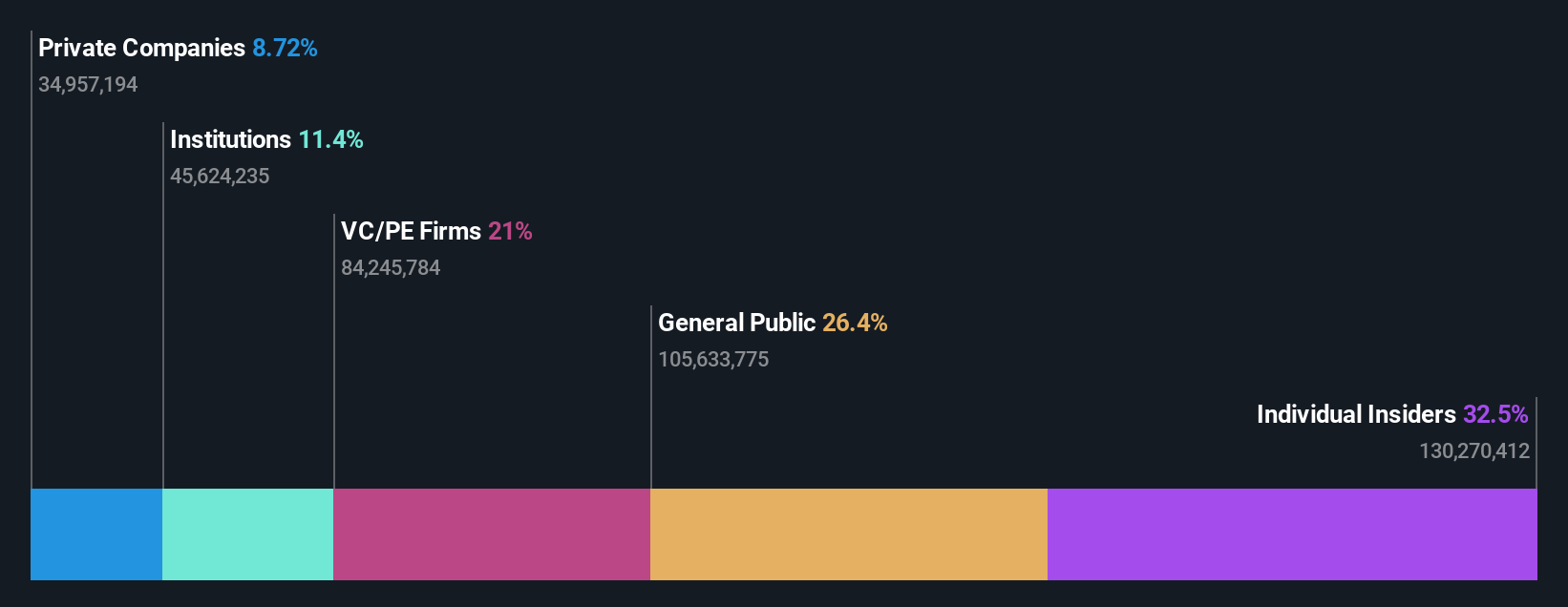

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and components for electronic equipment, with a market cap of CN¥13.93 billion.

Operations: POCO Holding Co., Ltd. generates its revenue primarily from the development, production, and sale of alloy soft magnetic powder and cores, along with related inductance components for electronic equipment.

Insider Ownership: 24.8%

Revenue Growth Forecast: 25.6% p.a.

POCO Holding has demonstrated strong growth, with earnings increasing by 41% over the past year and revenue reaching CNY 1.23 billion for the first nine months of 2024. The company's earnings are forecast to grow significantly at 26.59% annually, exceeding the Chinese market average. Despite a lower-than-industry-average Price-To-Earnings ratio of 39.5x, POCO's Return on Equity is expected to remain low at 19.7%. Insider trading activity shows no substantial buying or selling in recent months.

- Click here and access our complete growth analysis report to understand the dynamics of POCO Holding.

- Upon reviewing our latest valuation report, POCO Holding's share price might be too optimistic.

Turning Ideas Into Actions

- Embark on your investment journey to our 1516 Fast Growing Companies With High Insider Ownership selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300811

POCO Holding

Develops, produces, and sells alloy soft magnetic powder, and alloy soft magnetic core and related inductance components for the downstream users of electricity electronic equipment.

Flawless balance sheet with high growth potential.