In the current market landscape, small-cap stocks have captured attention as they join their larger peers in reaching record highs, with the Russell 2000 Index hitting a new peak amidst robust trading activity. Despite geopolitical tensions and tariff concerns, economic indicators such as rising personal income and spending suggest a resilient consumer base supporting these gains. In this environment, identifying undiscovered gems involves looking at companies that not only demonstrate potential for growth but also possess resilience to navigate economic uncertainties effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Bangkok Life Assurance (SET:BLA)

Simply Wall St Value Rating: ★★★★★☆

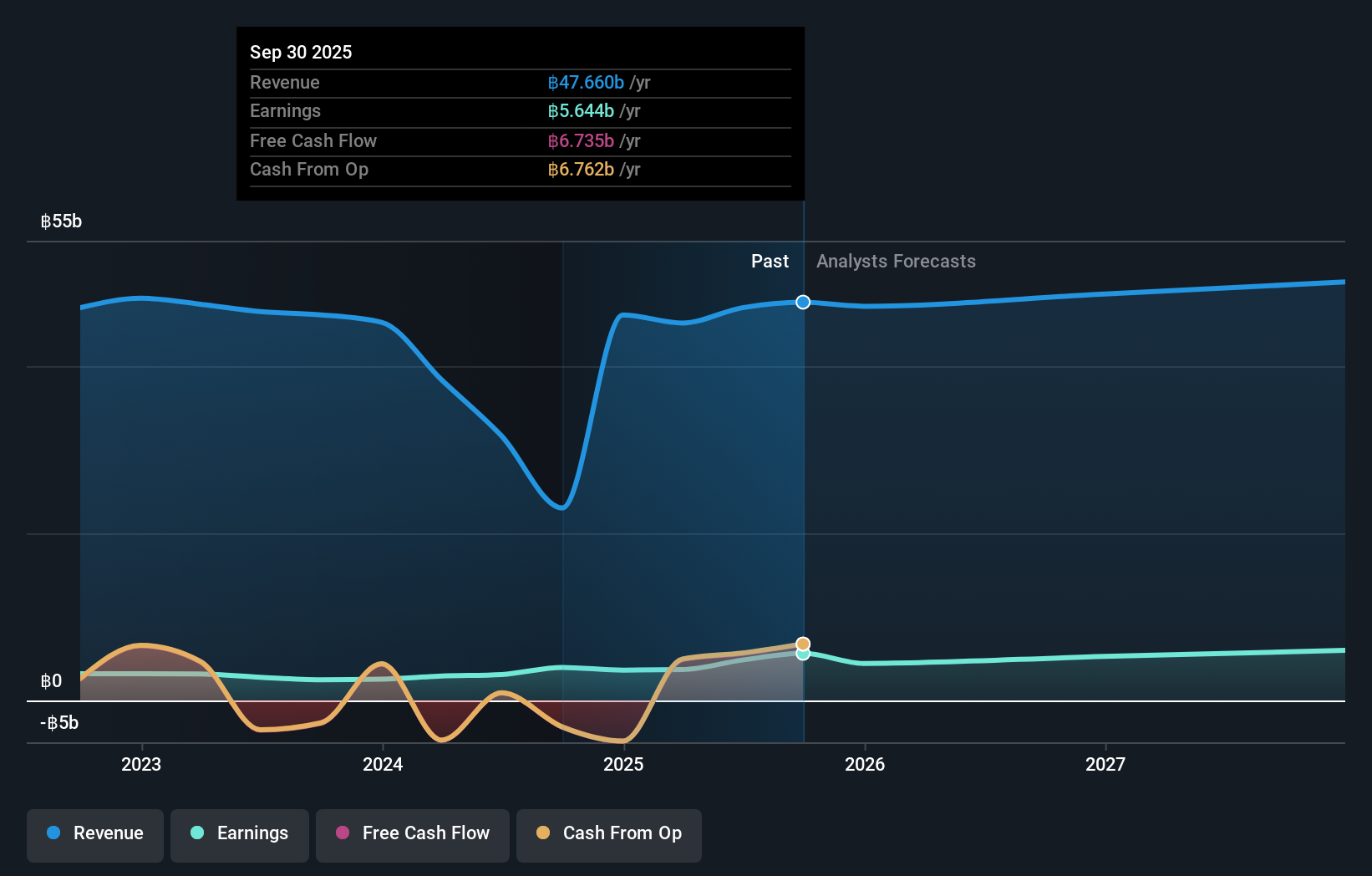

Overview: Bangkok Life Assurance Public Company Limited, with a market cap of THB35.52 billion, offers life insurance services to both individuals and corporates in Thailand through its subsidiaries.

Operations: BLA generates revenue primarily from its life insurance business, amounting to THB45.65 billion.

Bangkok Life Assurance, a nimble player in the insurance sector, showcases an intriguing profile with its earnings growing 22.6% last year, outpacing the industry average of 10.9%. Trading at 14.4% below estimated fair value suggests potential undervaluation. Despite recent volatility and being dropped from the FTSE All-World Index, BLA remains debt-free with high-quality earnings. The third quarter saw revenue at THB 12.77 billion and net income of THB 614 million, slightly lower than a year ago but nine-month figures showed improvement in net income to THB 2.67 billion from THB 2.19 billion previously.

Xinhuanet (SHSE:603888)

Simply Wall St Value Rating: ★★★★★★

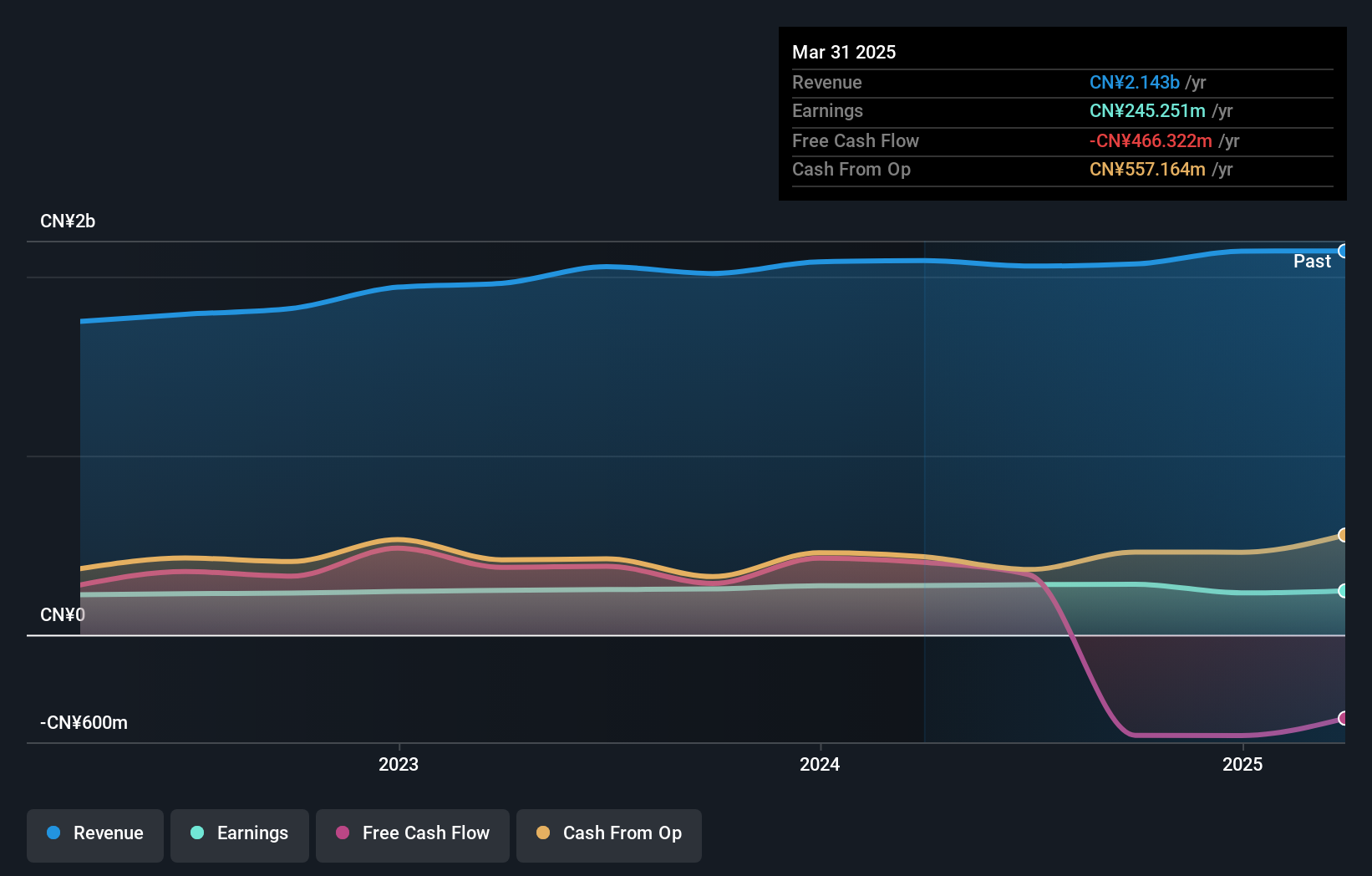

Overview: Xinhuanet Co., Ltd. operates a news information service portal in China with a market capitalization of CN¥13.11 billion.

Operations: Xinhuanet Co., Ltd. generates revenue primarily through its news information service portal in China. The company focuses on monetizing its digital content and advertising services, which are key components of its revenue model. Gross profit margin trends indicate fluctuations over recent periods, reflecting changes in cost management and pricing strategies.

Xinhuanet, with its nimble market presence, showcases a promising trajectory in the media sector. Over the past year, earnings growth of 10.2% outpaced the industry average of -10.2%, highlighting its robust performance. The company operates debt-free and boasts a favorable price-to-earnings ratio of 46.4x compared to the industry average of 52.2x, suggesting potential undervaluation in this context. Recent earnings for nine months ending September 2024 reflected net income at CNY 155 million, up from CNY 147 million previously, indicating steady profitability despite slightly lower sales figures at CNY 1,210 million from last year's CNY 1,222 million.

Genimous Technology (SZSE:000676)

Simply Wall St Value Rating: ★★★★☆☆

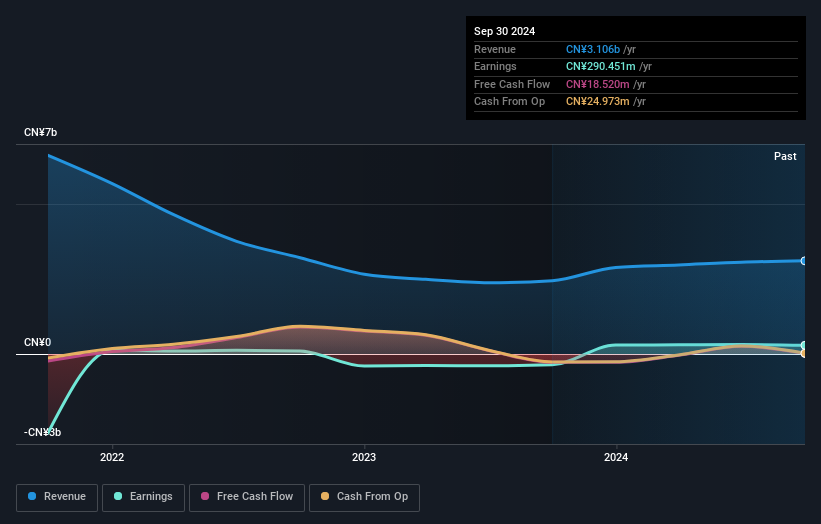

Overview: Genimous Technology Co., Ltd. operates in the Internet media and digital marketing sectors both in China and globally, with a market capitalization of CN¥12.70 billion.

Operations: Genimous Technology's revenue is primarily derived from its operations in Internet media and digital marketing. The company focuses on optimizing cost structures to enhance financial performance, with particular attention to managing expenses related to these segments. Its net profit margin reflects the efficiency of its business model within these sectors.

Genimous Technology, a smaller player in the tech industry, has shown resilience by becoming profitable this year, despite a volatile share price over the past three months. The company's debt to equity ratio rose from 2.8 to 5.6 over five years but maintains more cash than total debt, indicating financial stability. Recent earnings for nine months ending September 2024 showed sales at CNY 2.3 billion and revenue at CNY 2.37 billion, with net income slightly down to CNY 155 million compared to last year’s CNY 163 million. The company recently approved changes in its business scope and articles of association during an extraordinary general meeting in November 2024.

Where To Now?

- Delve into our full catalog of 4640 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000676

Genimous Technology

Engages in Internet media and digital marketing businesses in China and internationally.

Adequate balance sheet with acceptable track record.