Discover Zhejiang Rongtai Electric MaterialLtd And 2 More Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets continue to experience record highs, driven by a mix of domestic policy decisions and geopolitical developments, investors are increasingly focused on identifying stocks that may be trading below their estimated value. In this environment of robust market activity, discovering undervalued stocks like Zhejiang Rongtai Electric Material Ltd can offer potential opportunities for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY41.22 | TRY82.15 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1455.00 | ¥2892.66 | 49.7% |

| Enento Group Oyj (HLSE:ENENTO) | €18.02 | €35.91 | 49.8% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.84 | €15.60 | 49.7% |

| First Advantage (NasdaqGS:FA) | US$19.37 | US$38.63 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | US$203.19 | US$404.34 | 49.7% |

| Energy One (ASX:EOL) | A$5.30 | A$10.56 | 49.8% |

| Sands China (SEHK:1928) | HK$20.40 | HK$40.66 | 49.8% |

Let's review some notable picks from our screened stocks.

Zhejiang Rongtai Electric MaterialLtd (SHSE:603119)

Overview: Zhejiang Rongtai Electric Material Co., Ltd. (SHSE:603119) operates in the electric materials industry and has a market capitalization of CN¥7.58 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment information for Zhejiang Rongtai Electric Material Co., Ltd.

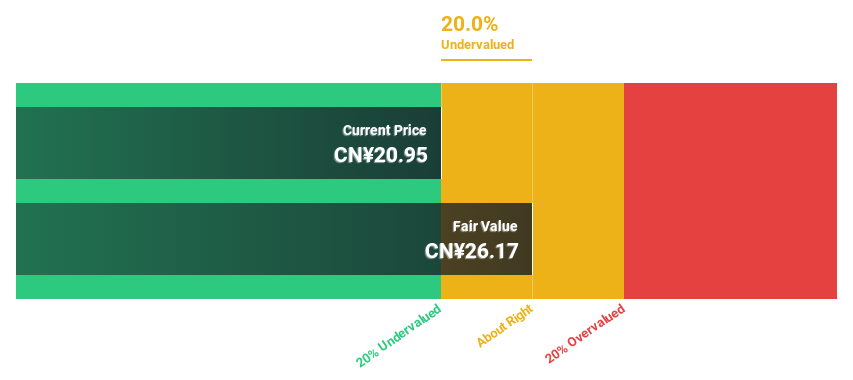

Estimated Discount To Fair Value: 21.1%

Zhejiang Rongtai Electric Material Ltd. is trading at CN¥20.69, below its fair value estimate of CN¥26.21, making it highly undervalued based on discounted cash flow analysis. Earnings grew 40.8% last year and are forecast to grow significantly at 33.41% annually over the next three years, outpacing the market's growth rate. Recent earnings reports show revenue increased to CN¥808.96 million from CN¥582.62 million a year ago, reflecting strong financial performance despite low return on equity forecasts of 17.7%.

- The analysis detailed in our Zhejiang Rongtai Electric MaterialLtd growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Zhejiang Rongtai Electric MaterialLtd stock in this financial health report.

Peric Special Gases (SHSE:688146)

Overview: Peric Special Gases Co., Ltd. focuses on the research, development, production, and sale of electronic special gases and trifluoromethanesulfonic acid series products in China, with a market cap of CN¥17.05 billion.

Operations: Revenue segments for SHSE:688146 include electronic special gases and trifluoromethanesulfonic acid series products in China.

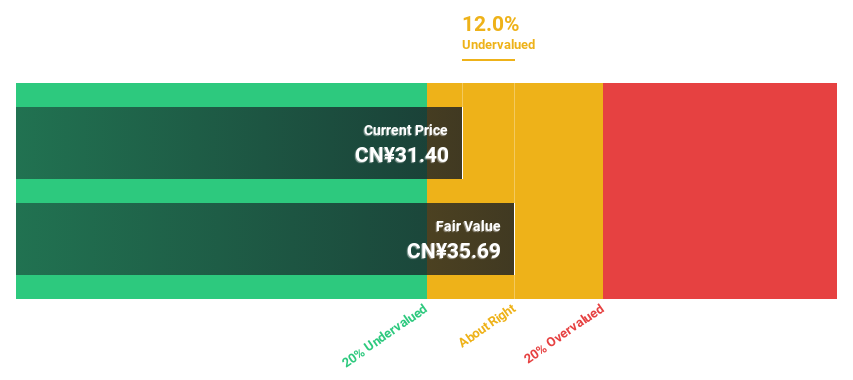

Estimated Discount To Fair Value: 10.2%

Peric Special Gases is trading at CN¥32.02, slightly below its fair value of CN¥35.66, suggesting it is undervalued based on cash flow analysis. The company's revenue grew to CN¥1.38 billion from CN¥1.2 billion year-on-year, though net income decreased to CN¥234.09 million from CN¥249.04 million, highlighting mixed financial results with significant earnings growth forecasted at 24% annually despite low return on equity projections of 8.3%.

- Our comprehensive growth report raises the possibility that Peric Special Gases is poised for substantial financial growth.

- Take a closer look at Peric Special Gases' balance sheet health here in our report.

Chroma ATE (TWSE:2360)

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software and hardware for computers and peripherals as well as various testing systems and power supplies across Taiwan, China, the United States, and internationally with a market cap of NT$181.54 billion.

Operations: The company's revenue segments include NT$30.84 billion from the Measuring Instruments Business and NT$1.69 billion from Automated Transport Engineering.

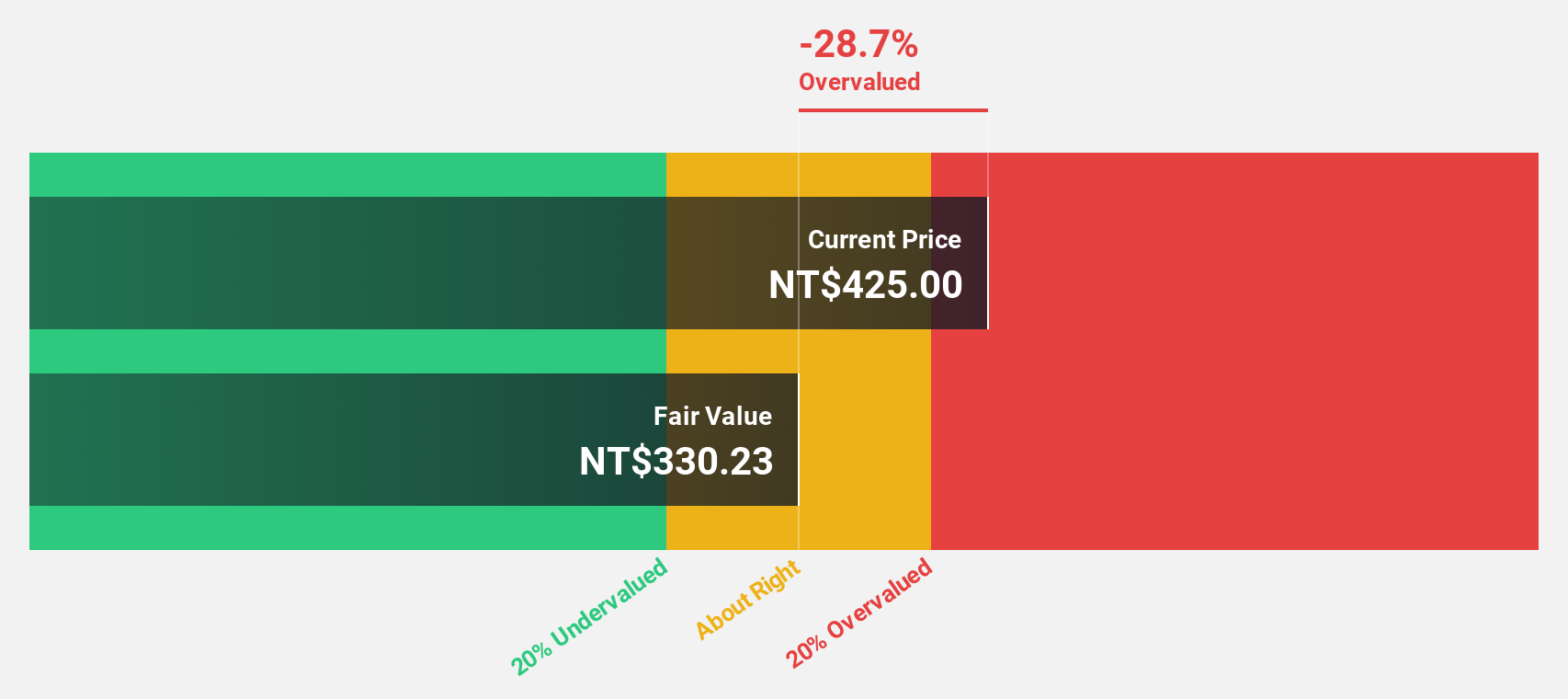

Estimated Discount To Fair Value: 10.4%

Chroma ATE, trading at NT$422, is priced below its fair value of NT$470.98, indicating undervaluation based on cash flows. Recent earnings reveal revenue growth to TWD 5.63 billion from TWD 4.85 billion year-on-year and net income increase to TWD 1.43 billion from TWD 1.23 billion, reflecting robust financial performance with expected significant annual earnings growth of over 20%, despite a highly volatile share price in recent months.

- Our expertly prepared growth report on Chroma ATE implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Chroma ATE with our comprehensive financial health report here.

Next Steps

- Explore the 890 names from our Undervalued Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688146

Peric Special Gases

Engages in the research and development, production, and sale of electronic special gases and trifluoromethanesulfonic acid series products in China.

Flawless balance sheet with reasonable growth potential.