- China

- /

- Electrical

- /

- SHSE:603119

Undiscovered Gems with Strong Fundamentals for December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with small-cap indices like the Russell 2000 joining their larger peers in this upward trajectory, investor sentiment is buoyed by a mix of domestic policy shifts and geopolitical developments. In this environment of economic optimism tempered by manufacturing slumps and tariff uncertainties, identifying stocks with strong fundamentals becomes crucial for navigating potential market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Rongtai Electric MaterialLtd (SHSE:603119)

Simply Wall St Value Rating: ★★★★★☆

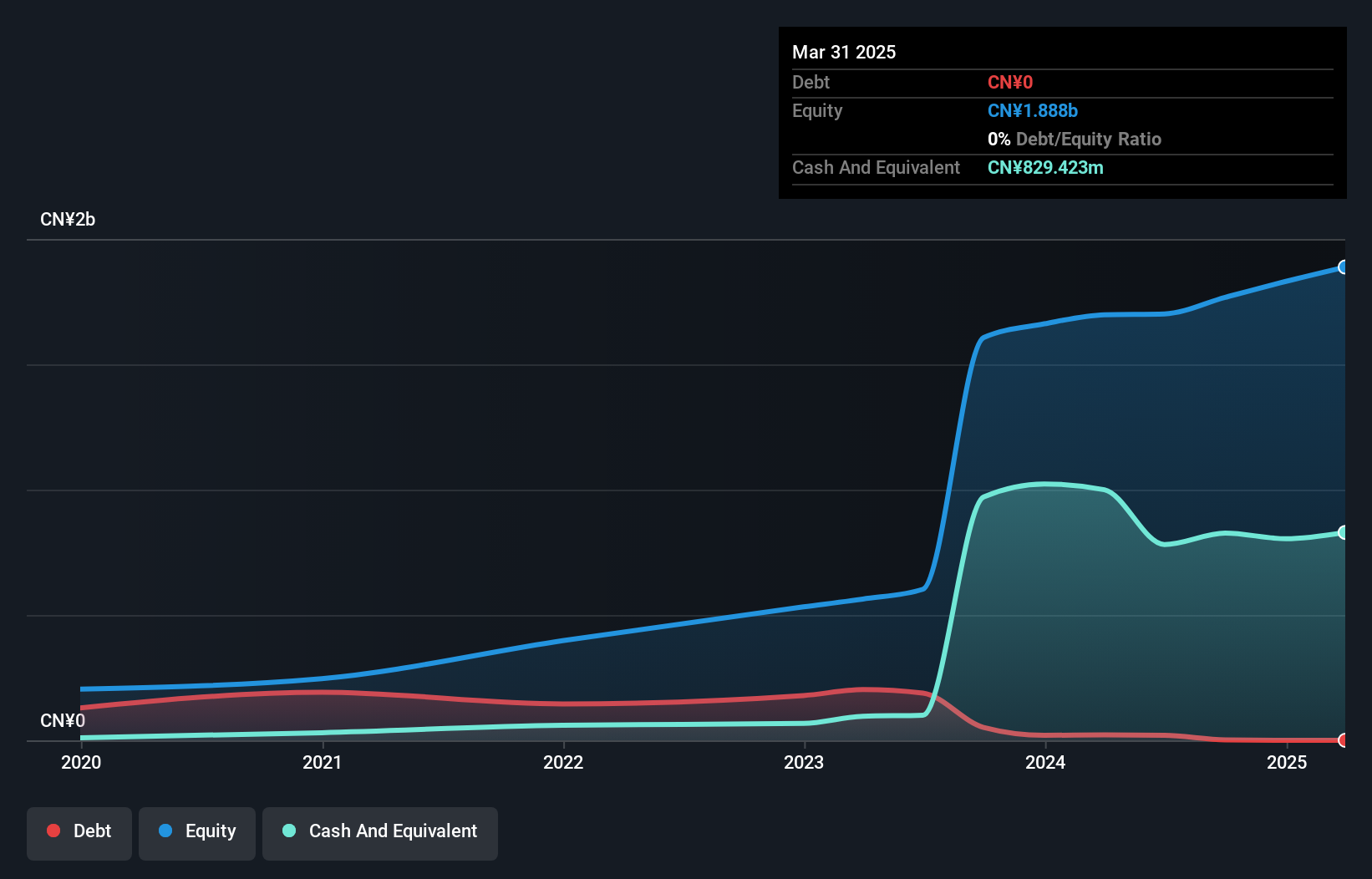

Overview: Zhejiang Rongtai Electric Material Co., Ltd. operates in the electric materials industry with a market cap of CN¥7.58 billion.

Operations: Rongtai Electric Material generates revenue through its electric materials segment. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of its operations and profitability relative to total revenue.

Zhejiang Rongtai Electric Material Co.,Ltd. showcases a robust performance, with earnings growth of 40.8% over the past year, outpacing the Electrical industry’s 1.1%. Trading at 21.1% below its estimated fair value, it appears to offer potential upside for investors seeking value in smaller companies. For the nine months ending September 2024, revenue reached CNY 808.96 million compared to CNY 582.62 million last year, while net income rose to CNY 166.55 million from CNY 117.68 million previously reported; basic earnings per share increased from CNY 0.38 to CNY 0.46 during this period, reflecting improved profitability and operational efficiency.

Guangdong Insight Brand Marketing GroupLtd (SZSE:300781)

Simply Wall St Value Rating: ★★★★★☆

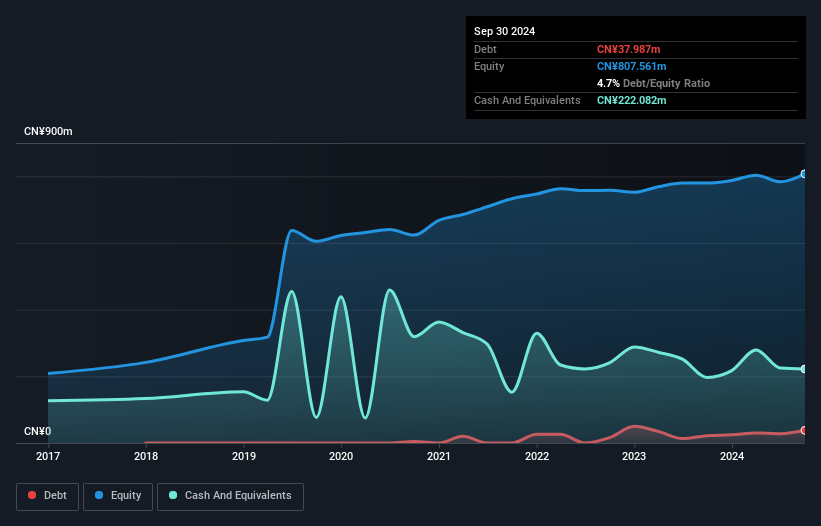

Overview: Guangdong Insight Brand Marketing Group Ltd (SZSE:300781) focuses on providing comprehensive brand marketing services and has a market capitalization of CN¥7.43 billion.

Operations: The company generates revenue primarily from its direct marketing segment, which amounts to CN¥849.93 million.

Guangdong Insight Brand Marketing Group, a nimble player in its field, has demonstrated robust growth with earnings climbing 34% over the past year, outpacing the media industry's -10% performance. The company reported sales of CNY 700.94 million for the first nine months of 2024, up from CNY 387.45 million in the same period last year, reflecting strong revenue momentum. Net income also saw an uptick to CNY 36.27 million from CNY 32.82 million a year prior. Despite this progress, their share price has been highly volatile recently and they have increased their debt to equity ratio from 0% to nearly 5% over five years.

Voneseals Technology (Shanghai) (SZSE:301161)

Simply Wall St Value Rating: ★★★★★★

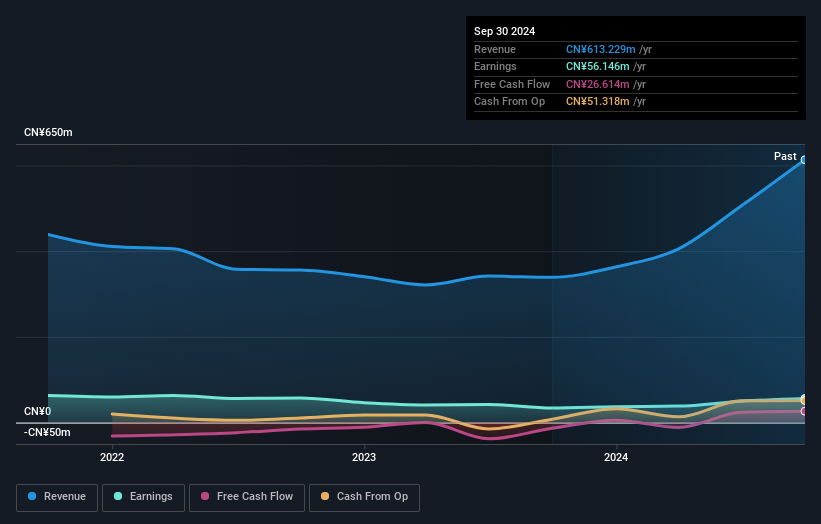

Overview: Voneseals Technology (Shanghai) Inc. focuses on the research, development, production, and sale of hydraulic and pneumatic sealing products in China, with a market cap of CN¥2.36 billion.

Operations: Voneseals Technology generates revenue primarily from the sale of hydraulic and pneumatic sealing products within China. The company's cost structure includes expenses related to research, development, and production activities. Its financial performance is characterized by its net profit margin trends over recent periods.

Voneseals Technology, a smaller player in the machinery sector, has shown impressive financial resilience. Over the past year, earnings surged by 64.3%, outpacing the industry average of -0.4%. The company's debt to equity ratio improved from 14.6% to 9.3% over five years, indicating stronger financial health. Recent earnings reports highlight net income growth to CNY 50.38 million from CNY 31.32 million a year ago, with basic EPS rising to CNY 0.42 from CNY 0.26 last year. Despite historical declines in earnings over five years at an annual rate of 11%, current performance and high-quality past earnings suggest potential for future growth within its niche market segment.

Taking Advantage

- Access the full spectrum of 4640 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Rongtai Electric MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603119

Zhejiang Rongtai Electric MaterialLtd

Zhejiang Rongtai Electric Material Co.,Ltd.

High growth potential with solid track record.