Discovering National Agricultural Development And 2 Emerging Small Caps With Robust Foundations

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by geopolitical tensions and economic shifts, small-cap stocks have made notable strides with the Russell 2000 Index reaching new highs. In this dynamic environment, identifying robust small-cap companies with solid foundations can be key to uncovering potential investment opportunities, as they often exhibit resilience and adaptability in changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

We'll examine a selection from our screener results.

National Agricultural Development (SASE:6010)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Agricultural Development Company focuses on the production of agricultural and livestock products in Saudi Arabia and internationally, with a market cap of SAR7.49 billion.

Operations: The company's primary revenue streams are derived from its Dairy and Food segment, contributing SAR3.06 billion, and its Agriculture segment, adding SAR152.88 million. The net profit margin trend is a key area to monitor for insights into profitability dynamics over time.

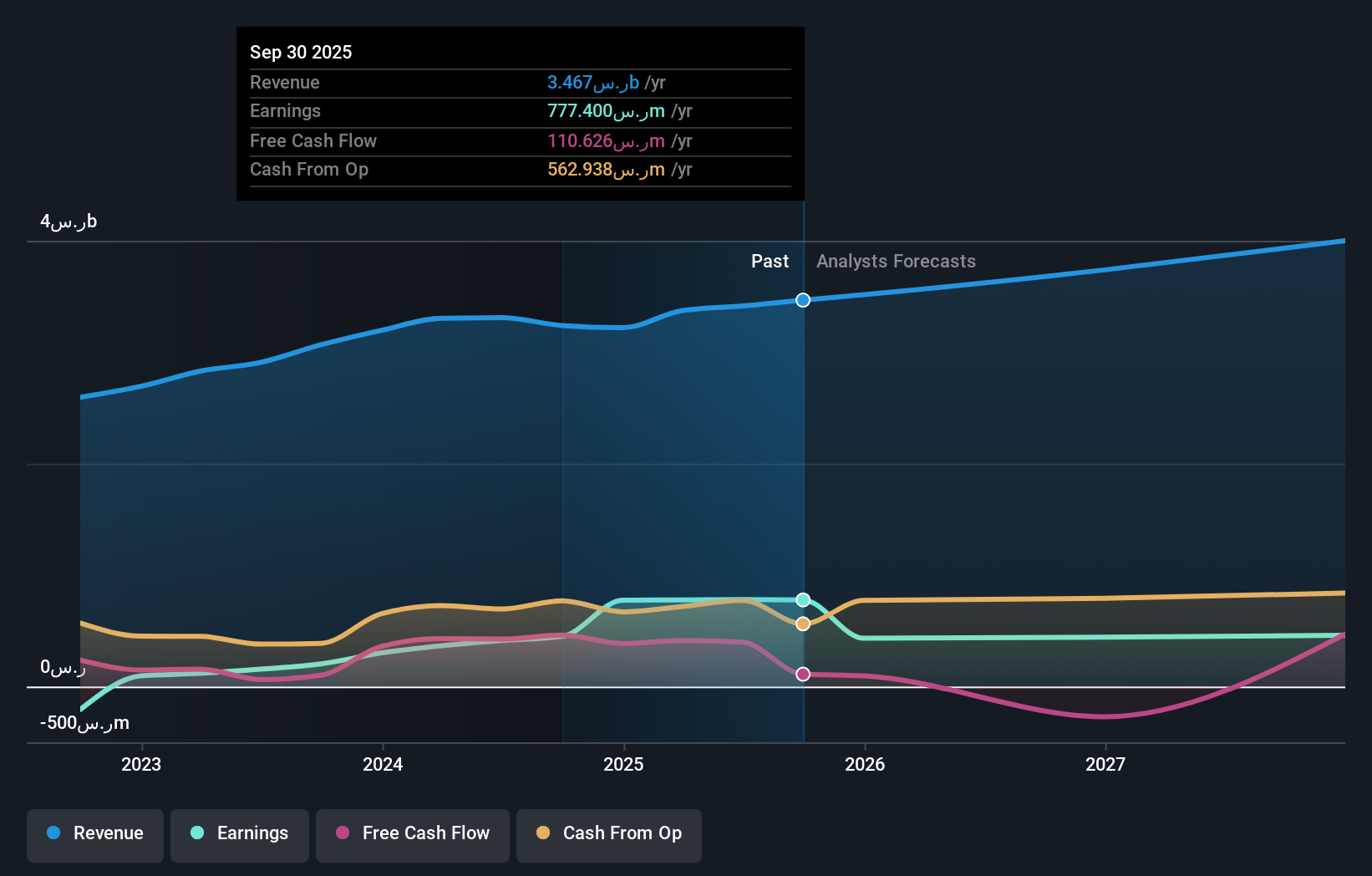

National Agricultural Development, a smaller player in its field, has shown impressive earnings growth of 121.7% over the past year, outpacing the broader food industry at 25.1%. Despite a dip in third-quarter sales to SAR 791.09 million from SAR 861.1 million last year, net income rose to SAR 113.38 million from SAR 75.27 million, suggesting improved operational efficiency or cost management strategies might be at play. The price-to-earnings ratio stands attractively below the SA market average at 16.6x, indicating potential undervaluation amidst forecasted revenue growth of 10.34% annually despite expected earnings contraction by an average of 3.5% per year for the next three years.

- Take a closer look at National Agricultural Development's potential here in our health report.

Understand National Agricultural Development's track record by examining our Past report.

Suzhou Sunmun Technology (SZSE:300522)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Sunmun Technology Co., Ltd. is involved in the research, production, and sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals in China with a market cap of CN¥4.33 billion.

Operations: Sunmun Technology generates revenue primarily from the sale of nano-coloring materials, functional nano-dispersions, special additives, intelligent color matching systems, and electronic chemicals. The company's net profit margin has shown notable variability over recent periods.

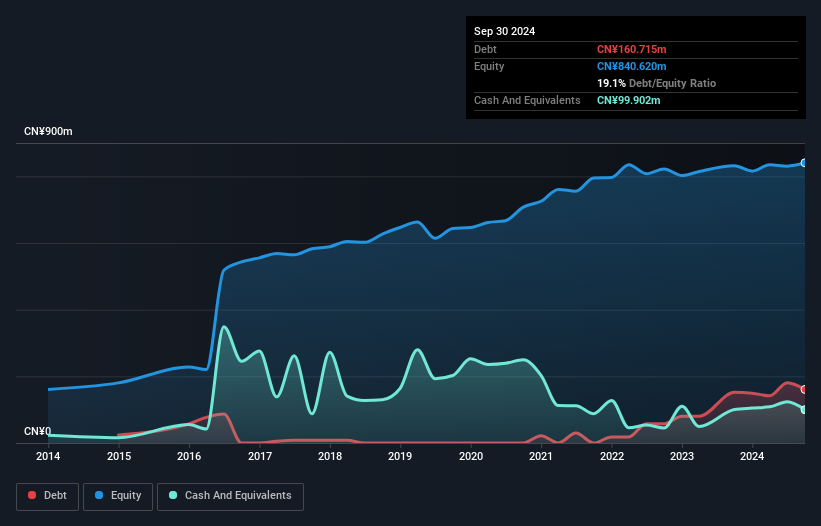

Suzhou Sunmun Technology, a small player in the tech industry, has shown promising financial growth. Over the past year, earnings surged by 124.4%, outpacing the chemicals sector's -5% performance. The company's debt to equity ratio rose from 0% to 19.1% over five years but remains manageable with a satisfactory net debt to equity ratio of 7.2%. Recent earnings for nine months ending September 2024 reported sales of CNY 525.8 million and net income of CNY 35.96 million, reflecting slight improvements from last year’s figures. A private placement aims to raise up to CNY 310 million through new share issuance at CNY 9.41 each, indicating strategic expansion plans supported by existing investors like Jiangsu Fenghui New Energy Development Co., Ltd., subject to regulatory approvals and shareholder consent.

- Unlock comprehensive insights into our analysis of Suzhou Sunmun Technology stock in this health report.

Gain insights into Suzhou Sunmun Technology's past trends and performance with our Past report.

Brilliance Technology (SZSE:300542)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Brilliance Technology Co., Ltd., along with its subsidiaries, offers information solutions and services in China, with a market capitalization of CN¥7.76 billion.

Operations: Brilliance Technology generates revenue primarily through its information solutions and services in China. The company's financial performance is reflected in its market capitalization of CN¥7.76 billion.

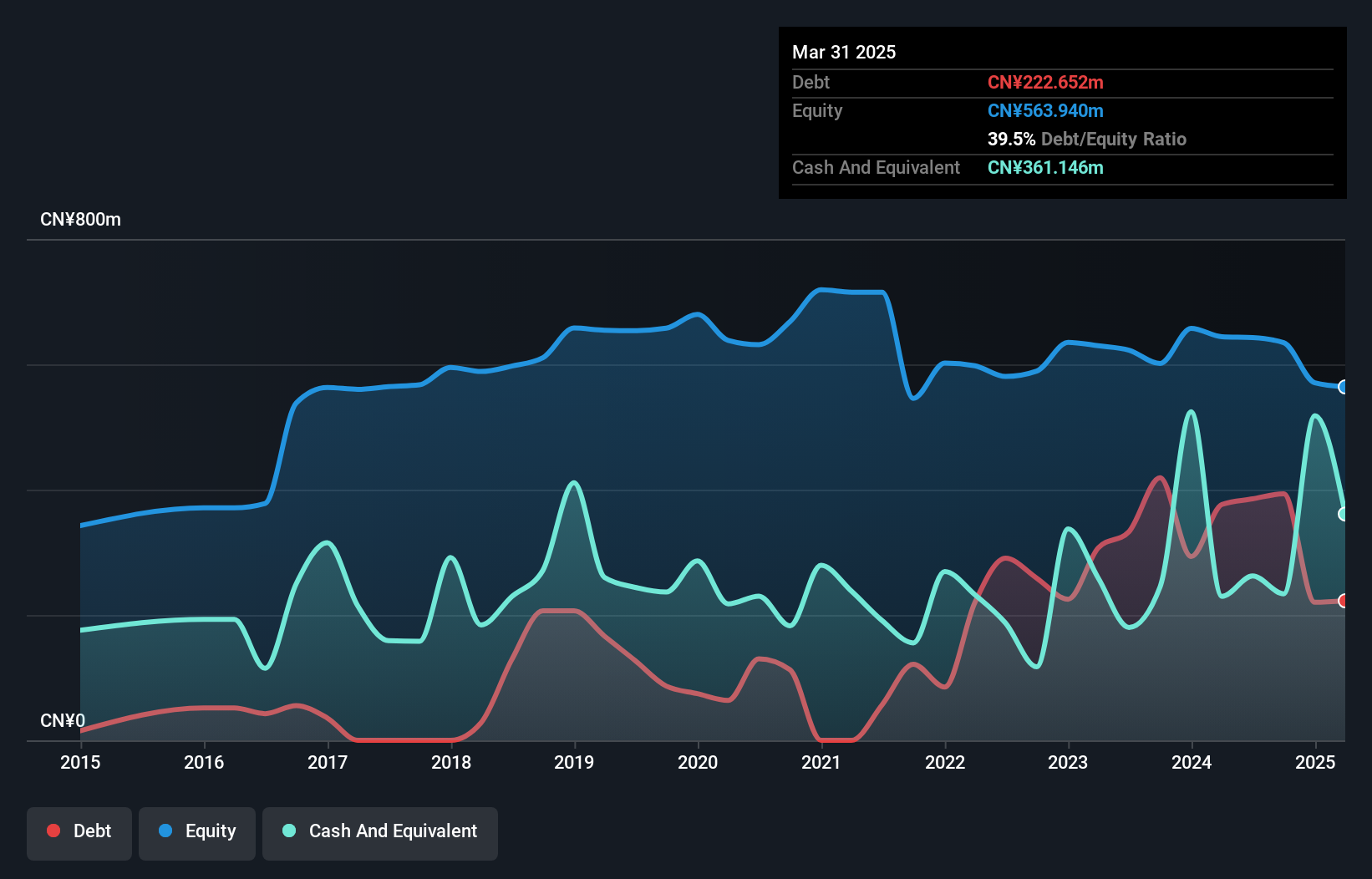

Brilliance Technology, a nimble player in the tech sector, has seen its earnings grow by 64.7% over the past year, outpacing the IT industry average of -8.1%. Despite this impressive growth, their net debt to equity ratio has climbed from 13.1% to 62% over five years, indicating rising leverage concerns. The company's EBIT covers interest payments at a healthy 3.5x rate, suggesting manageable debt servicing for now. However, recent financials reveal sales have dropped to CN¥672 million from CN¥849 million last year with a net loss shrinking slightly to CN¥17 million from CN¥19 million previously.

- Click here and access our complete health analysis report to understand the dynamics of Brilliance Technology.

Evaluate Brilliance Technology's historical performance by accessing our past performance report.

Summing It All Up

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4637 more companies for you to explore.Click here to unveil our expertly curated list of 4640 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brilliance Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300542

Brilliance Technology

Provides information solutions and services in China.

Adequate balance sheet with acceptable track record.