Asian Penny Stock Highlights: Winton Land And 2 More Top Picks

Reviewed by Simply Wall St

As global markets experience a surge driven by favorable trade deals, Asian stocks are also capturing investor attention with their unique opportunities. Penny stocks, though often considered a relic of past market eras, continue to offer potential value for those looking to invest in smaller or newer companies. In this article, we explore three penny stocks in Asia that stand out for their financial strength and potential growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.98 | THB3.93B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.43 | HK$902.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.08 | HK$3.6B | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.495 | SGD200.62M | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.70 | SGD667.37M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.56 | SGD10.08B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.97 | THB1.43B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.245 | SGD50.79M | ✅ 4 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.59 | SGD984.92M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 981 stocks from our Asian Penny Stocks screener.

We'll examine a selection from our screener results.

Winton Land (NZSE:WIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Winton Land Limited is a land developer focusing on creating integrated and master-planned neighborhoods in New Zealand and Australia, with a market cap of NZ$613.99 million.

Operations: The company generates revenue from two main segments: Residential, contributing NZ$150.24 million, and Commercial, adding NZ$18.72 million.

Market Cap: NZ$613.99M

Winton Land, a land developer with a market cap of NZ$613.99 million, has faced challenges with its financial performance. Despite stable weekly volatility and satisfactory debt levels, the company reported a large one-off loss impacting earnings over the past year. Its short-term assets cover liabilities well, but long-term liabilities exceed these assets. Recent developments include the Ayrburn Film Hub project, expected to significantly boost local economic activity during construction. The board's recent appointment of Josh Phillips as director brings extensive real estate expertise to Winton's seasoned management team as it navigates growth opportunities and financial hurdles in the competitive landscape.

- Click to explore a detailed breakdown of our findings in Winton Land's financial health report.

- Learn about Winton Land's future growth trajectory here.

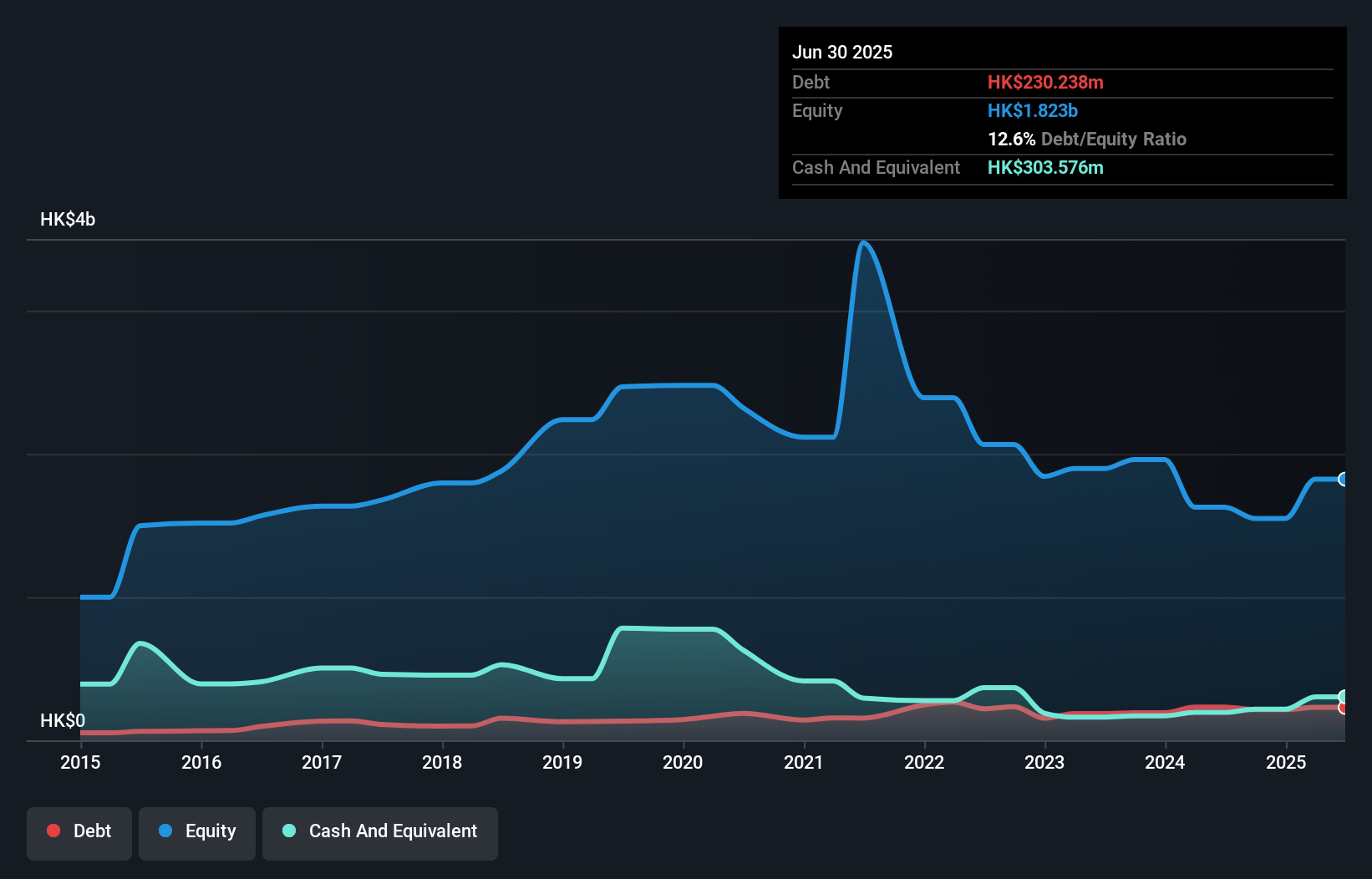

Lee's Pharmaceutical Holdings (SEHK:950)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lee's Pharmaceutical Holdings Limited is an investment holding company that develops, manufactures, markets, and sells pharmaceutical products primarily in the People's Republic of China, with a market cap of approximately HK$1.17 billion.

Operations: The company's revenue is derived from Licensed-In Products, contributing HK$553.24 million, and Proprietary and Generic Products, generating HK$846.73 million.

Market Cap: HK$1.17B

Lee's Pharmaceutical Holdings, with a market cap of HK$1.17 billion, has demonstrated significant earnings growth of 457.5% over the past year despite a declining trend over five years. The company's revenue streams from Licensed-In Products and Proprietary and Generic Products contribute substantially to its financials. While Return on Equity is low at 4.4%, the company benefits from well-covered interest payments and debt by operating cash flow, indicating sound financial management. Short-term assets exceed both short- and long-term liabilities, suggesting robust liquidity positions amidst stable weekly volatility in the stock market performance.

- Jump into the full analysis health report here for a deeper understanding of Lee's Pharmaceutical Holdings.

- Evaluate Lee's Pharmaceutical Holdings' historical performance by accessing our past performance report.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market cap of THB25.75 billion.

Operations: The company's revenue is primarily derived from real estate at THB31.52 billion, supplemented by building management, project management, and real estate brokerage services at THB2.50 billion, and the hotel business contributing THB593 million.

Market Cap: THB25.75B

Sansiri Public Company Limited, with a market cap of THB25.75 billion, faces challenges in its financial structure despite being undervalued by 9.8% compared to fair value estimates. Recent earnings declined sharply year-over-year, with net income falling to THB813.88 million from THB1,314.98 million and revenue dropping significantly as well. The company's debt level is high relative to equity at 137.9%, yet short-term assets comfortably cover both short- and long-term liabilities, indicating strong liquidity management. While dividends have decreased recently, the company maintains experienced management and board teams contributing to strategic stability amidst volatile returns.

- Click here and access our complete financial health analysis report to understand the dynamics of Sansiri.

- Evaluate Sansiri's prospects by accessing our earnings growth report.

Seize The Opportunity

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 978 more companies for you to explore.Click here to unveil our expertly curated list of 981 Asian Penny Stocks.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:950

Lee's Pharmaceutical Holdings

An investment holding company, develops, manufactures, markets, and sells pharmaceutical products in the People's Republic of China, Hong Kong, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives