Mega Lifesciences And 2 More Leading Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets experience a surge, with U.S. stock indexes nearing record highs and European indices reaching new levels, investors are keeping a close eye on inflation data and monetary policy adjustments. In this dynamic environment, dividend stocks like Mega Lifesciences offer potential stability through consistent income streams, making them an attractive consideration for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.96% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

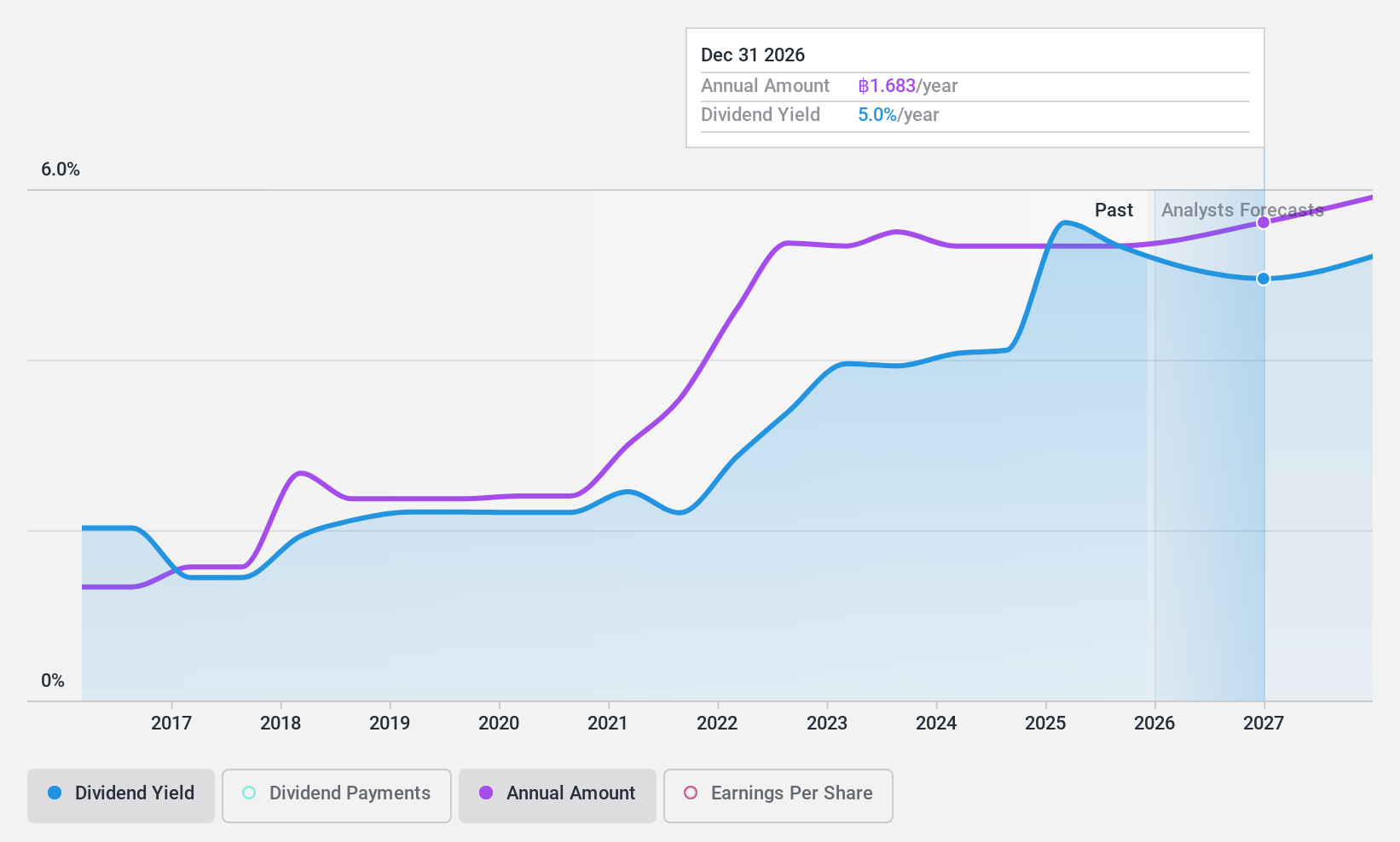

Mega Lifesciences (SET:MEGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mega Lifesciences Public Company Limited, along with its subsidiaries, produces and distributes health food supplements, prescription and over-the-counter pharmaceutical products, herbal items, vitamins, and fast-moving consumer goods across Southeast Asia and Sub-Saharan Africa; it has a market capitalization of approximately THB26.59 billion.

Operations: Mega Lifesciences generates its revenue through three primary segments: Brands at THB8.24 billion, Distribution at THB7.34 billion, and Original Equipment Manufacture (OEM) at THB289.67 million.

Dividend Yield: 5%

Mega Lifesciences' dividend payments have been volatile over the past decade, though they have increased overall. The dividends are currently covered by both earnings and cash flows, with payout ratios of 75.6% and 82.4%, respectively, suggesting sustainability despite past instability. Trading at 50.3% below estimated fair value, the stock offers potential upside but its dividend yield of 5.04% is lower than the top quartile in Thailand's market at 7.54%.

- Click here to discover the nuances of Mega Lifesciences with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Mega Lifesciences is priced lower than what may be justified by its financials.

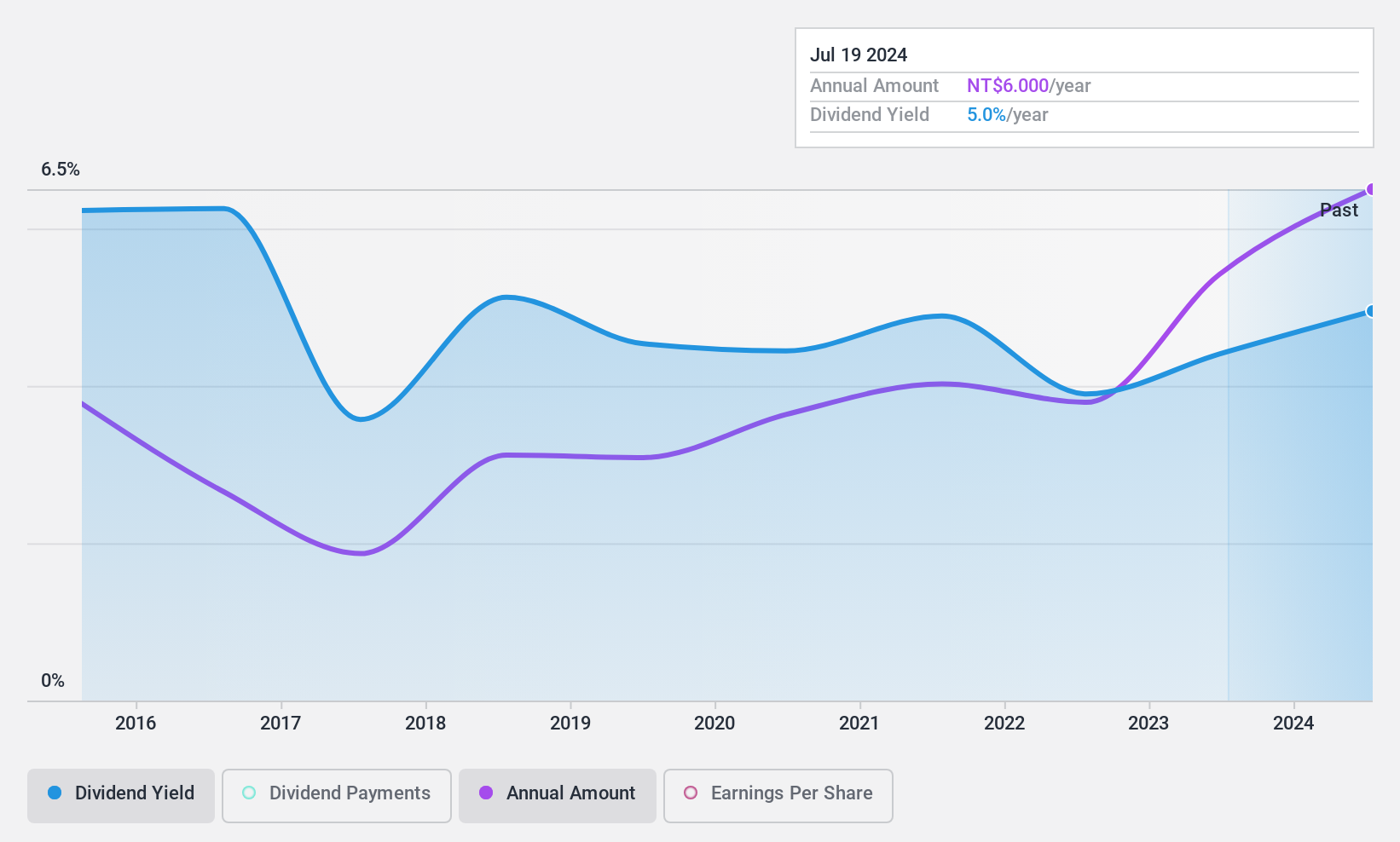

Taiwan TaxiLtd (TPEX:2640)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Taiwan Taxi Co., Ltd. offers taxi services in Taiwan and has a market capitalization of NT$7.79 billion.

Operations: Taiwan Taxi Co., Ltd.'s revenue segments include Information Media Services generating NT$2.34 billion and Sales of Platform Peripherals contributing NT$968.16 million.

Dividend Yield: 4.5%

Taiwan Taxi Ltd. offers a dividend yield in the top 25% of the Taiwan market, supported by a payout ratio of 72.1% and cash flow coverage at 74.4%. Despite these strengths, its dividend history has been volatile over the past decade, with periods of significant fluctuation. The stock's price-to-earnings ratio of 16.1x is attractive compared to the Taiwan market average, although investors should be cautious about its inconsistent dividend reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Taiwan TaxiLtd.

- According our valuation report, there's an indication that Taiwan TaxiLtd's share price might be on the expensive side.

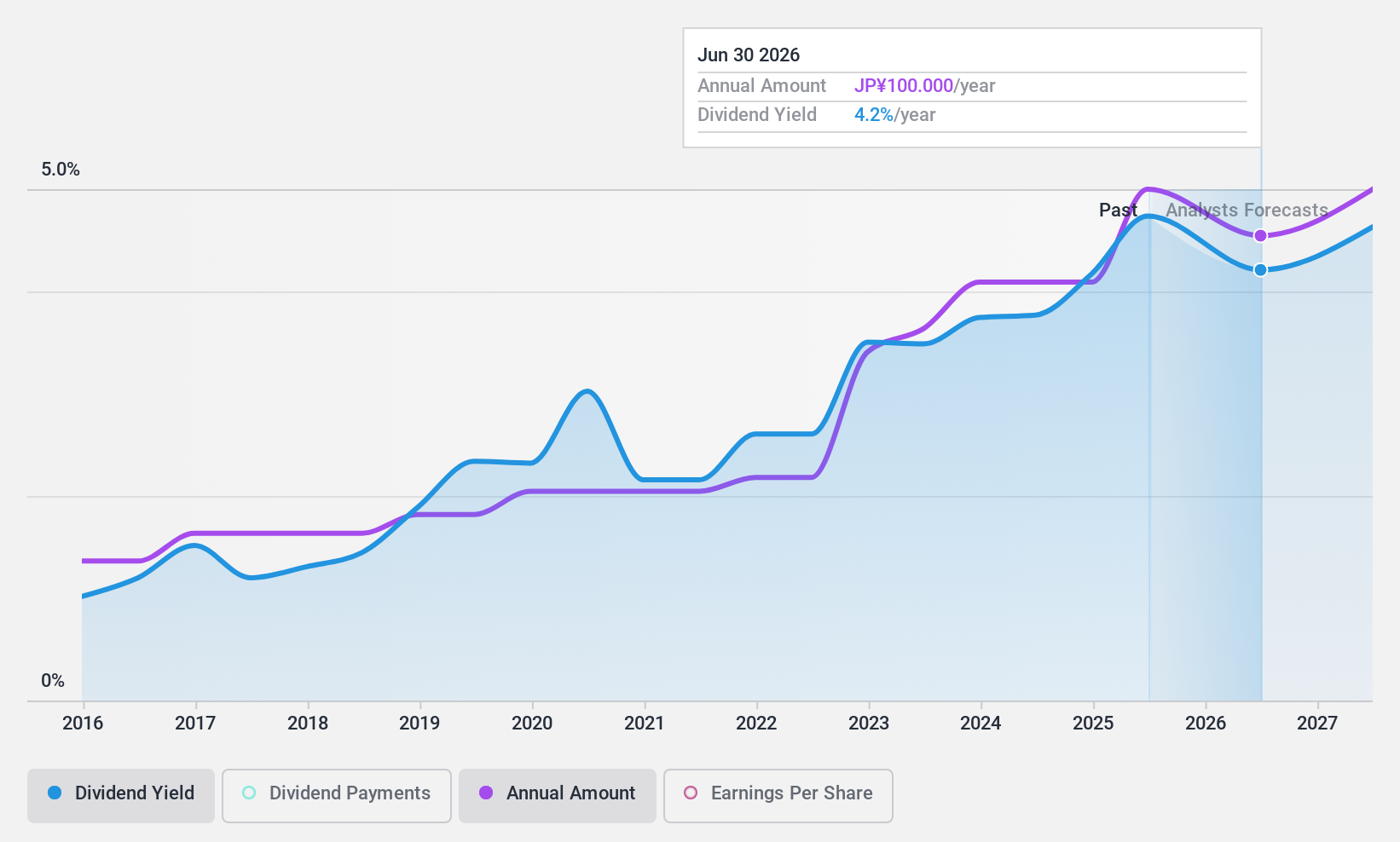

Ai Holdings (TSE:3076)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ai Holdings Corporation specializes in providing security and peripheral computer equipment, measuring devices, and card and other office equipment, with a market cap of ¥105.80 billion.

Operations: Ai Holdings Corporation generates revenue through its offerings in security and peripheral computer equipment, measuring devices, and card and other office equipment.

Dividend Yield: 4.4%

Ai Holdings offers a dividend yield of 4.41%, placing it in the top 25% of JP market payers. Despite its low payout ratio of 10.5%, dividends are not well covered by cash flows, with a high cash payout ratio of 140.1%. Earnings grew significantly last year but are expected to decline substantially over the next three years. The company announced a special dividend, enhancing its stable and reliable decade-long dividend history amidst these financial dynamics.

- Unlock comprehensive insights into our analysis of Ai Holdings stock in this dividend report.

- Our valuation report unveils the possibility Ai Holdings' shares may be trading at a premium.

Summing It All Up

- Dive into all 1985 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:MEGA

Mega Lifesciences

Manufactures and sells health food supplements, prescription pharmaceutical products, over-the-counter products, herbal products, vitamins, and fast-moving consumer goods in Southeast Asia and Sub-Saharan Africa.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives