- Thailand

- /

- Entertainment

- /

- SET:RS

Exploring High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are keenly observing the robust performance of high-growth sectors like technology. In such a dynamic environment, identifying stocks with strong fundamentals and innovative potential can be crucial for enhancing portfolio growth, particularly when market sentiment is buoyed by positive economic indicators such as declining jobless claims and stabilizing mortgage rates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.46% | 109.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1298 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

RS (SET:RS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RS Public Company Limited, along with its subsidiaries, operates in the commerce, media, music, and other sectors within Thailand and has a market capitalization of THB12.66 billion.

Operations: RS, with a market cap of THB12.66 billion, generates revenue primarily from its Multi-Platform Commerce and Media Business segments, contributing THB1.46 billion and THB1.37 billion respectively. The company also has interests in Music Business and Showbiz Business, adding THB91.91 million and THB405.20 million to its revenues.

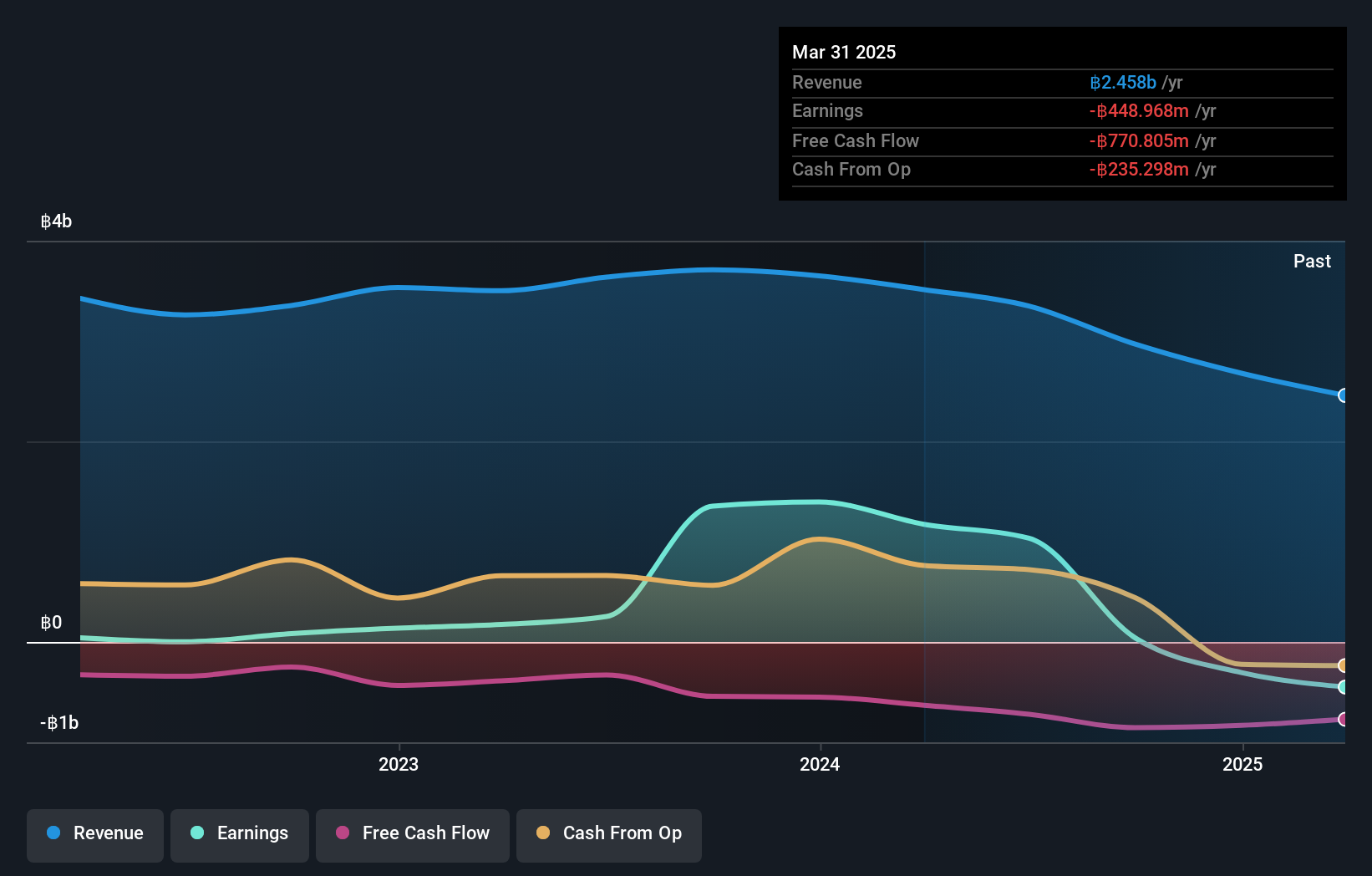

RS Public Company Limited, despite a challenging year with earnings plummeting by 97%, is poised for a robust recovery with anticipated annual profit growth of 47.8%. This forecast surpasses the Thai market's average of 17.9%, underscoring RS's potential resilience and adaptability in the tech sector. The company's commitment to innovation is evident from its R&D spending, crucial for staying competitive in high-growth tech industries. Moreover, recent strategic board decisions to restructure and cancel certain investments indicate a focused approach to refining its business model and enhancing core operations, which could significantly influence its trajectory in the evolving tech landscape.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a company that develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.21 billion.

Operations: Temenos generates revenue primarily through the sale of integrated banking software systems to financial institutions worldwide. The company's business model focuses on providing comprehensive software solutions that cater to various banking needs, enhancing operational efficiency and customer experience for its clients.

Temenos is making significant strides in the tech industry, particularly with its recent integration of generative AI technology on NVIDIA's platform, which enhances banks' data processing capabilities. This move not only boosts operational efficiency but also ensures customer data privacy and control, aligning with growing demands for responsible AI solutions. Financially, Temenos showcased a robust performance in Q3 2024, with revenue climbing to $246.92 million from $236.7 million year-over-year and net income increasing to $30.85 million from $21.88 million. These figures underscore a promising trajectory, supported by an 11.4% forecasted annual earnings growth rate that outpaces the Swiss market average significantly at 6.9%. Additionally, Temenos has reinvested in its own stock, repurchasing shares worth CHF 200 million recently—a testament to its commitment to shareholder value and confidence in its future prospects.

- Take a closer look at Temenos' potential here in our health report.

Review our historical performance report to gain insights into Temenos''s past performance.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou DPtech Technologies Co., Ltd. specializes in the research, development, production, and sale of network security and application delivery products both in China and internationally, with a market cap of CN¥11.70 billion.

Operations: DPtech Technologies focuses on network security and application delivery solutions, serving both domestic and international markets. The company's revenue model is built around the development, production, and sale of these technology products.

Hangzhou DPtech Technologies Ltd. has demonstrated robust financial growth, with revenue surging to CNY 819.3 million, up from CNY 720.1 million year-over-year, and net income increasing significantly to CNY 92.38 million from CNY 67.08 million in the same period. This performance is underscored by an impressive forecast of earnings growth at 26.3% annually, outpacing the broader Chinese market's projection of 26.2%. Despite not engaging in share repurchases this quarter, the company's strategic focus on R&D investments aligns with its commitment to innovation and market expansion in the competitive tech landscape.

Seize The Opportunity

- Explore the 1298 names from our High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:RS

RS

Engages in the multi-platform commerce, media, and music and showbiz businesses in Thailand.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion