- Thailand

- /

- Basic Materials

- /

- SET:SCC

Asian Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of renewed tariff threats and economic uncertainties, investors are increasingly turning their attention to Asia, where growth companies with high insider ownership present intriguing opportunities. In this environment, stocks that combine robust growth potential with significant insider ownership can offer a compelling mix of confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Schooinc (TSE:264A) | 29.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

We're going to check out a few of the best picks from our screener tool.

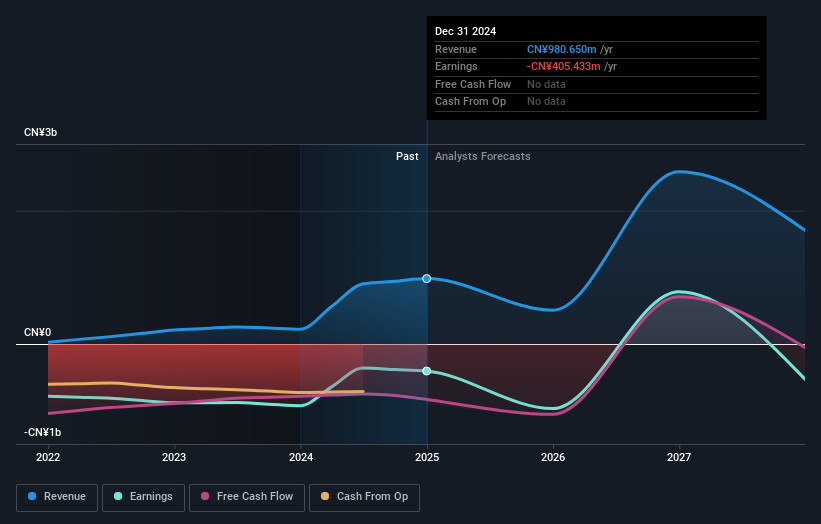

Ascentage Pharma Group International (SEHK:6855)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ascentage Pharma Group International is a clinical-stage biotechnology company focused on developing therapies for cancers, chronic hepatitis B virus (HBV), and age-related diseases in Mainland China, with a market cap of HK$17.32 billion.

Operations: The company generates revenue from the development and sale of novel small-scale therapies, amounting to CN¥980.65 million.

Insider Ownership: 13.7%

Earnings Growth Forecast: 64.9% p.a.

Ascentage Pharma Group International, a growth-focused company in Asia, has demonstrated significant revenue growth and is forecast to grow faster than the Hong Kong market. Despite recent shareholder dilution and share price volatility, the firm is advancing its innovative drug pipeline. Recent clinical data presentations at ASCO 2025 highlight promising results for key drug candidates lisaftoclax and alrizomadlin, supporting their further development. These advancements underscore Ascentage's commitment to addressing unmet medical needs in oncology.

- Delve into the full analysis future growth report here for a deeper understanding of Ascentage Pharma Group International.

- The valuation report we've compiled suggests that Ascentage Pharma Group International's current price could be inflated.

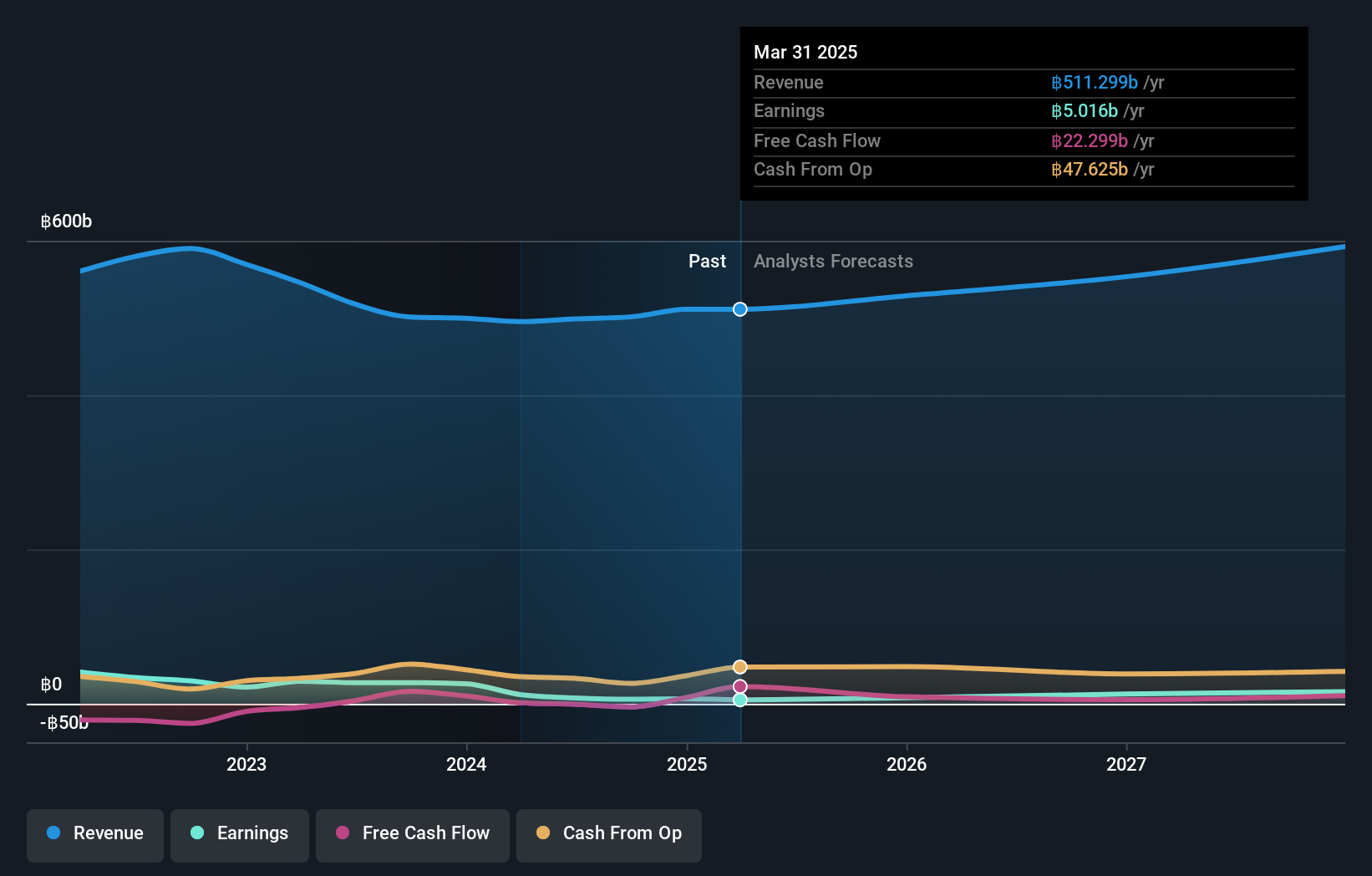

Siam Cement (SET:SCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Siam Cement Public Company Limited, with a market cap of THB205.80 billion, operates in the cement and building materials, chemicals, and packaging sectors both in Thailand and internationally.

Operations: Siam Cement's revenue segments include THB131.05 billion from SCGP, THB24.74 billion from SCG Decor (SCGD), THB215.10 billion from SCG Chemicals (SCGC), THB81.39 billion from the SCG Cement and Green Solutions Business, and THB136.41 billion from the SCG Smart Living Business and SCG Distribution and Retail Business.

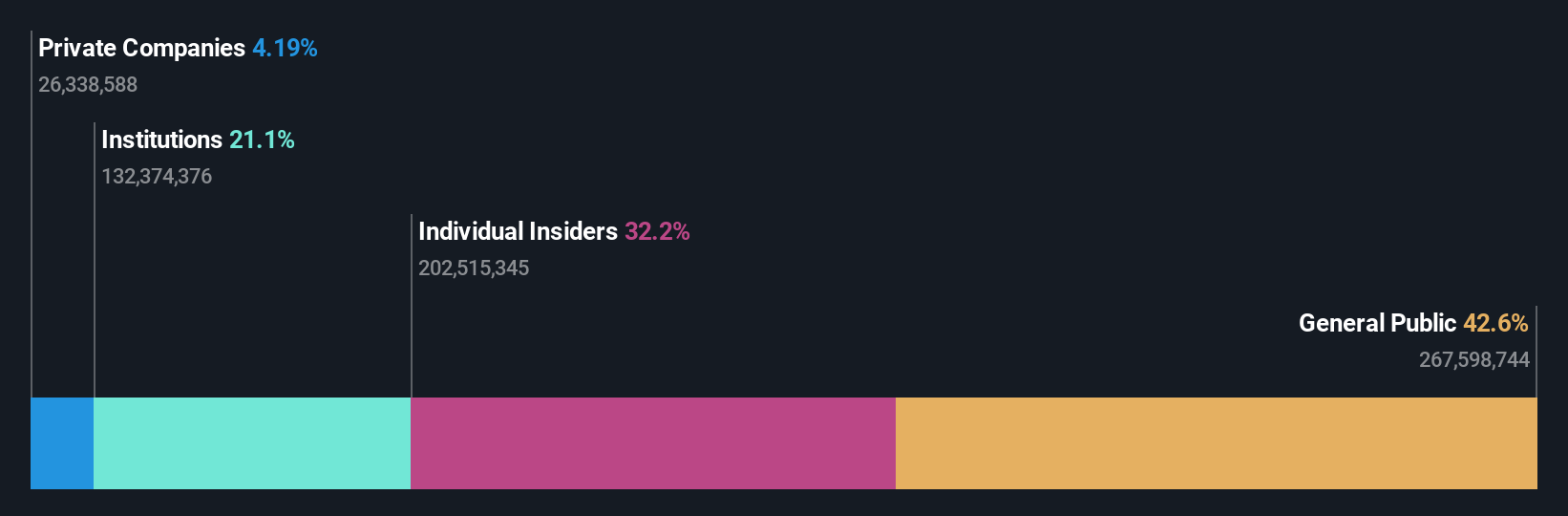

Insider Ownership: 33.6%

Earnings Growth Forecast: 40.3% p.a.

Siam Cement, a growth-focused company in Asia, is forecast to achieve significant earnings growth of 40.3% annually, outpacing the Thai market. However, its profit margins have declined from 2.4% to 1%, and recent earnings results showed a drop in net income to THB 1.10 billion from THB 2.42 billion year-on-year. The company's financial position is strained as interest payments are not well covered by earnings, and its share price has been volatile recently.

- Dive into the specifics of Siam Cement here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Siam Cement is priced higher than what may be justified by its financials.

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Changchuan Technology Co., Ltd specializes in the research, development, production, and sale of integrated circuit equipment and high-frequency communication materials, with a market cap of CN¥27.06 billion.

Operations: The company generates revenue from the development, production, and sale of integrated circuit equipment and high-frequency communication materials.

Insider Ownership: 32.2%

Earnings Growth Forecast: 32% p.a.

Hangzhou Changchuan Technology shows strong growth potential, with earnings forecast to rise significantly at 32% annually, surpassing the Chinese market's average. Despite a slower revenue growth rate of 19.3%, it remains above the national average. Recent financial results reveal impressive profit improvements, with net income jumping to CNY 111 million from CNY 4.08 million year-on-year. The company's price-to-earnings ratio is favorable compared to industry peers, indicating good relative value for investors seeking growth opportunities in Asia.

- Navigate through the intricacies of Hangzhou Changchuan TechnologyLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Hangzhou Changchuan TechnologyLtd may be undervalued.

Seize The Opportunity

- Gain an insight into the universe of 630 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SCC

Siam Cement

Operates in the cement and building materials, chemicals, and packaging businesses in Thailand and internationally.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives