- Thailand

- /

- Personal Products

- /

- SET:KAMART

3 Growth Companies With High Insider Ownership Anticipating 32% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and record-high stock indices, growth stocks have continued to capture investor interest, outperforming their value counterparts. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Karmarts (SET:KAMART)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Karmarts Public Company Limited operates in Thailand, focusing on the manufacturing, packaging, import, and distribution of cosmetics and consumer products with a market cap of THB11.87 billion.

Operations: The company's revenue segments comprise THB2.96 billion from the manufacture and distribution of consumer products, THB26.15 million from warehouse rental, and a loss of THB4.01 million from investment properties and distribution of by-products and agriculture.

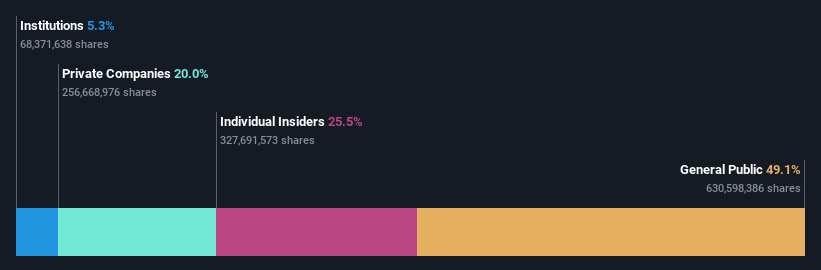

Insider Ownership: 25.5%

Earnings Growth Forecast: 17% p.a.

Karmarts offers potential as a growth company with high insider ownership, trading at a favorable value with a P/E ratio of 16.9x compared to the industry average of 23x. Despite slower-than-desired revenue growth at 18.7% annually, it outpaces the TH market's 5.7%. Earnings are expected to increase by 17% per year, surpassing market expectations. However, its dividend yield of 4.02% is not well covered by free cash flows, signaling caution for income-focused investors.

- Click here and access our complete growth analysis report to understand the dynamics of Karmarts.

- The valuation report we've compiled suggests that Karmarts' current price could be quite moderate.

Siam Cement (SET:SCC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: The Siam Cement Public Company Limited, with a market cap of THB174.60 billion, operates in the cement and building materials, chemicals, and packaging sectors both in Thailand and internationally.

Operations: Siam Cement's revenue is primarily derived from its chemicals segment at THB210.30 billion, followed by the SCG Smart Living Business and SCG Distribution and Retail Business at THB140.17 billion, packaging (SCGP) at THB132.78 billion, SCG Cement and Green Solutions Business at THB81.89 billion, and SCG Decor (SCGD) contributing THB25.56 billion.

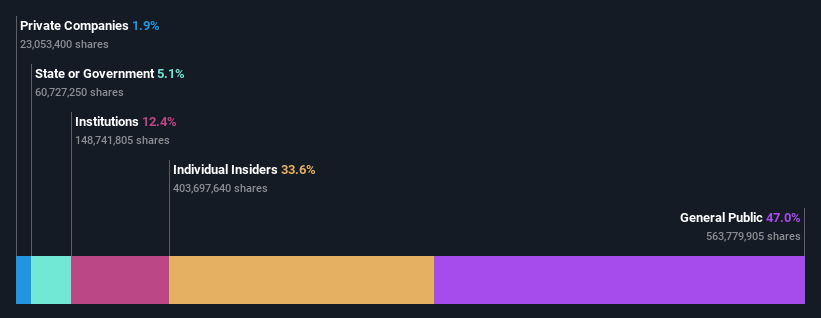

Insider Ownership: 33.6%

Earnings Growth Forecast: 32.2% p.a.

Siam Cement's insider ownership aligns with its growth potential, as earnings are forecast to rise significantly at 32.23% annually, outpacing the Thai market. However, revenue growth is modest at 6% per year and profit margins have declined from last year. Recent issuance of THB 15 billion in debentures reflects strategic financial management amidst a challenging environment where interest payments aren't well covered by earnings. The dividend yield remains unsustainable given current profit levels.

- Click to explore a detailed breakdown of our findings in Siam Cement's earnings growth report.

- Our comprehensive valuation report raises the possibility that Siam Cement is priced higher than what may be justified by its financials.

UTour Group (SZSE:002707)

Simply Wall St Growth Rating: ★★★★★★

Overview: UTour Group Co., Ltd. operates in the outbound tourism wholesale and retail sector both in China and internationally, with a market cap of CN¥7.49 billion.

Operations: The company generates revenue primarily through its outbound tourism wholesale and retail operations in China and abroad.

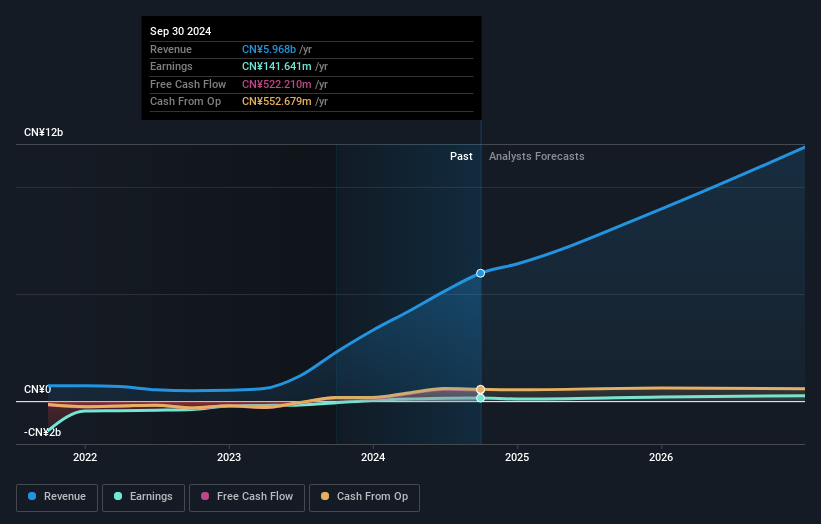

Insider Ownership: 24.1%

Earnings Growth Forecast: 32.8% p.a.

UTour Group's insider ownership supports its growth trajectory, with earnings expected to grow significantly at 32.8% per year, surpassing the Chinese market average. Revenue is forecast to increase by 31.5% annually, indicating robust expansion potential. The stock trades well below estimated fair value, suggesting possible undervaluation. Despite no recent insider trading activity in the past three months, UTour became profitable this year and held a shareholder meeting in February for director elections.

- Get an in-depth perspective on UTour Group's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility UTour Group's shares may be trading at a premium.

Taking Advantage

- Gain an insight into the universe of 1463 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Karmarts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KAMART

Karmarts

Together with its subsidiary, engages in the manufacturing, packaging, import, and distribution of cosmetics and consumer products in Thailand.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives