- Thailand

- /

- Personal Products

- /

- SET:KISS

3 Penny Stocks With Market Caps Over US$50M To Consider

Reviewed by Simply Wall St

Global markets have been experiencing notable shifts, with U.S. stock indexes climbing toward record highs despite inflation concerns and fluctuating Treasury yields. Against this backdrop, investors are increasingly exploring diverse opportunities to balance risk and reward in their portfolios. While the term "penny stock" may seem outdated, these smaller or newer companies can still offer significant growth potential when supported by robust financials. We'll examine three penny stocks that stand out for their financial strength and potential for long-term success in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$45.23B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

Click here to see the full list of 5,679 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Computer And Technologies Holdings (SEHK:46)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Computer And Technologies Holdings Limited is an investment holding company that offers IT solutions to enterprises, multinational corporations, and government organizations across Hong Kong, Mainland China, and internationally with a market cap of HK$412.59 million.

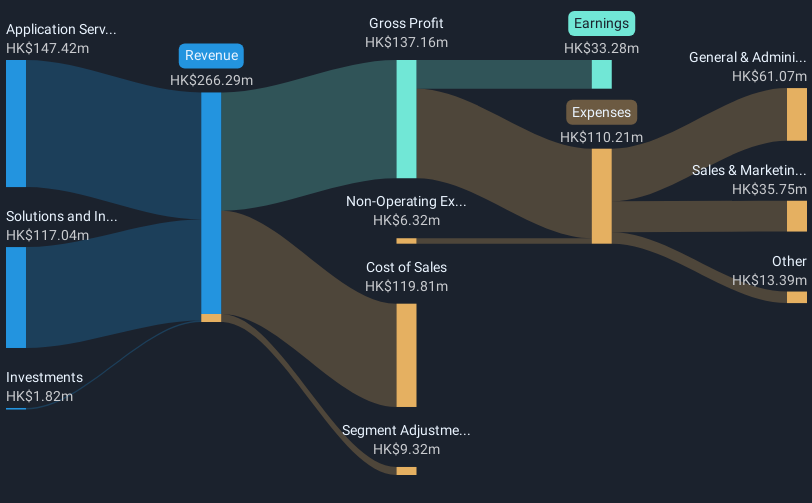

Operations: The company's revenue is primarily derived from its Application Services segment, which generated HK$147.42 million, followed by Solutions and Integration Services with HK$117.04 million, and Investments contributing HK$1.82 million.

Market Cap: HK$412.59M

Computer And Technologies Holdings, with a market cap of HK$412.59 million, derives most of its revenue from Application Services (HK$147.42 million) and Solutions and Integration Services (HK$117.04 million). Despite being debt-free and having strong short-term asset coverage, the company faces challenges with declining earnings over the past five years at an annual rate of 10.5%. Its Price-To-Earnings ratio is favorable compared to the industry average, but recent negative earnings growth (-23.2%) poses concerns about its ability to outpace industry trends. The management team is experienced; however, dividend stability remains uncertain due to an unstable track record.

- Take a closer look at Computer And Technologies Holdings' potential here in our financial health report.

- Gain insights into Computer And Technologies Holdings' past trends and performance with our report on the company's historical track record.

Rojukiss International (SET:KISS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rojukiss International Public Company Limited distributes skincare, cosmetics, food supplements, pharmaceutical, and medical products across Thailand, Indonesia, Cambodia, Laos, and internationally with a market cap of THB2.42 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, generating THB1.10 billion.

Market Cap: THB2.42B

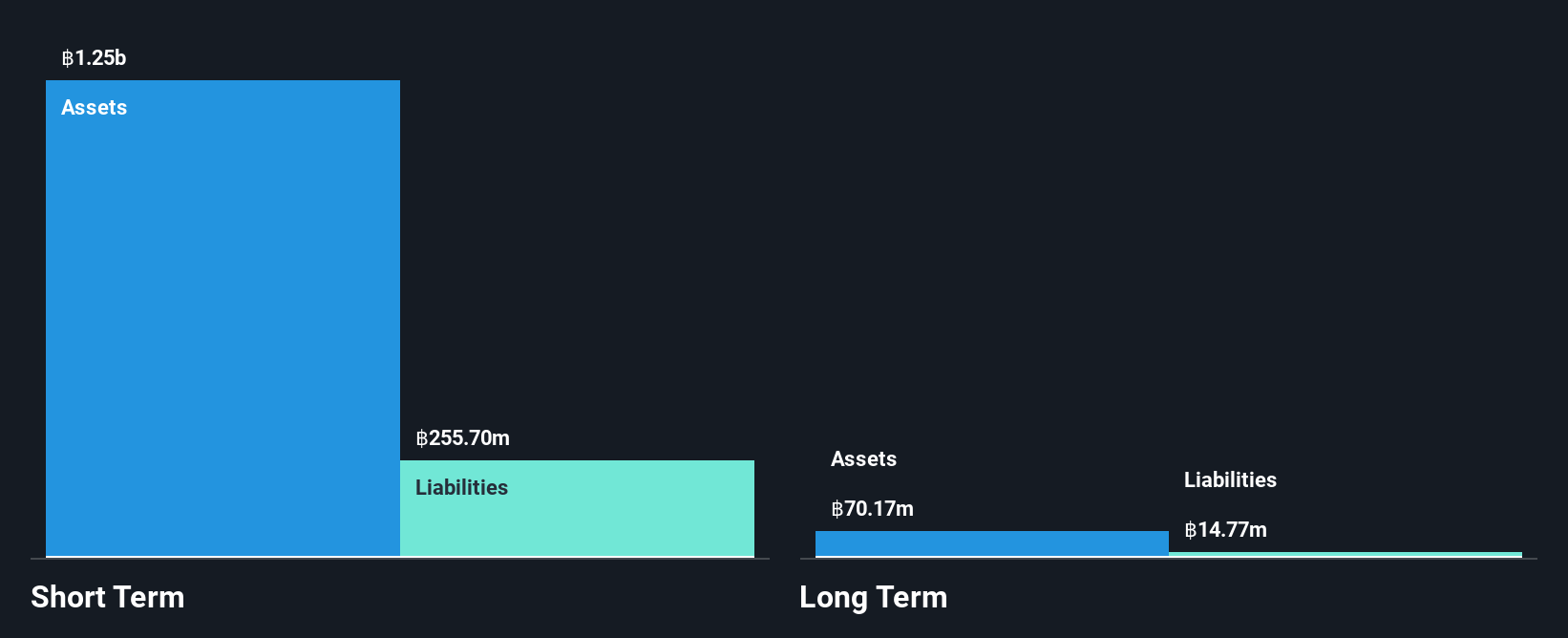

Rojukiss International, with a market cap of THB2.42 billion, has shown promising financial health with short-term assets (THB1.2 billion) exceeding both short- and long-term liabilities. The company is debt-free, marking a significant improvement from five years ago when its debt-to-equity ratio was 48.1%. Despite a low return on equity (16.4%), Rojukiss's earnings grew by 39.2% last year, surpassing industry averages and reversing a five-year decline trend (-7.5% annually). Recent executive changes may impact strategic direction; however, the management team lacks experience with an average tenure of just 0.2 years.

- Navigate through the intricacies of Rojukiss International with our comprehensive balance sheet health report here.

- Gain insights into Rojukiss International's outlook and expected performance with our report on the company's earnings estimates.

QTC Energy (SET:QTC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: QTC Energy Public Company Limited, along with its subsidiaries, manufactures, sells, and distributes electric transformers in Thailand and internationally with a market cap of THB1.33 billion.

Operations: QTC Energy's revenue is primarily derived from the domestic sale of electric transformers (THB1.01 billion), followed by export sales of electric transformers (THB194.28 million), domestic sales of electric equipment (THB376.32 million), manufacturing and sale of electricity domestically (THB47.91 million), and domestic operations in electric vehicle charging stations (THB0.91 million).

Market Cap: THB1.33B

QTC Energy, with a market cap of THB1.33 billion, has demonstrated financial stability and growth potential. The company's revenue increased to THB1.52 billion in 2024 from THB1.34 billion the previous year, while net income rose to THB113.29 million from THB66.89 million, indicating improved profitability with net profit margins rising to 7.5%. QTC's debt-to-equity ratio decreased significantly over five years, enhancing its financial health as its operating cash flow covers debt well beyond requirements (734.8%). Despite a low return on equity (6.9%), earnings grew by 69.4% last year, outpacing industry averages and reversing past declines.

- Jump into the full analysis health report here for a deeper understanding of QTC Energy.

- Evaluate QTC Energy's historical performance by accessing our past performance report.

Summing It All Up

- Reveal the 5,679 hidden gems among our Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:KISS

Rojukiss International

Engages in the development, contract manufacturing, and distribution of skincare, cosmetics, and food supplements in Thailand, Indonesia, the Philippines, Vietnam, Cambodia, Laos, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion